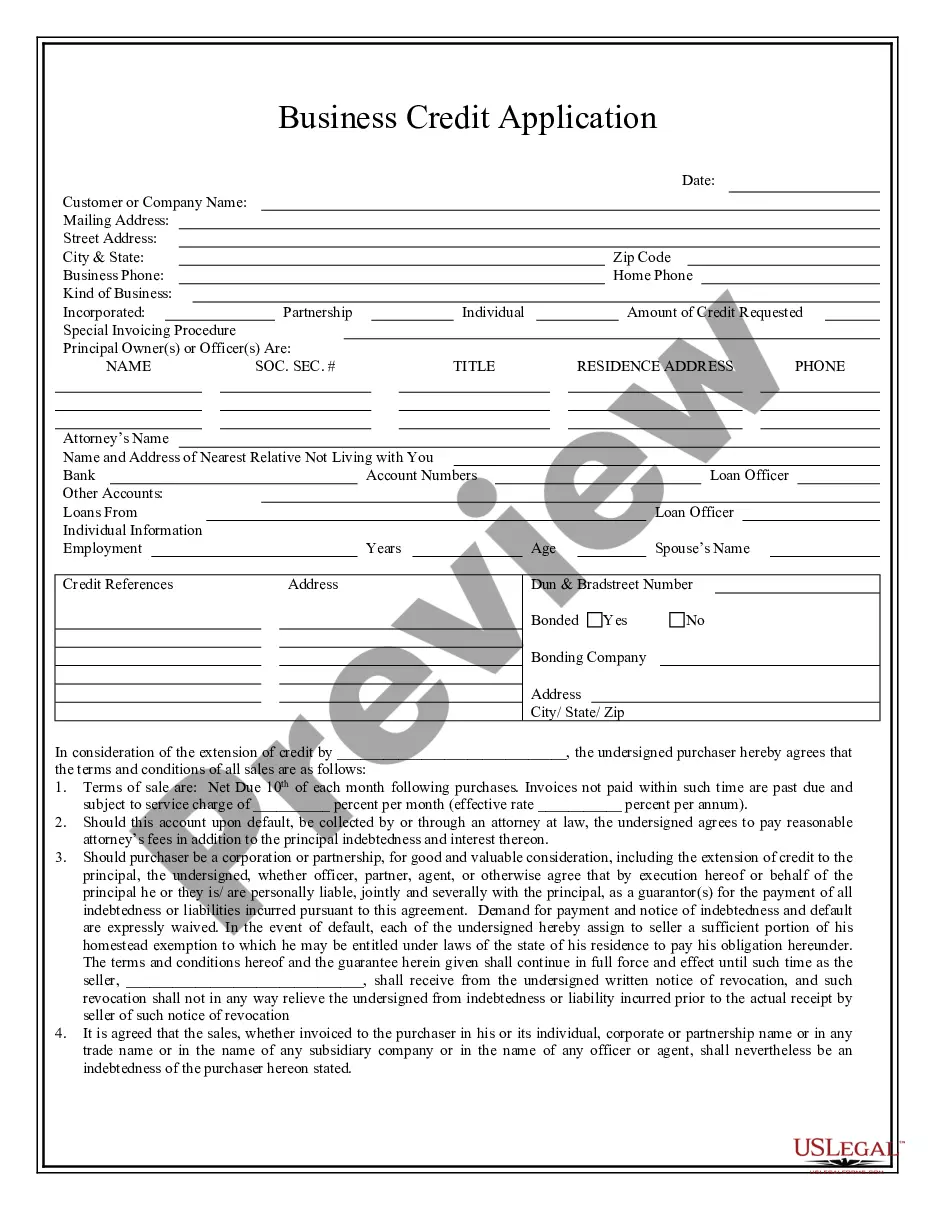

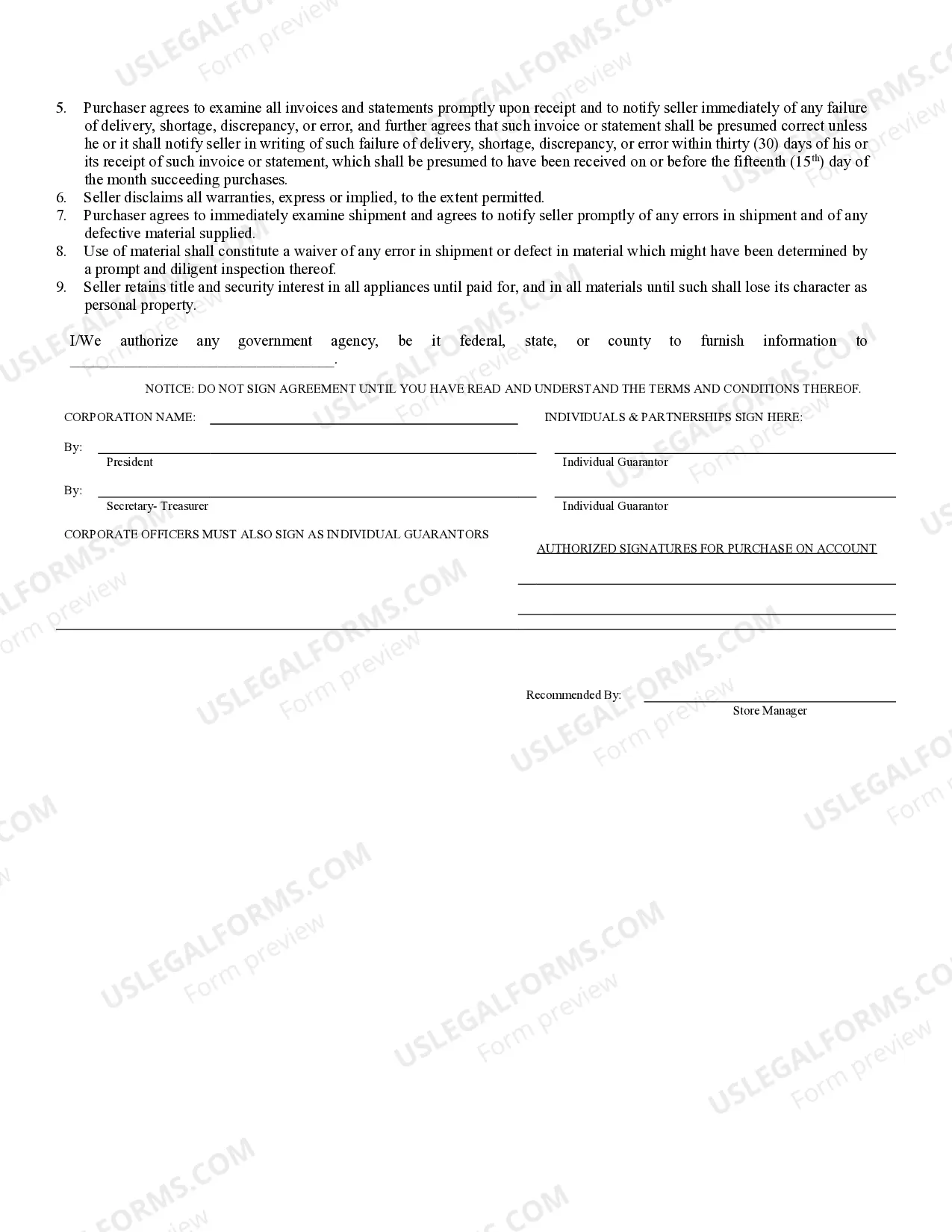

Fort Lauderdale Florida is home to a bustling business community with various opportunities for growth and expansion. To take advantage of these opportunities, local businesses often rely on Fort Lauderdale Florida Business Credit Application to secure the necessary funds to fuel their operations. The Fort Lauderdale Florida Business Credit Application is a comprehensive document that allows businesses to apply for credit or financing from financial institutions and lenders based in the Fort Lauderdale area. This application serves as a formal request for credit and provides essential information about the business, helping lenders assess the creditworthiness of the applicant. These credit applications come in different types, catering to the diverse needs of businesses operating in Fort Lauderdale. Here are some prominent variations: 1. Small Business Credit Application: Designed for small businesses and startups, this application focuses on providing credit for initial capital investments, equipment purchases, and general business needs. 2. Commercial Real Estate Credit Application: This type of application is specifically tailored for businesses looking to invest in commercial real estate properties or seeking capital for property development projects in Fort Lauderdale. 3. Vendor Credit Application: Local businesses often establish relationships with vendors for supplies and inventory. Vendor credit applications help businesses apply for credit directly with their suppliers, ensuring smooth procurement processes. 4. Revolving Line of Credit Application: Fort Lauderdale businesses seeking flexible financing options often opt for revolving lines of credit. This type of credit application allows businesses to access a predetermined credit limit that can be repeatedly borrowed and repaid as needed. 