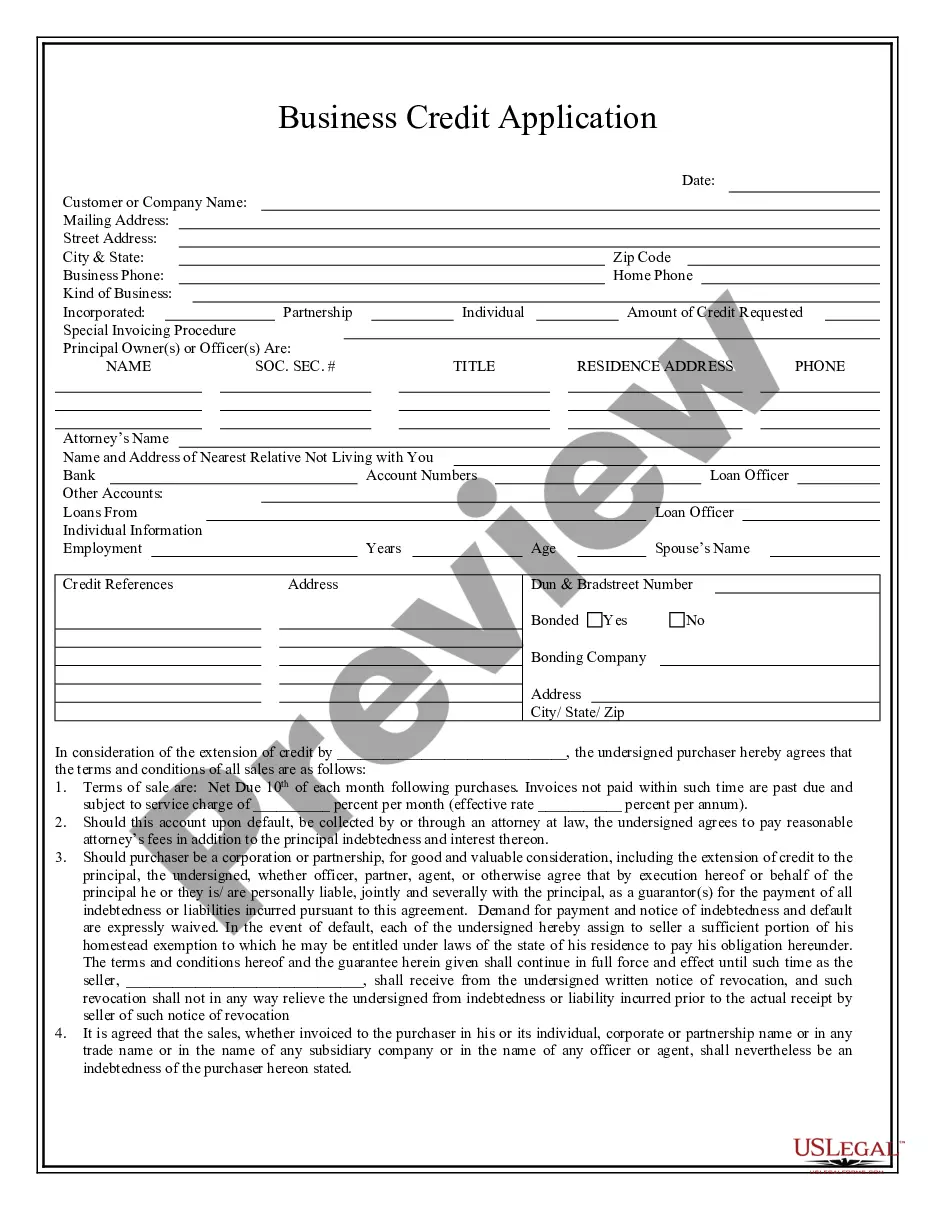

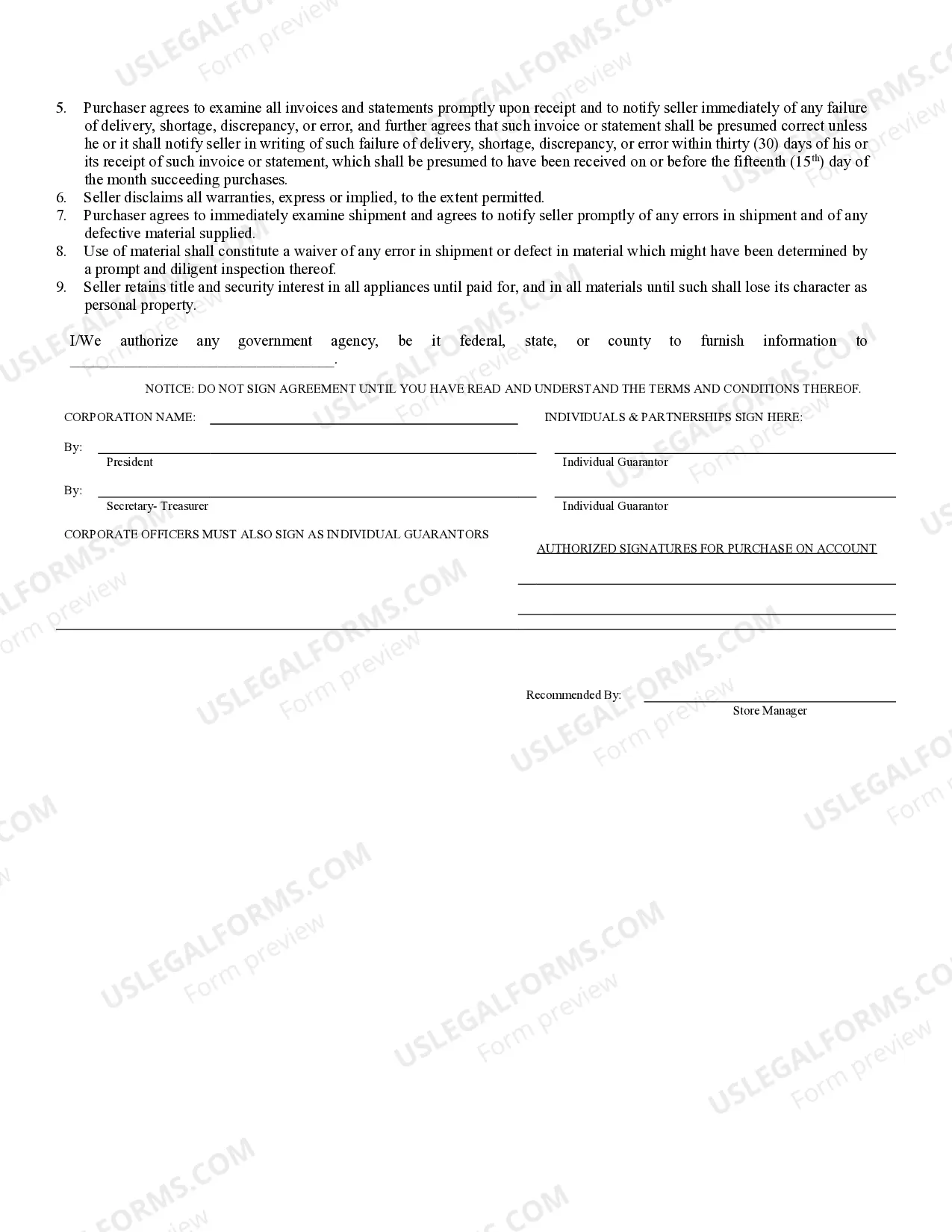

Miami-Dade Florida Business Credit Application is a comprehensive and essential document required by businesses in Miami-Dade County, Florida, when applying for credit or financing. This application serves as a formal request for credit, providing crucial information about the company's financial stability, creditworthiness, and ability to repay borrowed funds. The Miami-Dade County government, financial institutions, and creditors rely on this application to assess the eligibility of businesses and make informed decisions regarding credit approvals. The Miami-Dade Florida Business Credit Application typically encompasses several sections that gather detailed information about the applying business. These sections include: 1. Business Details: This section collects essential information about the company, such as its legal name, trade name, address, phone number, email, and tax identification number (TIN). Providing accurate and up-to-date contact information is crucial for effective communication between the applicant and the creditor. 2. Ownership and Management: In this segment, businesses are required to disclose the names, titles, addresses, and contact details of all owners, partners, or major shareholders. Creditors analyze this information to assess the management team's experience and background. 3. Financial Information: This crucial section outlines the financial history and current status of the business. It includes details such as annual revenue, profit or loss statements, balance sheets, cash flow statements, and any outstanding debts or loans. Accurate financial information helps creditors evaluate the business's financial stability and capacity to repay borrowed funds. 4. Trade and Credit References: Here, the business must provide comprehensive information about its existing and past suppliers, vendors, and creditors. These references serve as testimonies to the company's creditworthiness, payment history, and overall reliability. 5. Banking and Financial Institutions: This section requires the business to list all financial institutions they currently work with, including bank accounts, lines of credit, and loans. This information helps creditors in understanding the business's existing financial relationships. 