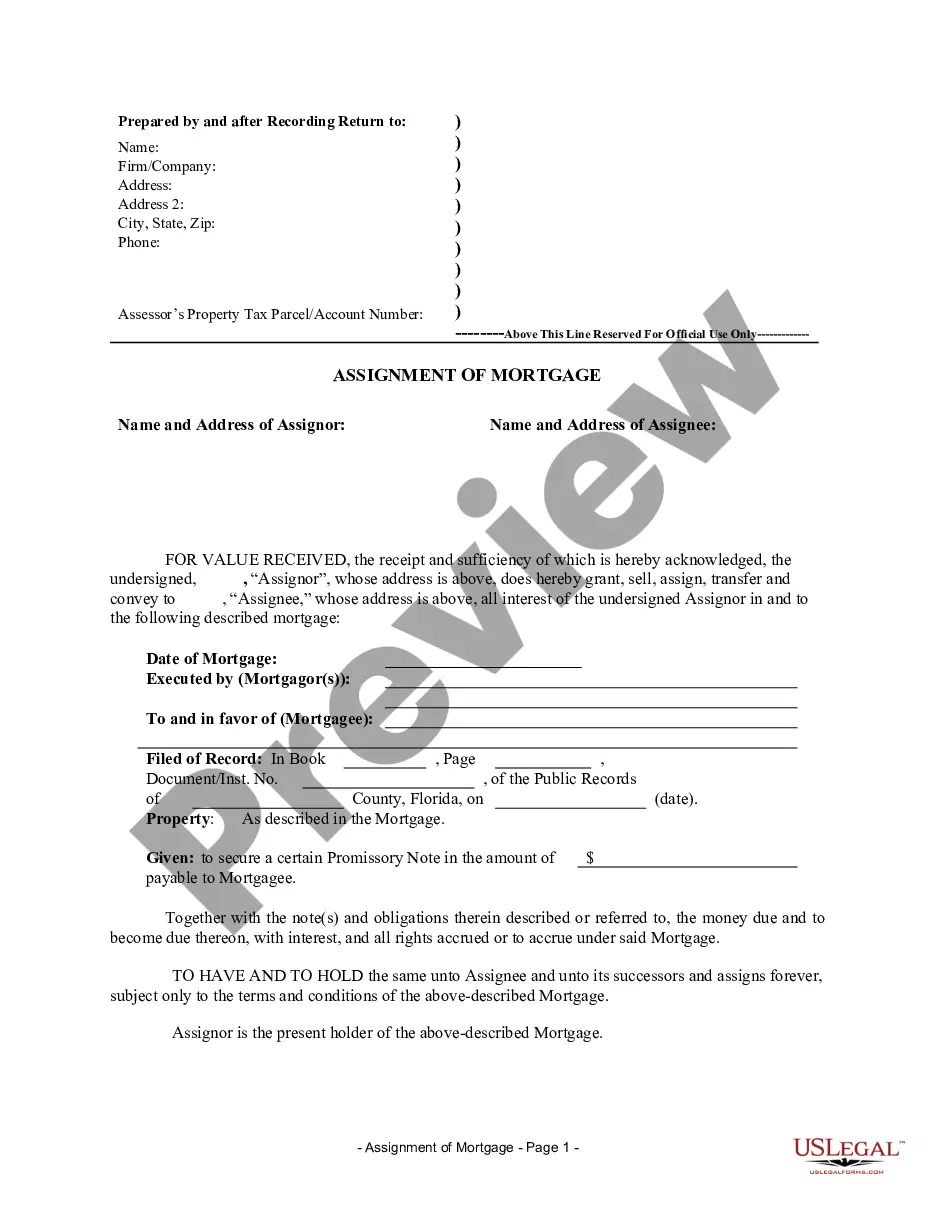

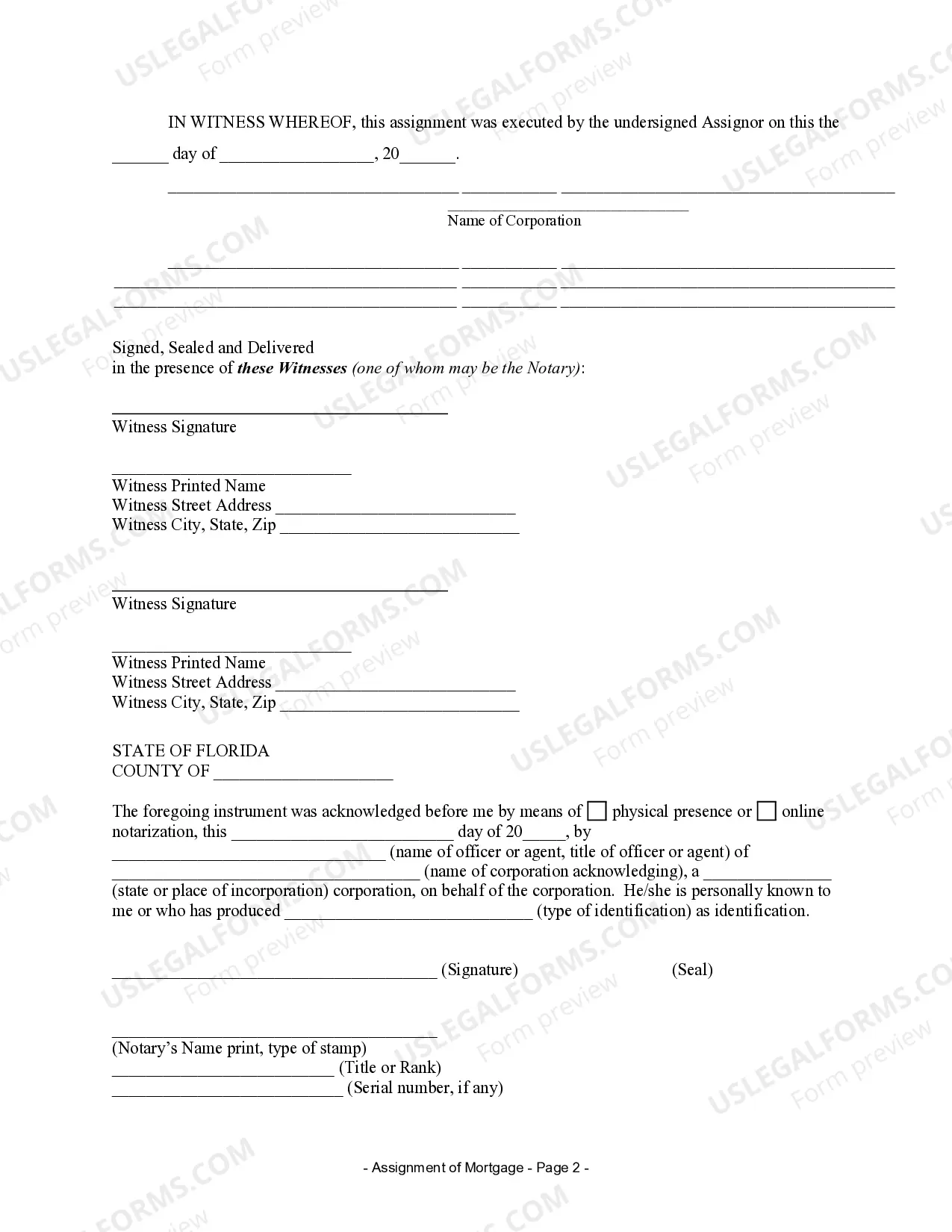

Title: Understanding Orlando, Florida Assignment of Mortgage by Corporate Mortgage Holder: A Comprehensive Guide Description: In Orlando, Florida, an assignment of mortgage by a corporate mortgage holder is a legal process that involves the transfer of a mortgage from one entity to another. This assignment occurs when a corporate mortgage holder, such as a lending institution or a mortgage service, assigns their rights and responsibilities on a mortgage loan to another entity, often a new financial institution or a loan servicing company. Keywords: Orlando, Florida, assignment of mortgage, corporate mortgage holder, types Introduction: In this detailed description, we will explore the intricacies of the Orlando, Florida Assignment of Mortgage by Corporate Mortgage Holder. We will showcase the significance of such agreements, how they function, and highlight any potential variations or types of assignments that may exist in this context. 1. Definition and Process of Assignment of Mortgage: An assignment of mortgage refers to the legal transfer of mortgage interests from one entity, the assignor (corporate mortgage holder), to another entity, the assignee. This process typically involves a written agreement that outlines the details of the assignment, including the mortgage loan amount, property details, and the rights and obligations of the new mortgage holder. 2. The Role of Corporate Mortgage Holders: Corporate mortgage holders, such as banks, financial institutions, or mortgage services, act as the initial lenders or the entities responsible for managing mortgage loans. These institutions often assign mortgages to manage risk, enhance liquidity, or streamline their portfolios. 