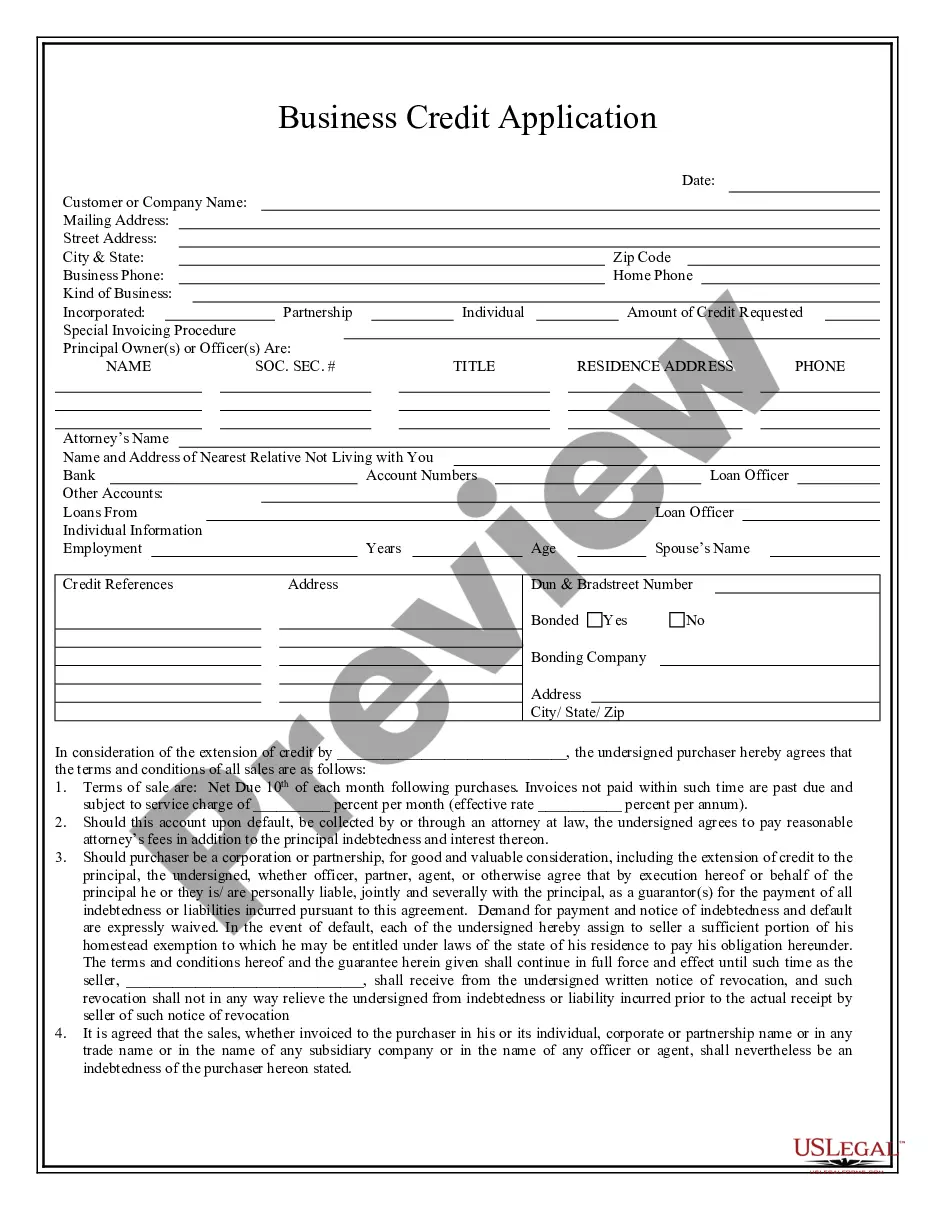

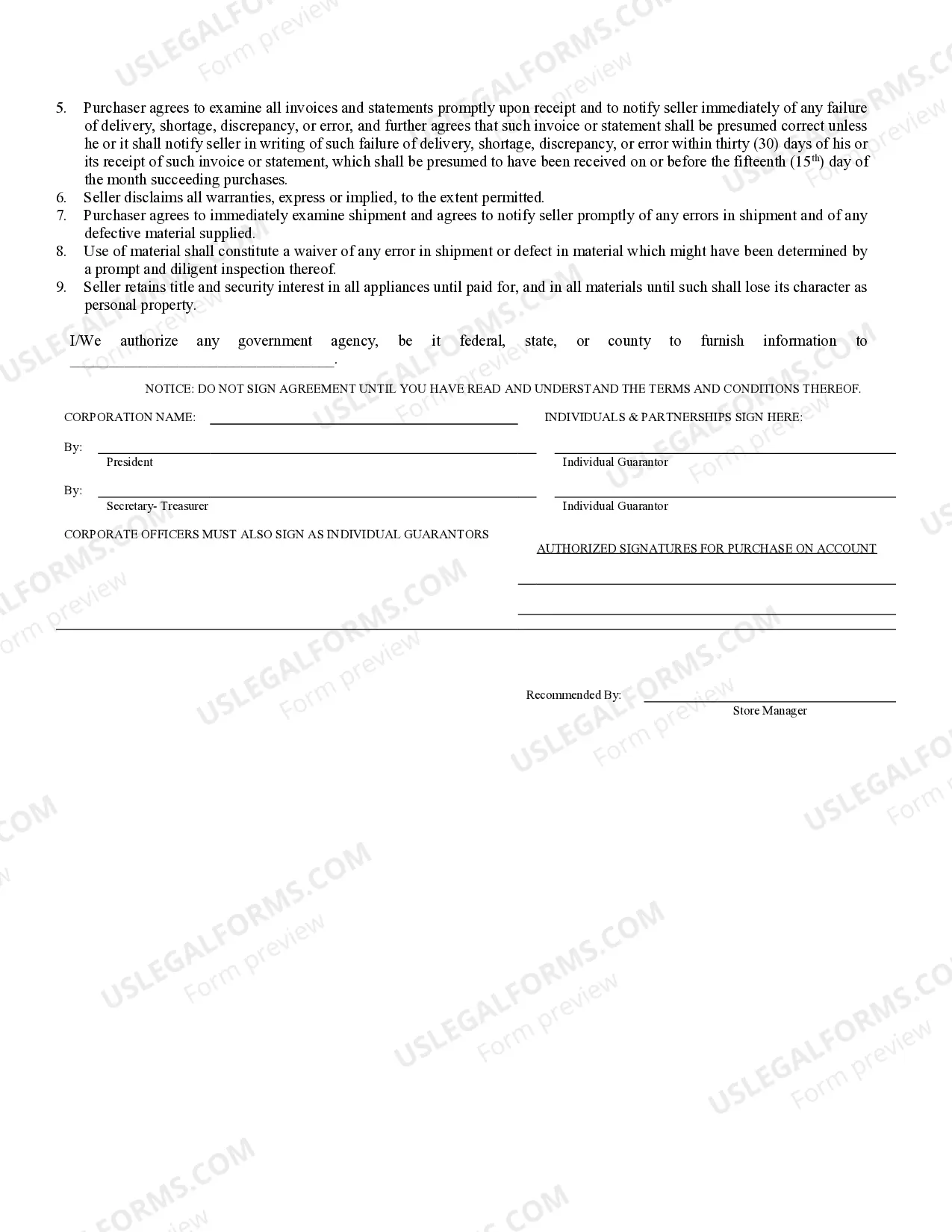

Gainesville Florida Business Credit Application is an essential document that businesses in Gainesville need to submit when applying for credit services or establishing credit relationships with financial institutions or creditors. This detailed application provides vital information about the business, financial history, creditworthiness, and other essential details to evaluate eligibility for credit. The Gainesville Florida Business Credit Application typically includes the following key elements: 1. Business Information: This section requires providing comprehensive details about the business, such as legal name, trade name, business structure (sole proprietorship, partnership, or corporation), address, contact information, industry type, and years in operation. 2. Ownership Details: Here, the application seeks information regarding the business's ownership structure, including owner names, social security numbers, percentage ownership, and addresses. 3. Financial Information: This section requires disclosing financial data, such as annual revenue, net income, assets, liabilities, and outstanding debt. Additionally, businesses may need to provide bank statements, tax returns, balance sheets, profit and loss statements, and other relevant financial documents. 4. Credit References: Applicants are typically requested to provide references from current and past creditors or suppliers, including contact information and credit limits. This helps determine the applicant's creditworthiness and payment history. 5. Trade References: Businesses are often required to provide trade references from other businesses they have worked with, indicating a good payment history. These references should include the names, addresses, and phone numbers of the trade partners. 6. Legal Information: This section covers details about any bankruptcies, legal judgments or liens filed against the business, or pending litigation. Applicants may need to provide supporting documentation to verify their information. 