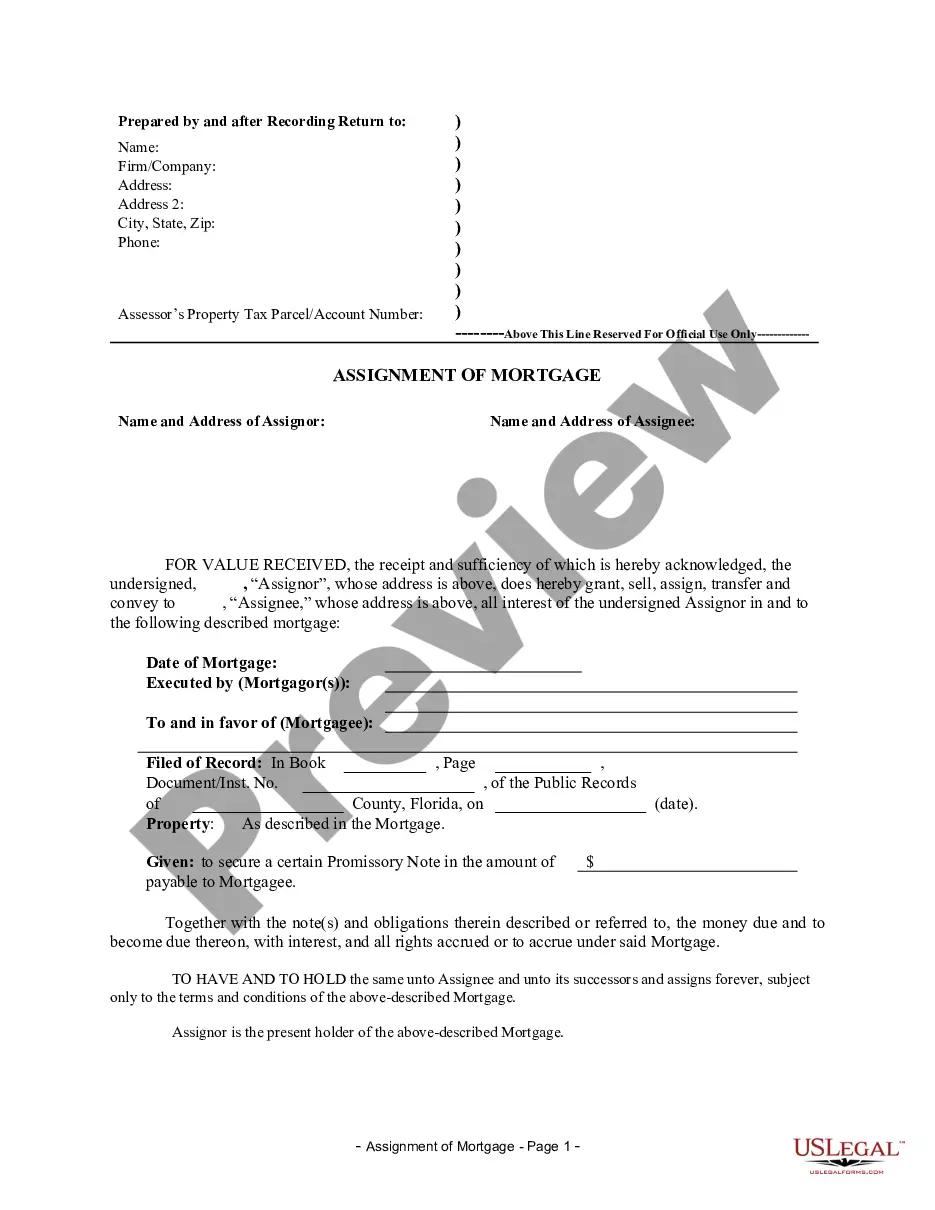

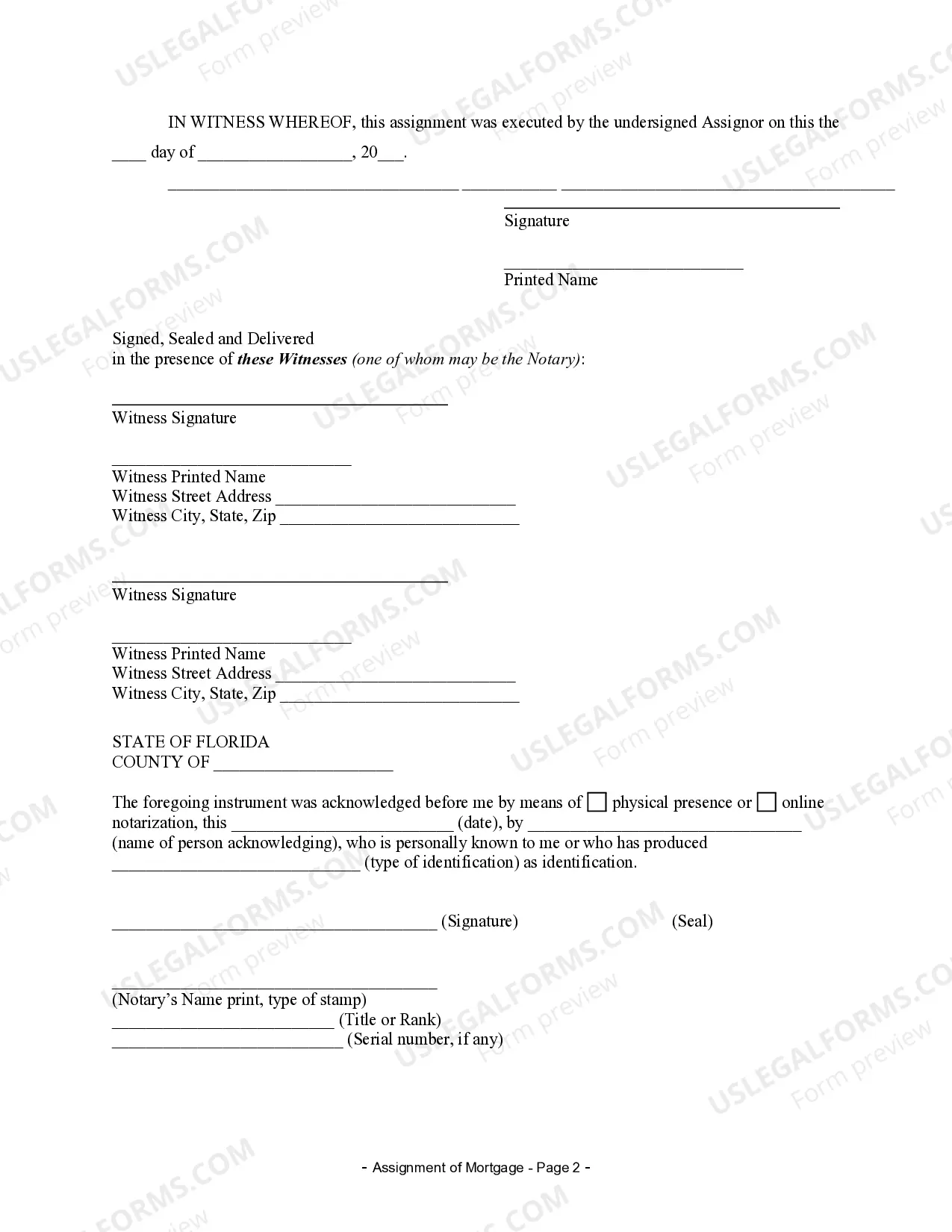

Cape Coral, Florida Assignment of Mortgage by Individual Mortgage Holder: Understanding the Process and Types of Assignments Introduction: The Cape Coral Florida Assignment of Mortgage by Individual Mortgage Holder refers to the legal transfer of a mortgage from one individual mortgage holder to another. This process allows individuals to transfer their rights and interests in a property loan to another party, providing flexibility in managing mortgage obligations. This article aims to provide a detailed description of the Cape Coral Florida Assignment of Mortgage, explaining its working, importance, and the various types of assignments involved. What is Cape Coral Florida Assignment of Mortgage? The Assignment of Mortgage is a legal document used when a homeowner sells or transfers their property loan to another individual, granting them the right to collect the mortgage payments. This transfer allows borrowers in Cape Coral, Florida, to have more control over their mortgage, especially in situations where they require financial flexibility or need to move out of town. Working of Cape Coral Florida Assignment of Mortgage: When an individual intends to assign their mortgage, they will need to go through a specific process. First, both the mortgage assignor (current mortgage holder) and assignee (new mortgage holder) must agree to the terms and conditions of the transfer. These terms may include the outstanding mortgage balance, interest rate, repayment terms, and any additional clauses relevant to the loan. Once the agreement is reached, an Assignment of Mortgage form is drafted, indicating the intent to transfer the mortgage rights. This document must be signed by both parties, notarized, and delivered to the appropriate authorities, such as the Cape Coral County Recorder's Office. Following this, the assignee becomes the new