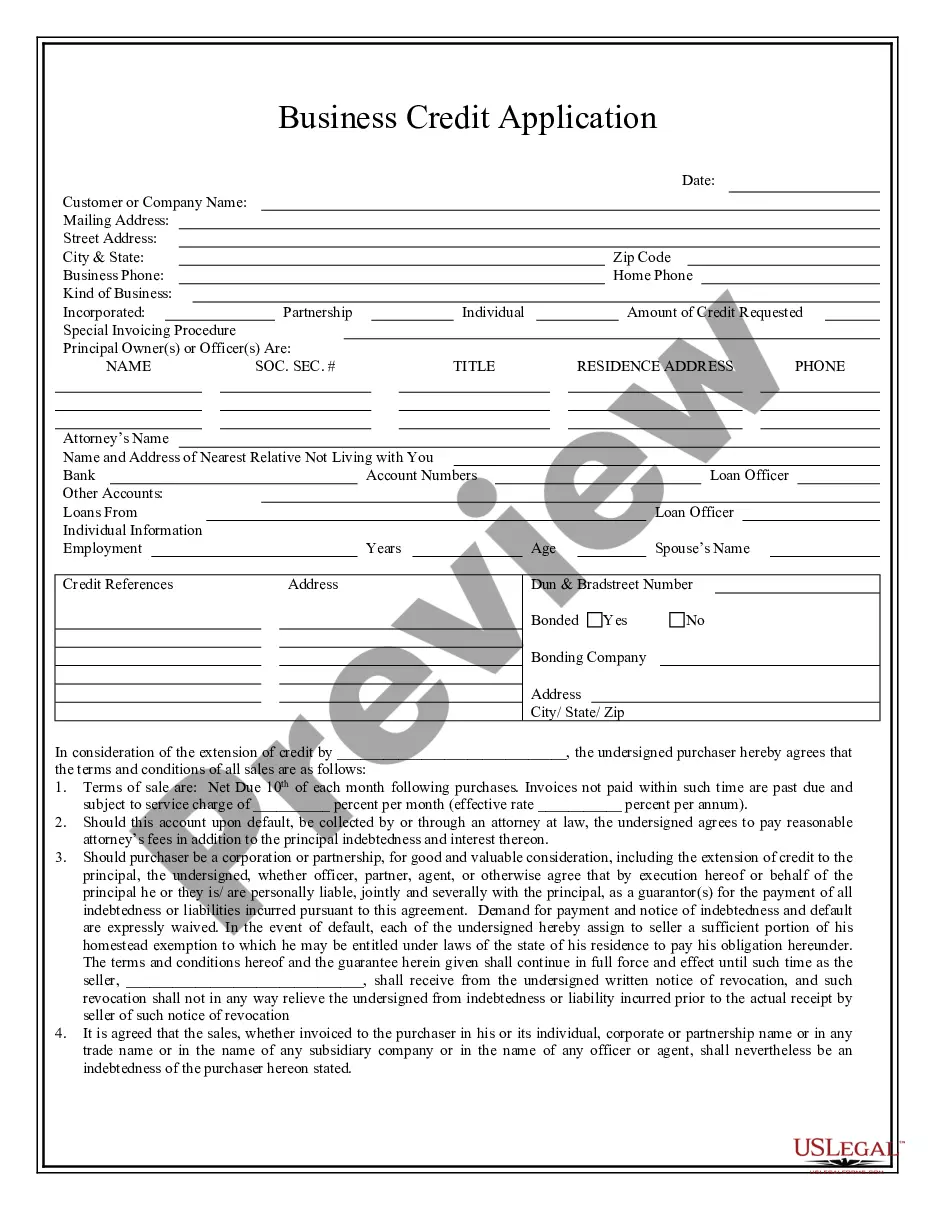

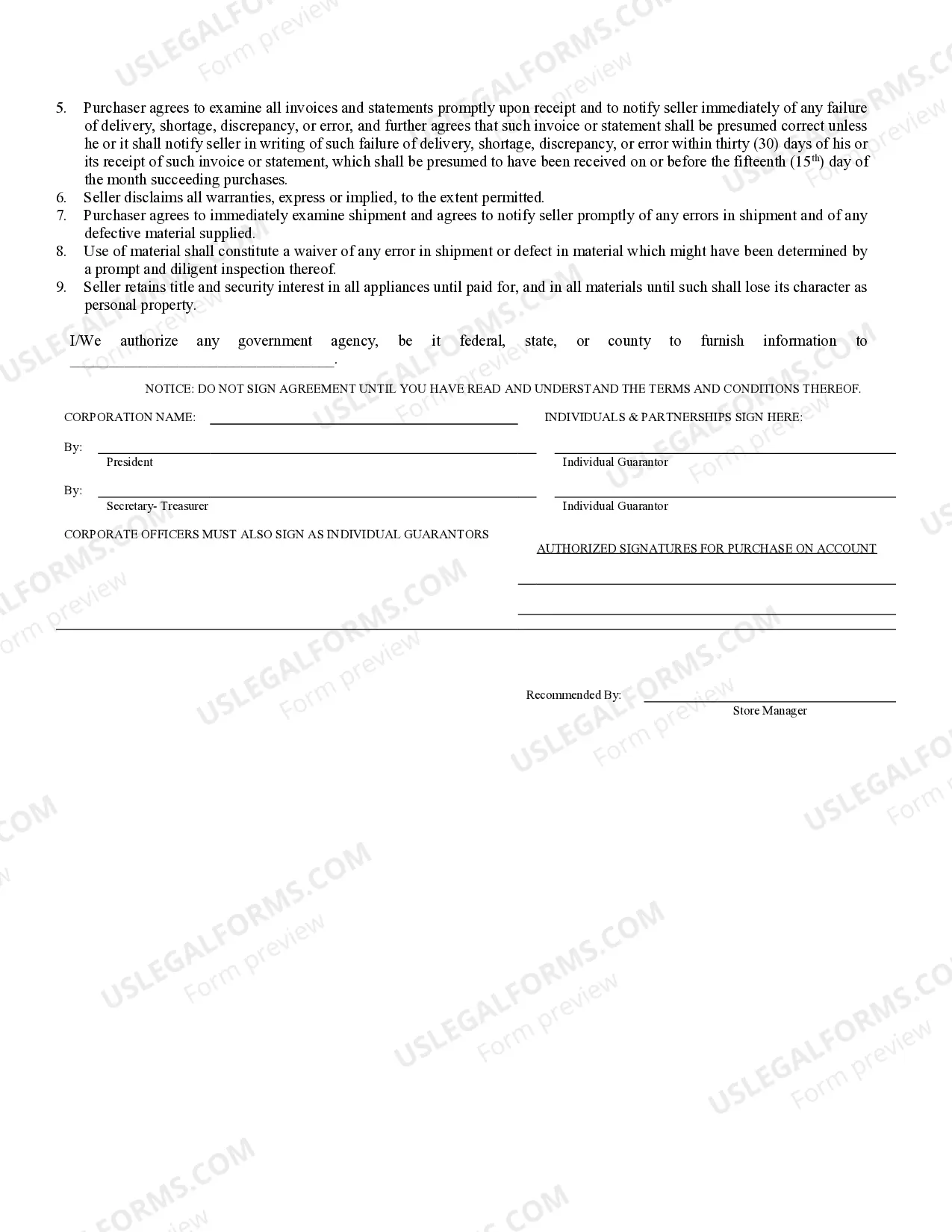

Orange Florida Business Credit Application is a crucial document that facilitates the process of obtaining credit for businesses operating in Orange, Florida. This application is specifically designed to gather essential information from business entities seeking credit. It serves as a comprehensive tool for businesses to showcase their financial stability, creditworthiness, and overall suitability for credit approval. The Orange Florida Business Credit Application typically includes several sections, each designed to gather specific details about the business and its financial history. These sections commonly include: 1. Business Information: This section requires the company name, address, contact information, and legal structure of the business. It also includes details about the industry, years in operation, and any affiliated companies. 2. Financial Statements: Here, businesses are required to provide their financial statements, including income statements, balance sheets, and cash flow statements. These documents offer insights into the financial health and performance of the company. 3. Trade References: Businesses are expected to provide trade references from vendors, suppliers, or other entities they have conducted business with in the past. These references serve to verify the company's ability to meet payment obligations promptly. 4. Bank References: This section typically requests the names and contact information of banks where the business holds accounts. It allows lenders to verify the company's banking history and relationships. 5. Credit Request: Businesses are required to specify the amount of credit they are seeking and provide a clear explanation for the purpose of the credit. This section also includes the desired repayment terms and conditions. 6. Personal Guarantees: In some cases, lenders may ask for personal guarantees from business owners or other key individuals associated with the company. These guarantees demonstrate an additional level of commitment and security. It is important to note that there are various types of Orange Florida Business Credit Applications catering to different types of businesses or industries. The specific types may include: 1. Orange Florida Small Business Credit Application: Tailored for small businesses looking for credit opportunities in Orange, Florida. This application may focus on the unique needs and challenges faced by small enterprises. 2. Orange Florida Commercial Credit Application: Designed for larger commercial businesses operating in various industries such as manufacturing, retail, or services. This application may require more extensive financial documentation due to the higher credit amounts requested. 3. Orange Florida Start-up Business Credit Application: Specifically created for newly established companies seeking credit options. Start-up businesses usually face specific challenges in obtaining credit, and this application takes those factors into account. 