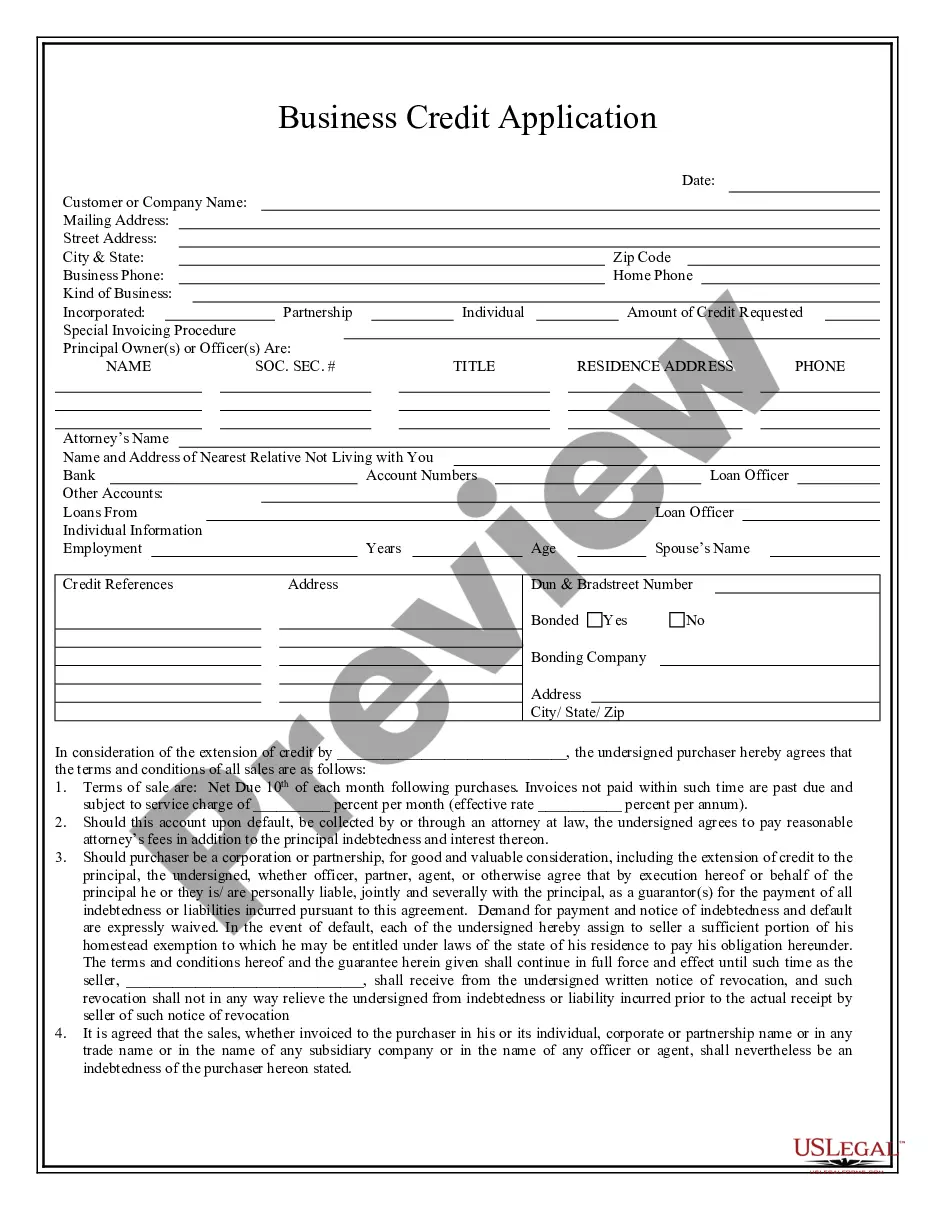

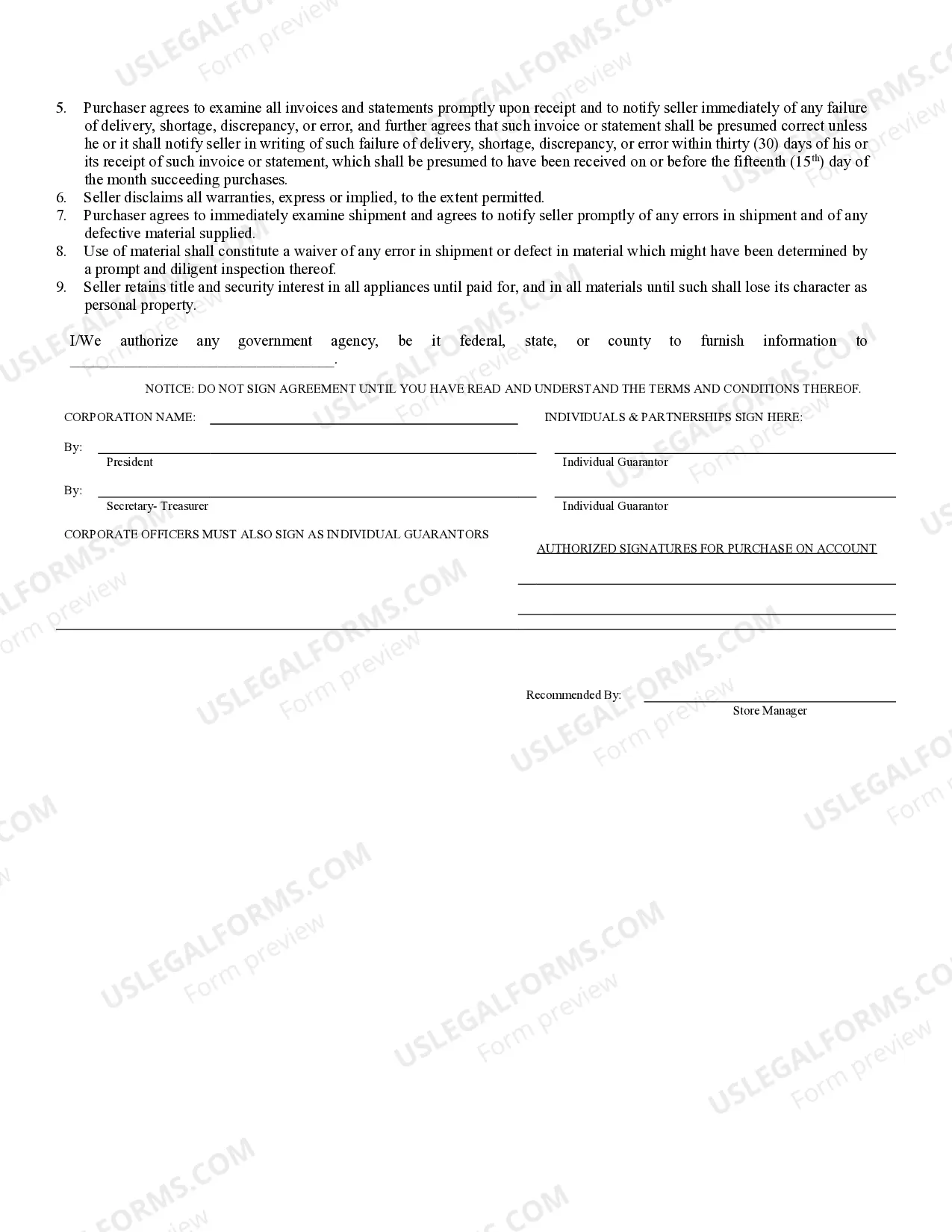

Lakeland Florida Business Credit Application is a crucial document that enables businesses in Lakeland, Florida, to apply for credit services from financial institutions or lenders. This application serves as a formal request for credit that helps businesses access funds to optimize their operations, invest in new equipment, or expand their offerings. Keywords: Lakeland Florida, business credit application, credit services, financial institutions, lenders, formal request, access funds, optimize operations, invest in equipment, expand offerings. There are various types of Lakeland Florida Business Credit Applications available, designed to cater to the diverse needs of businesses. Here are some common types: 1. Small Business Credit Application: Geared towards small businesses, this application allows startups and smaller enterprises to request credit facilities to support their growth, pay bills, purchase inventory, or cover unforeseen expenses. 2. Corporate Credit Application: Designed for larger corporations and established businesses, this application is suitable for companies seeking substantial credit lines for ongoing operations, mergers and acquisitions, or other significant financial transactions. 3. Vendor Credit Application: This type of application is used when businesses want to establish a credit account with specific vendors or suppliers. It enables them to purchase goods or services on credit, usually with favorable terms and payment arrangements. 4. Business Credit Card Application: Similar to personal credit cards, business credit cards offer companies access to revolving credit. The application process is relatively straightforward and allows businesses to manage day-to-day expenses, track transactions, and build credit history. 5. Line of Credit Application: A line of credit application provides businesses with a flexible credit option, allowing them to borrow funds as needed, up to a predetermined limit. This application is well-suited for managing cash flow fluctuations or covering short-term financing requirements. Businesses in Lakeland, Florida, must carefully fill out the credit application, providing accurate and comprehensive information about their company, financial statements, credit history, and the purpose for which the credit is sought. Lenders evaluate these applications to assess the creditworthiness of the business, determining the risk associated with extending credit and establishing appropriate terms and conditions. Applying for business credit in Lakeland, Florida, can significantly benefit companies, helping them obtain the necessary funds to sustain and expand their operations. By completing the credit application accurately and understanding the specific requirements of different types of applications, businesses can increase their chances of securing favorable credit terms and gaining access to vital financial resources.

