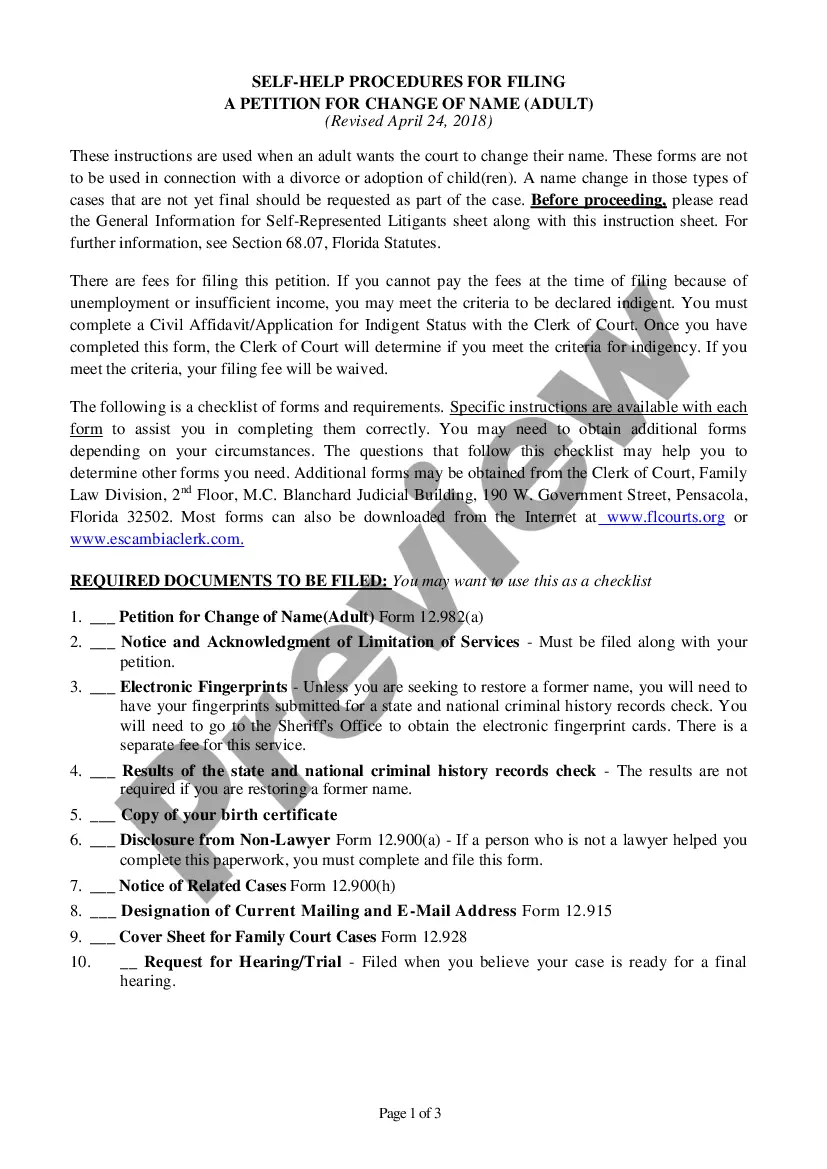

Certificate of Compliance with Mandatory Disclosure - Official: This is an official form from the Florida Circuit Court, which complies with all applicable laws and statutes. USLF amends and updates the Florida Circuit Court forms as is required by Florida statutes and law.

