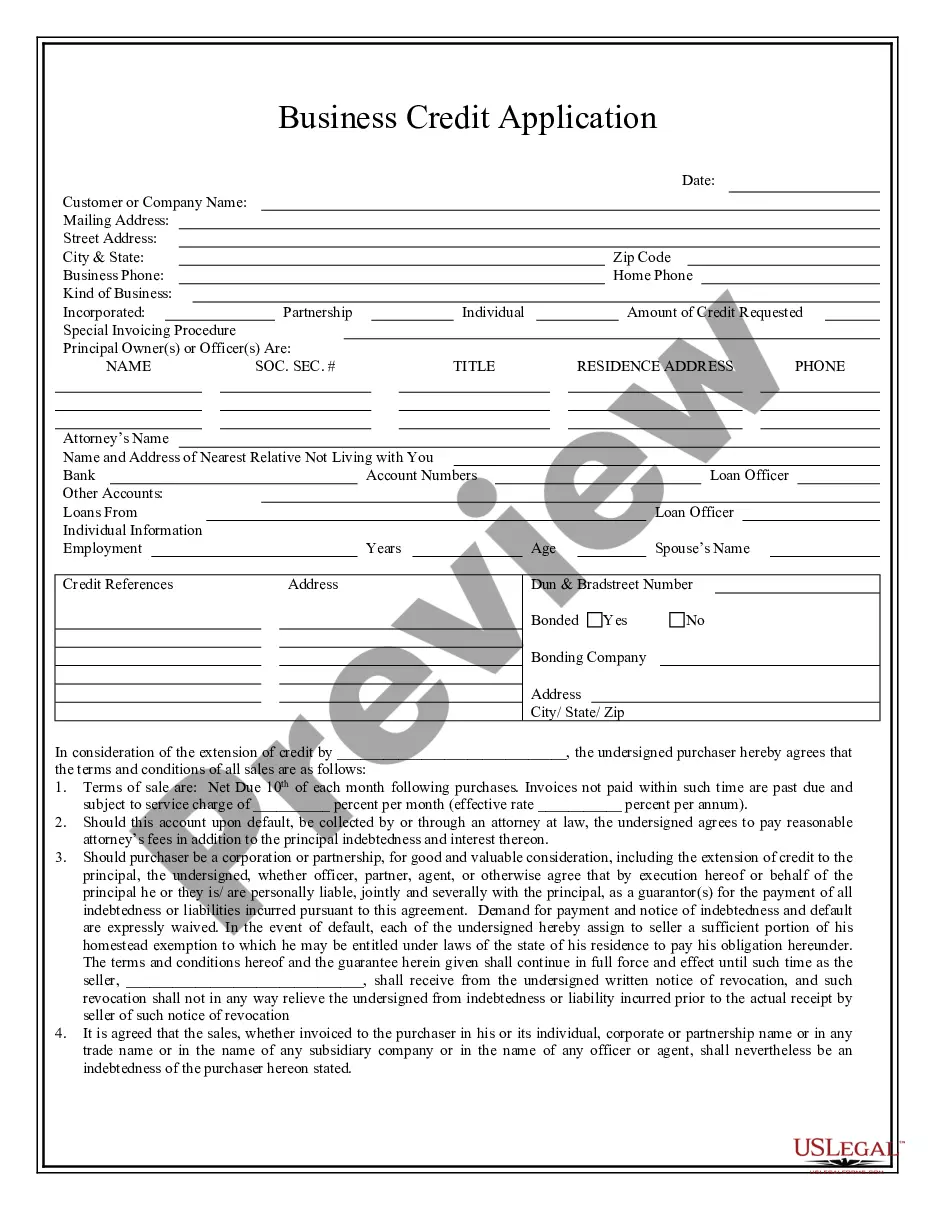

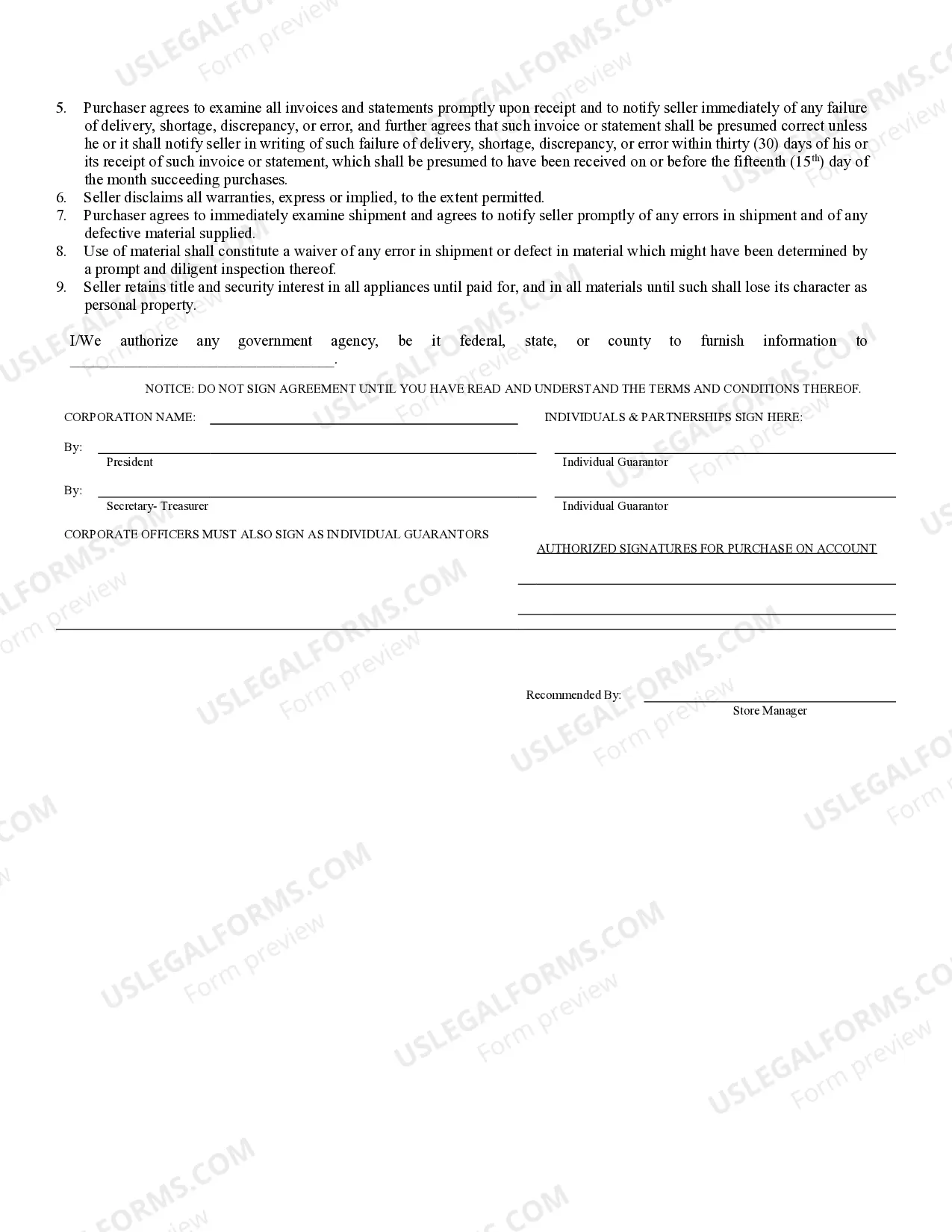

Pembroke Pines, Florida Business Credit Application: A Comprehensive Guide If you are a business owner in Pembroke Pines, Florida, looking to obtain credit for your company, it is crucial to familiarize yourself with the Pembroke Pines Business Credit Application process. This application plays a vital role in assessing your business's creditworthiness and determining the terms and conditions for extending credit. The Pembroke Pines Business Credit Application is a standardized form that allows businesses to apply for credit from various financial institutions, suppliers, or vendors. It includes essential information about your company's financial background, ownership details, and credit requirements. To ensure a smooth and efficient application process, it is important to provide accurate and complete information in your Pembroke Pines Business Credit Application. This helps lenders evaluate your creditworthiness promptly and make informed decisions about extending credit to your business. Key elements typically found in the Pembroke Pines Business Credit Application include: 1. Company Information: This section requires you to provide basic details about your business, such as the legal name, physical address, contact information, and any additional locations if applicable. It also includes the nature of your business, such as the industry or sector you operate in. 2. Ownership and Management: Here, you will need to disclose information about the ownership structure of your business, including the names, addresses, and contact details of all owners or partners. Additionally, details about key management personnel, such as the CEO or CFO, may be required. 3. Financial Statements: The Pembroke Pines Business Credit Application may request financial statements, including income statements, balance sheets, and cash flow statements. These statements help lenders assess your business's financial health, profitability, and ability to repay credit obligations. 4. Trade References: You will need to provide a list of trade references, which are companies or suppliers with whom your business has existing credit relationships. Including reputable trade references can strengthen your application and demonstrate your creditworthiness. 