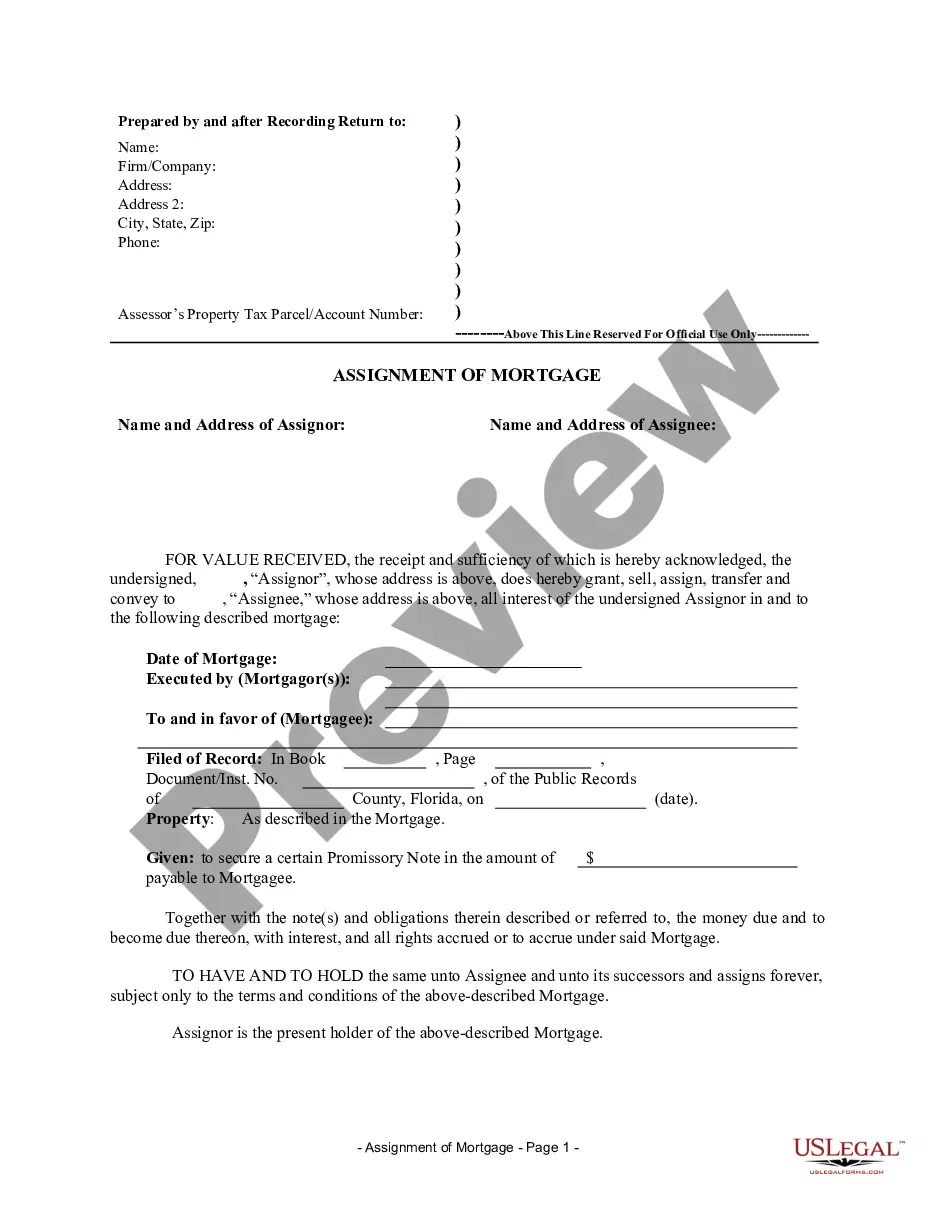

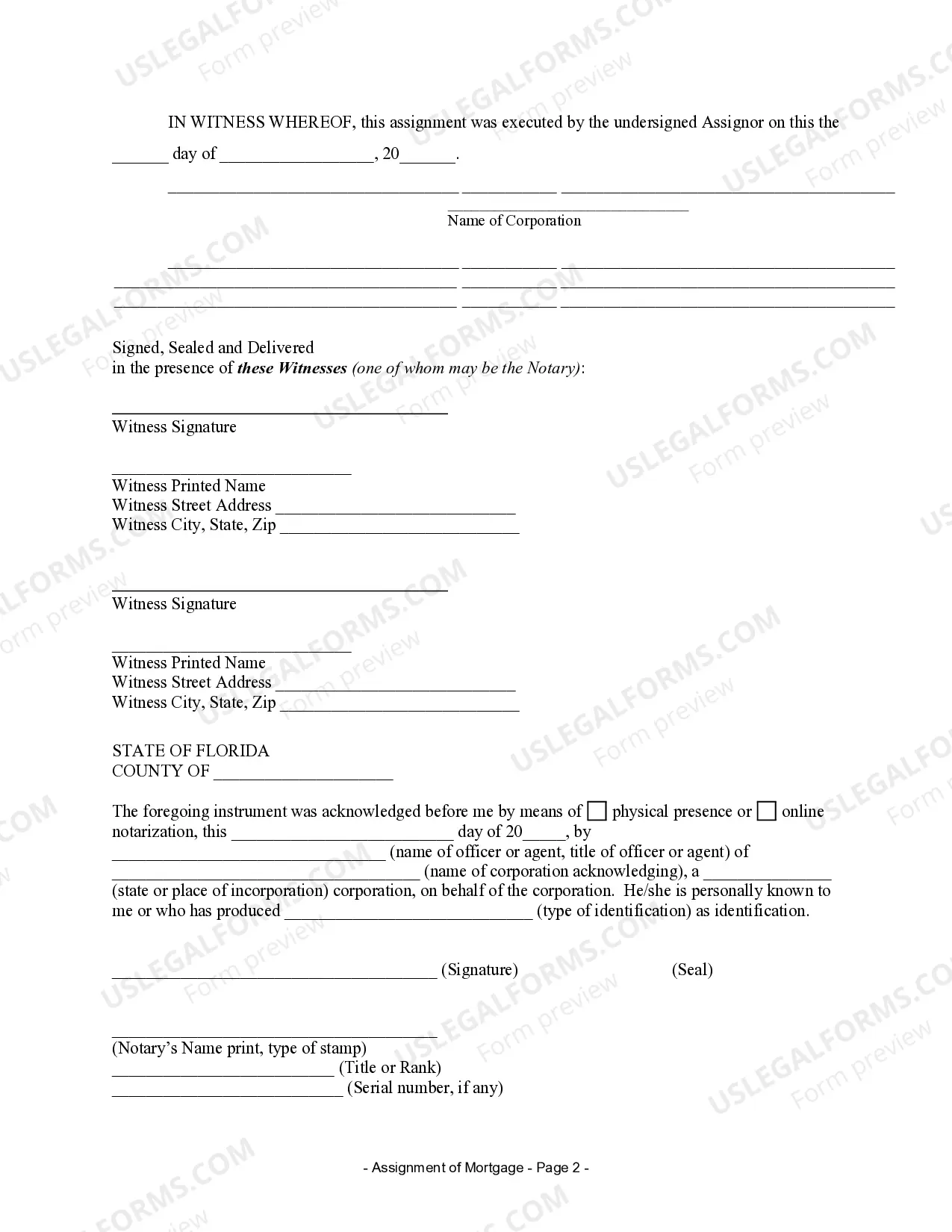

Tampa, Florida Assignment of Mortgage by Corporate Mortgage Holder: A Comprehensive Overview In Tampa, Florida, when a corporate mortgage holder desires to transfer or assign their rights to a mortgage, they can do so through a legal process called the Assignment of Mortgage. This particular assignment involves the transfer of the mortgage from a corporate mortgage holder to another entity, individual, or a different corporation. This article delves into the various types of Tampa, Florida Assignment of Mortgage by Corporate Mortgage Holder, outlining their characteristics, importance, and the key steps involved. Types of Tampa, Florida Assignment of Mortgage by Corporate Mortgage Holder: 1. Full Assignment: A full assignment occurs when the corporate mortgage holder transfers the complete rights and interests in the mortgage to a new entity. This assignment is often done when the mortgage holder wants to sell off the mortgage or when there is a change in ownership due to corporate restructuring or mergers. 2. Partial Assignment: A partial assignment occurs when the corporate mortgage holder transfers only a portion of their rights and interests in the mortgage to another entity or individual. This type of assignment might be utilized when a mortgage holder wants to share the risk associated with the mortgage or when they wish to divide the mortgage investment among multiple parties. 3. Assignment in Blank: An assignment in blank occurs when the corporate mortgage holder assigns the mortgage without specifying the assignee. This means that the mortgage can be transferred or assigned multiple times without the need for subsequent documentation or public record updates. Blank assignments provide flexibility to the mortgage holder for future transfers. Importance and Process of Tampa, Florida Assignment of Mortgage by Corporate Mortgage Holder: The Assignment of Mortgage plays a crucial role in the mortgage industry