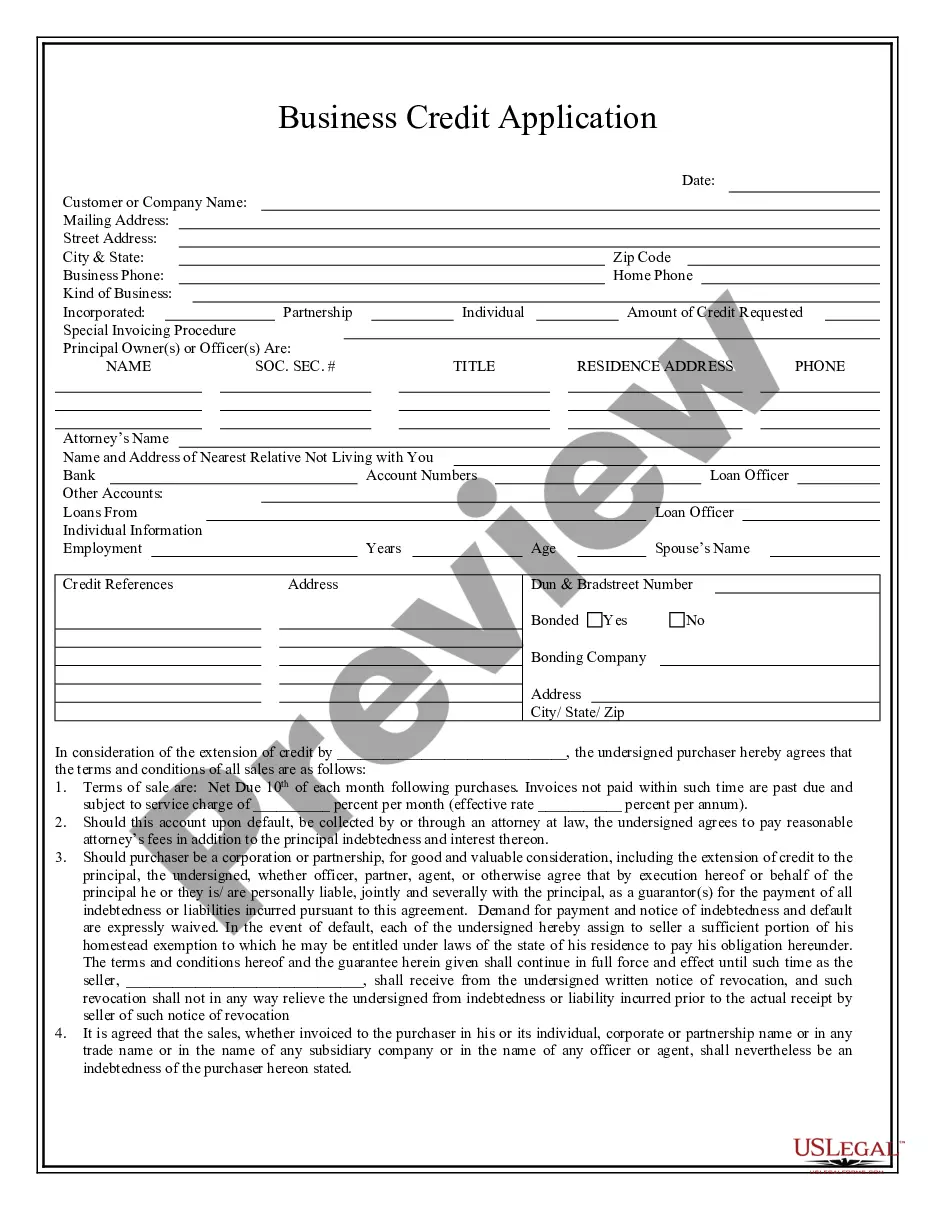

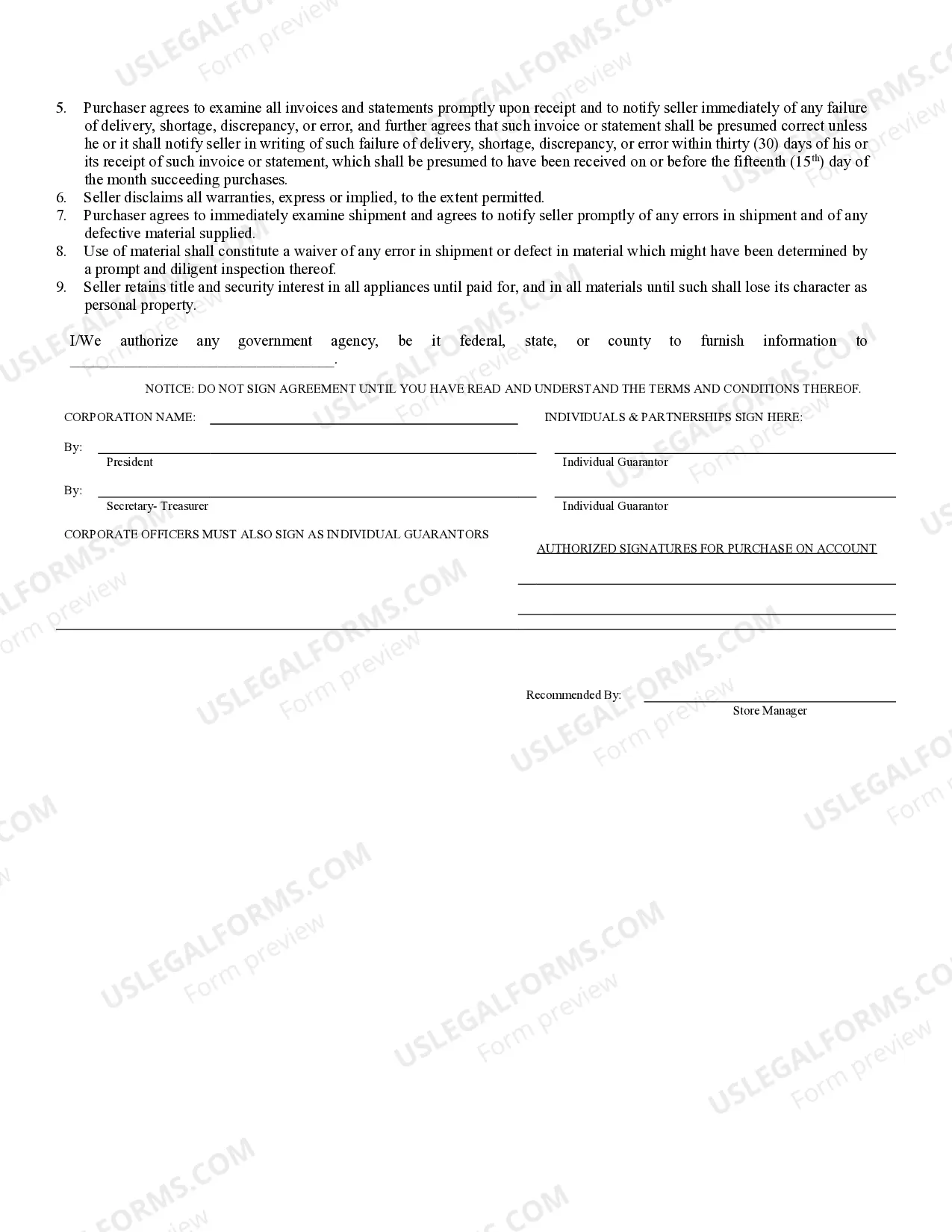

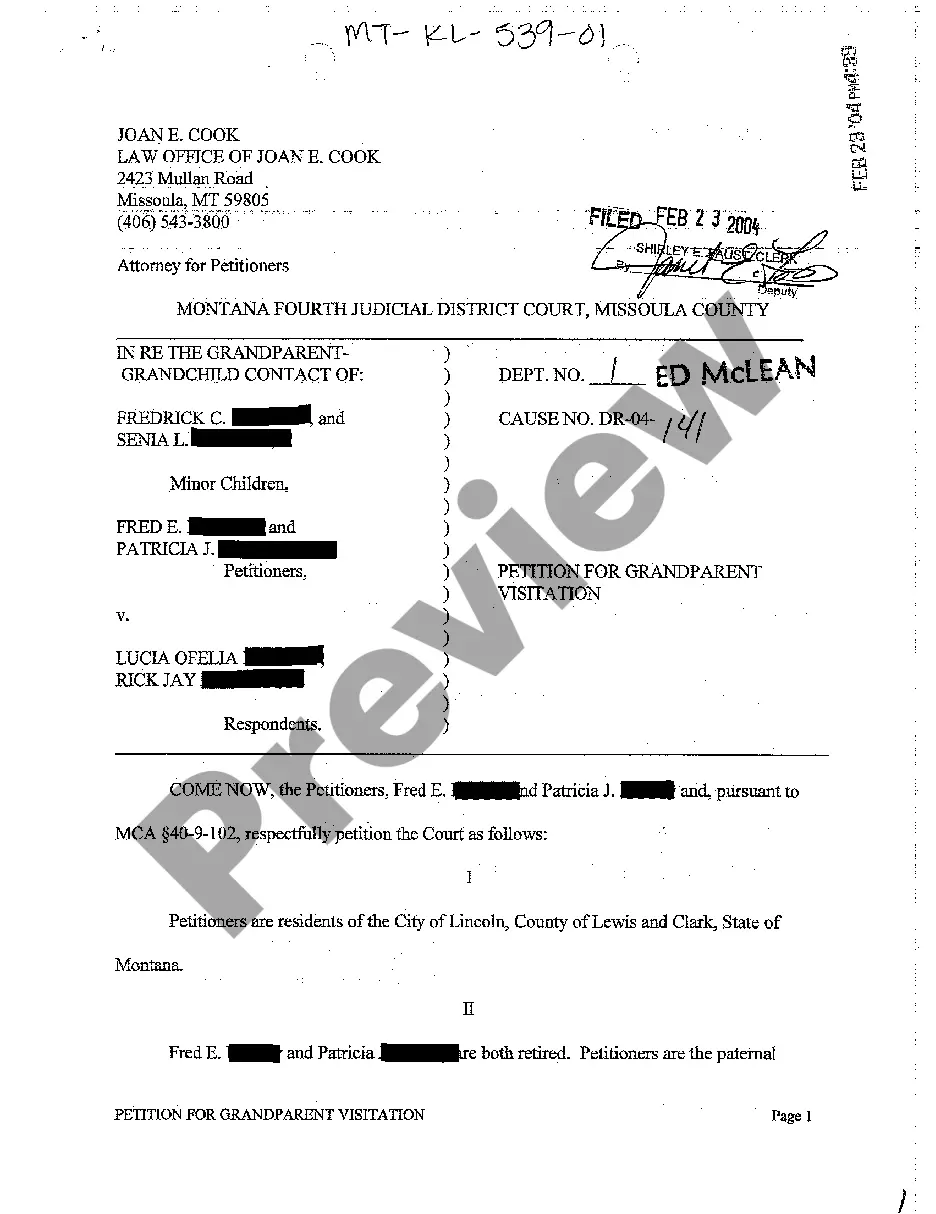

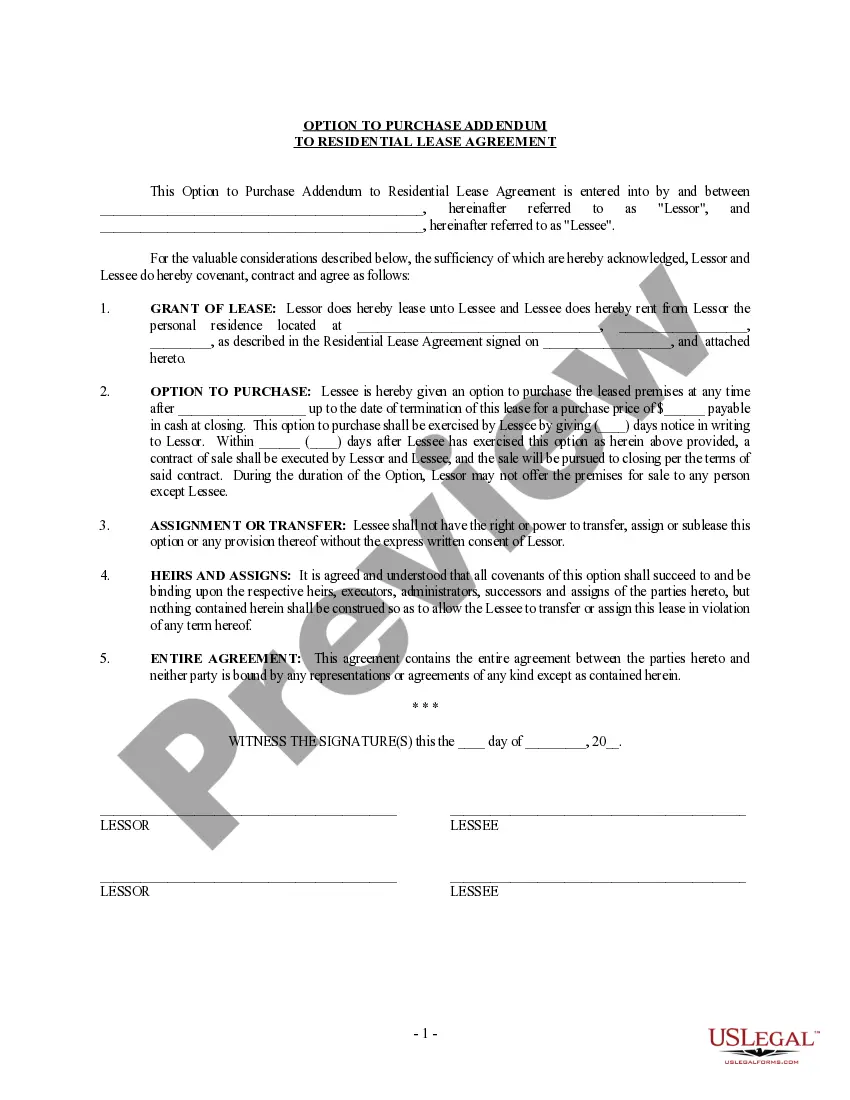

Palm Beach Florida Business Credit Application is a document that business owners or entrepreneurs in Palm Beach, Florida, can utilize to apply for credit from financial institutions or lenders. This application serves as a formal request for a credit line, loan, or financing, allowing businesses to access funds for various purposes such as expansion, inventory purchase, equipment acquisition, or working capital. Business credit applications in Palm Beach, Florida, come in different types, designed to cater to specific needs and requirements. Some common types of credit applications available in Palm Beach include: 1. Small Business Credit Application: This type of application is suitable for small businesses, startups, or self-employed individuals in Palm Beach. It usually requires basic business information, personal details of the owner(s), financial statements, business plans, and credit history. 2. Commercial Credit Application: Designed for larger Palm Beach businesses, including corporations and partnerships, this application requires to be detailed financial information about the company, bank references, trade references, tax ID numbers, and sometimes even personal guarantees from the owners. 3. Vendor Credit Application: This specific application is used when businesses in Palm Beach wish to establish a credit relationship with vendors or suppliers. It typically includes business identification, trade references, bank information, and details about the products or services being purchased. 4. Business Line of Credit Application: This type of application is specifically for obtaining a revolving line of credit that businesses in Palm Beach can tap into when needed. It requires providing financial history, credit scores, collateral details (if necessary), and sometimes a business plan for demonstrating potential repayment capabilities. Regardless of the type, Palm Beach Florida Business Credit Applications typically require comprehensive details about the business, its financial health, and the purpose for seeking credit. It is essential to fill out the application accurately and provide all necessary supporting documents to maximize the chances of credit approval.

