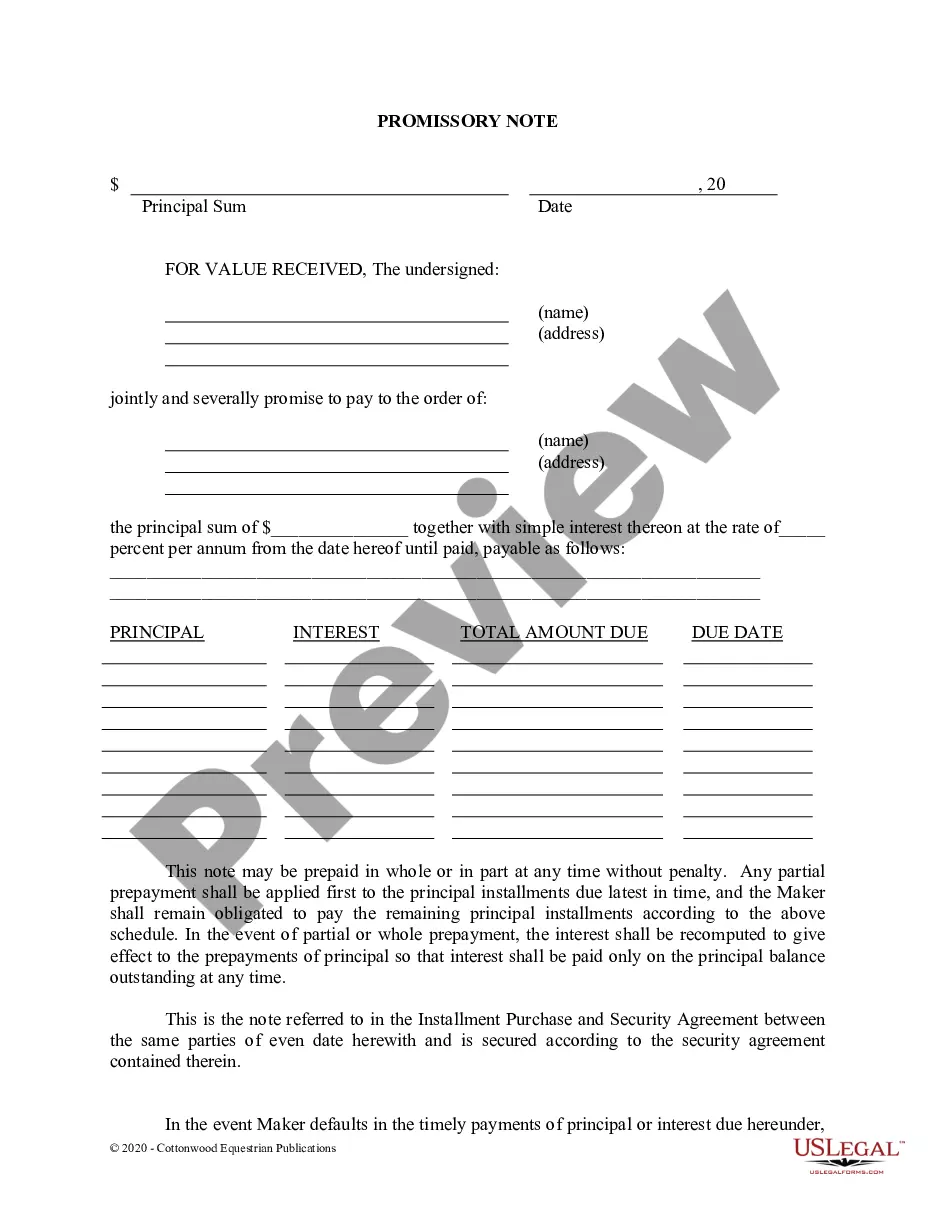

A Hillsborough Florida Promissory Note — Horse Equine Form is a legal document designed specifically for horse owners and enthusiasts in Hillsborough County, Florida. This document serves as a written agreement between two parties, typically the horse owner (lender) and the borrower, outlining the terms and conditions of a loan involving horses. The Hillsborough Florida Promissory Note — Horse Equine Form is created to ensure a transparent and binding arrangement between the parties involved in a horse-related transaction. It establishes clear guidelines regarding the loan amount, interest rates, repayment terms, and any other specific details the parties wish to include. Keywords: Hillsborough Florida, Promissory Note, Horse Equine Forms, horse owners, enthusiasts, Hillsborough County, legal document, written agreement, two parties, lender, borrower, loan, horses, terms and conditions, transparent, binding arrangement, loan amount, interest rates, repayment terms, specific details. Different types of Hillsborough Florida Promissory Note — Horse Equine Forms include: 1. Standard Promissory Note: This form outlines the general terms and conditions of a loan involving horses, such as the loan amount, interest rates, repayment schedule, and any additional provisions agreed upon by the parties. 2. Secured Promissory Note: This form includes additional clauses to protect the lender's interests by securing the loan with collateral, such as a horse or any other valuable asset. It specifies the consequences in case of default or non-payment. 3. Guarantor Promissory Note: This form involves a guarantor, a third party responsible for fulfilling the borrower's obligations in case of default. It provides an extra layer of security for lenders by ensuring that the loan will be repaid, even if the borrower fails to do so. 4. Installment Promissory Note: This form involves a structured payment plan, allowing the borrower to repay the loan in regular installments over a predetermined period. It specifies the dates and amounts of each payment, as well as any penalties or interest rates for late payments. 5. Demand Promissory Note: This form allows the lender to request immediate repayment of the full loan amount, known as a demand loan. It doesn't involve specific repayment schedules or installments, as the lender can demand repayment at any time. 6. Balloon Promissory Note: This form involves regular payments of interest and a portion of the principal, with a larger "balloon" payment due at the end of the loan term. It is commonly used when the borrower expects a significant sum of money in the future, enabling them to make a larger final payment. 