Lakeland Florida Business Credit Application

Description

How to fill out Lakeland Florida Business Credit Application?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone without any legal background to create such paperwork from scratch, mostly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our service offers a massive library with over 85,000 ready-to-use state-specific documents that work for practically any legal case. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you require the Lakeland Florida Business Credit Application or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Lakeland Florida Business Credit Application quickly employing our reliable service. In case you are already a subscriber, you can proceed to log in to your account to get the appropriate form.

However, in case you are unfamiliar with our platform, ensure that you follow these steps prior to obtaining the Lakeland Florida Business Credit Application:

- Be sure the form you have found is suitable for your location considering that the regulations of one state or area do not work for another state or area.

- Preview the form and go through a short outline (if provided) of cases the paper can be used for.

- In case the one you chosen doesn’t meet your needs, you can start over and look for the needed document.

- Click Buy now and choose the subscription plan that suits you the best.

- with your credentials or create one from scratch.

- Choose the payment method and proceed to download the Lakeland Florida Business Credit Application as soon as the payment is done.

You’re all set! Now you can proceed to print out the form or complete it online. In case you have any issues locating your purchased documents, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.

Form popularity

FAQ

The base state sales tax rate in Florida is 6%, but with additional local surtaxes, the rate can reach up to 8.5% depending on the county. Specifically, in Lakeland, businesses collect a total sales tax of 7%. It is vital to be aware of these rates when processing your Lakeland Florida Business Credit Application.

Obtaining a Florida business license can take anywhere from a few days to several weeks, depending on the type of business and the required approvals. Early preparation can expedite this process. If you're applying for a Lakeland Florida Business Credit Application, consider initiating your licensing process promptly to avoid delays.

Yes, Polk County requires businesses to obtain a business tax receipt to operate legally. This receipt helps verify that your business complies with local regulations. If you're intending to apply for a Lakeland Florida Business Credit Application, ensuring you have this receipt is part of establishing a solid foundation for your business.

Florida does not have a state sales tax rate of 7.5%. The state sales tax is currently set at 6%, with some local counties imposing additional surtaxes. For businesses in Lakeland, understanding these rates is essential when completing your Lakeland Florida Business Credit Application.

The highest sales tax in Florida can be found in several areas, primarily due to local surtaxes that cities impose on top of the state rate. Notably, counties like Miami-Dade often have a combined sales tax that exceeds the standard rates. When considering a Lakeland Florida Business Credit Application, it's important to factor these taxes into your business expenses.

The half cent sales tax in Polk County is an additional tax imposed to fund specific local projects and services. This tax is applied to most sales transactions, contributing to the overall revenue for community enhancements. If you're applying for a Lakeland Florida Business Credit Application, understanding local taxes is crucial for your financial planning.

For new business credit applications, you might need to estimate your potential revenue based on your business model and market strategies. Providing a well-researched projection, even if it's a low number, can be beneficial. As you complete your Lakeland Florida Business Credit Application, ensure your estimates are realistic and supported by a solid plan to boost your credibility with lenders.

To calculate annual revenue for your new business, sum up all expected sales over a year. Include income from all sources related to your business operations. This calculation is crucial when completing a Lakeland Florida Business Credit Application, as lenders will use this information to gauge your financial sustainability.

When you just started your business, you can indicate your projected revenue based on your market research and expected customer base. If you have no revenue yet, simply state that your revenue is zero and include your forecasted figures. Being transparent in your Lakeland Florida Business Credit Application helps cultivate trust with lenders.

For a new business applying for an American Express card, use projected revenue figures based on your business plan. If you haven't generated income yet, it’s acceptable to provide an estimate based on expected sales. This approach shows lenders your proactive planning, which can be beneficial in securing your Lakeland Florida Business Credit Application.