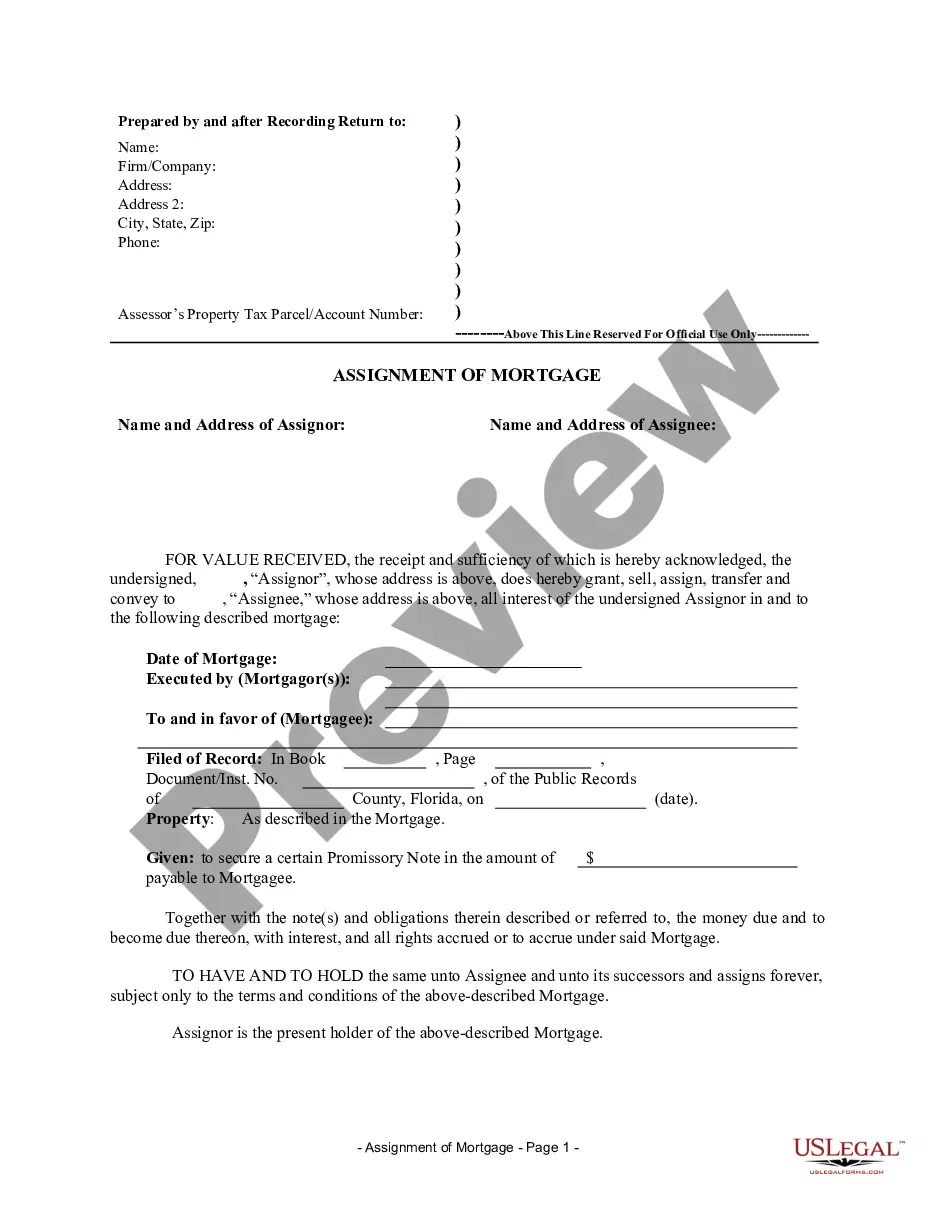

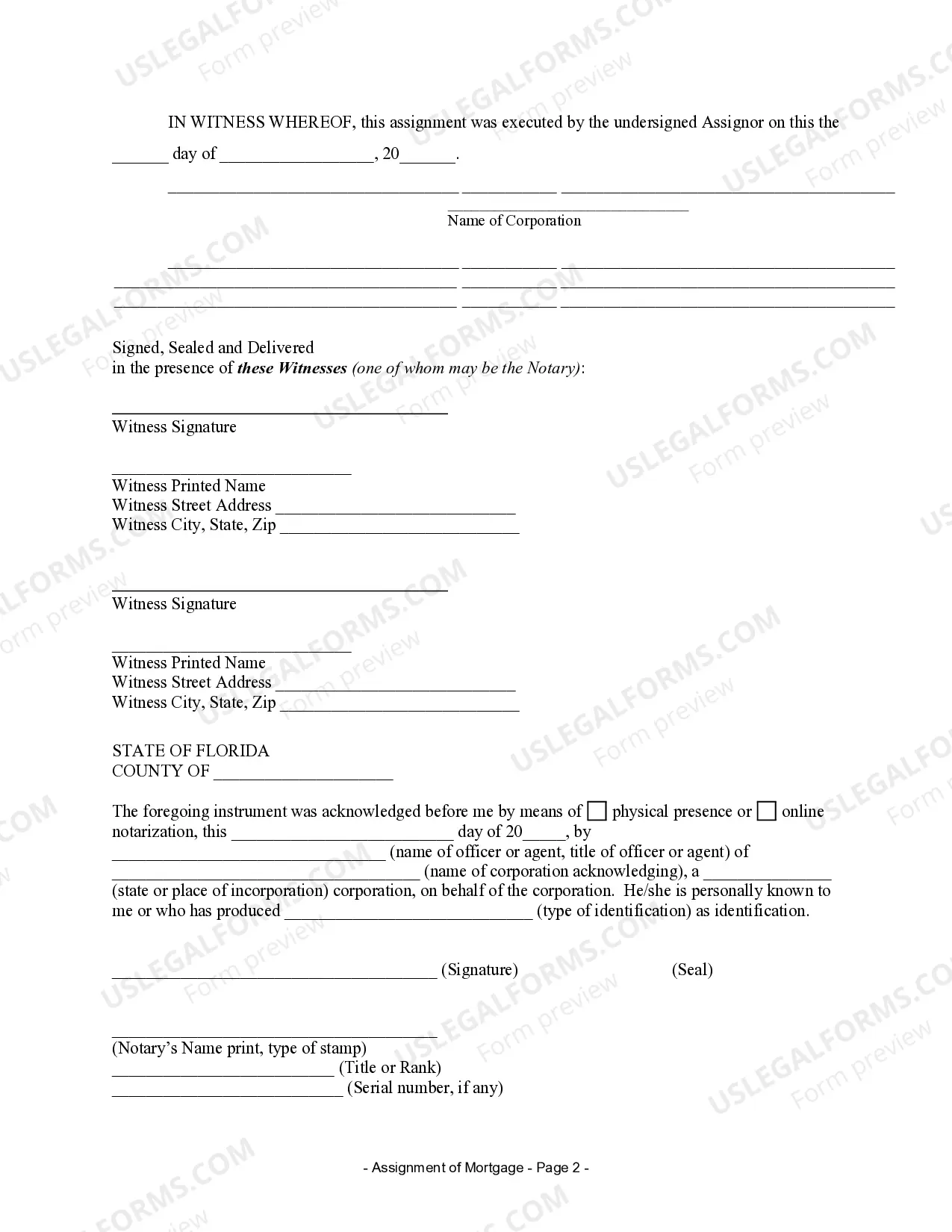

The Palm Beach Florida Assignment of Mortgage by Corporate Mortgage Holder is a legally binding document that transfers the ownership rights of a mortgage from one corporate mortgage holder to another. This process entails the original mortgage holder, also known as the assignor, transferring their interest in the mortgage to a new corporate entity, known as the assignee. Keywords: Palm Beach Florida, Assignment of Mortgage, Corporate Mortgage Holder, ownership rights, document, mortgage holder, assignor, assignee. There are different types of Palm Beach Florida Assignment of Mortgage by Corporate Mortgage Holder based on specific circumstances or requirements: 1. Partial Assignment: This type of assignment involves transferring a portion of the mortgage rather than the entire mortgage. It allows the assignor to sell a partial interest in the mortgage to the assignee, while retaining the remaining interest. 2. Full Assignment: A full assignment of mortgage involves the complete transfer of ownership rights from the assignor to the assignee. This type of assignment is typically used when the assignor wants to completely sell their interest in the mortgage. 3. Assignment with Recourse: In this type of assignment, the assignor remains partially liable for the mortgage. If the assignee defaults on the mortgage or faces any financial troubles, the assignor can be held responsible for taking certain actions, such as reimbursing the assignee for any losses incurred. 4. Assignment without Recourse: Unlike assignment with recourse, in this type of assignment, the assignor relinquishes all liability for the mortgage once it is transferred to the assignee. The assignee assumes full responsibility for the mortgage, including any potential losses. 