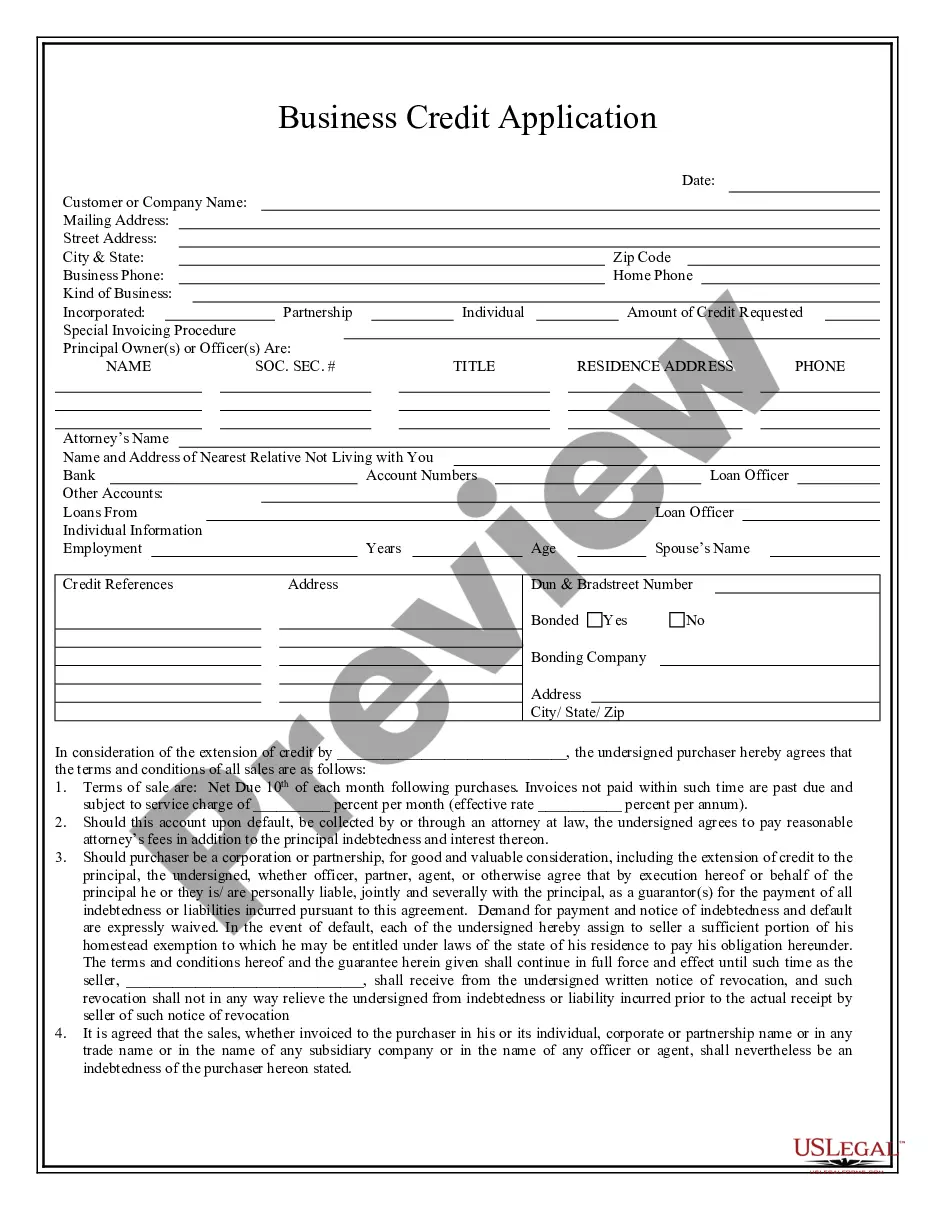

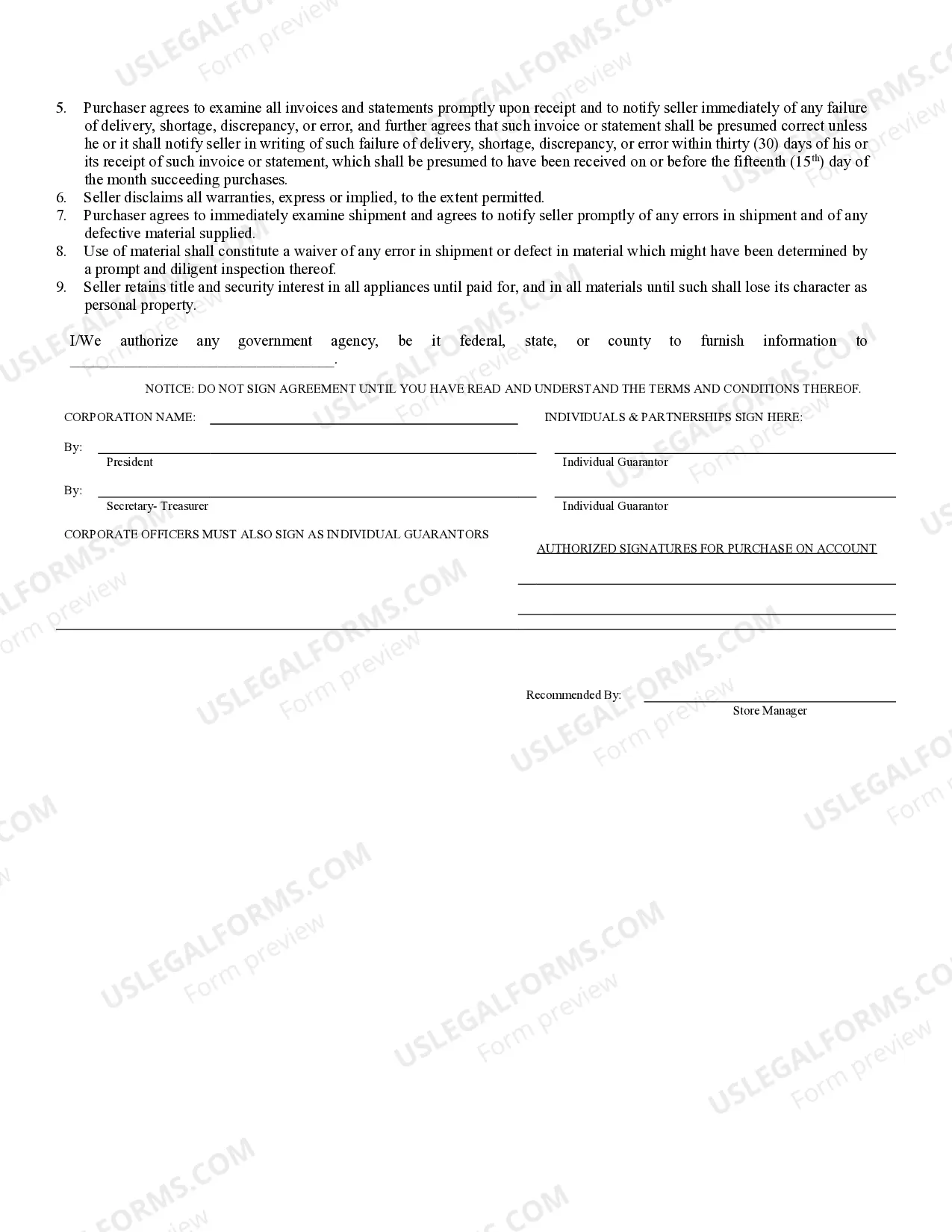

The Jacksonville Florida Business Credit Application is a comprehensive and detailed form used by businesses in Jacksonville, Florida, to apply for credit from financial institutions, lenders, and other credit providers. This application serves as a crucial document to understand the financial health, creditworthiness, and repayment capacity of businesses seeking credit in the Jacksonville area. The Jacksonville Florida Business Credit Application includes various sections and fields that require detailed information to be filled by the applicant. These sections typically consist of key details related to the business, such as legal name, address, contact information, business type (sole proprietorship, partnership, corporation, etc.), years in operation, and industry classification. Another crucial section of the credit application involves detailed financial information about the business. This section may require the disclosure of financial statements, bank statements, tax returns, balance sheets, profit and loss statements, and cash flow statements. These financial documents provide an overview of the company's revenue, expenses, assets, liabilities, and overall financial stability. Additionally, the credit application may require the applicant to provide information regarding the desired credit limit, loan purpose, and intended use of the funds. This section helps lenders understand the specific needs and objectives of the business, enabling them to assess the viability of granting credit. Moreover, the Jacksonville Florida Business Credit Application may also request information regarding any existing credit facilities, outstanding debts, bankruptcies, tax liens, or legal disputes the business may be involved in. This section aims to give lenders a comprehensive understanding of the business's credit history and potential risks associated with granting credit. It is worth noting that while there may not be specific types of Jacksonville Florida Business Credit Applications, different lenders or financial institutions may have their own customized versions of the credit application. These variations may differ in terms of the layout, required information, or additional sections depending