as it ensures a transparent and legal transfer of mortgage rights. The process generally involves the following steps: 1. Verification: The corporate mortgage holder verifies the accuracy of the mortgage, ensuring that all necessary documents and information are in order before initiating the assignment. 2. Preparation of Assignment: A legally binding assignment document is drafted, clearly stating the intent of transfer, the parties involved, and the details of the mortgage being assigned. This document needs to be comprehensive, providing all relevant information for a smooth transition. 3. Execution: The corporate mortgage holder and the assignee sign the assignment document, displaying their acceptance and understanding of the transfer. This step is vital to ensure the validity of the assignment. 4. Recording: To make the assignment official, the assignment document is recorded with the appropriate county office, usually the County Clerk's Office or Recorder of Deeds. This step ensures public record of the transfer and protects the rights of all parties involved. 5. Notification: After recording the assignment, relevant parties, such as the borrower, are notified of the change in mortgage ownership. This step helps maintain transparency and avoids any confusion or disputes in the future. In conclusion, the Tampa, Florida Assignment of Mortgage by Corporate Mortgage Holder is an essential process that enables the transfer of mortgage rights and interests between corporate entities. The various types of assignments, such as full assignment, partial assignment, and assignment in blank, cater to different needs of mortgage holders. By following the necessary steps of verification, preparation, execution, recording, and notification, a smooth transfer of mortgage rights can be achieved while maintaining transparency and compliance with legal requirements.

Tampa Florida Assignment of Mortgage by Corporate Mortgage Holder

Description

How to fill out Tampa Florida Assignment Of Mortgage By Corporate Mortgage Holder?