7. Acceleration Promissory Note: This form includes a clause that accelerates the loan repayment if the borrower fails to meet specific conditions or breaches the terms of the agreement. It allows the lender to demand immediate repayment of the remaining loan balance, imposing penalties or legal actions if necessary. Remember that when dealing with legal documents, it is crucial to consult with an attorney or legal professional to ensure compliance with local laws and regulations, as well as to address any specific requirements or circumstances.

Hillsborough Florida Promissory Note - Horse Equine Forms

Description

How to fill out Hillsborough Florida Promissory Note - Horse Equine Forms?

No matter what social or professional status, filling out legal forms is an unfortunate necessity in today’s world. Too often, it’s practically impossible for a person with no law education to draft this sort of paperwork from scratch, mainly due to the convoluted jargon and legal subtleties they entail. This is where US Legal Forms can save the day. Our service provides a massive collection with more than 85,000 ready-to-use state-specific forms that work for almost any legal situation. US Legal Forms also is an excellent asset for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you need the Hillsborough Florida Promissory Note - Horse Equine Forms or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Hillsborough Florida Promissory Note - Horse Equine Forms in minutes using our reliable service. If you are already a subscriber, you can proceed to log in to your account to download the needed form.

Nevertheless, in case you are a novice to our platform, make sure to follow these steps before downloading the Hillsborough Florida Promissory Note - Horse Equine Forms:

- Ensure the form you have chosen is specific to your location because the rules of one state or county do not work for another state or county.

- Review the form and read a short outline (if provided) of cases the paper can be used for.

- If the one you selected doesn’t meet your needs, you can start again and search for the needed form.

- Click Buy now and pick the subscription option that suits you the best.

- with your login information or create one from scratch.

- Pick the payment gateway and proceed to download the Hillsborough Florida Promissory Note - Horse Equine Forms once the payment is completed.

You’re good to go! Now you can proceed to print out the form or complete it online. If you have any issues locating your purchased forms, you can quickly access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.