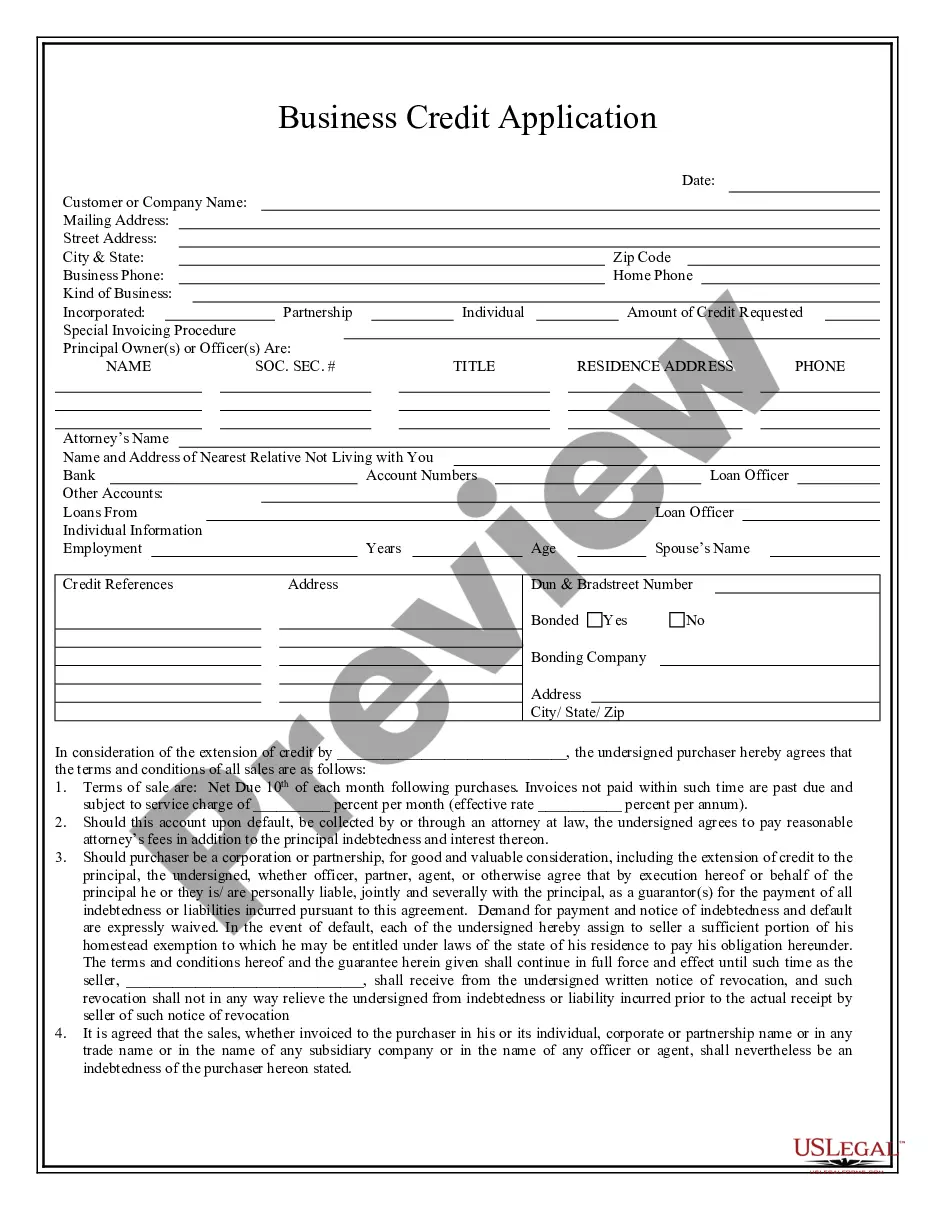

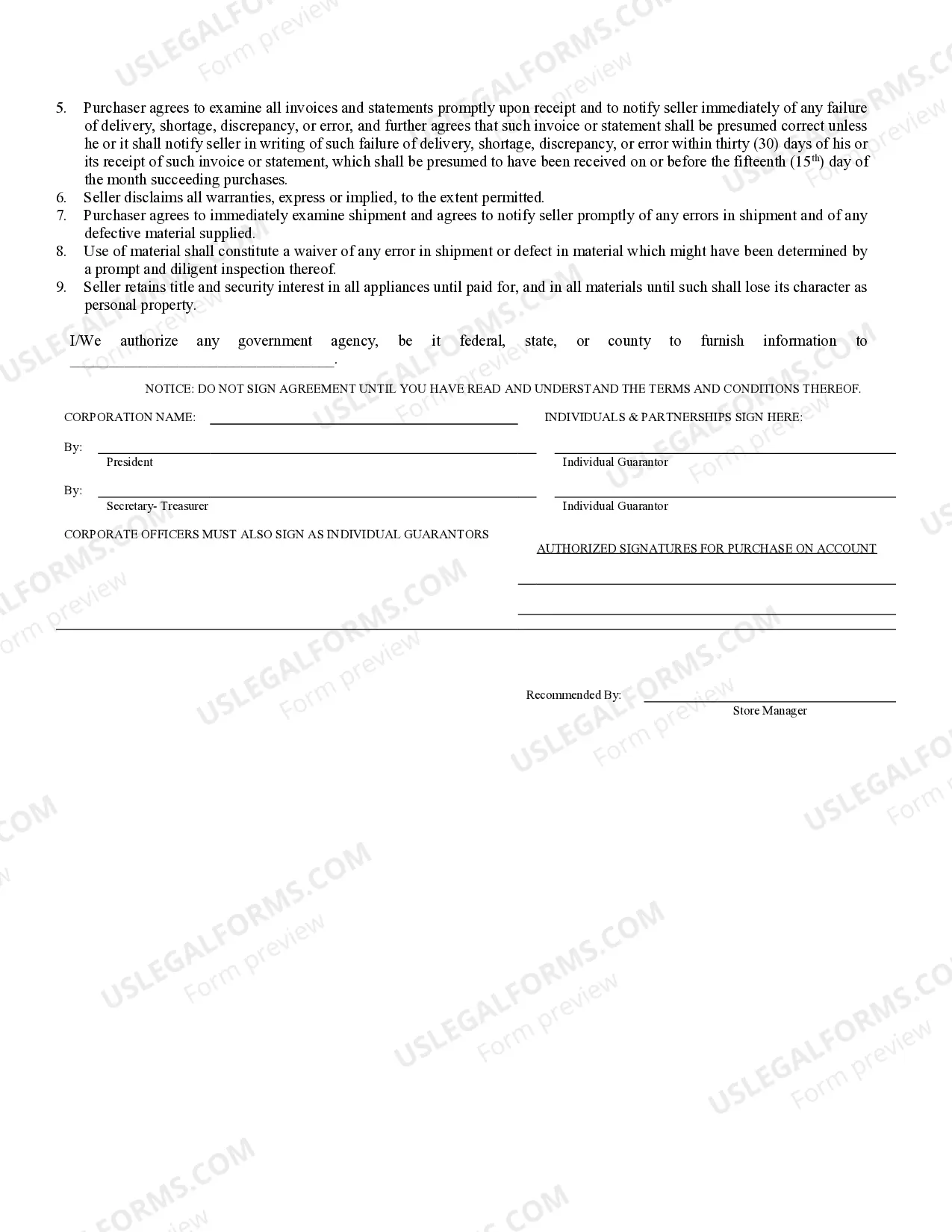

Hollywood Florida Business Credit Application

Description

How to fill out Florida Business Credit Application?

Regardless of social or career position, fulfilling legal paperwork is an unfortunate requirement in the current professional landscape.

Too frequently, it’s nearly impossible for an individual without a legal background to generate this type of documentation from the ground up, primarily due to the intricate terminology and legal nuances they entail.

This is where US Legal Forms steps in to help.

Make sure the template you’ve found is tailored to your locality since the regulations of one state or region may not apply to another.

After reviewing the document and checking any brief description (if available) of applicable cases, if it doesn’t satisfy your requirements, you can restart your search for the needed form.

- Our platform offers an extensive library containing over 85,000 ready-to-use state-specific forms that cater to nearly any legal situation.

- US Legal Forms also acts as a valuable resource for associates or legal advisors seeking to enhance their efficiency with our DIY papers.

- Whether you need the Hollywood Florida Business Credit Application or other relevant documents for your state or locality, everything is readily available with US Legal Forms.

- Here’s how you can obtain the Hollywood Florida Business Credit Application in minutes through our reliable platform.

- If you are an existing subscriber, feel free to Log In to your account to access the correct form.

- However, if you are unfamiliar with our library, ensure you complete these steps before downloading the Hollywood Florida Business Credit Application.

Form popularity

FAQ

A tax receipt and a business license are often used interchangeably, but they can represent different things. While a tax receipt verifies tax payment, a business license grants permission to operate. It's essential to clarify these distinctions, especially when preparing your Hollywood Florida Business Credit Application.

Florida does not have a statewide sales tax of 7.5%. The standard rate remains at 6%, with possible local additions that can take it to 7%. Understanding these rates is crucial for budgeting when you are handling your Hollywood Florida Business Credit Application.

