Lakeland Florida Assignment of Mortgage by Corporate Mortgage Holder is a legal process that involves the transfer of a mortgage from one party to another within the context of a corporate entity. This action is typically executed when a lending institution or their corporate mortgage holder wishes to transfer the rights and obligations associated with a mortgage loan to another entity. The Assignment of Mortgage is a legal document that facilitates this transfer, ensuring that the new entity becomes the legal holder of the mortgage and assumes all rights and responsibilities linked to it. This process is governed by Florida state laws and is essential for maintaining clarity and transparency in mortgage transactions. There are several types of Lakeland Florida Assignments of Mortgage by Corporate Mortgage Holder, each fulfilling specific purposes within the loan transfer process. Some of the most common types include: 1. Full Assignment: This involves the complete transfer of the mortgage from the current corporate mortgage holder to the new entity. It includes all rights, interests, and responsibilities associated with the mortgage. 2. Partial Assignment: In some cases, the corporate mortgage holder may transfer only a portion of their interest in the mortgage. This is usually done when there is a need to divide the loan or when multiple parties are involved. 3. Assignment of Security Interest: This type of assignment is focused on transferring the security interest or lien associated with the mortgage rather than the entire mortgage itself. It allows for the transfer of the collateral linked to the loan. 4. Assignment in Blank: This occurs when the corporate mortgage holder transfers the mortgage without specifying the new entity or party to whom it is being assigned. This type of assignment is commonly used when the mortgage is packaged for sale on the secondary market. 5. Along Assignment: In situations where there is an endorsement on a promissory note that carries the mortgage, an along assignment may be used. It is a separate document that provides a detailed endorsement for the transfer of the mortgage. It is important to note that the Assignment of Mortgage by Corporate Mortgage Holder in Lakeland Florida must be executed and recorded appropriately to ensure its legality and enforceability. This process typically involves preparing the necessary documents, obtaining signatures from involved parties, and filing the assignment with the appropriate local authorities. Understanding the different types of Lakeland Florida Assignment of Mortgage by Corporate Mortgage Holder is crucial for lenders, borrowers, and investors alike. By having a comprehensive knowledge of these processes, individuals can make informed decisions and navigate mortgage transactions confidently.

Lakeland Florida Assignment of Mortgage by Corporate Mortgage Holder

State:

Florida

City:

Lakeland

Control #:

FL-121RE

Format:

Word;