7. Additional Information: This section may vary, depending on the lender or credit institution. It can include requests for a business plan, marketing strategy, collateral details, purpose of the credit, and other relevant information. Different types of Gainesville Florida Business Credit Applications may include: 1. Small Business Credit Application: Tailored for small businesses seeking credit services or loans to support their growth, purchase inventory, or cover operational expenses. 2. Commercial Credit Application: Specifically designed for larger enterprises or corporations requiring substantial credit limits and sophisticated credit facilities. 3. Revolving Line of Credit Application: Meant for businesses in need of ongoing access to a predetermined amount of credit, typically used for managing cash flow fluctuations and short-term financing needs. 4. Start-up Business Credit Application: Geared towards entrepreneurs or newly established businesses seeking initial credit, often requiring additional information like business plans, projected financials, and personal guarantees. 5. Vendor Credit Application: Applied when a business wishes to establish credit terms with suppliers or vendors, allowing the purchase of goods or services on credit with agreed-upon payment terms. Gainesville Florida Business Credit Applications serve as crucial tools to assess a business's creditworthiness, evaluate risk, and determine the terms and conditions under which credit services will be provided. Accuracy, honesty, and completeness in providing information are vital to ensure a smooth credit application process.

Gainesville Florida Business Credit Application

Description

How to fill out Gainesville Florida Business Credit Application?