6. Collateral and Guarantor Information: If collateral or personal guarantors are being offered to secure the credit, this section gathers the necessary details. Collateral can include assets such as real estate, equipment, inventory, or accounts receivable that the business commits to forfeit in case of default. Different types of Miami-Dade Florida Business Credit Applications may exist, such as applications specific to financing programs provided by the Miami-Dade County government, local banks, or credit unions. Additionally, there may be variations in the application process and additional requirements depending on the type of credit being sought, such as small business loans, commercial mortgages, lines of credit, or credit cards. In conclusion, the Miami-Dade Florida Business Credit Application is a detailed and important document required by businesses seeking credit or financing in Miami-Dade County. By accurately completing this application, businesses provide creditors with the necessary information to assess their creditworthiness and make informed decisions regarding loan approvals.

Miami-Dade Florida Business Credit Application

Description

How to fill out Miami-Dade Florida Business Credit Application?

No matter the social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for someone without any law background to draft such papers from scratch, mainly due to the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes in handy. Our platform provides a massive catalog with over 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also is an excellent asset for associates or legal counsels who want to save time utilizing our DYI tpapers.

Whether you require the Miami-Dade Florida Business Credit Application or any other document that will be valid in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Miami-Dade Florida Business Credit Application quickly using our reliable platform. If you are presently a subscriber, you can go ahead and log in to your account to download the appropriate form.

However, if you are a novice to our library, make sure to follow these steps before downloading the Miami-Dade Florida Business Credit Application:

- Ensure the form you have chosen is good for your location since the regulations of one state or area do not work for another state or area.

- Preview the form and read a short description (if available) of cases the paper can be used for.

- If the form you chosen doesn’t meet your requirements, you can start again and look for the necessary form.

- Click Buy now and pick the subscription option you prefer the best.

- with your login information or register for one from scratch.

- Pick the payment method and proceed to download the Miami-Dade Florida Business Credit Application as soon as the payment is completed.

You’re good to go! Now you can go ahead and print out the form or fill it out online. If you have any problems getting your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.