on the specific policies and requirements of each lender. In conclusion, the Jacksonville Florida Business Credit Application is a detailed and comprehensive document that businesses in Jacksonville used to apply for credit. It consists of various sections collecting information about the business's details, financial information, credit history, and intended use of funds. While there may not be distinct types of credit applications, variations can exist between lenders.

Jacksonville Florida Business Credit Application

Description

How to fill out Jacksonville Florida Business Credit Application?

No matter what social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for someone with no law education to draft such papers from scratch, mainly because of the convoluted jargon and legal subtleties they entail. This is where US Legal Forms comes to the rescue. Our service provides a massive collection with over 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to save time using our DYI forms.

Whether you require the Jacksonville Florida Business Credit Application or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Jacksonville Florida Business Credit Application in minutes employing our reliable service. If you are presently an existing customer, you can go ahead and log in to your account to get the appropriate form.

However, if you are new to our library, make sure to follow these steps before downloading the Jacksonville Florida Business Credit Application:

- Be sure the form you have chosen is specific to your location considering that the rules of one state or county do not work for another state or county.

- Preview the form and go through a brief description (if available) of cases the paper can be used for.

- In case the one you picked doesn’t suit your needs, you can start over and search for the needed document.

- Click Buy now and pick the subscription plan you prefer the best.

- with your login information or create one from scratch.

- Select the payment method and proceed to download the Jacksonville Florida Business Credit Application once the payment is through.

You’re good to go! Now you can go ahead and print the form or complete it online. In case you have any problems locating your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.