4. Orange Florida Construction Business Credit Application: Geared towards businesses operating in the construction industry, including contractors, builders, and subcontractors. This specialized application may require additional documentation related to ongoing projects, liens, and bonding. In conclusion, the Orange Florida Business Credit Application serves as a vital tool for businesses in Orange, Florida, to apply for credit. By providing comprehensive business and financial information, this application assists lenders in evaluating creditworthiness and determining whether to extend credit to businesses in the vibrant Orange, Florida business community.

Orange Florida Business Credit Application

Description

How to fill out Orange Florida Business Credit Application?

If you are looking for a valid form, it’s extremely hard to choose a better platform than the US Legal Forms website – probably the most comprehensive libraries on the web. With this library, you can find a large number of templates for organization and personal purposes by types and regions, or keywords. With the high-quality search function, getting the most up-to-date Orange Florida Business Credit Application is as easy as 1-2-3. Moreover, the relevance of each record is confirmed by a team of expert attorneys that on a regular basis review the templates on our platform and revise them in accordance with the newest state and county demands.

If you already know about our system and have a registered account, all you should do to receive the Orange Florida Business Credit Application is to log in to your account and click the Download option.

If you use US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have opened the form you require. Read its explanation and utilize the Preview feature to explore its content. If it doesn’t meet your requirements, utilize the Search field at the top of the screen to find the appropriate record.

- Confirm your choice. Choose the Buy now option. After that, pick the preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Use your credit card or PayPal account to finish the registration procedure.

- Obtain the form. Pick the format and save it to your system.

- Make adjustments. Fill out, edit, print, and sign the received Orange Florida Business Credit Application.

Each and every form you save in your account has no expiry date and is yours permanently. You can easily access them via the My Forms menu, so if you want to get an extra copy for modifying or creating a hard copy, you may return and download it once more anytime.

Take advantage of the US Legal Forms extensive library to get access to the Orange Florida Business Credit Application you were looking for and a large number of other professional and state-specific samples on a single platform!