The Orange Florida Assignment of Mortgage by Individual Mortgage Holder is an important legal document that deals with the transfer of mortgage rights from one individual mortgage holder to another in Orange County, Florida. This document signifies a change in ownership or assignment of a mortgage loan. In this context, the term "Orange Florida" refers to the geographic location where the assignment is made, specifically within Orange County. Meanwhile, an "Individual Mortgage Holder" refers to a private individual or entity who holds the mortgage on a property. Keywords: Orange Florida Assignment of Mortgage, Individual Mortgage Holder, Orange County, transfer of mortgage rights, change in ownership, assignment of mortgage loan. There are various types of Orange Florida Assignment of Mortgage by Individual Mortgage Holder, each with its own specific characteristics and requirements. Some commonly encountered types include: 1. Voluntary Assignment: This type of assignment occurs when the mortgage holder voluntarily transfers their rights to another individual mortgage holder. It typically requires the consent and agreement of all parties involved. 2. Involuntary Assignment: In contrast to voluntary assignments, an involuntary assignment occurs when the transfer of mortgage rights is mandated by law or court order. This typically happens in cases of foreclosure, bankruptcy, or as a result of legal proceedings. 3. Partial Assignment: In cases where the mortgage holder wants to transfer only a portion of their mortgage rights, a partial assignment can be made. This enables the original holder to retain some ownership while giving part of the rights to another individual mortgage holder. 4. Cross-Assignment: This type of assignment occurs when multiple mortgage holders agree to transfer their respective mortgage rights to one another. This is typically done to consolidate ownership or simplify the mortgage arrangement. 5. Subsequent Assignment: Subsequent assignments refer to the transfer of mortgage rights from one individual mortgage holder to another after an initial assignment has already taken place. This type of assignment can occur multiple times over the life of a mortgage loan. It is important to note that in Orange County, Florida, specific legal procedures and documentation must be followed when executing an assignment of mortgage. These processes may vary depending on the type of assignment, the parties involved, and any additional legal requirements in the state of Florida. Keywords: Voluntary Assignment, Involuntary Assignment, Partial Assignment, Cross-Assignment, Subsequent Assignment, Orange County, Florida, legal procedures, documentation, mortgage rights, transfer of ownership.

Orange Florida Assignment of Mortgage by Individual Mortgage Holder

State:

Florida

County:

Orange

Control #:

FL-120RE

Format:

Word;