5. Bank References: This section typically requires you to disclose your business banking relationship, providing details of your primary business bank account. This information helps lenders verify your financial position and may also be used for direct payment options if credit is extended. Different Types of Pembroke Pines Business Credit Applications: 1. Revolving Line of Credit Application: This type of application is designed for businesses seeking access to a flexible credit line. A revolving line of credit allows borrowers to withdraw funds up to a predetermined credit limit. As the borrower repays the borrowed amount, the credit limit is replenished, providing ongoing access to funds. 2. Equipment Financing Application: If your business requires funding for purchasing or leasing equipment, an equipment financing application will be specific to this purpose. Lenders typically evaluate equipment value, anticipated usage, and projected cash flow from its use when considering such applications. 3. Business Credit Card Application: Some financial institutions offer business credit cards tailored to the needs of small business owners. These applications focus on credit card usage, limits, and associated benefits, such as rewards programs or introductory offers. Remember, each Pembroke Pines Business Credit Application may vary slightly depending on the lender or financial institution. It is advisable to research specific application requirements and tailor your submission accordingly. Additionally, ensuring that your business has maintained good financial records and a positive credit history can significantly improve your chances of a successful credit application in Pembroke Pines, Florida.

Pembroke Pines Florida Business Credit Application

Category:

State:

Florida

City:

Pembroke Pines

Control #:

FL-20-CR

Format:

Word;

Rich Text

Instant download

Description