3. Orlando, Florida Assignment of Mortgage: In Orlando, Florida, the assignment of mortgage follows the general principles of Florida state laws. However, it is crucial to consult legal experts or reference local regulations to ensure compliance with any specific regional requirements or processes. 4. Types of Orlando, Florida Assignment of Mortgage by Corporate Mortgage Holder: a) Assignment to Another Financial Institution: A corporate mortgage holder may assign the mortgage loan to a different financial institution. This assignment can occur due to acquisitions, mergers, or business reorganizations. b) Assignment to a Loan Servicing Company: In some cases, corporate mortgage holders may outsource the servicing of mortgage loans to specialized loan servicing companies. These assignments involve the transfer of the loan management responsibilities and any associated rights to the new servicing entity. c) Assignment due to Default or Financial Hardship: When a borrower faces financial difficulties or defaults on the mortgage loan, the corporate mortgage holder may assign the loan to another institution or service specializing in distressed loans management. d) Assignment to Facilitate Securitization: Corporate mortgage holders often assign mortgages to facilitate loan securitization, where a pool of mortgage loans is bundled together and sold as a security to investors. This allows the mortgage holder to mitigate risk and increase liquidity. Conclusion: Orlando, Florida Assignment of Mortgage by Corporate Mortgage Holder is a legal process that allows a corporate mortgage holder to transfer their rights and obligations regarding a mortgage loan to another entity. Whether it involves a transfer to another institution, loan servicing company, or occurs due to defaults or securitization, understanding the different types of assignments is essential for all involved parties.

