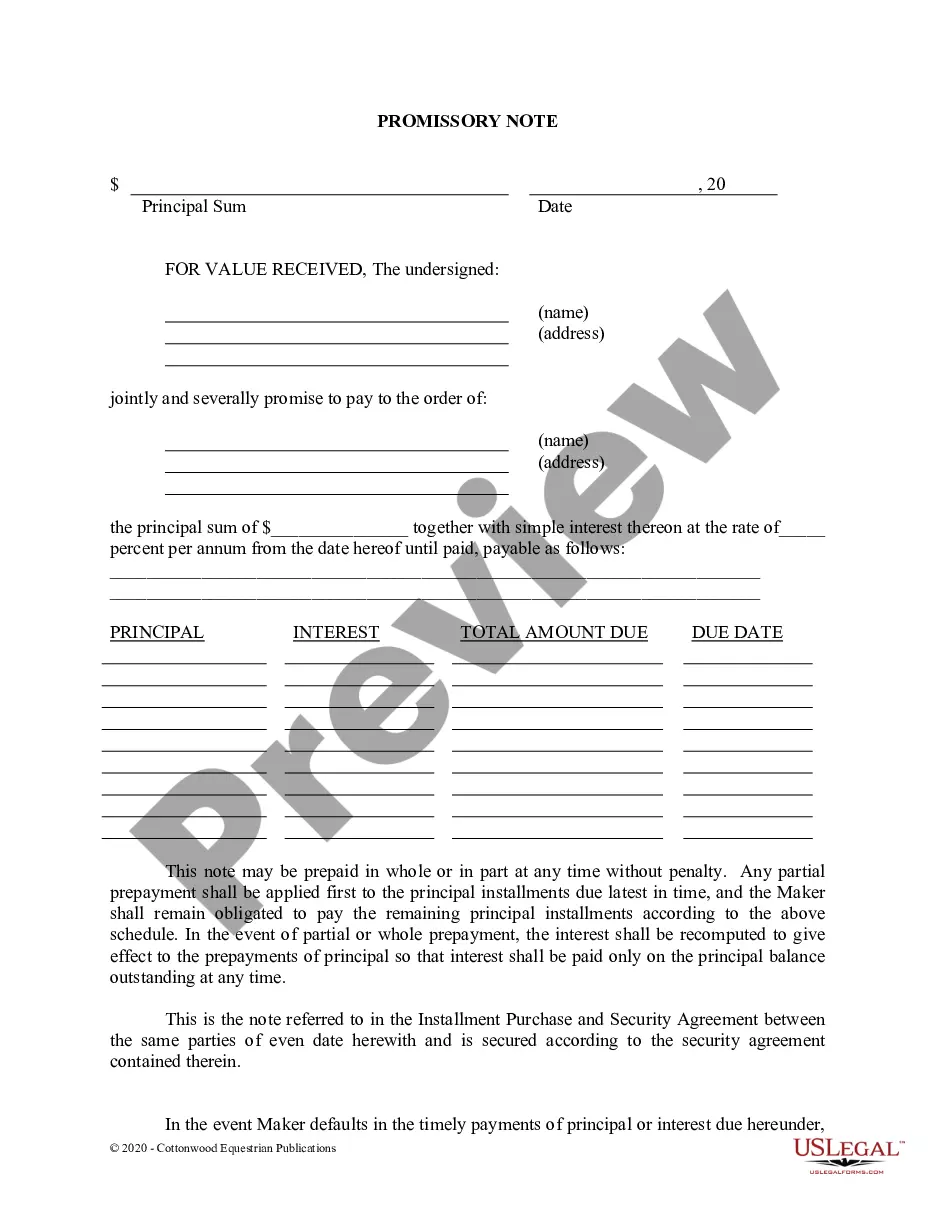

West Palm Beach Florida Promissory Note — Horse Equine Forms: A Comprehensive Guide Introduction: A West Palm Beach Florida Promissory Note — Horse Equine Form is a legally binding contract used in the horse industry to document a loan or payment agreement between parties involved. This document provides a clear record of the terms and conditions of the loan, ensuring transparency and protection for both the lender and the borrower. Key Features: 1. Legal Validity: The West Palm Beach Florida Promissory Note — Horse Equine Form complies with the laws and regulations specific to the state, offering legal validity and enforceability. 2. Loan Amount and Interest Rate: This form allows for the accurate documentation of the loan's principal amount, the interest rate agreed upon, and the method of interest calculation, ensuring clarity and transparency. 3. Repayment Terms: The document outlines the repayment schedule, specifying the installment amounts, frequency, due dates, and any penalties for late or missed payments. 4. Collateral Agreement: If applicable, the form includes a provision for securing the loan with a collateral — such as a horse or other equine assets — protecting the lender's interests. 5. Governing Law and Jurisdiction: The West Palm Beach Florida Promissory Note — Horse Equine Form specifies the governing law and jurisdiction applicable to the agreement, ensuring ease of legal enforcement if necessary. Types of West Palm Beach Florida Promissory Note — Horse Equine Forms: 1. Simple Promissory Note: This form is used when the loan agreement is straightforward, without any additional complexities or collateral involved. 2. Secured Promissory Note: When a loan is backed by collateral, this form documents the agreement between the lender and borrower while clearly outlining the rights and obligations of each party. 3. Installment Promissory Note: This type of promissory note details a loan that is repayable in regular installments, specifying each installment's amount, frequency, and due dates. 4. Balloon Promissory Note: In cases where a larger final payment, known as the "balloon payment," is required at the end of the loan term, this form properly documents the terms and obligations related to the balloon payment. Conclusion: The West Palm Beach Florida Promissory Note — Horse Equine Forms are vital legal documents used to regulate monetary agreements in the horse industry. Whether you're a lender or borrower, using these forms ensures clarity, security, and a legally enforceable agreement tailored to West Palm Beach, Florida's legal requirements. Remember to consult with an attorney to ensure compliance with relevant laws and to address any specific contractual needs.

