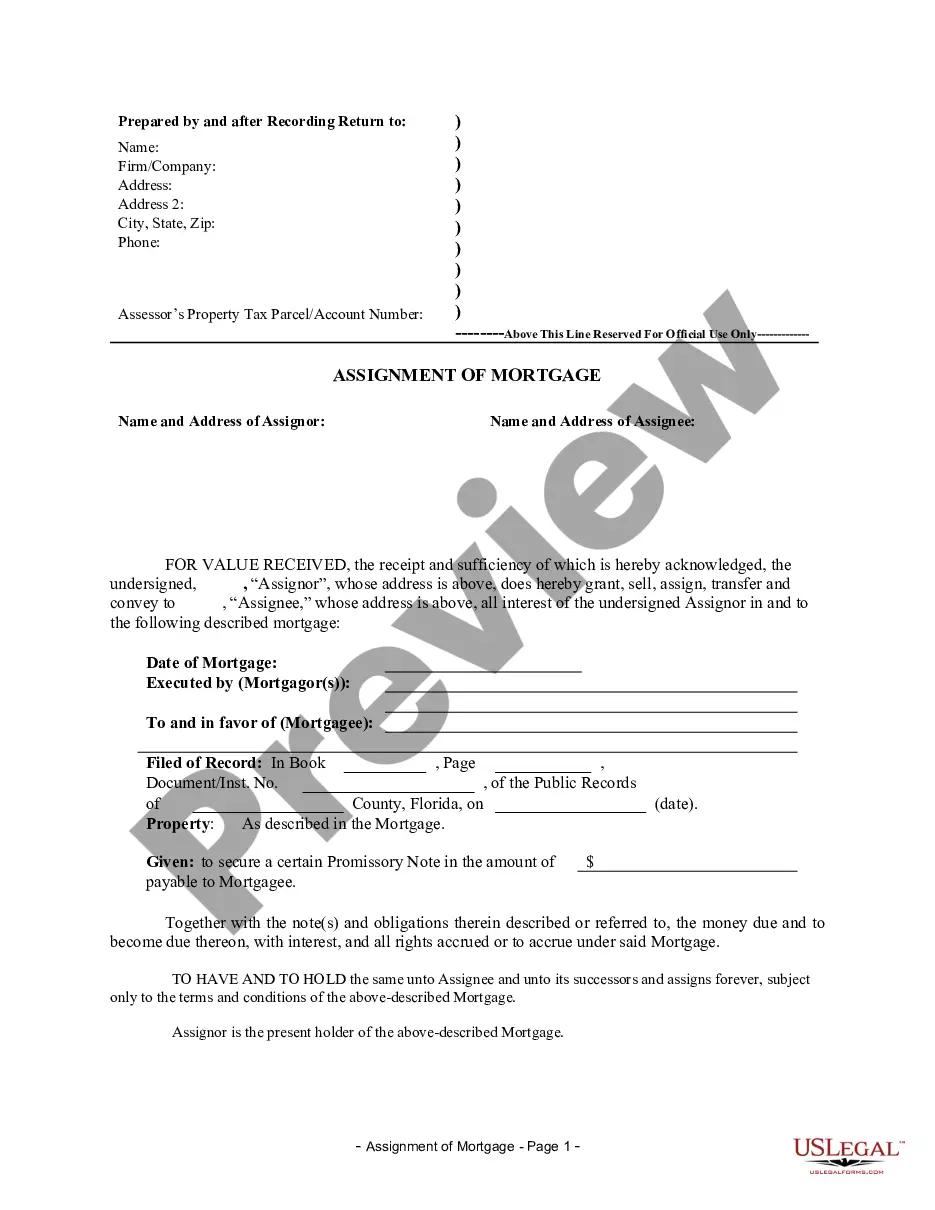

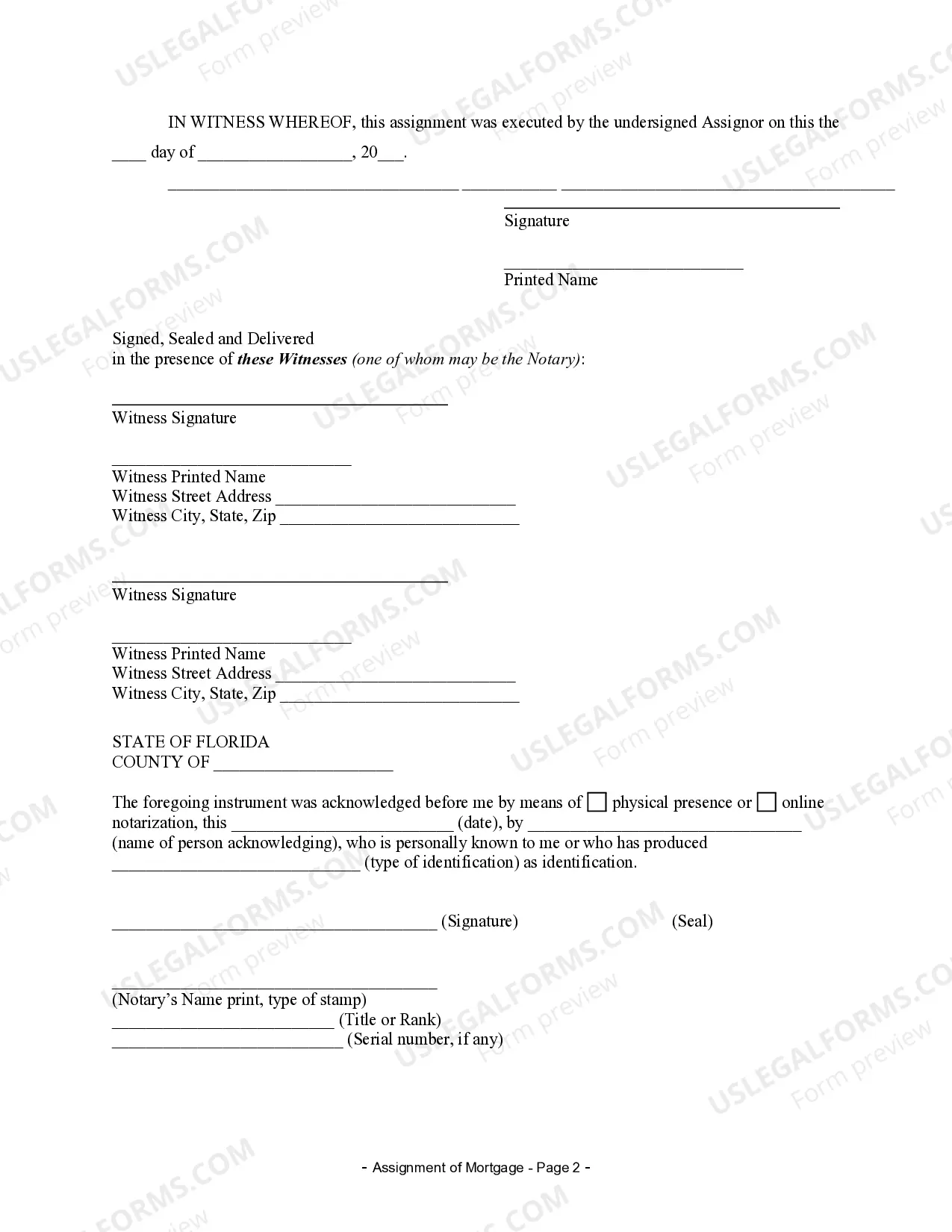

The Palm Beach Florida Assignment of Mortgage by Individual Mortgage Holder is a legal process through which a mortgage holder transfers their mortgage rights to another party. This assignment allows the new party to assume all the rights and obligations associated with the original mortgage agreement in exchange for a consideration or payment. In Palm Beach, Florida, there are several types of Assignments of Mortgage by Individual Mortgage Holder, including: 1. Voluntary Assignment: This type of assignment occurs when a mortgage holder willingly transfers their rights to another person or entity. It often takes place when the original mortgage holder wants to sell the mortgage or transfer it to a trusted party such as a family member, friend, or business partner. 2. Involuntary Assignment: In some cases, a mortgage holder may be forced to assign their mortgage rights. This can happen due to various reasons, including foreclosure, bankruptcy, or court-ordered settlements. In such cases, the mortgage holder must transfer the mortgage to the designated party or entity as determined by the court or legal process. 3. Partial Assignment: Sometimes, a mortgage holder may choose to assign only a portion of their mortgage rights to another party. This type of assignment allows the original mortgage holder to keep a partial interest in the mortgage while sharing the responsibilities, risks, and benefits with the assignee. 4. Complete Assignment: This is the most common type of assignment wherein the mortgage holder transfers all their rights and interests in the mortgage to the assignee. The assignee assumes full responsibility for the mortgage, including the payment collection, foreclosure procedures, and all other obligations outlined in the original mortgage agreement. It's important to note that the Assignment of Mortgage by Individual Mortgage Holder must be properly documented and recorded to ensure the legality of the transfer. This involves drafting