mortgage holder with rights to collect payments and manage the mortgage terms. Types of Cape Coral Florida Assignment of Mortgage: 1. Full Assignment: In a full assignment, the assignor transfers the entire mortgage to the assignee, including all rights, interests, and obligations associated with the loan. The assignee essentially steps into the shoes of the original mortgage holder, assuming full responsibility for the mortgage. 2. Partial Assignment: In cases where a mortgage holder seeks financial assistance or wants to distribute the risk, they may opt for a partial assignment. In this type, the assignor transfers a portion of their mortgage to the assignee, retaining the ownership of the remaining part. Consequently, both parties become joint mortgage holders, with shared responsibility and rights. 3. Assignment of Mortgage for Investment Purposes: Some individuals in Cape Coral, Florida, assign their mortgage to an investor for the purpose of generating passive income. In such cases, the assignor transfers the mortgage to the assignee, allowing them to collect mortgage payments while still retaining ownership of the property. This type of assignment often occurs when the assignor is unable or unwilling to manage the mortgage actively. Conclusion: Cape Coral Florida Assignment of Mortgage by Individual Mortgage Holder provides homeowners in Cape Coral, Florida, with the opportunity to transfer their mortgage to another individual. This legal process helps homeowners manage financial obligations, gain flexibility, and potentially generate passive income. Understanding the different types of assignments available, such as full assignments, partial assignments, and assignments for investment purposes, can assist homeowners in making informed decisions regarding their mortgages. Remember to consult professionals like real estate attorneys or mortgage advisors to ensure a smooth and legally sound assignment process.