Make use of the US Legal Forms and get instant access to any form you want. Our helpful website with a huge number of documents simplifies the way to find and obtain virtually any document sample you need. You are able to export, fill, and sign the Tampa Florida Assignment of Mortgage by Corporate Mortgage Holder in just a few minutes instead of surfing the Net for hours searching for an appropriate template.

Using our library is an excellent strategy to raise the safety of your document submissions. Our experienced legal professionals on a regular basis check all the records to make certain that the forms are appropriate for a particular state and compliant with new laws and polices.

How can you obtain the Tampa Florida Assignment of Mortgage by Corporate Mortgage Holder? If you have a profile, just log in to the account. The Download option will appear on all the documents you view. In addition, you can get all the earlier saved records in the My Forms menu.

If you don’t have a profile yet, follow the instructions listed below:

- Open the page with the form you need. Make certain that it is the form you were seeking: examine its headline and description, and use the Preview function when it is available. Otherwise, use the Search field to look for the needed one.

- Start the saving procedure. Select Buy Now and select the pricing plan you prefer. Then, sign up for an account and process your order using a credit card or PayPal.

- Export the file. Pick the format to obtain the Tampa Florida Assignment of Mortgage by Corporate Mortgage Holder and change and fill, or sign it according to your requirements.

US Legal Forms is probably the most significant and trustworthy form libraries on the web. Our company is always ready to assist you in any legal procedure, even if it is just downloading the Tampa Florida Assignment of Mortgage by Corporate Mortgage Holder.

Feel free to take full advantage of our platform and make your document experience as convenient as possible!