Rich Text

Instant download

Description

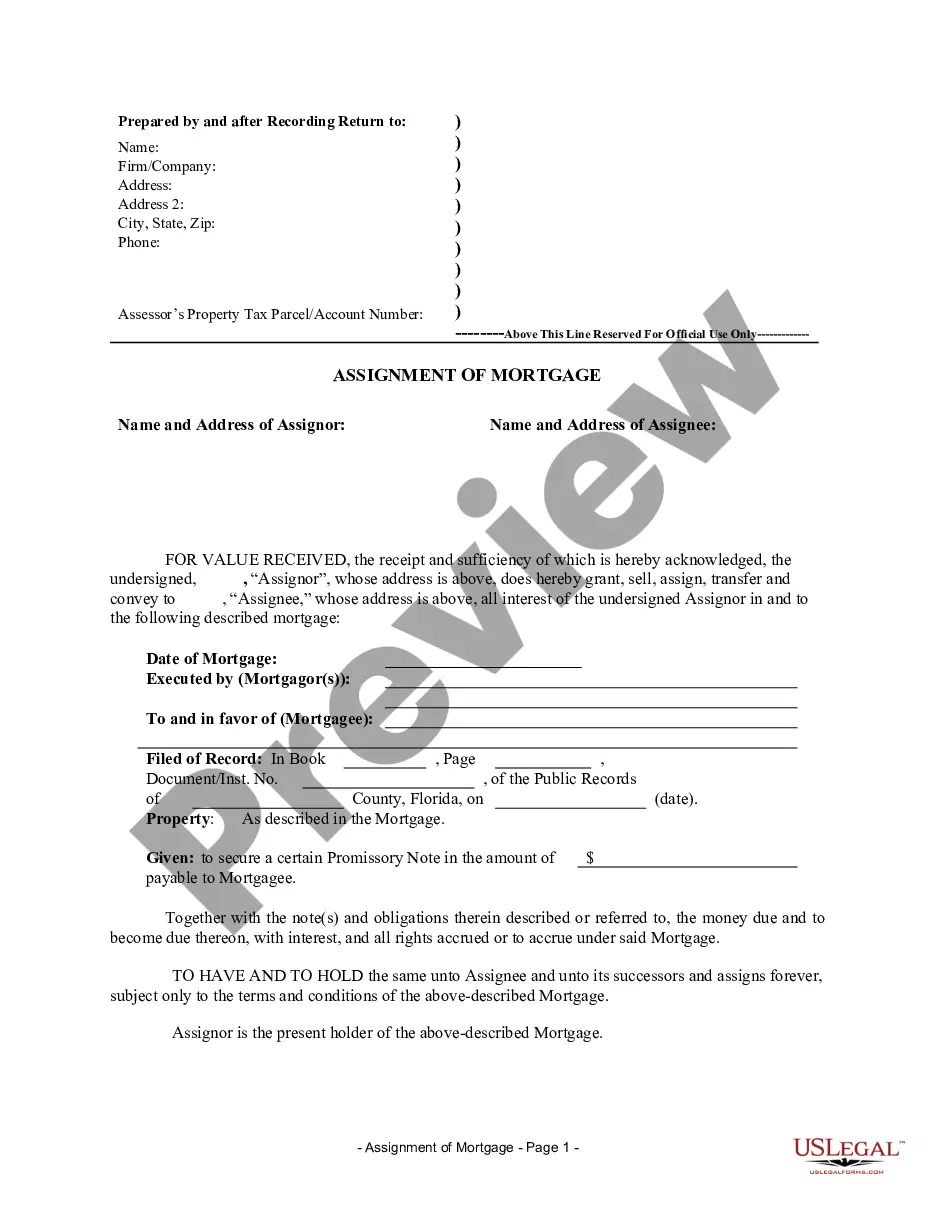

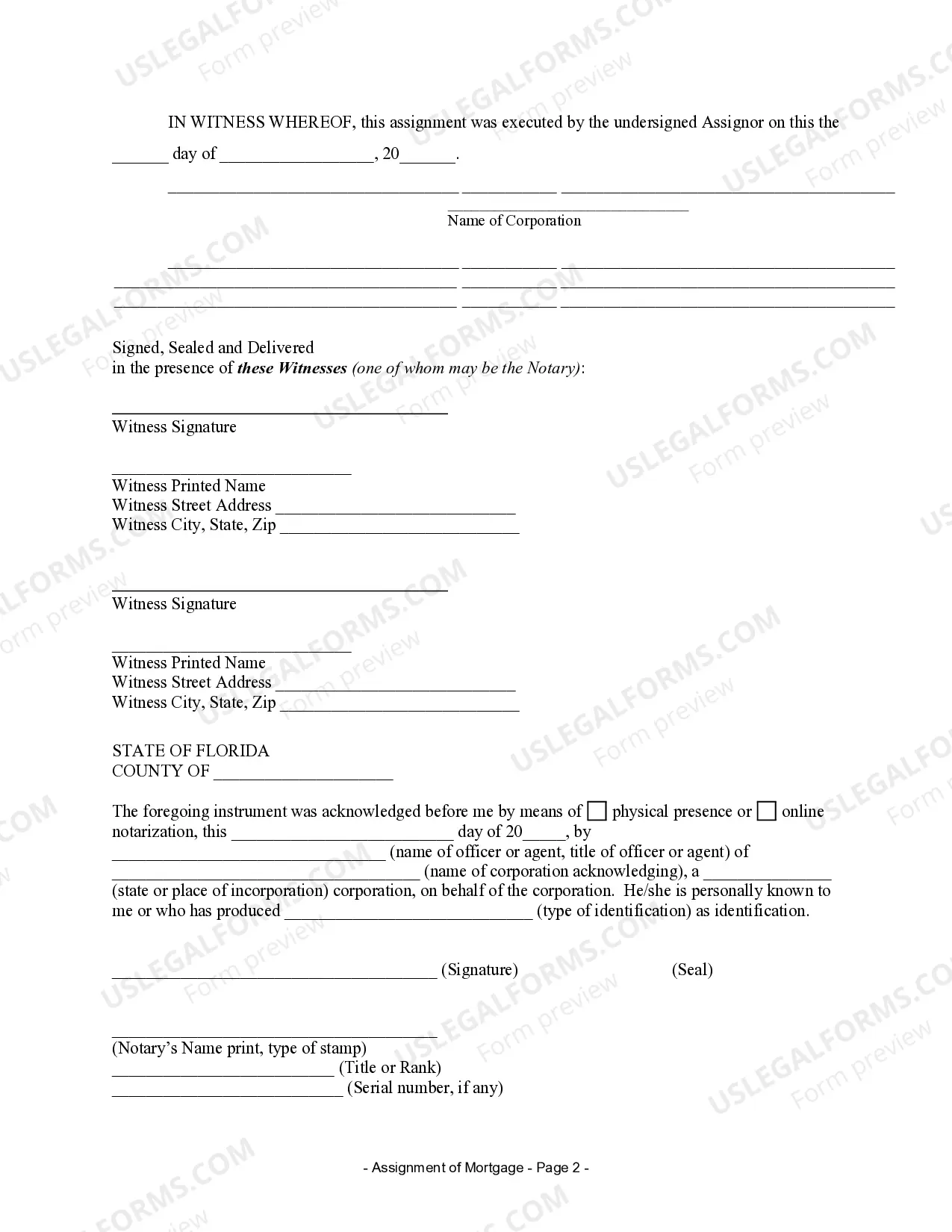

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Lakeland Florida Assignment of Mortgage by Corporate Mortgage Holder is a legal process that involves the transfer of a mortgage from one party to another within the context of a corporate entity. This action is typically executed when a lending institution or their corporate mortgage holder wishes to transfer the rights and obligations associated with a mortgage loan to another entity. The Assignment of Mortgage is a legal document that facilitates this transfer, ensuring that the new entity becomes the legal holder of the mortgage and assumes all rights and responsibilities linked to it. This process is governed by Florida state laws and is essential for maintaining clarity and transparency in mortgage transactions. There are several types of Lakeland Florida Assignments of Mortgage by Corporate Mortgage Holder, each fulfilling specific purposes within the loan transfer process. Some of the most common types include: 1. Full Assignment: This involves the complete transfer of the mortgage from the current corporate mortgage holder to the new entity. It includes all rights, interests, and responsibilities associated with the mortgage. 2. Partial Assignment: In some cases, the corporate mortgage holder may transfer only a portion of their interest in the mortgage. This is usually done when there is a need to divide the loan or when multiple parties are involved. 