5. Equipment Financing Application: Businesses requiring new equipment or machinery can utilize this credit application to secure funds for equipment purchases or lease agreements. The Fort Lauderdale Florida Business Credit Application typically includes essential information such as the business's legal name, address, tax identification number, financial statements, cash flow projections, executive profiles, and other supporting documents. Lenders use this information to evaluate the creditworthiness of the business and make informed decisions regarding loan approvals and interest rates. In conclusion, the Fort Lauderdale Florida Business Credit Application is a crucial tool for local businesses in need of financing solutions. By providing the necessary information and documentation, businesses can highlight their financial stability and growth potential, ultimately securing the credit required to expand and thrive in the dynamic Fort Lauderdale business environment.

Fort Lauderdale Florida Business Credit Application

Description

How to fill out Fort Lauderdale Florida Business Credit Application?

We always strive to minimize or prevent legal damage when dealing with nuanced legal or financial affairs. To do so, we apply for attorney solutions that, as a rule, are very costly. Nevertheless, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of turning to a lawyer. We offer access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Fort Lauderdale Florida Business Credit Application or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is just as easy if you’re new to the platform! You can create your account in a matter of minutes.

- Make sure to check if the Fort Lauderdale Florida Business Credit Application complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Fort Lauderdale Florida Business Credit Application would work for you, you can select the subscription option and proceed to payment.

- Then you can download the document in any available format.

For more than 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!