Broward Florida Business Credit Application is a formal document that individuals or businesses within Broward County, Florida, used to apply for credit or financial assistance from a lending institution or creditor. This application serves as a means for lenders to assess the creditworthiness of the applicant and determine their eligibility for obtaining credit. Keywords: Broward Florida, business credit, application, lending institution, creditor, creditworthiness, eligibility. Different types of Broward Florida Business Credit Applications include: 1. Small Business Loan Application: This type of credit application is specifically designed for small businesses in Broward County, Florida, seeking financial support to start or expand their operations. It requires businesses to provide detailed information about their financial history, business plan, revenue projections, and other relevant details. 2. Credit Line Application: This application is intended for businesses interested in establishing a credit line with a lending institution in Broward County, Florida. A credit line provides borrowers with access to funds up to a certain limit, allowing them to withdraw money as needed. To apply, businesses must provide financial statements, business revenue, credit history, and collateral information. 3. Business Credit Card Application: Broward County businesses can also apply for business credit cards through this application. These credit cards offer convenient payment options and often come with additional benefits such as rewards programs or travel perks. Applicants will need to provide business and personal financial information, credit history, and specify the desired credit limit. 4. Equipment Financing Application: Certain businesses in Broward County may require funding specifically for acquiring or replacing equipment. Equipment financing applications typically require details about the equipment being financed, its cost, any down payment, business financials, and credit history. 5. Trade Credit Application: This type of application allows Broward County businesses to apply for credit directly with their suppliers or vendors. Trade credit applications typically request information about the business, financial statements, trade references, and details about desired payment terms and credit limit. By providing comprehensive and accurate information within the Broward Florida Business Credit Application, applicants increase their chances of obtaining credit and financial support for their businesses in Broward County, Florida.

Broward Florida Business Credit Application

Category:

State:

Florida

County:

Broward

Control #:

FL-20-CR

Format:

Word;

