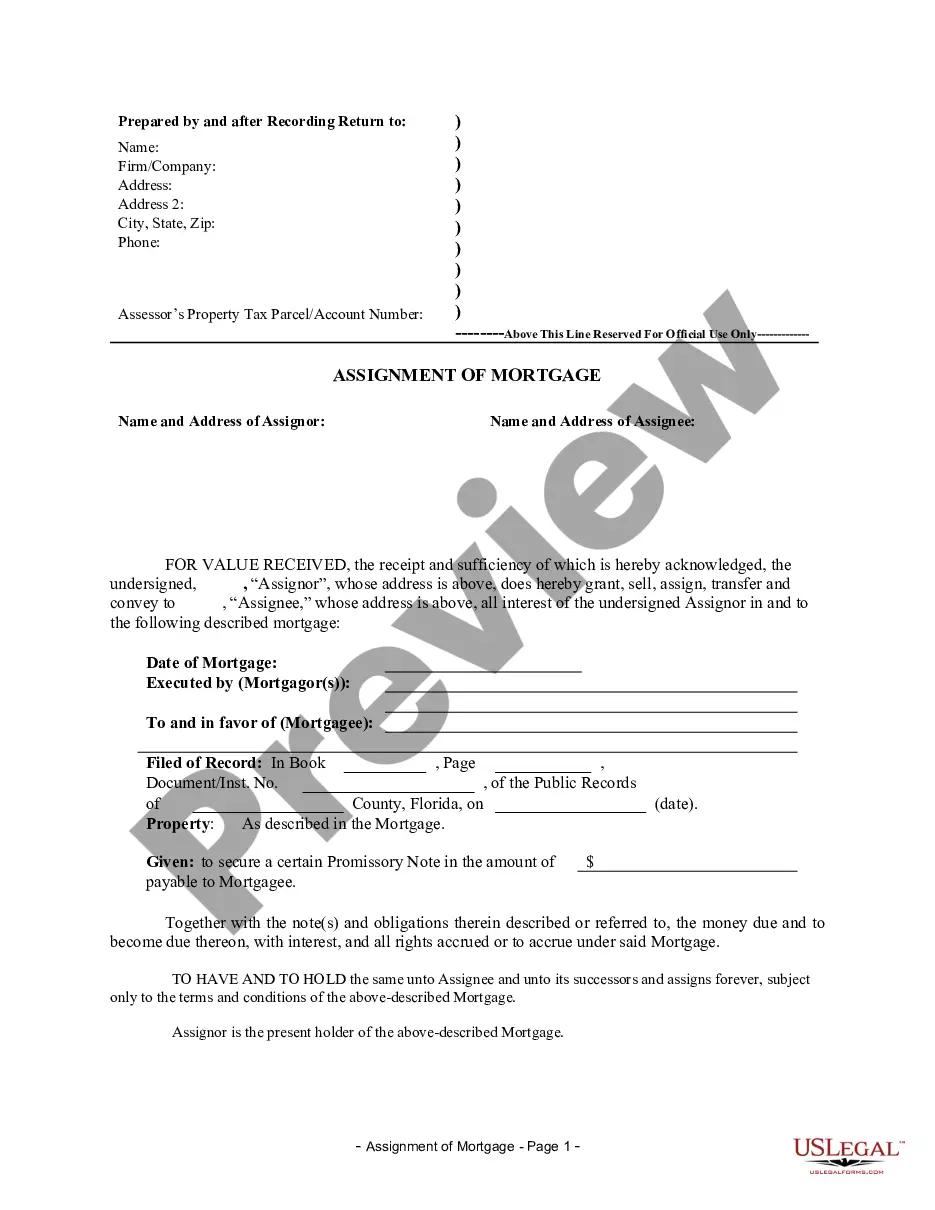

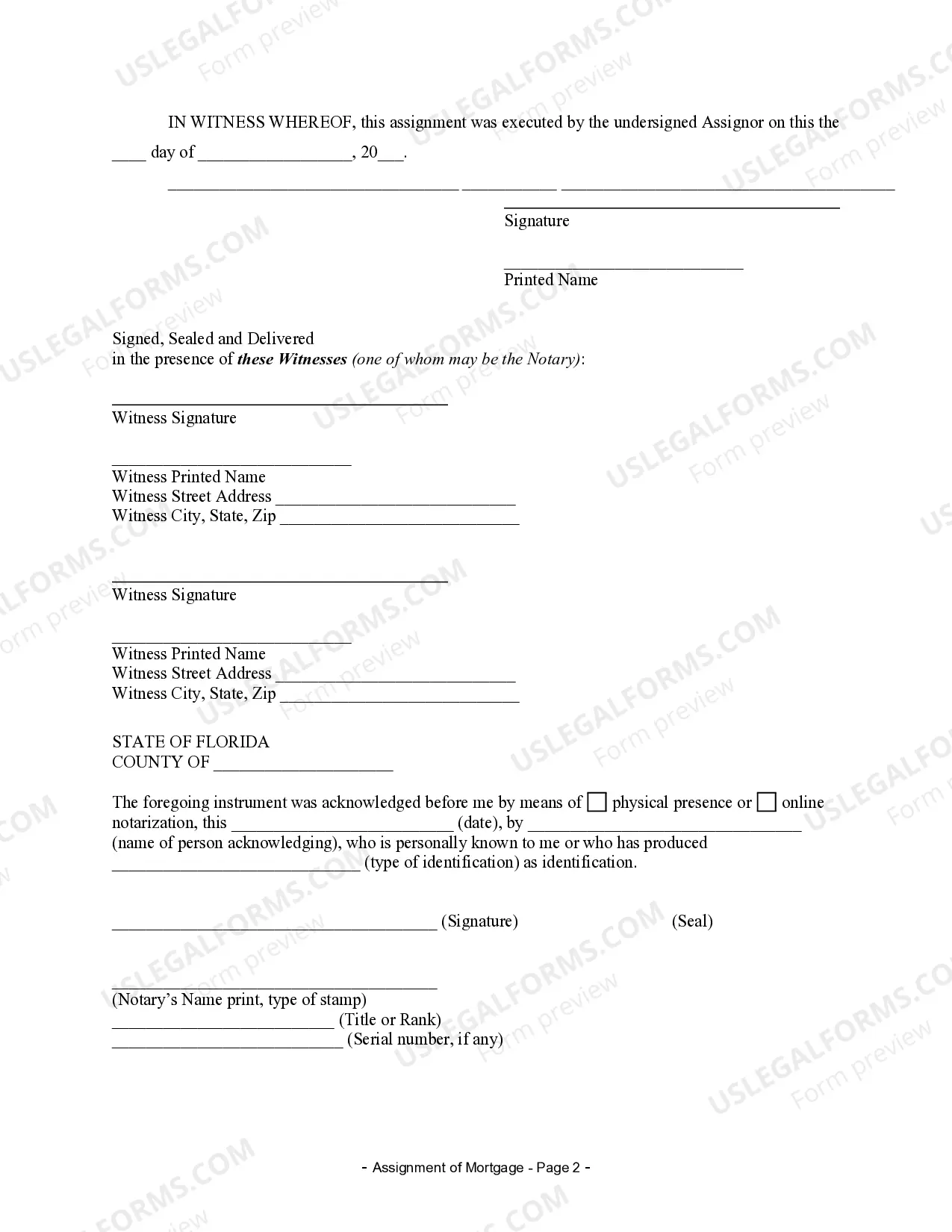

Pembroke Pines, located in sunny South Florida, is home to many individuals who invest in real estate and secure mortgages for their properties. In the world of mortgage financing, an assignment of mortgage refers to the transfer of a mortgage from one party to another, often with the assistance of a mortgage holder. In the case of Pembroke Pines, Florida, individual mortgage holders can engage in the assignment process to transfer their mortgage rights. When an individual mortgage holder chooses to assign their mortgage in Pembroke Pines, they are essentially transferring their interest in the property and the accompanying mortgage to another party. This can occur due to various reasons, such as selling the property, entering a new loan agreement, or satisfying financial obligations. The assignment of mortgage allows for a smooth transition of the mortgage responsibility from one individual to another. In Pembroke Pines, Florida, different types of assignment of mortgage by individual mortgage holders can occur, each with its own specific characteristics: 1. Standard Assignment: This is the most common type of assignment where an individual mortgage holder transfers their mortgage rights and obligations to another person or entity. The new assignee assumes all responsibilities and benefits associated with the mortgage, including making timely payments, managing property taxes, and fulfilling any financial obligations. 2. Partial Assignment: In certain cases, an individual mortgage holder may choose to assign only a portion of their mortgage. This can happen when they sell a percentage of the property or divide the mortgage responsibilities between multiple parties. In this scenario, the assignee assumes responsibility for the specific portion of the mortgage assigned to them. 3. Assignment with Assumption: This type of assignment occurs when a new party agrees to assume both the mortgage debt and the related property. The individual mortgage holder transfers both the property and the mortgage responsibility to the assignee, who becomes the new owner and borrower. 