Rich Text

Instant download

Description

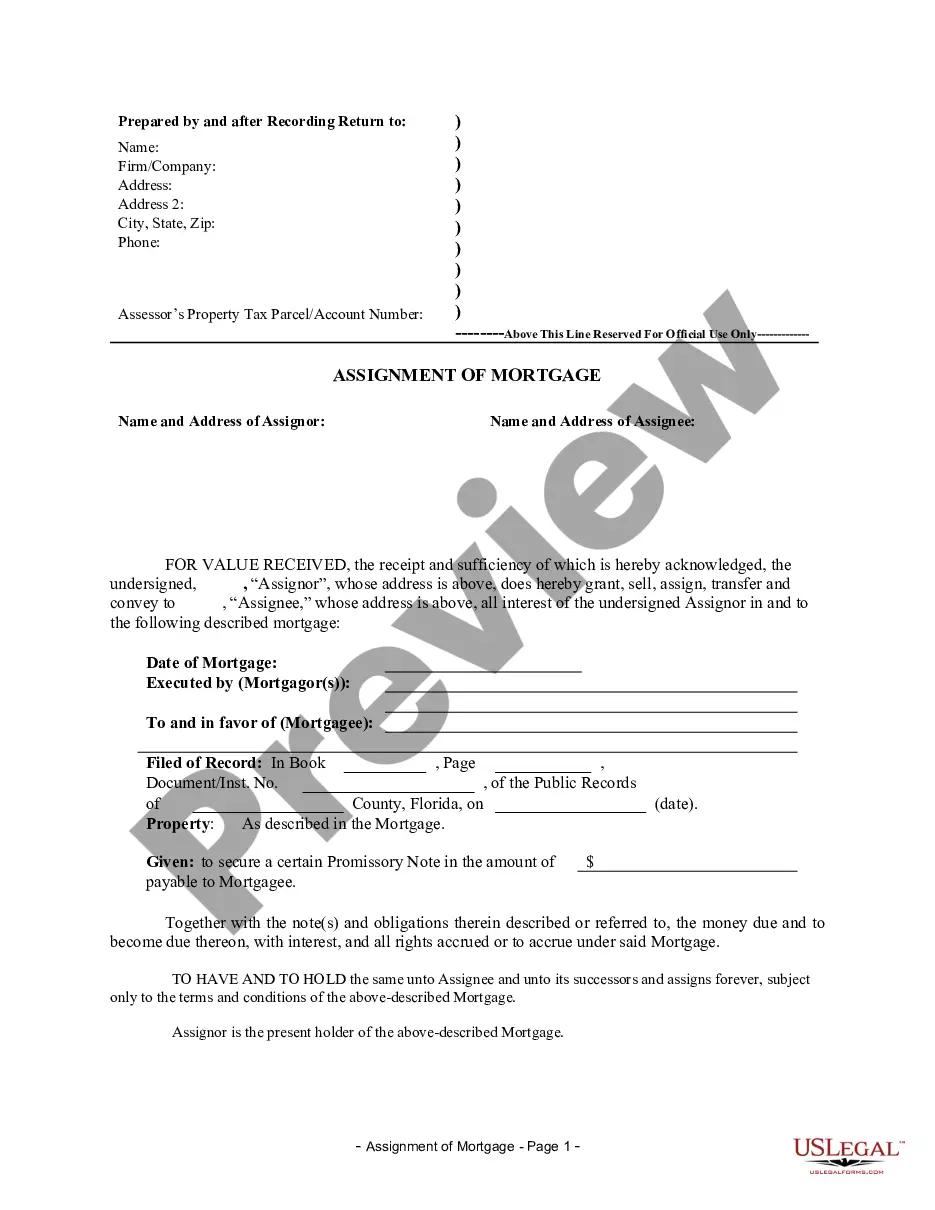

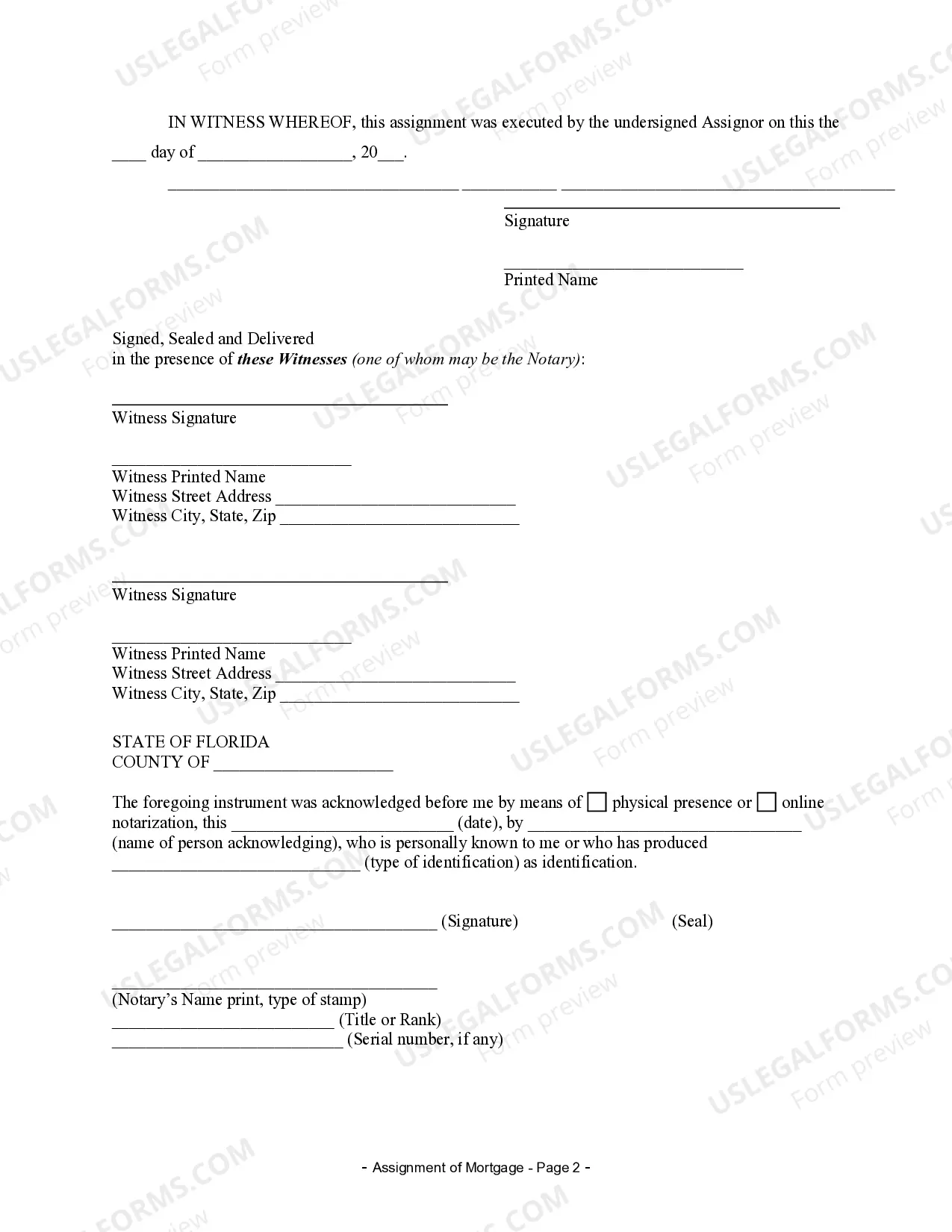

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

The Orange Florida Assignment of Mortgage by Individual Mortgage Holder is an important legal document that deals with the transfer of mortgage rights from one individual mortgage holder to another in Orange County, Florida. This document signifies a change in ownership or assignment of a mortgage loan. In this context, the term "Orange Florida" refers to the geographic location where the assignment is made, specifically within Orange County. Meanwhile, an "Individual Mortgage Holder" refers to a private individual or entity who holds the mortgage on a property. Keywords: Orange Florida Assignment of Mortgage, Individual Mortgage Holder, Orange County, transfer of mortgage rights, change in ownership, assignment of mortgage loan. There are various types of Orange Florida Assignment of Mortgage by Individual Mortgage Holder, each with its own specific characteristics and requirements. Some commonly encountered types include: 1. Voluntary Assignment: This type of assignment occurs when the mortgage holder voluntarily transfers their rights to another individual mortgage holder. It typically requires the consent and agreement of all parties involved. 2. Involuntary Assignment: In contrast to voluntary assignments, an involuntary assignment occurs when the transfer of mortgage rights is mandated by law or court order. This typically happens in cases of foreclosure, bankruptcy, or as a result of legal proceedings. 