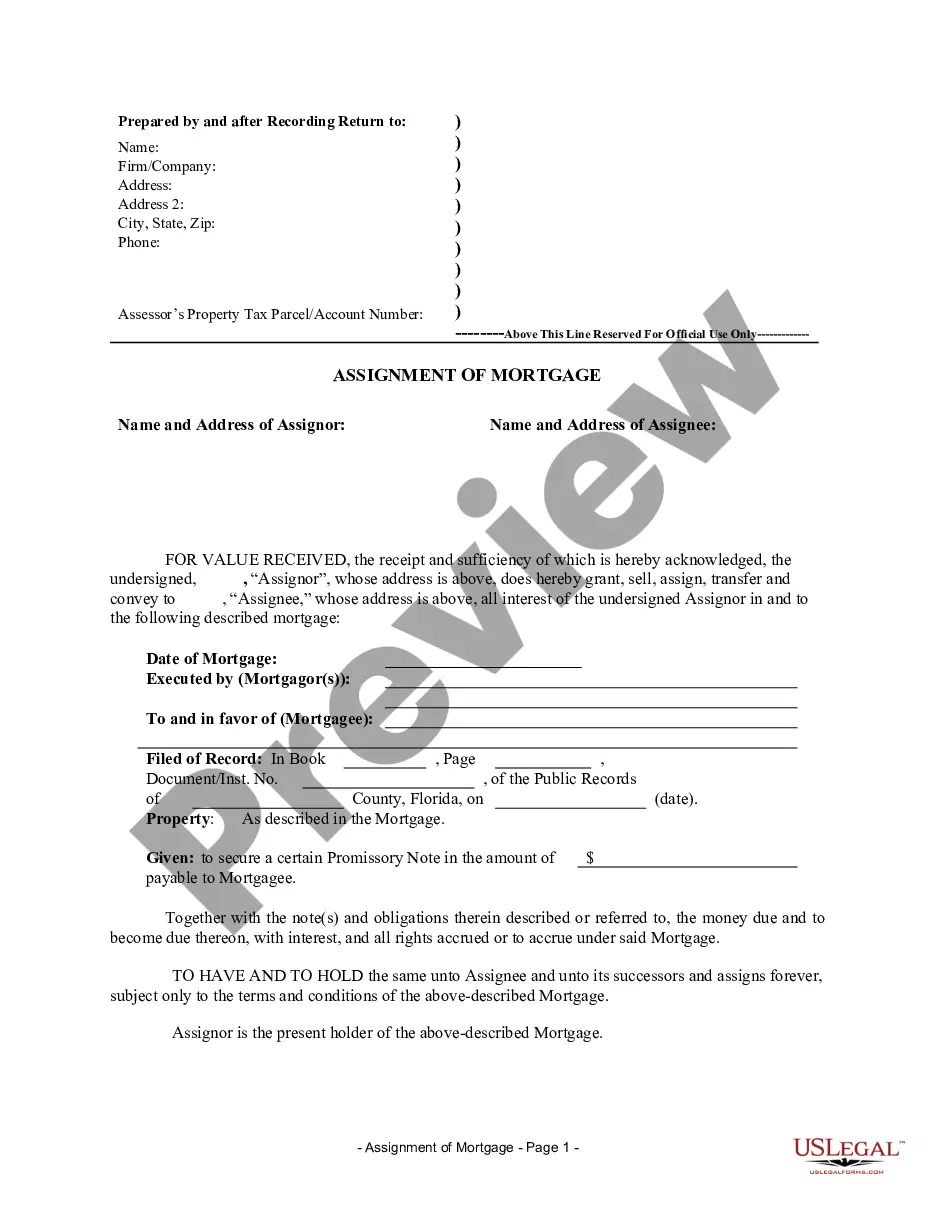

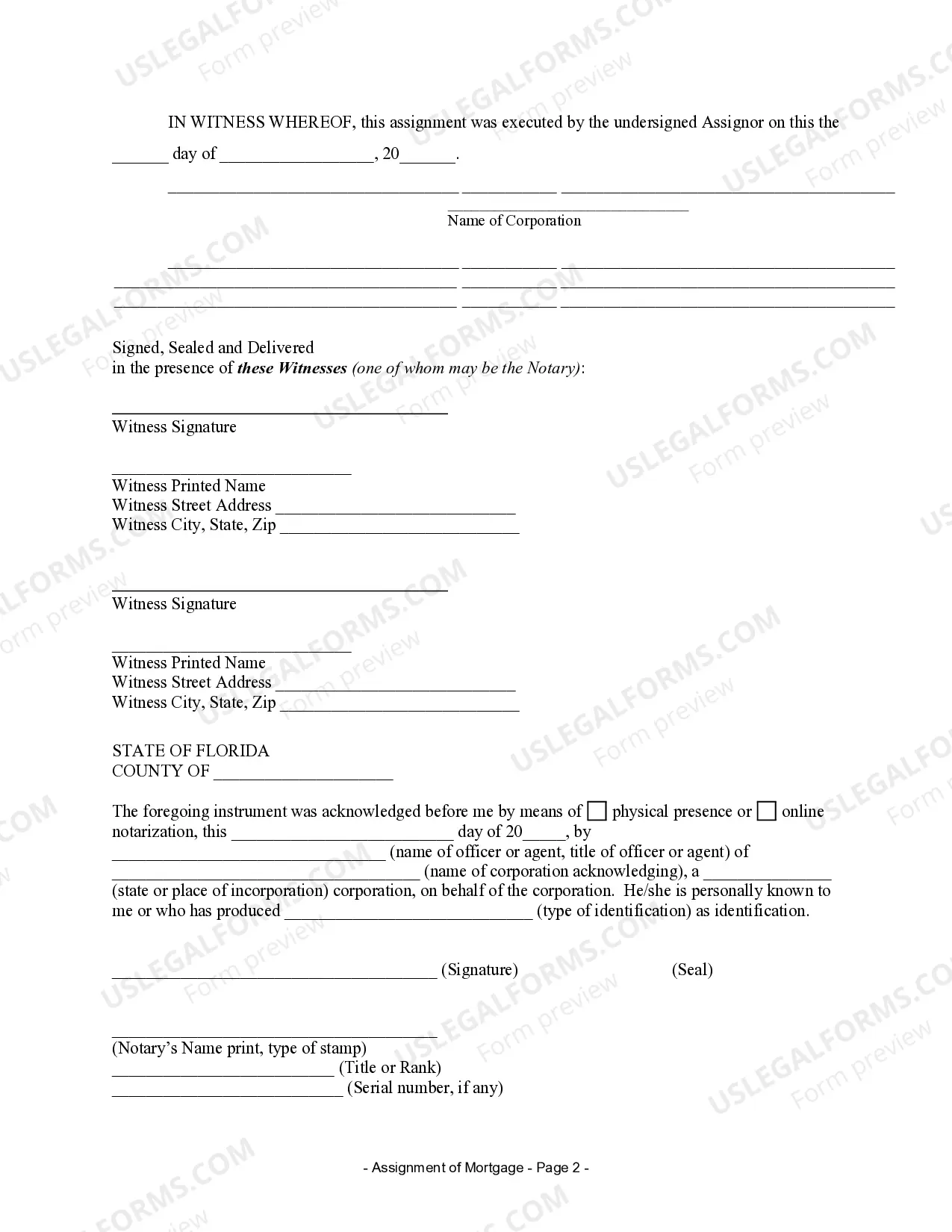

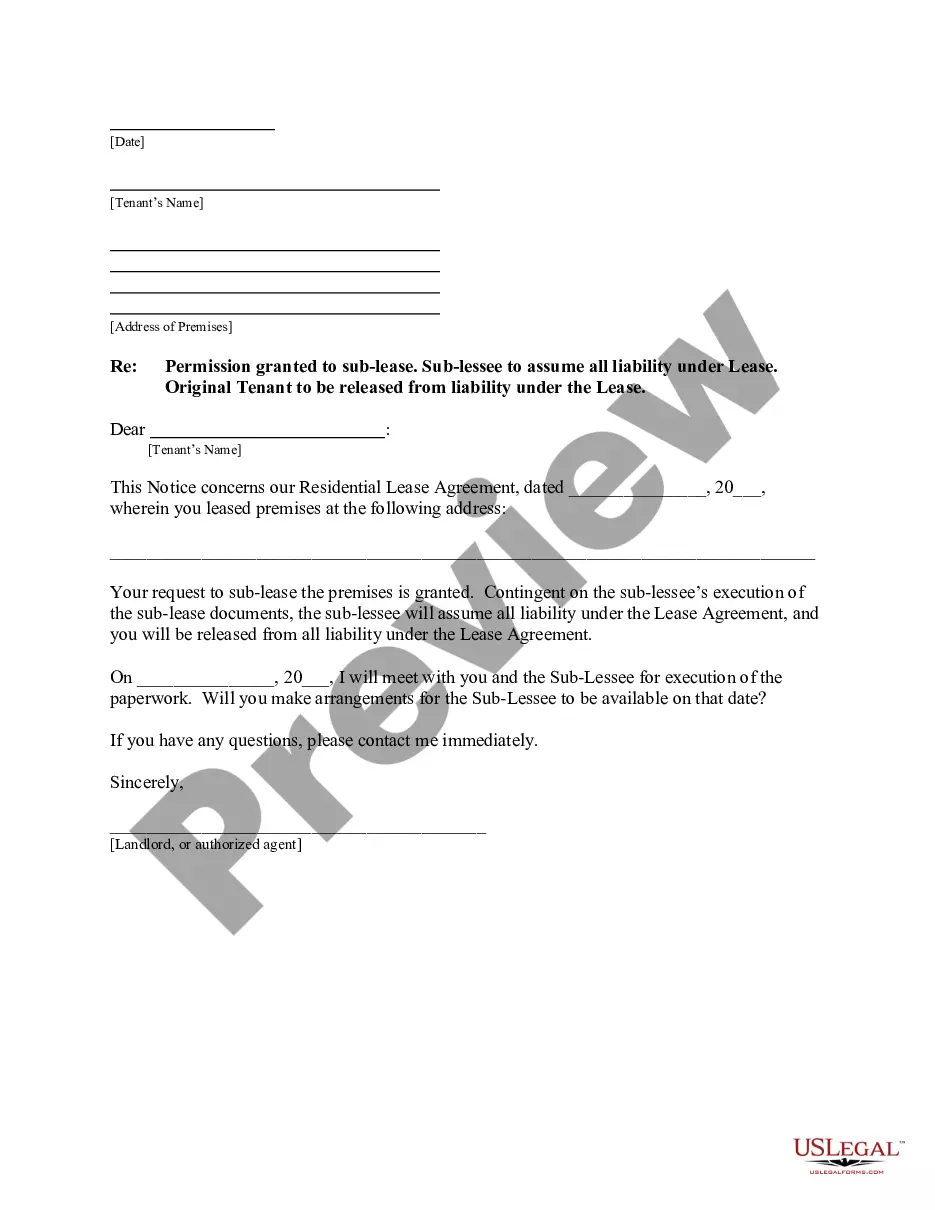

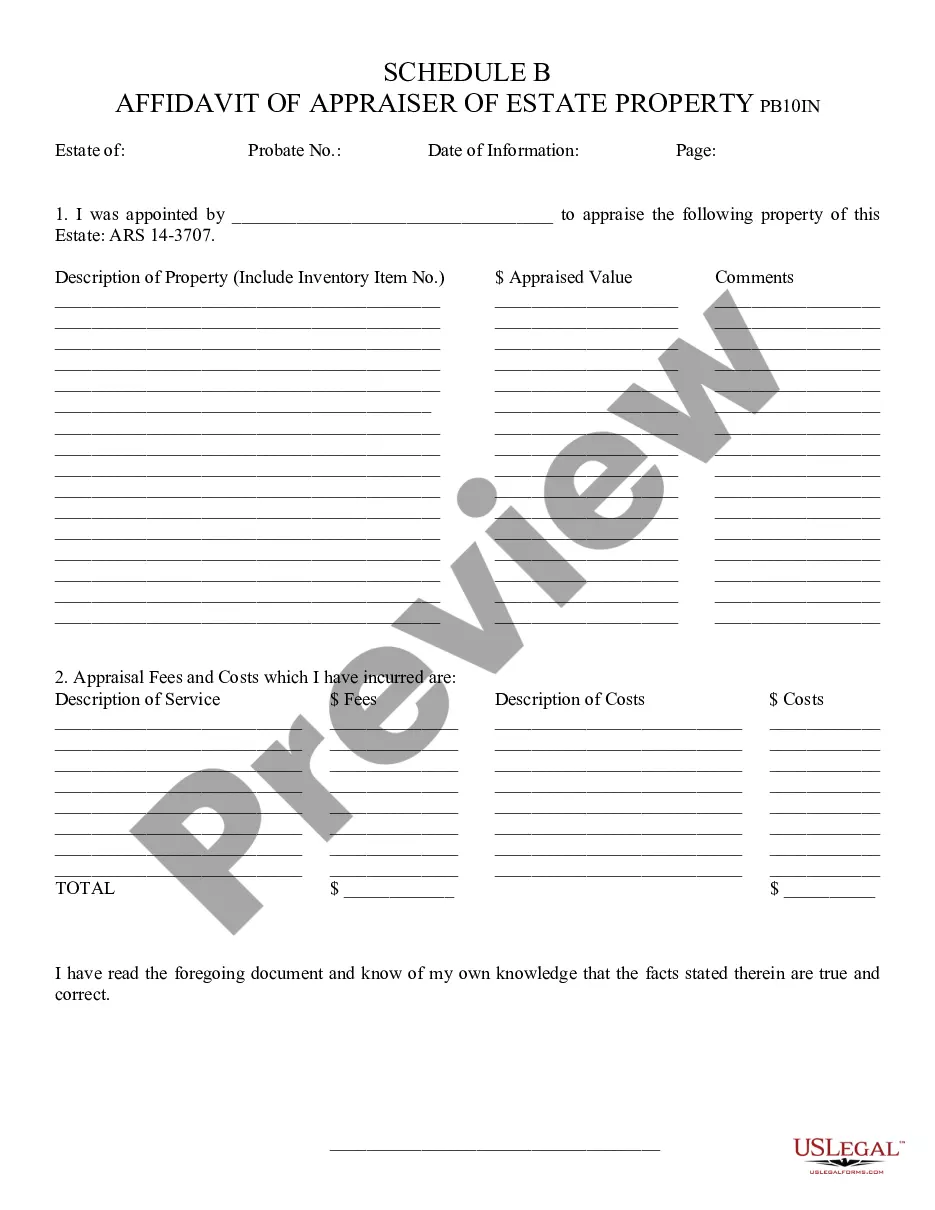

Miramar Florida Assignment of Mortgage by Corporate Mortgage Holder is a legal process in which a corporate entity transfers the rights and obligations of a mortgage loan to another party. This assignment is a crucial step in the mortgage industry and ensures the transfer of ownership and payment responsibility from one corporation to another. The Miramar Florida Assignment of Mortgage by Corporate Mortgage Holder involves the transfer of a mortgage loan from a corporate mortgage lender to a different corporate entity. This can happen due to a variety of reasons such as mergers and acquisitions, the sale of loan portfolios, or strategic business decisions. During this process, the first corporate mortgage holder assigns the mortgage note, which is the legal document representing the debt obligation, to the new corporate mortgage holder. The assignment is typically documented through an Assignment of Mortgage