West Palm Beach Florida Promissory Note - Horse Equine Forms

Description

How to fill out West Palm Beach Florida Promissory Note - Horse Equine Forms?

If you are looking for a valid form template, it’s difficult to choose a better place than the US Legal Forms website – probably the most extensive libraries on the internet. Here you can get a large number of form samples for organization and personal purposes by categories and regions, or keywords. With our advanced search function, getting the newest West Palm Beach Florida Promissory Note - Horse Equine Forms is as easy as 1-2-3. In addition, the relevance of every record is confirmed by a group of professional lawyers that on a regular basis check the templates on our website and update them based on the latest state and county demands.

If you already know about our system and have a registered account, all you need to get the West Palm Beach Florida Promissory Note - Horse Equine Forms is to log in to your profile and click the Download button.

If you make use of US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have opened the form you want. Read its description and make use of the Preview feature (if available) to explore its content. If it doesn’t meet your requirements, use the Search field near the top of the screen to discover the needed record.

- Affirm your selection. Select the Buy now button. After that, select the preferred subscription plan and provide credentials to sign up for an account.

- Process the purchase. Use your credit card or PayPal account to complete the registration procedure.

- Receive the template. Choose the file format and download it to your system.

- Make modifications. Fill out, revise, print, and sign the received West Palm Beach Florida Promissory Note - Horse Equine Forms.

Each and every template you add to your profile has no expiry date and is yours forever. You always have the ability to gain access to them using the My Forms menu, so if you want to have an extra duplicate for modifying or creating a hard copy, you can return and download it again whenever you want.

Take advantage of the US Legal Forms professional library to gain access to the West Palm Beach Florida Promissory Note - Horse Equine Forms you were looking for and a large number of other professional and state-specific samples on a single platform!