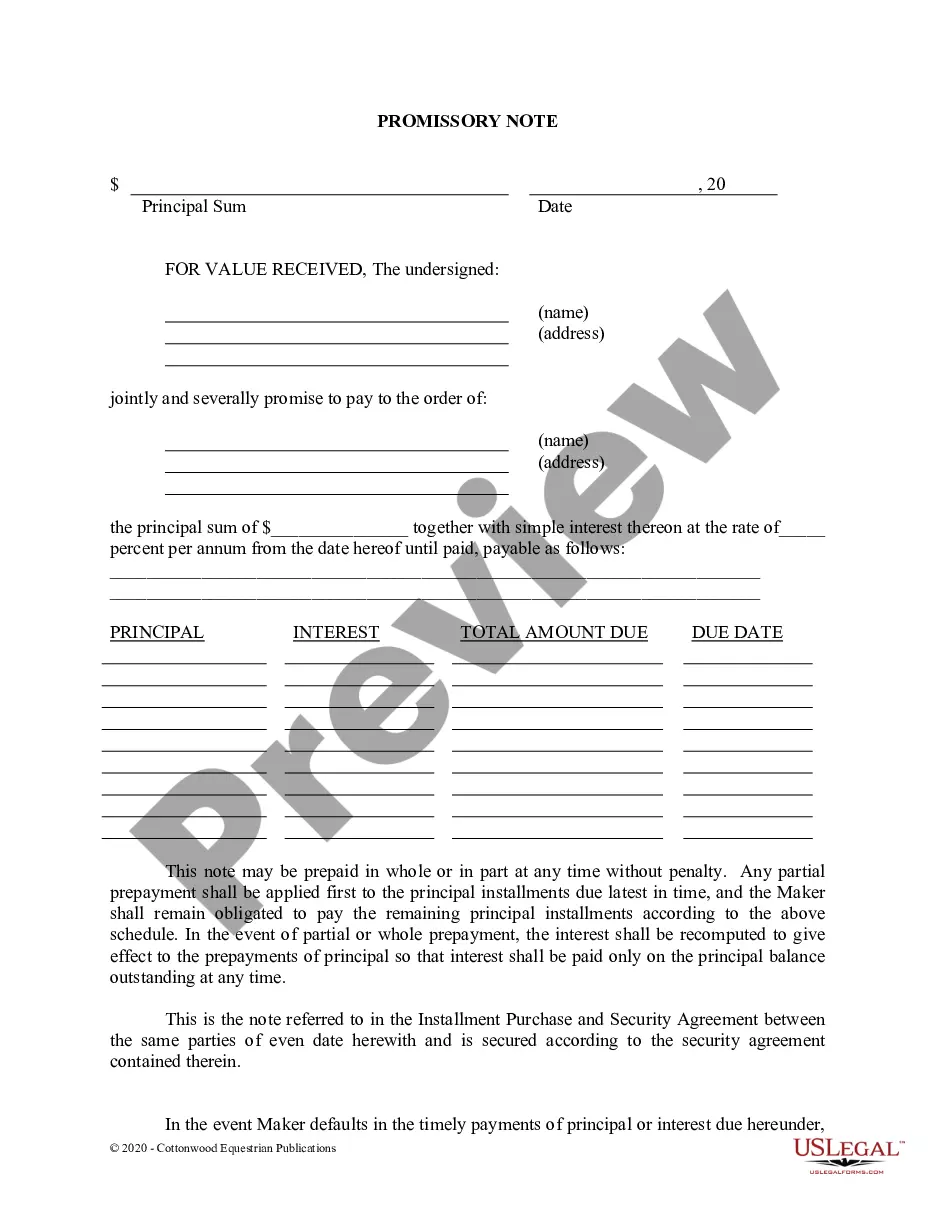

A Miami-Dade Florida Promissory Note — Horse Equine Form is a legally binding document used to record and formalize a loan agreement related to horses or equine-related transactions in Miami-Dade County, Florida. It serves as a written evidence of a borrower's promise to repay a specified amount of money borrowed from a lender, typically with interest, within a certain timeframe. The Miami-Dade Florida Promissory Note — Horse Equine Forms are specifically designed to address the unique aspects and considerations of loan transactions pertaining to horses and equine-related matters. These forms include detailed clauses and provisions to ensure clarity, protection, and compliance with relevant laws, regulations, and standards applicable in Miami-Dade County, Florida. Some specific types of Miami-Dade Florida Promissory Note — Horse Equine Forms that may exist are: 1. Simple Promissory Note: This form outlines the basic terms and conditions of a loan, including the principal amount borrowed, interest rate, repayment schedule, and any late payment penalties or provisions. 2. Secured Promissory Note: This form includes additional clauses and provisions to secure the loan by utilizing a horse or equine-related asset as collateral. It specifies the rights and remedies of the lender in case of default or non-repayment by the borrower. 3. Installment Promissory Note: This form divides the loan amount into equal installments, allowing the borrower to repay the loan in periodic payments over a specified period. It outlines the interest rate, installment amounts, and repayment schedule. 4. Balloon Promissory Note: This form allows the borrower to make smaller periodic payments initially, with a large final payment (balloon payment) due at the end of the loan term. The terms of this note typically include the interest rate, payment schedule, and the specific amount due as the balloon payment. 5. Demand Promissory Note: This form provides flexibility to the lender, allowing them to demand full repayment of the loan at any time, with or without cause. It includes provisions for notification periods and additional fees or penalties in the event of early repayment. 6. Co-Signer Promissory Note: This form involves a third-party co-signer who agrees to be responsible for the loan in case the borrower defaults. It outlines the co-signer's obligations, legal rights, and potential liability towards the loan. It is important to consult with a legal professional or an experienced attorney who specializes in equine law to ensure that the chosen Miami-Dade Florida Promissory Note — Horse Equine Form accurately reflects the intended terms, conditions, and obligations of the loan agreement and complies with local laws and regulations.

Miami-Dade Florida Promissory Note - Horse Equine Forms

Description

How to fill out Miami-Dade Florida Promissory Note - Horse Equine Forms?

If you are searching for a valid form, it’s impossible to choose a better place than the US Legal Forms site – one of the most considerable online libraries. With this library, you can get a large number of templates for business and individual purposes by categories and regions, or keywords. With our advanced search option, getting the newest Miami-Dade Florida Promissory Note - Horse Equine Forms is as elementary as 1-2-3. Additionally, the relevance of every file is verified by a group of professional attorneys that regularly review the templates on our website and revise them based on the most recent state and county requirements.

If you already know about our system and have an account, all you should do to get the Miami-Dade Florida Promissory Note - Horse Equine Forms is to log in to your user profile and click the Download button.

If you make use of US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have found the form you want. Look at its explanation and use the Preview option to see its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to discover the needed document.

- Affirm your decision. Choose the Buy now button. Next, select your preferred subscription plan and provide credentials to register an account.

- Make the transaction. Make use of your credit card or PayPal account to finish the registration procedure.

- Receive the form. Select the file format and download it on your device.

- Make changes. Fill out, edit, print, and sign the acquired Miami-Dade Florida Promissory Note - Horse Equine Forms.

Each form you add to your user profile does not have an expiry date and is yours permanently. It is possible to gain access to them using the My Forms menu, so if you want to receive an additional copy for editing or creating a hard copy, you can come back and export it once again at any time.

Take advantage of the US Legal Forms extensive catalogue to gain access to the Miami-Dade Florida Promissory Note - Horse Equine Forms you were seeking and a large number of other professional and state-specific samples on a single website!