Miramar Florida Assignment of Mortgage by Individual Mortgage Holder is a legal document that transfers the rights and responsibilities of a mortgage from one individual to another in the city of Miramar, Florida. This assignment is commonly used when a mortgage holder wants to transfer their mortgage to another individual or entity. The purpose of this assignment is to provide a clear record of the transfer and ensure that the new mortgage holder has the legal authority to collect payments and enforce the terms of the mortgage. The process of an assignment of mortgage is initiated by the current mortgage holder, also known as the assignor. The assignor may decide to assign the mortgage for various reasons, such as financial gain, consolidation of debts, or a change in ownership. The assignor must draft a legally binding document known as the assignment of mortgage, which specifies the details of the transfer, including the parties involved, the mortgage amount, and the terms and conditions. In Miramar, Florida, there are no specific types of assignment of mortgage by individual mortgage holder as it is a general term used to describe the transfer of a mortgage from an individual to another individual. However, there may be variations in the terms and conditions depending on the agreement between the parties involved. Some common variations include: 1. Partial Assignment of Mortgage: This type of assignment occurs when only a portion of the mortgage is transferred. For example, the mortgage holder may transfer a portion of the mortgage to another individual to share the financial responsibility. 2. Assumption of Mortgage: In this type of assignment, the assignee takes on both the rights and obligations of the mortgage. The assignee essentially steps into the shoes of the original mortgage holder and becomes responsible for making the mortgage payments. 3. Release of Mortgage: This type of assignment involves the release of the mortgage altogether. The assignor, or original mortgage holder, transfers the ownership of the property to the assignee, and the assignee becomes solely responsible for the property and any remaining loan obligations. It's important to note that an assignment of mortgage should be executed with the guidance of a qualified attorney or real estate professional to ensure compliance with relevant laws and regulations in Miramar, Florida. This will help protect the rights and interests of both the assignor and the assignee and ensure a smooth transfer of the mortgage.

Miramar Florida Assignment of Mortgage by Individual Mortgage Holder

State:

Florida

City:

Miramar

Control #:

FL-120RE

Format:

Word;