Orlando Florida Assignment of Mortgage by Corporate Mortgage Holder

Description

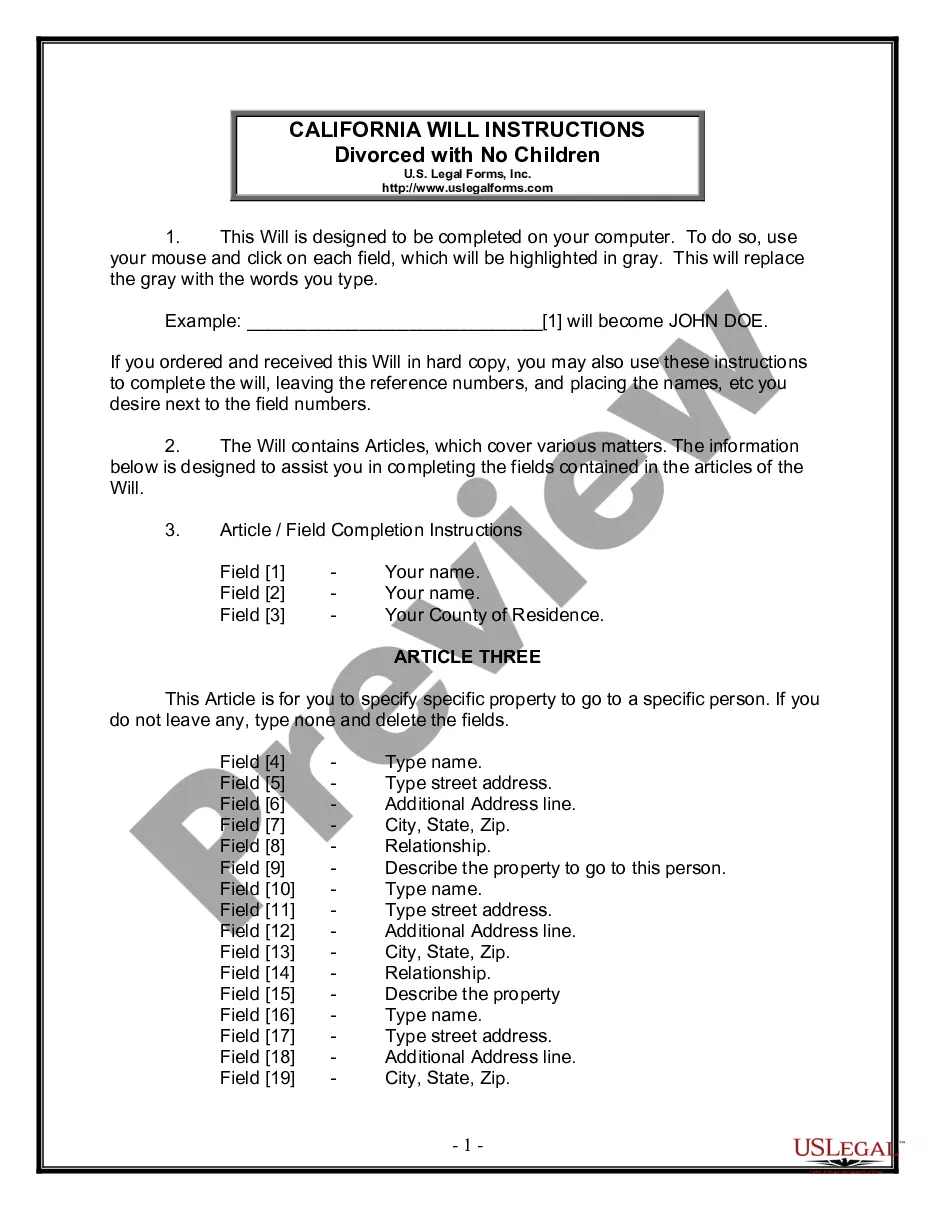

How to fill out Orlando Florida Assignment Of Mortgage By Corporate Mortgage Holder?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Orlando Florida Assignment of Mortgage by Corporate Mortgage Holder becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Orlando Florida Assignment of Mortgage by Corporate Mortgage Holder takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a couple of additional actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve picked the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Orlando Florida Assignment of Mortgage by Corporate Mortgage Holder. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!