3. Assignment of Security Interest: This type of assignment is focused on transferring the security interest or lien associated with the mortgage rather than the entire mortgage itself. It allows for the transfer of the collateral linked to the loan. 4. Assignment in Blank: This occurs when the corporate mortgage holder transfers the mortgage without specifying the new entity or party to whom it is being assigned. This type of assignment is commonly used when the mortgage is packaged for sale on the secondary market. 5. Along Assignment: In situations where there is an endorsement on a promissory note that carries the mortgage, an along assignment may be used. It is a separate document that provides a detailed endorsement for the transfer of the mortgage. It is important to note that the Assignment of Mortgage by Corporate Mortgage Holder in Lakeland Florida must be executed and recorded appropriately to ensure its legality and enforceability. This process typically involves preparing the necessary documents, obtaining signatures from involved parties, and filing the assignment with the appropriate local authorities. Understanding the different types of Lakeland Florida Assignment of Mortgage by Corporate Mortgage Holder is crucial for lenders, borrowers, and investors alike. By having a comprehensive knowledge of these processes, individuals can make informed decisions and navigate mortgage transactions confidently.

Free preview

How to fill out Lakeland Florida Assignment Of Mortgage By Corporate Mortgage Holder?

If you’ve already used our service before, log in to your account and download the Lakeland Florida Assignment of Mortgage by Corporate Mortgage Holder on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Ensure you’ve found an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Lakeland Florida Assignment of Mortgage by Corporate Mortgage Holder. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!