5. Assignment for Security: This type of assignment is commonly used in mortgage-backed security transactions. It involves assigning the mortgage to a trust or special purpose vehicle for the purpose of securing an investment. Regardless of the type, the Palm Beach Florida Assignment of Mortgage by Corporate Mortgage Holder serves as a crucial legal instrument in facilitating the transfer of mortgage ownership rights. It establishes the new corporate mortgage holder as the legal recipient of the rights, duties, and obligations associated with the mortgage.

Palm Beach Florida Assignment of Mortgage by Corporate Mortgage Holder

Description

How to fill out Palm Beach Florida Assignment Of Mortgage By Corporate Mortgage Holder?

Do you need a trustworthy and inexpensive legal forms provider to buy the Palm Beach Florida Assignment of Mortgage by Corporate Mortgage Holder? US Legal Forms is your go-to solution.

No matter if you need a basic agreement to set regulations for cohabitating with your partner or a set of forms to advance your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and framed based on the requirements of separate state and area.

To download the document, you need to log in account, locate the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Palm Beach Florida Assignment of Mortgage by Corporate Mortgage Holder conforms to the regulations of your state and local area.

- Read the form’s description (if available) to learn who and what the document is good for.

- Start the search over if the template isn’t good for your specific scenario.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is done, download the Palm Beach Florida Assignment of Mortgage by Corporate Mortgage Holder in any available file format. You can get back to the website at any time and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time learning about legal papers online for good.