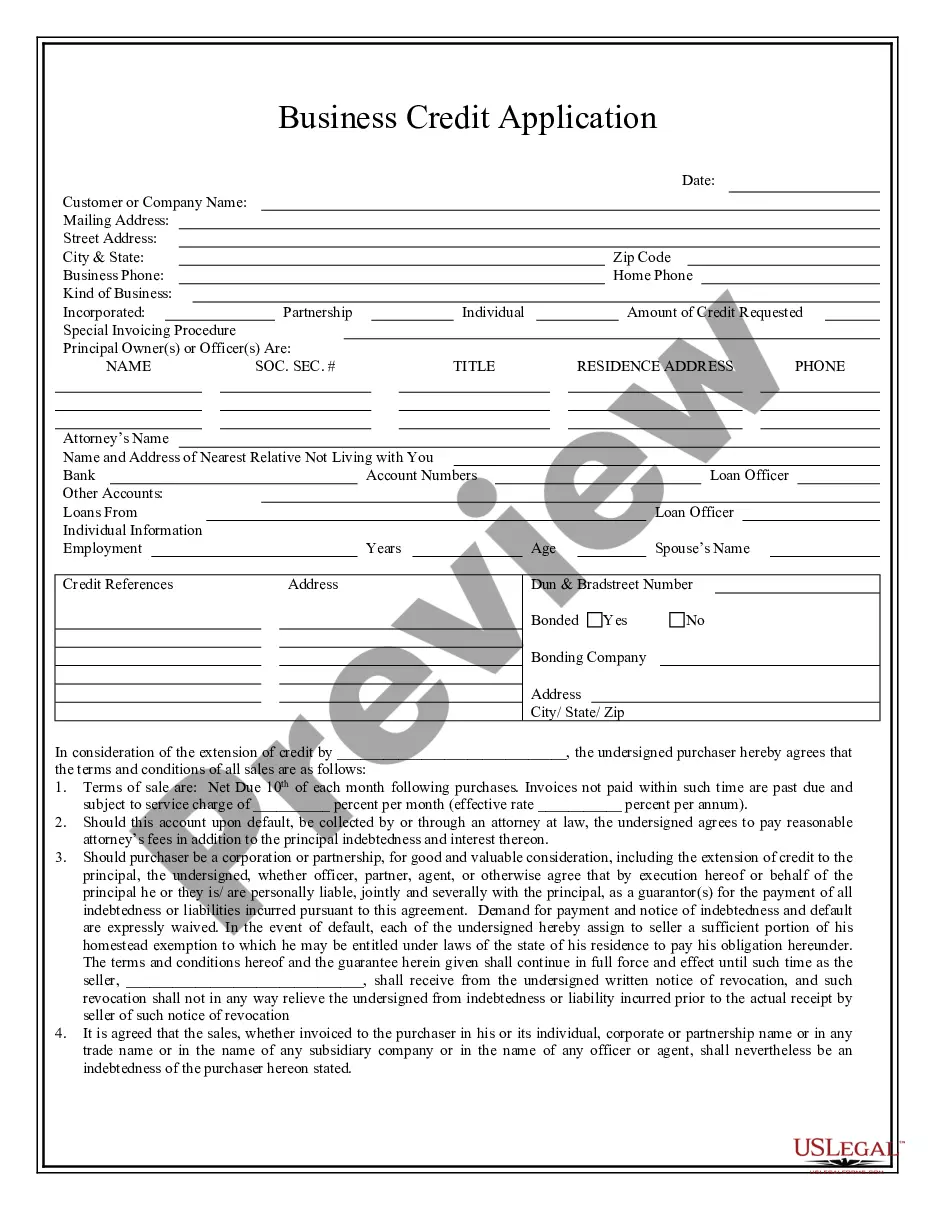

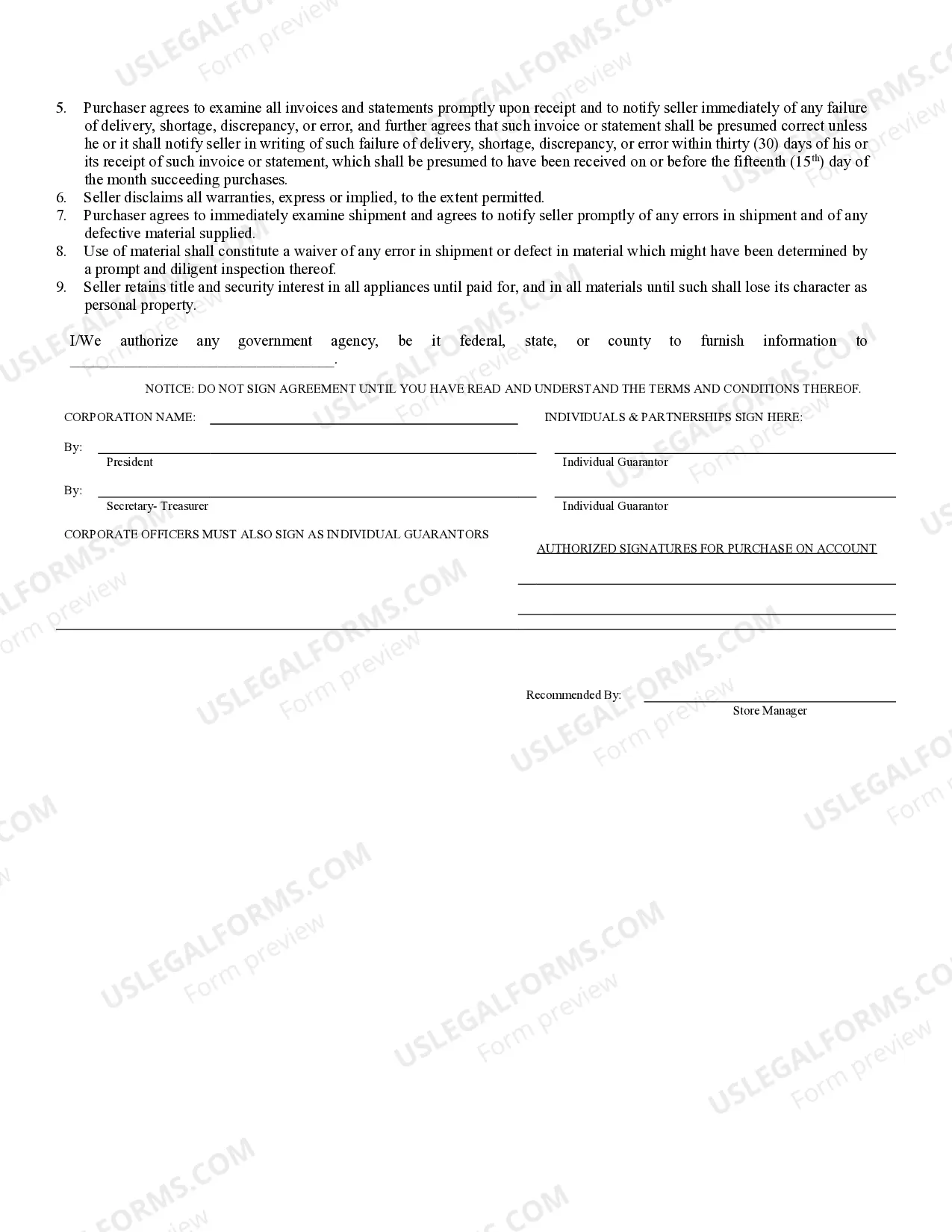

Cape Coral Florida Business Credit Application is a vital document used by businesses in the city of Cape Coral, Florida, to apply for credit from various financial institutions or lenders. This comprehensive application form enables businesses to provide detailed information about their company, financials, and credit history, helping lenders assess their creditworthiness and make informed decisions regarding loan approvals. Here are some relevant keywords to include in the description: — Cape Coral, Florida: Highlighting the specific location of the businesses seeking credit, emphasizing the local relevance. — Business Credit: Focus on the type of credit being applied for, which pertains to funding specifically for business purposes. — Application: Referring to the process of applying for credit, indicating the initial step towards acquiring financial assistance. — Financial Institutions: Emphasizing the various lenders or financial organizations that accept Cape Coral business credit applications. — Lenders: Mentioning the entities responsible for evaluating the creditworthiness of businesses and granting loans or credit. — Creditworthiness: Indicating the measure of the business's ability to repay the debt and fulfill its financial obligations. — Loan Approvals: Highlighting the outcome that businesses seek when applying for credit, which is obtaining approval for the requested loan amount. Different types of Cape Coral Florida Business Credit Applications may include: 1. Small Business Credit Application: Designed for small businesses seeking credit to support their operations, growth, or expansion plans. 2. Start-up Business Credit Application: Intended for newly established businesses in Cape Coral that require initial funding to kick-start their operations. 3. Corporate/Business Line of Credit Application: Tailored for established companies in Cape Coral, allowing them to obtain a revolving line of credit that can be used when needed. 4. Equipment Financing Credit Application: Specifically crafted for businesses looking to secure credit solely for purchasing or leasing equipment vital to their operations. 5. Inventory Financing Credit Application: Geared towards businesses needing credit to manage and fulfill their inventory demands, enabling them to meet customer orders effectively. These types of Cape Coral Florida Business Credit Applications cater to various needs and circumstances, ensuring that businesses in Cape Coral have the opportunity to access the necessary financial resources to thrive and succeed.