Palm Beach Florida Business Credit Application

Description

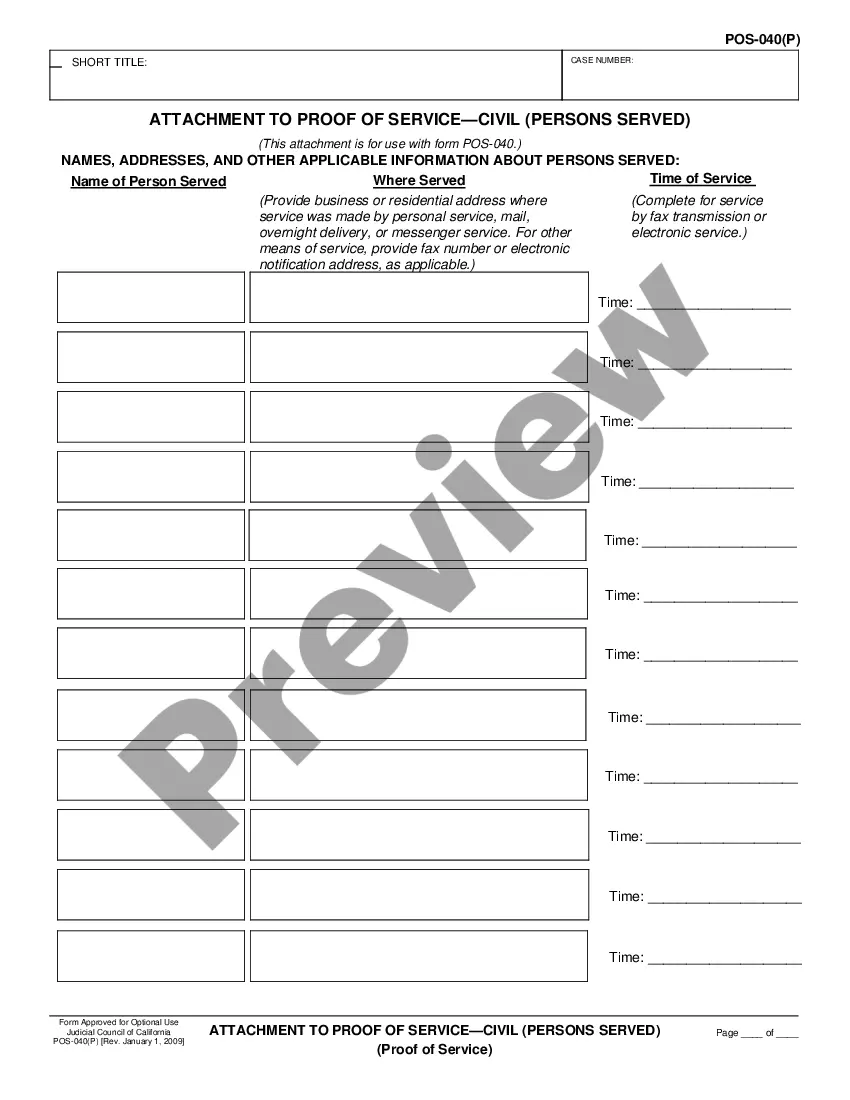

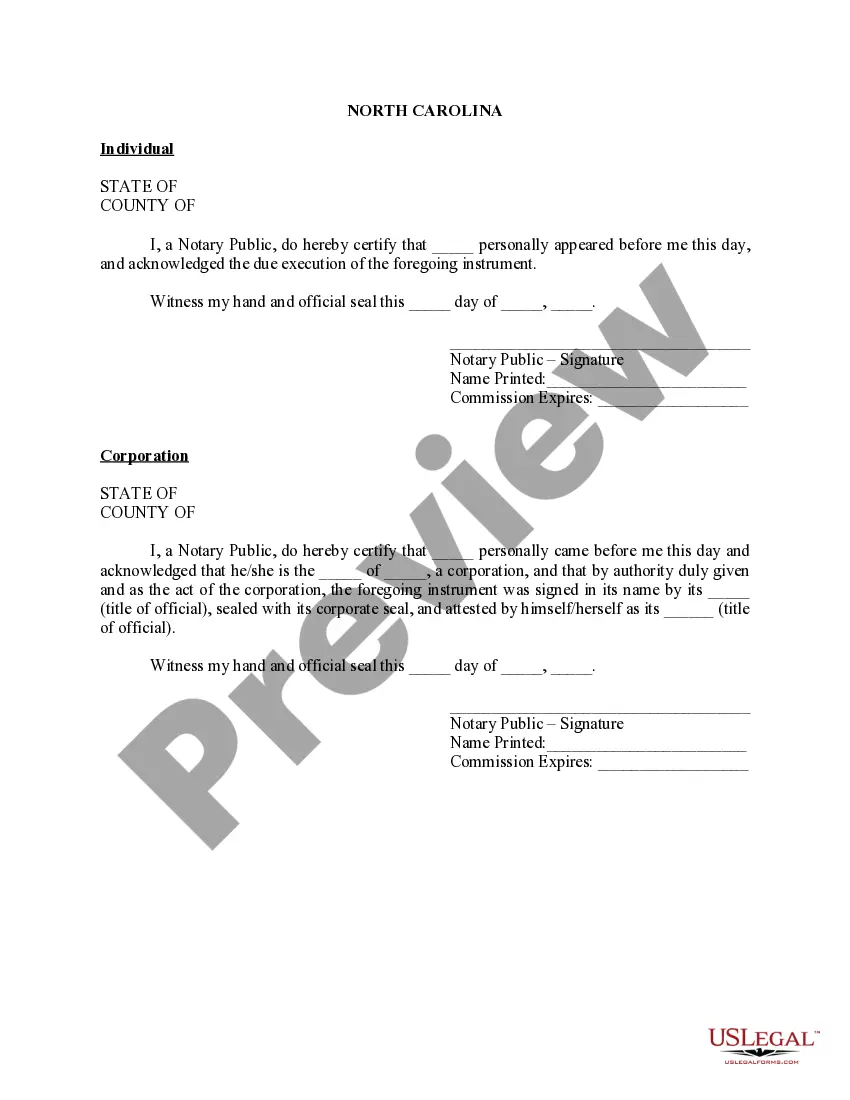

How to fill out Palm Beach Florida Business Credit Application?

We always strive to minimize or prevent legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we apply for attorney solutions that, usually, are very costly. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of legal counsel. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Palm Beach Florida Business Credit Application or any other form easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is just as easy if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Palm Beach Florida Business Credit Application complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Palm Beach Florida Business Credit Application is proper for your case, you can choose the subscription option and make a payment.

- Then you can download the form in any available format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

Call the Palm Beach County Planning and Zoning Office at 561-233-5000. Chances are it is legal to open a home business in your town, but it's better to make sure first. Find out what license(s) you need to do business. 561-355-2272 ( Palm Beach County Occupational License Office).

To start a business in Florida you need to: Check with your County Tax Collector to see if you need a license. Register your business with the Department of Revenue. Register with the IRS. Corporate entities or fictitious name registrants should register with the Department of State.

Note. Business tax receipts can sometimes work as a type of business permit, but not always. Some cities may require business licenses and business permits along with a business tax receipt in order for a business to operate.

In Florida, you will need a general business license, called a business tax receipt, if you provide goods and/or services to the general public whether you are operating your new business at home or in a separate commercial location.