To get a Broward County business tax receipt, you can apply online through the Broward County official website, or you can visit their office in person. Make sure to have all required documents ready to ensure a smooth process. A valid tax receipt is essential for your Hollywood Florida Business Credit Application.

The highest sales tax in Florida can be found in some local jurisdictions, which can go as high as 8%. This includes additional local taxes on the state base rate. It's important to know these details, especially when calculating costs for your Hollywood Florida Business Credit Application.

For Fort Lauderdale business tax inquiries, you can reach them at (954) 828-5002. Their office is equipped to answer questions about business licenses and tax receipts. Contacting them can provide valuable information as you navigate your Hollywood Florida Business Credit Application.

Florida's base sales tax is 6%. However, when considering local taxes, the total can rise to 7%, depending on the county you are in. It's important to understand these rates, particularly when addressing expenses in your Hollywood Florida Business Credit Application.

To contact Broward County business tax, you can call their office directly at (954) 357-5579. They provide assistance regarding business tax receipts and other related inquiries. Having the right information is key, especially when preparing your Hollywood Florida Business Credit Application.

Another name for a business tax receipt is an occupational license. This document proves that a business is authorized to operate in the area. Obtaining your business tax receipt is crucial, especially when applying for a Hollywood Florida Business Credit Application, as it establishes your business legitimacy.

The timeframe for obtaining a Florida business license can vary, typically ranging from a few days to several weeks. This duration depends on the type of business and any additional permits you may require. To expedite the process, ensuring that all required documentation is complete and accurate can help. Utilizing reliable resources like US Legal Forms can make your Hollywood Florida Business Credit Application process quicker and more efficient.

A local business tax receipt is a document that confirms your business is authorized to operate within a specific municipality. This receipt helps verify that you adhere to local regulations, including zoning laws and safety standards. Understanding this requirement is crucial for maintaining your business's good standing. You may find that completing your Hollywood Florida Business Credit Application is part of the process to obtain this important document.