If you are searching for a valid form template, it’s difficult to find a more convenient platform than the US Legal Forms website – probably the most comprehensive online libraries. Here you can get thousands of templates for organization and individual purposes by categories and states, or key phrases. With the high-quality search feature, getting the most up-to-date Gainesville Florida Business Credit Application is as elementary as 1-2-3. Furthermore, the relevance of every record is verified by a group of skilled attorneys that on a regular basis review the templates on our platform and revise them according to the most recent state and county laws.

If you already know about our platform and have an account, all you should do to get the Gainesville Florida Business Credit Application is to log in to your profile and click the Download button.

If you utilize US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have opened the form you need. Read its description and utilize the Preview feature (if available) to check its content. If it doesn’t meet your requirements, use the Search field at the top of the screen to get the proper document.

- Affirm your decision. Click the Buy now button. Following that, select your preferred subscription plan and provide credentials to sign up for an account.

- Make the purchase. Use your bank card or PayPal account to complete the registration procedure.

- Get the template. Select the format and save it to your system.

- Make changes. Fill out, revise, print, and sign the received Gainesville Florida Business Credit Application.

Each and every template you save in your profile does not have an expiration date and is yours forever. You always have the ability to access them using the My Forms menu, so if you want to have an extra duplicate for enhancing or creating a hard copy, feel free to come back and save it again anytime.

Take advantage of the US Legal Forms professional library to gain access to the Gainesville Florida Business Credit Application you were seeking and thousands of other professional and state-specific templates on one platform!