Rich Text

Instant download

Description

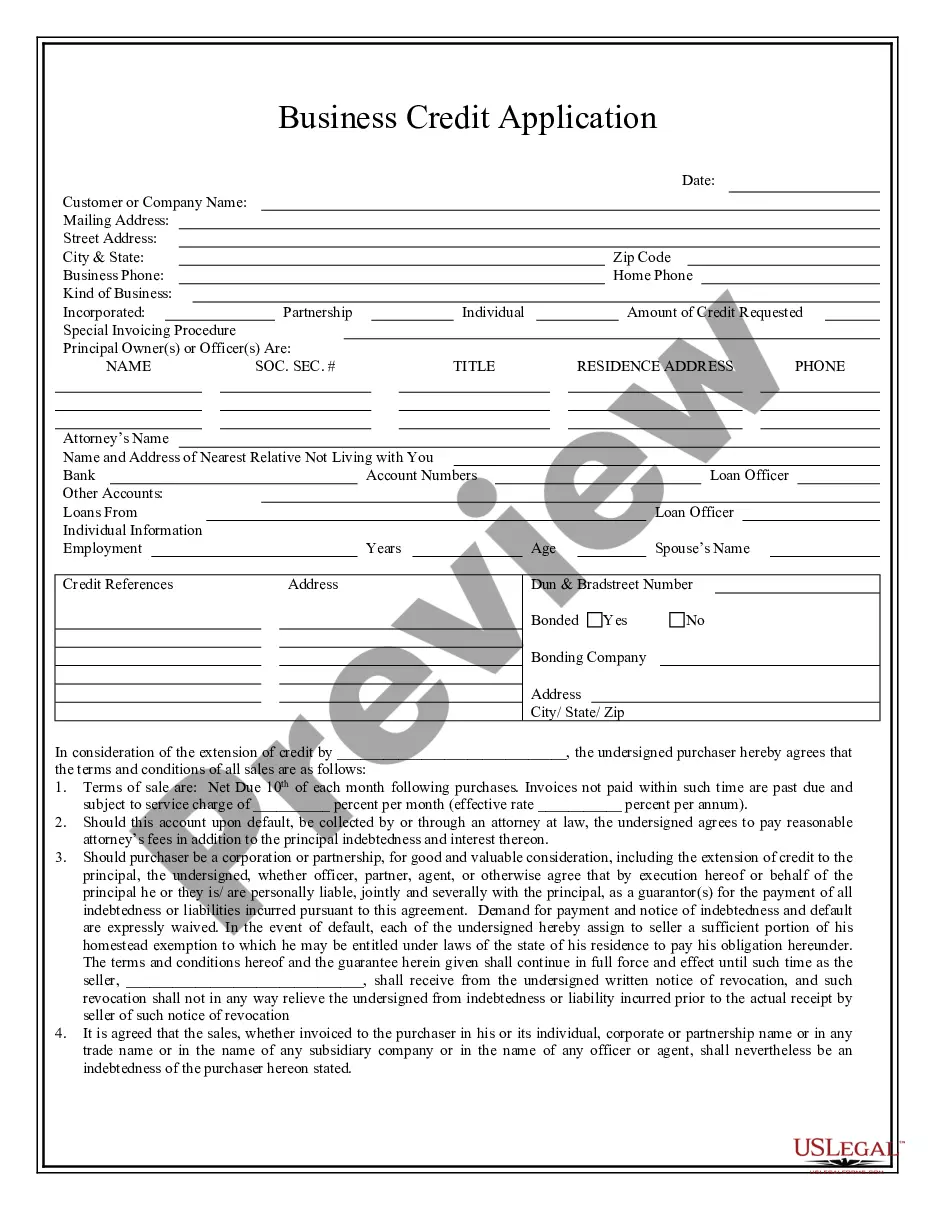

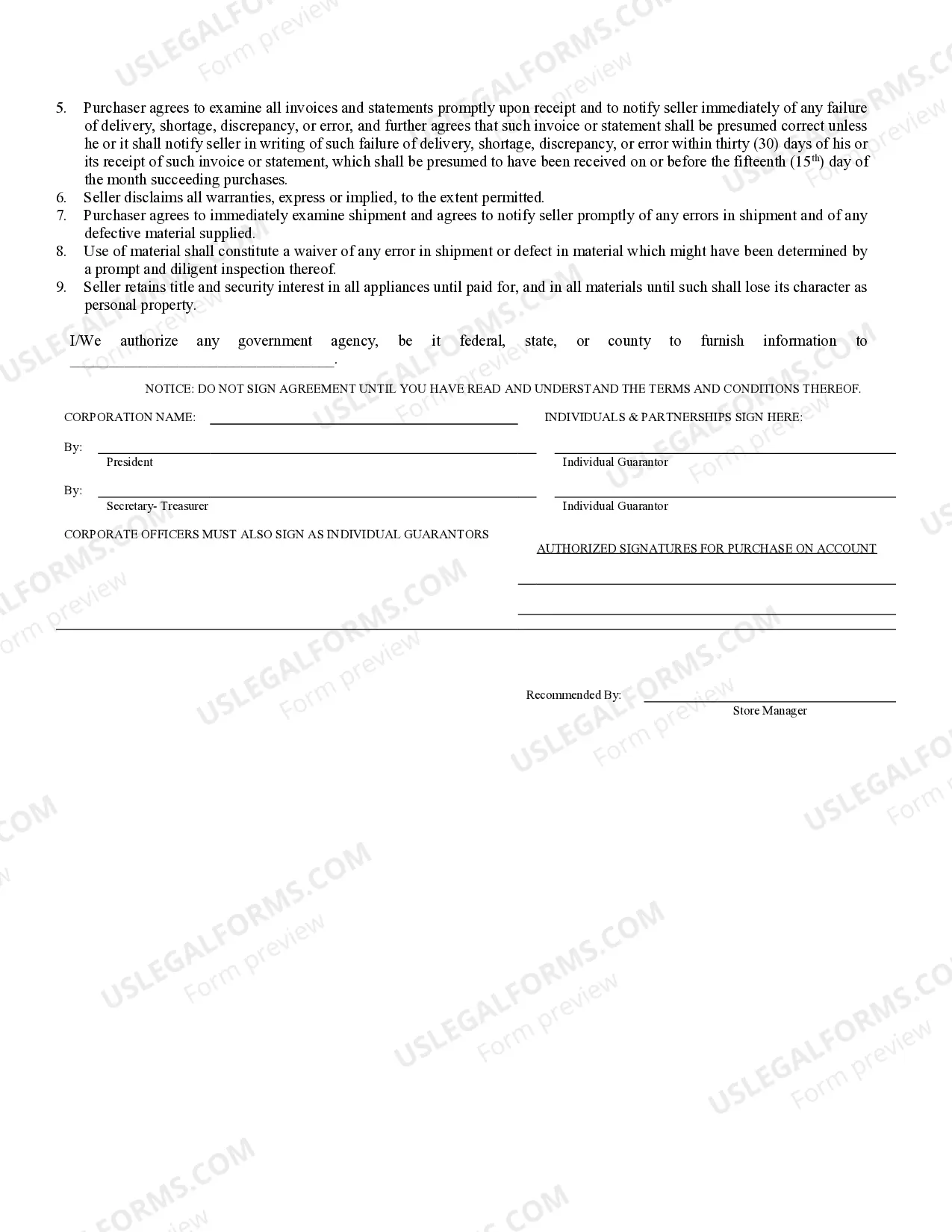

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Broward Florida Business Credit Application is a formal document that individuals or businesses within Broward County, Florida, used to apply for credit or financial assistance from a lending institution or creditor. This application serves as a means for lenders to assess the creditworthiness of the applicant and determine their eligibility for obtaining credit. Keywords: Broward Florida, business credit, application, lending institution, creditor, creditworthiness, eligibility. Different types of Broward Florida Business Credit Applications include: 1. Small Business Loan Application: This type of credit application is specifically designed for small businesses in Broward County, Florida, seeking financial support to start or expand their operations. It requires businesses to provide detailed information about their financial history, business plan, revenue projections, and other relevant details. 2. Credit Line Application: This application is intended for businesses interested in establishing a credit line with a lending institution in Broward County, Florida. A credit line provides borrowers with access to funds up to a certain limit, allowing them to withdraw money as needed. To apply, businesses must provide financial statements, business revenue, credit history, and collateral information. 3. Business Credit Card Application: Broward County businesses can also apply for business credit cards through this application. These credit cards offer convenient payment options and often come with additional benefits such as rewards programs or travel perks. Applicants will need to provide business and personal financial information, credit history, and specify the desired credit limit. 4. Equipment Financing Application: Certain businesses in Broward County may require funding specifically for acquiring or replacing equipment. Equipment financing applications typically require details about the equipment being financed, its cost, any down payment, business financials, and credit history. 5. Trade Credit Application: This type of application allows Broward County businesses to apply for credit directly with their suppliers or vendors. Trade credit applications typically request information about the business, financial statements, trade references, and details about desired payment terms and credit limit. By providing comprehensive and accurate information within the Broward Florida Business Credit Application, applicants increase their chances of obtaining credit and financial support for their businesses in Broward County, Florida.

Free preview

How to fill out Broward Florida Business Credit Application?

If you’ve already utilized our service before, log in to your account and save the Broward Florida Business Credit Application on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Broward Florida Business Credit Application. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!