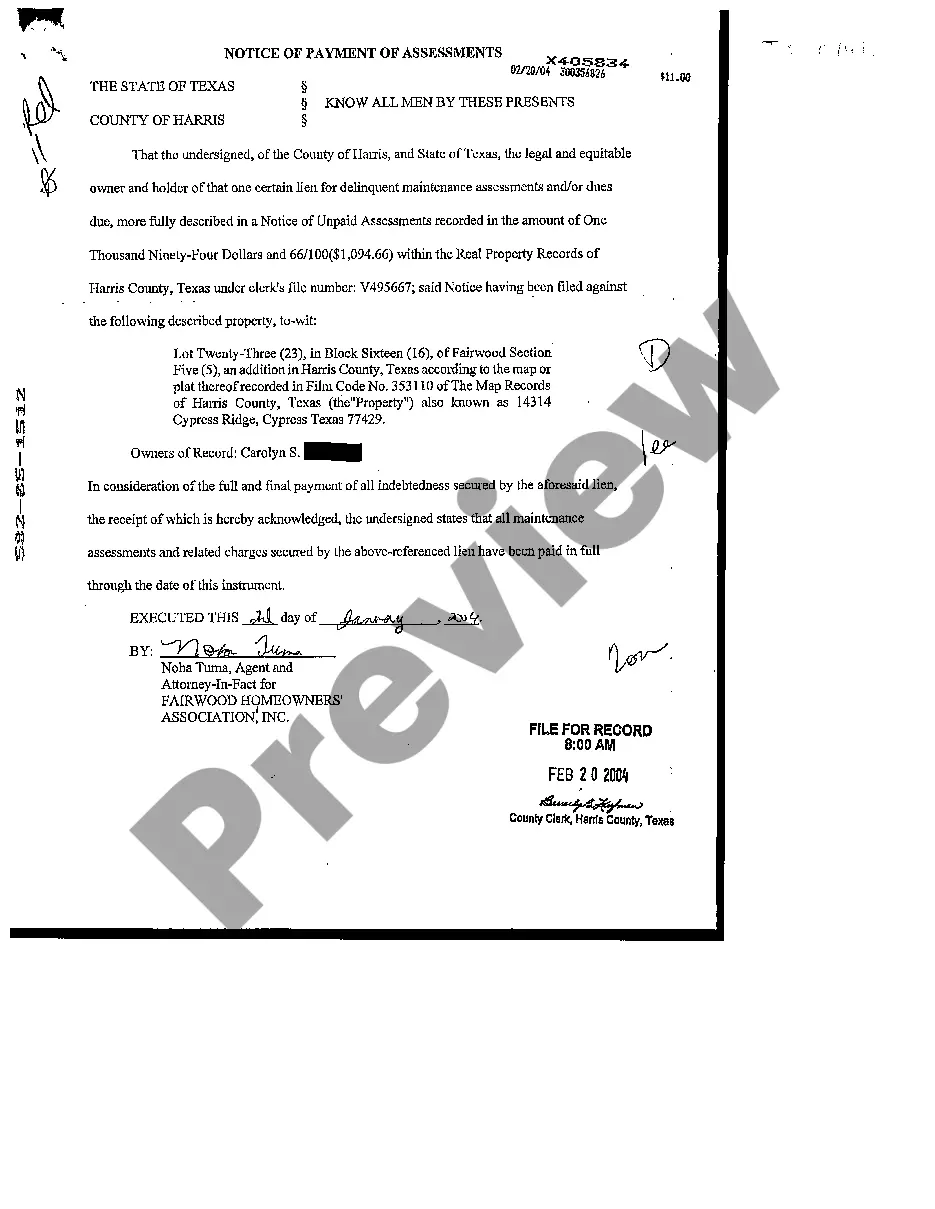

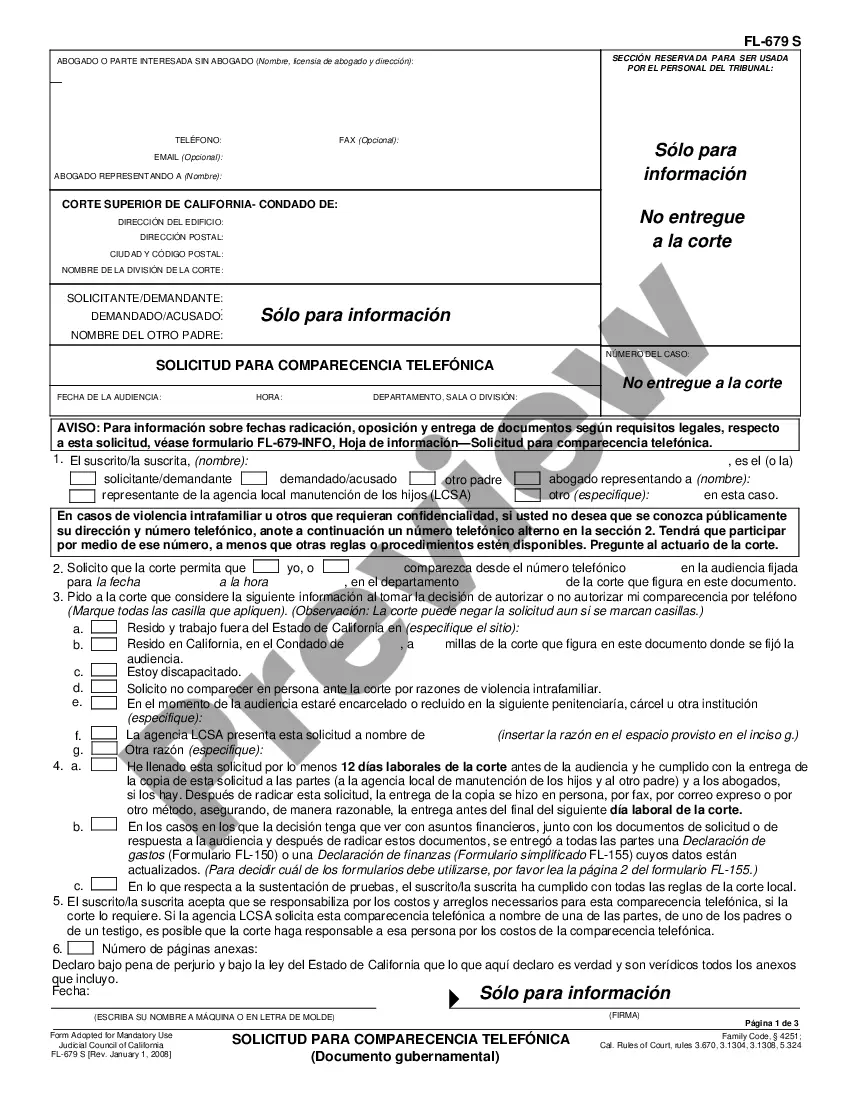

The Orlando Florida Certificate of Compliance with Mandatory Disclosure is an official document that certifies an individual, business, or entity's adherence to the required guidelines and regulations pertaining to mandatory disclosure in Orlando, Florida. It serves as proof that the recipient has complied with all necessary legal and procedural obligations in disclosing specific information as mandated by the law. In Orlando, Florida, mandatory disclosure encompasses various aspects such as real estate transactions, federal and state tax filings, financial disclosures, and other legal proceedings. The certificate is often obtained through a comprehensive review and evaluation process conducted by authorized agencies or organizations, ensuring transparency and compliance with relevant laws. There are several types of Orlando Florida Certificates of Compliance with Mandatory Disclosure, each catering to different areas of legal compliance. Some notable categories include: 1. Real Estate Certificate: This type of certificate ensures that all parties involved in a real estate transaction have fully disclosed relevant information regarding the property, such as liens, encumbrances, pending litigation, and issues affecting the property's value. 2. Tax Compliance Certificate: Individuals or businesses seeking this certificate must demonstrate full compliance with all applicable federal, state, and local tax laws. It entails disclosing income, assets, expenses, and other financial information accurately and in a timely manner. 3. Business Compliance Certificate: This certificate validates that a business entity has adhered to all necessary disclosure requirements, such as providing accurate financial statements, shareholder information, corporate records, licenses, permits, and any other legally mandated information. 4. Litigation Compliance Certificate: A Litigation Compliance Certificate is obtained when all parties involved in a legal proceeding or lawsuit have fulfilled their disclosure obligations. It encompasses the disclosure of evidence, witnesses, financial details, or any other information relevant to the case. 5. Financial Disclosure Certificate: Individuals or entities holding public office or involved in public transactions may require this certificate to confirm compliance with disclosure rules concerning their financial interests, investments, stock holdings, and potential conflicts of interest. It is crucial for individuals, businesses, and entities in Orlando, Florida, to obtain the appropriate Certificate of Compliance with Mandatory Disclosure relevant to their circumstances. Such certificates safeguard against legal implications and demonstrate accountability, fostering trust and transparency in various transactions and legal proceedings.