Cape Coral Florida Business Credit Application

Description

How to fill out Cape Coral Florida Business Credit Application?

If you are searching for a relevant form, it’s difficult to find a more convenient place than the US Legal Forms website – one of the most considerable libraries on the web. Here you can get thousands of templates for business and individual purposes by categories and regions, or keywords. With our advanced search function, discovering the latest Cape Coral Florida Business Credit Application is as easy as 1-2-3. In addition, the relevance of each and every file is verified by a group of professional attorneys that on a regular basis review the templates on our platform and update them in accordance with the latest state and county laws.

If you already know about our system and have a registered account, all you should do to get the Cape Coral Florida Business Credit Application is to log in to your user profile and click the Download option.

If you use US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have found the form you require. Look at its information and make use of the Preview option to see its content. If it doesn’t meet your requirements, utilize the Search field at the top of the screen to find the needed record.

- Affirm your selection. Select the Buy now option. After that, choose your preferred subscription plan and provide credentials to register an account.

- Process the financial transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Get the template. Choose the file format and download it to your system.

- Make changes. Fill out, revise, print, and sign the received Cape Coral Florida Business Credit Application.

Each template you add to your user profile has no expiration date and is yours forever. It is possible to access them using the My Forms menu, so if you need to get an extra duplicate for editing or printing, you can come back and download it once again at any time.

Take advantage of the US Legal Forms professional collection to get access to the Cape Coral Florida Business Credit Application you were seeking and thousands of other professional and state-specific samples on a single platform!