an assignment document, signing it in the presence of a notary public, and registering it with the relevant county clerk's office. In conclusion, the Palm Beach Florida Assignment of Mortgage by Individual Mortgage Holder is a legal process that allows a mortgage holder to transfer their mortgage rights to another party. This assignment can be voluntary or involuntary and can involve either a partial or complete transfer of the mortgage rights. Proper documentation and registration are essential to ensure the validity and enforceability of the assignment.

Palm Beach Florida Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out Palm Beach Florida Assignment Of Mortgage By Individual Mortgage Holder?

Are you looking for a reliable and inexpensive legal forms supplier to buy the Palm Beach Florida Assignment of Mortgage by Individual Mortgage Holder? US Legal Forms is your go-to solution.

No matter if you need a basic arrangement to set rules for cohabitating with your partner or a package of forms to move your separation or divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and framed based on the requirements of particular state and area.

To download the form, you need to log in account, locate the needed form, and click the Download button next to it. Please take into account that you can download your previously purchased form templates anytime from the My Forms tab.

Are you new to our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Check if the Palm Beach Florida Assignment of Mortgage by Individual Mortgage Holder conforms to the laws of your state and local area.

- Read the form’s details (if provided) to learn who and what the form is good for.

- Start the search over in case the form isn’t good for your legal scenario.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Palm Beach Florida Assignment of Mortgage by Individual Mortgage Holder in any provided file format. You can return to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending hours learning about legal paperwork online once and for all.