Rich Text

Instant download

Description

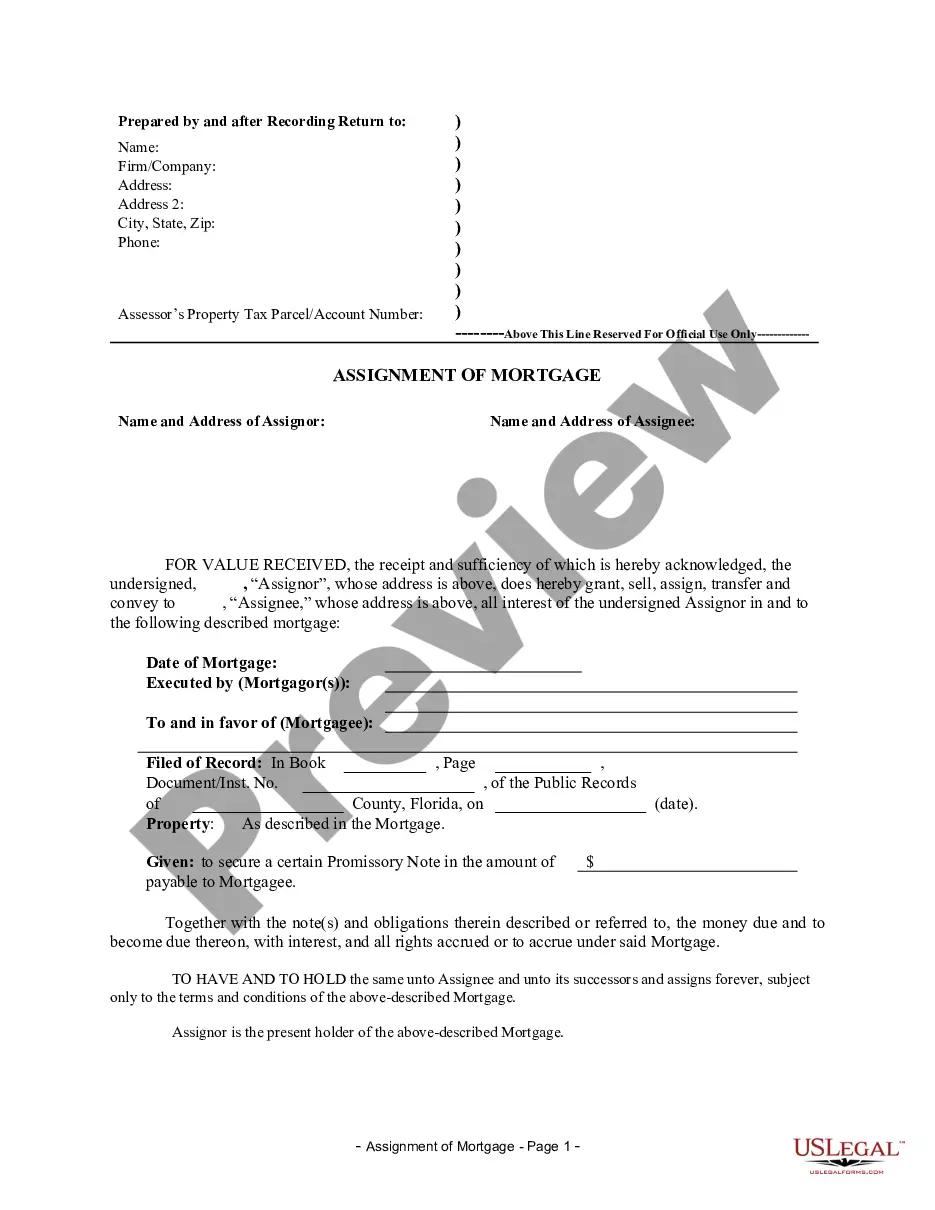

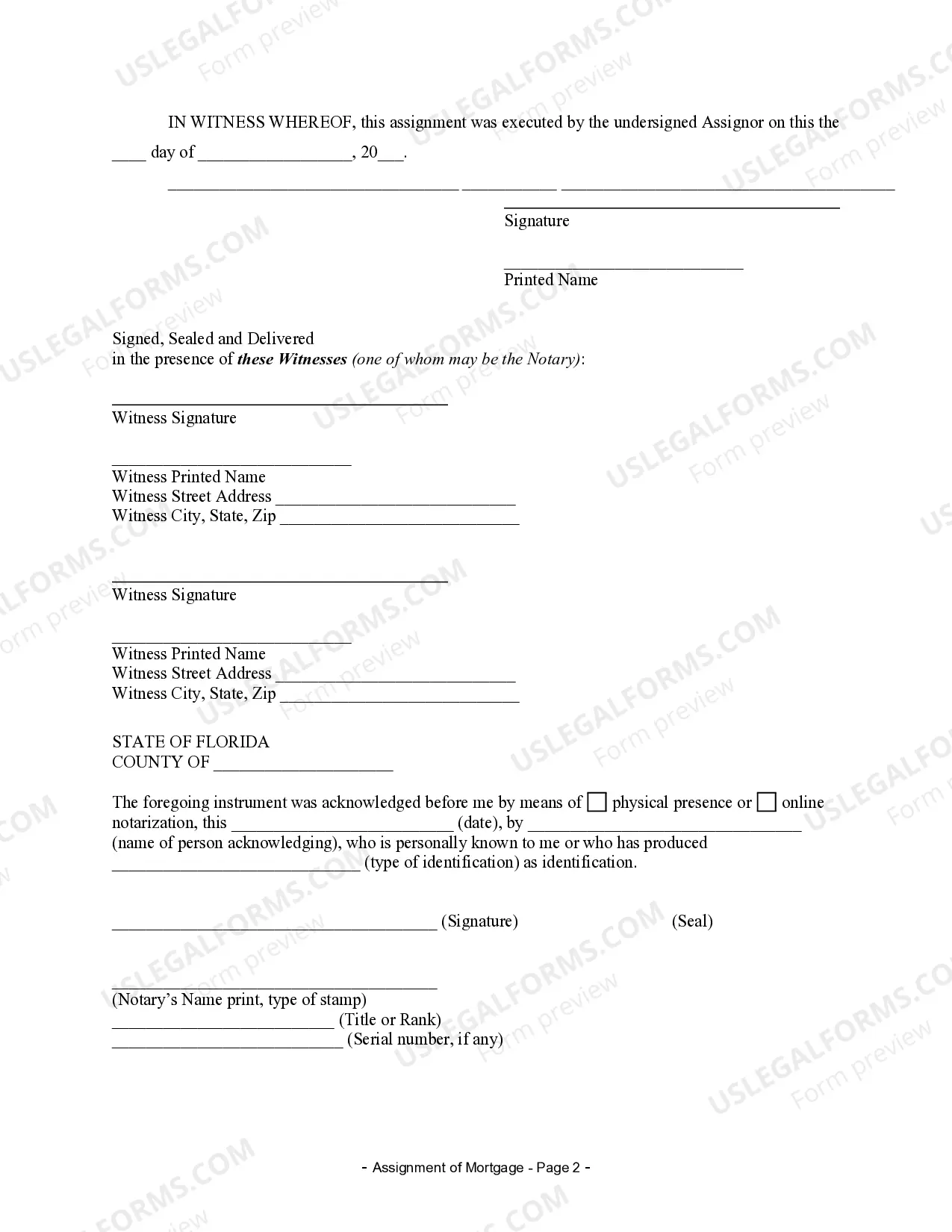

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Miramar Florida Assignment of Mortgage by Individual Mortgage Holder is a legal document that transfers the rights and responsibilities of a mortgage from one individual to another in the city of Miramar, Florida. This assignment is commonly used when a mortgage holder wants to transfer their mortgage to another individual or entity. The purpose of this assignment is to provide a clear record of the transfer and ensure that the new mortgage holder has the legal authority to collect payments and enforce the terms of the mortgage. The process of an assignment of mortgage is initiated by the current mortgage holder, also known as the assignor. The assignor may decide to assign the mortgage for various reasons, such as financial gain, consolidation of debts, or a change in ownership. The assignor must draft a legally binding document known as the assignment of mortgage, which specifies the details of the transfer, including the parties involved, the mortgage amount, and the terms and conditions. In Miramar, Florida, there are no specific types of assignment of mortgage by individual mortgage holder as it is a general term used to describe the transfer of a mortgage from an individual to another individual. However, there may be variations in the terms and conditions depending on the agreement between the parties involved. Some common variations include: 1. Partial Assignment of Mortgage: This type of assignment occurs when only a portion of the mortgage is transferred. For example, the mortgage holder may transfer a portion of the mortgage to another individual to share the financial responsibility. 2. Assumption of Mortgage: In this type of assignment, the assignee takes on both the rights and obligations of the mortgage. The assignee essentially steps into the shoes of the original mortgage holder and becomes responsible for making the mortgage payments. 3. Release of Mortgage: This type of assignment involves the release of the mortgage altogether. The assignor, or original mortgage holder, transfers the ownership of the property to the assignee, and the assignee becomes solely responsible for the property and any remaining loan obligations. It's important to note that an assignment of mortgage should be executed with the guidance of a qualified attorney or real estate professional to ensure compliance with relevant laws and regulations in Miramar, Florida. This will help protect the rights and interests of both the assignor and the assignee and ensure a smooth transfer of the mortgage.

Free preview

How to fill out Miramar Florida Assignment Of Mortgage By Individual Mortgage Holder?

If you’ve already used our service before, log in to your account and save the Miramar Florida Assignment of Mortgage by Individual Mortgage Holder on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Ensure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Miramar Florida Assignment of Mortgage by Individual Mortgage Holder. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!