4. Assignment with Novation: Novation is a legal concept that involves the substitution of a new party for an existing party in a legal agreement. In this assignment, the individual mortgage holder relinquishes all rights and obligations associated with the mortgage, replacing it with a new agreement between the new party and the lender. Pembroke Pines, Florida, Assignment of Mortgage by Individual Mortgage Holder is a crucial process that allows individuals to transfer their mortgage rights and obligations to ensure a smooth transition in property ownership. It is essential to consult with a knowledgeable real estate attorney or mortgage professional to navigate the legal complexities and ensure compliance with all relevant laws and regulations in Pembroke Pines, Florida. Keywords: Pembroke Pines, Florida, assignment of mortgage, individual mortgage holder, mortgage financing, transfer of mortgage, mortgage rights, mortgage holder, property ownership, legal complexities, real estate attorney, mortgage professional.

Pembroke Pines Florida Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out Pembroke Pines Florida Assignment Of Mortgage By Individual Mortgage Holder?

No matter what social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for a person with no law education to create such paperwork from scratch, mostly because of the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes in handy. Our platform offers a huge library with over 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you require the Pembroke Pines Florida Assignment of Mortgage by Individual Mortgage Holder or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Pembroke Pines Florida Assignment of Mortgage by Individual Mortgage Holder quickly using our trusted platform. In case you are presently a subscriber, you can proceed to log in to your account to download the needed form.

However, in case you are a novice to our platform, make sure to follow these steps prior to downloading the Pembroke Pines Florida Assignment of Mortgage by Individual Mortgage Holder:

- Be sure the form you have found is good for your area because the rules of one state or county do not work for another state or county.

- Review the document and go through a brief description (if available) of cases the paper can be used for.

- If the form you selected doesn’t suit your needs, you can start again and look for the necessary form.

- Click Buy now and pick the subscription plan you prefer the best.

- with your login information or register for one from scratch.

- Pick the payment gateway and proceed to download the Pembroke Pines Florida Assignment of Mortgage by Individual Mortgage Holder as soon as the payment is completed.

You’re all set! Now you can proceed to print out the document or complete it online. If you have any problems locating your purchased forms, you can easily find them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.