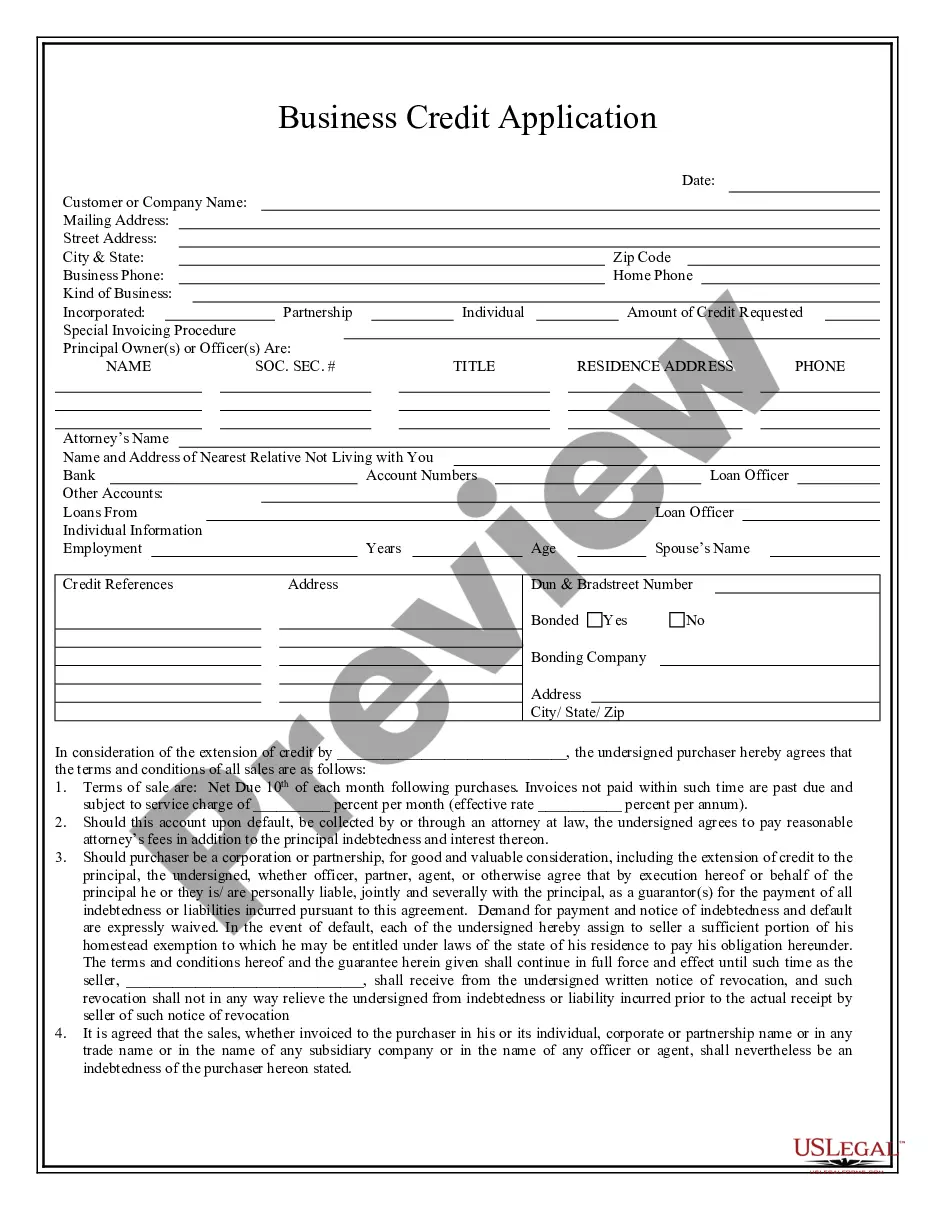

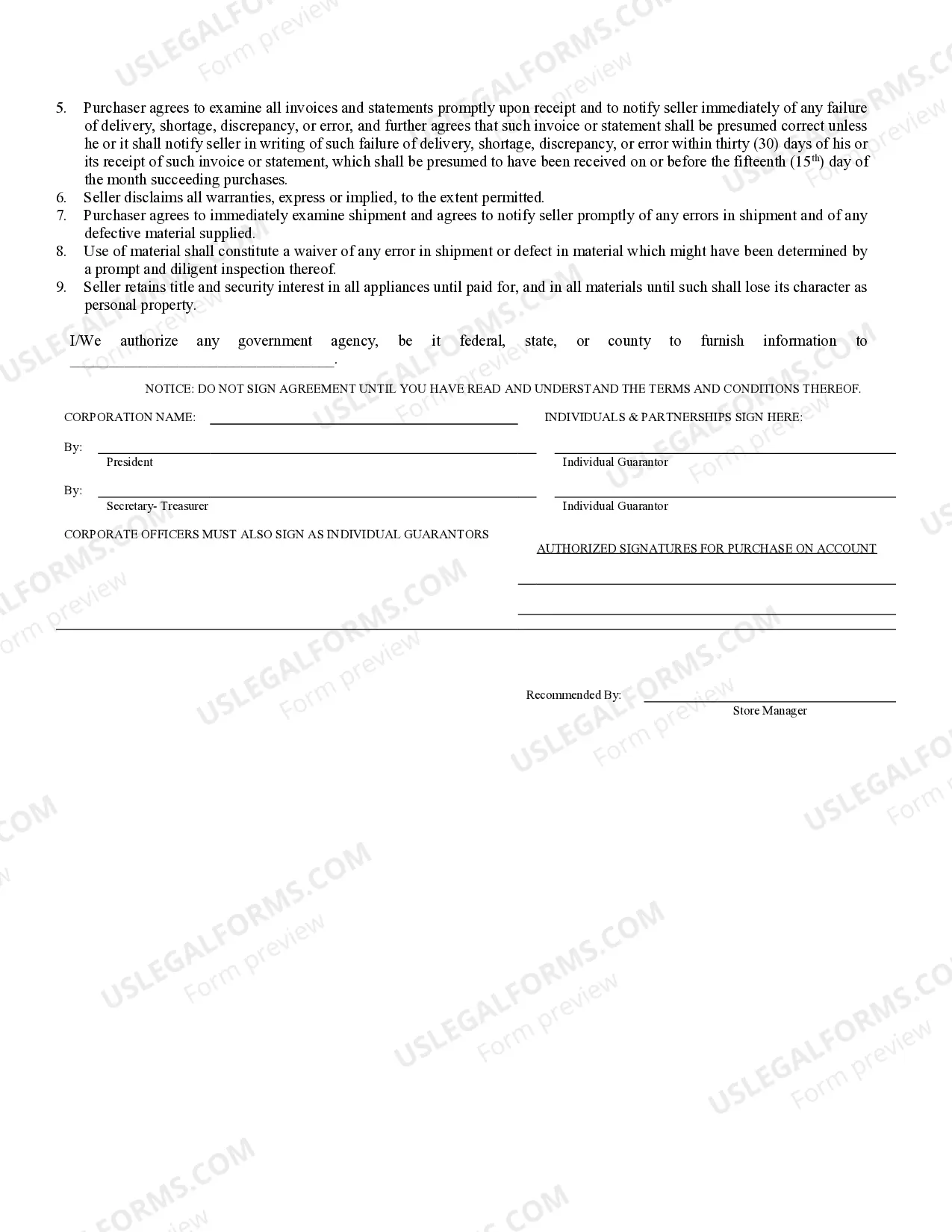

Hillsborough County, located in Florida, offers a variety of business credit applications designed to support local businesses in their growth and expansion plans. The Hillsborough Florida Business Credit Application serves as a comprehensive tool for businesses to apply for credit and financing options offered by the county. By submitting a credit application, businesses can access financial resources to enhance their operations, invest in new equipment, expand their facilities, or develop innovative strategies. The Hillsborough Florida Business Credit Application accommodates various types of businesses, including startups, small and medium-sized enterprises (SMEs), and established corporations. The county understands the importance of nurturing a diverse business landscape and thus strives to provide tailored credit solutions for different industries and sectors. Key types of Hillsborough Florida Business Credit Applications: 1. Startups Business Credit Application: This application is suitable for newly established businesses seeking financial support to kick-start their operations or launch innovative products/services. Startups can access funding options to cover initial setup costs, inventory purchase, marketing expenses, and working capital. 2. Small Business Credit Application: Designed specifically for small businesses, this application enables owners to apply for credit facilities to support their day-to-day operations. Small businesses can utilize credit lines or small loans to manage cash flow, purchase inventory, upgrade technology, and cover operational expenses. 3. Minority-Owned Business Credit Application: Hillsborough County values diversity and provides credit applications dedicated to supporting minority-owned businesses. By offering specific funding opportunities, the county aims to foster inclusivity and bridge the financial gap for entrepreneurs from diverse backgrounds. 