3. Partial Assignment: In cases where the mortgage holder wants to transfer only a portion of their mortgage rights, a partial assignment can be made. This enables the original holder to retain some ownership while giving part of the rights to another individual mortgage holder. 4. Cross-Assignment: This type of assignment occurs when multiple mortgage holders agree to transfer their respective mortgage rights to one another. This is typically done to consolidate ownership or simplify the mortgage arrangement. 5. Subsequent Assignment: Subsequent assignments refer to the transfer of mortgage rights from one individual mortgage holder to another after an initial assignment has already taken place. This type of assignment can occur multiple times over the life of a mortgage loan. It is important to note that in Orange County, Florida, specific legal procedures and documentation must be followed when executing an assignment of mortgage. These processes may vary depending on the type of assignment, the parties involved, and any additional legal requirements in the state of Florida. Keywords: Voluntary Assignment, Involuntary Assignment, Partial Assignment, Cross-Assignment, Subsequent Assignment, Orange County, Florida, legal procedures, documentation, mortgage rights, transfer of ownership.

Free preview

How to fill out Orange Florida Assignment Of Mortgage By Individual Mortgage Holder?

If you’ve already used our service before, log in to your account and save the Orange Florida Assignment of Mortgage by Individual Mortgage Holder on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Orange Florida Assignment of Mortgage by Individual Mortgage Holder. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!