form, which outlines the details of the transfer, including the names of the parties involved, loan amount, property address, and any applicable terms and conditions. There are different types of Miramar Florida Assignment of Mortgage by Corporate Mortgage Holder based on the specific circumstances and intentions of the parties involved. Some common types include: 1. Assignment to a Service: In this scenario, the corporate mortgage holder transfers the servicing rights of the loan to another entity, often a specialized mortgage servicing company. The servicing company then takes on the responsibility of collecting loan payments, managing escrow accounts, and handling customer service inquiries. 2. Assignment to a Secondary Market Investor: Corporate mortgage holders may also assign mortgage loans to secondary market investors such as Fannie Mae or Freddie Mac. By doing so, the original lender frees up capital to fund new loans, and the secondary market investor assumes the risk and potential returns associated with the mortgage. 3. Assignment to a Loan Pool: In certain cases, corporate mortgage holders assign loans to a mortgage-backed securities (MBS) trust or a mortgage loan pool. This allows the mortgage loans to be bundled together as an investment product and sold to investors on the secondary market. 4. Assignment due to Merger or Acquisition: When two corporate entities merge or when one entity acquires another, the mortgage loans held by the acquired entity may be assigned to the acquiring entity. This ensures the smooth transfer of the loan portfolio and allows for a seamless continuation of payment processing and customer service. In conclusion, the Miramar Florida Assignment of Mortgage by Corporate Mortgage Holder is a critical process that facilitates the transfer of mortgage loans from one corporate entity to another. This assignment can occur for various reasons, and different types of assignments exist depending on the specific circumstances involved. It is essential for all parties involved to meticulously document the assignment to ensure legal compliance and clarity in the transfer of ownership and obligations.

Miramar Florida Assignment of Mortgage by Corporate Mortgage Holder

Description

How to fill out Miramar Florida Assignment Of Mortgage By Corporate Mortgage Holder?

We always strive to minimize or avoid legal issues when dealing with nuanced legal or financial affairs. To do so, we apply for legal services that, usually, are extremely costly. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of turning to a lawyer. We offer access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Miramar Florida Assignment of Mortgage by Corporate Mortgage Holder or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is just as effortless if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Miramar Florida Assignment of Mortgage by Corporate Mortgage Holder complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Miramar Florida Assignment of Mortgage by Corporate Mortgage Holder is suitable for your case, you can choose the subscription plan and proceed to payment.

- Then you can download the document in any suitable format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!