4. Expansion and Growth Credit Application: Businesses planning to expand their operations can utilize this credit application to support their growth strategies. Whether expanding into new markets, acquiring additional premises, or investing in new technology, this application assists businesses in obtaining the necessary financing for such initiatives. 5. Green Businesses Credit Application: Hillsborough County encourages sustainable practices by providing credit applications specifically for green businesses. These applications assist businesses in pursuing eco-friendly initiatives, such as implementing energy-efficient technology, adopting renewable energy sources, or following environmentally conscious manufacturing processes. Through these diverse credit applications, Hillsborough County facilitates economic development and encourages local businesses to thrive. By tailoring credit options to the unique needs of each business type, the county establishes a supportive environment that fosters entrepreneurship, growth, and sustainability.

Hillsborough Florida Business Credit Application

Description

How to fill out Hillsborough Florida Business Credit Application?

We always strive to reduce or avoid legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we apply for attorney solutions that, usually, are very expensive. Nevertheless, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of legal counsel. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Hillsborough Florida Business Credit Application or any other form easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is equally easy if you’re unfamiliar with the website! You can create your account within minutes.

- Make sure to check if the Hillsborough Florida Business Credit Application complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Hillsborough Florida Business Credit Application is suitable for you, you can choose the subscription plan and make a payment.

- Then you can download the form in any available file format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!