This general business license is usually called a business tax receipt in Florida and is required for any new business providing merchandise or services to the public, even if the business is a one-person company and operates out of a private residence.

To start a Florida LLC, you'll need to file the Articles of Organization with the Florida Division of Corporations. The filing fee is $125. This can be done online at the SunBiz website or by mail. The Articles of Organization is the document that officially creates your Florida limited liability company.

State Licensed Professional Business TaxFeeBusiness Tax$100.00Fire InspectionN/AApplication$15.00Total$115

Call the Palm Beach County Planning and Zoning Office at 561-233-5000. Chances are it is legal to open a home business in your town, but it's better to make sure first. Find out what license(s) you need to do business. 561-355-2272 ( Palm Beach County Occupational License Office).

State Licensed Professional Business TaxFeeBusiness Tax$100.00Fire InspectionN/AApplication$15.00Total$115

Interesting Questions

More info

Credit Union Central has the largest selection of debit cards, including contactless debit cards and MasterCard cards, at affordable prices all across Florida, including the St. Pete area. Credit Union Central has the largest selection of debit cards, including contactless debit cards and MasterCard cards, at affordable prices all across Florida, including the St. Pete area. Florida Bank is the first institution to offer digital banking in the state to meet your digital banking demands. With more than 200,000 products available, you can shop for the best available deals without a bank account. Florida Bank is the first institution to offer digital banking in the state to meet your digital banking demands. With more than 200,000 products available, you can shop for the best available deals without a bank account. You can also choose from our wide array of free credit cards and offers. You can also choose from our wide array of free credit cards and offers.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.