Cape Coral Florida Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out Cape Coral Florida Assignment Of Mortgage By Individual Mortgage Holder?

We consistently aim to reduce or avert legal complications when handling intricate legal or financial matters.

In order to achieve this, we seek legal remedies that are generally quite costly.

However, not all legal matters are as complicated.

Many of them can be addressed by ourselves.

Utilize US Legal Forms whenever you need to acquire and download the Cape Coral Florida Assignment of Mortgage by Individual Mortgage Holder or any other document quickly and securely.

- US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform empowers you to manage your affairs independently without needing a lawyer.

- We provide access to legal document templates that are not always readily available.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

Form popularity

FAQ

To establish residency in Lee County, Florida, you need to provide proof of your physical presence in the county, along with an intention to remain there. You can do this by obtaining a local driver’s license, registering your vehicle, and filing a declaration of domicile. Each of these steps helps solidify your residency, especially when navigating legal matters like the Cape Coral Florida Assignment of Mortgage by Individual Mortgage Holder.

Proof of residency in Lee County typically includes documents such as a driver’s license, utility bills, or bank statements that display your name and address. This documentation is vital when applying for various services or filing legal documents, such as the Cape Coral Florida Assignment of Mortgage by Individual Mortgage Holder. Having clear proof of residency ensures smoother transactions.

Filing a Florida declaration of domicile involves filling out the appropriate form found on the state’s official websites or at your local county clerk's office. Once you complete the form, have it notarized and submit it to the county clerk's office in person or by mail. This document is crucial for establishing residency and can support processes such as the Cape Coral Florida Assignment of Mortgage by Individual Mortgage Holder.

To file a declaration of domicile in Lee County, you must obtain the declaration form from the Lee County Clerk of Courts' website or their office. After filling it out, ensure that you have it notarized before submitting it in person or by mail. This declaration confirms your residency status and can be beneficial in various legal processes, including the Cape Coral Florida Assignment of Mortgage by Individual Mortgage Holder.

Filing a declaration of domicile in Lee County requires you to complete the necessary form, which is available at the Lee County Clerk of Courts' office or online. After completing the form, you must sign it in the presence of a notary public and submit it to the Clerk's office. This declaration serves as proof of your residency and assists with the Cape Coral Florida Assignment of Mortgage by Individual Mortgage Holder.

To obtain the deed to your house in Florida, you can request a copy from the county's property appraiser or clerk of court office where your home is located. Often, you can access this information online through their official websites. Additionally, if your home has undergone a recent transfer, the deed may be available via your title company or attorney. Understanding the process of obtaining a deed is essential for the Cape Coral Florida Assignment of Mortgage by Individual Mortgage Holder.

An example of an assignment of a mortgage occurs when a lender transfers their rights to receive mortgage payments from the borrower to another entity. For instance, if you hold a mortgage on your home in Cape Coral, Florida, and you want to sell that mortgage to another financial institution, you would execute an assignment of mortgage. This document would officially state that the new entity now enjoys the rights and responsibilities related to your mortgage. Understanding the Cape Coral Florida Assignment of Mortgage by Individual Mortgage Holder is crucial for ensuring a smooth transition in such transactions.

An assignment of mortgage in Florida is a legal document that transfers the rights to the mortgage from one lender to another. This process is common for the Cape Coral Florida Assignment of Mortgage by Individual Mortgage Holder and helps ensure smooth transactions between parties. It’s important for both buyers and sellers to understand how this assignment works to protect their interests.

The term assignment refers specifically to the transfer of rights or interests in a mortgage, while a home is the physical property owned. In discussions around the Cape Coral Florida Assignment of Mortgage by Individual Mortgage Holder, it's important to differentiate between the legal processes involved and the tangible asset itself. This understanding can simplify real estate transactions.

In Florida, the homeowner holds the title to the property, unless a lender holds a mortgage against it. The title indicates ownership and can be transferred through legal means, such as sale or assignment. If you're looking to manage your title or mortgage assignments effectively, consider resources and forms available for the Cape Coral Florida Assignment of Mortgage by Individual Mortgage Holder to ensure a smooth process.