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Pembroke Pines, Florida Business Credit Application: A Comprehensive Guide If you are a business owner in Pembroke Pines, Florida, looking to obtain credit for your company, it is crucial to familiarize yourself with the Pembroke Pines Business Credit Application process. This application plays a vital role in assessing your business's creditworthiness and determining the terms and conditions for extending credit. The Pembroke Pines Business Credit Application is a standardized form that allows businesses to apply for credit from various financial institutions, suppliers, or vendors. It includes essential information about your company's financial background, ownership details, and credit requirements. To ensure a smooth and efficient application process, it is important to provide accurate and complete information in your Pembroke Pines Business Credit Application. This helps lenders evaluate your creditworthiness promptly and make informed decisions about extending credit to your business. Key elements typically found in the Pembroke Pines Business Credit Application include: 1. Company Information: This section requires you to provide basic details about your business, such as the legal name, physical address, contact information, and any additional locations if applicable. It also includes the nature of your business, such as the industry or sector you operate in. 2. Ownership and Management: Here, you will need to disclose information about the ownership structure of your business, including the names, addresses, and contact details of all owners or partners. Additionally, details about key management personnel, such as the CEO or CFO, may be required. 3. Financial Statements: The Pembroke Pines Business Credit Application may request financial statements, including income statements, balance sheets, and cash flow statements. These statements help lenders assess your business's financial health, profitability, and ability to repay credit obligations. 4. Trade References: You will need to provide a list of trade references, which are companies or suppliers with whom your business has existing credit relationships. Including reputable trade references can strengthen your application and demonstrate your creditworthiness. 5. Bank References: This section typically requires you to disclose your business banking relationship, providing details of your primary business bank account. This information helps lenders verify your financial position and may also be used for direct payment options if credit is extended. Different Types of Pembroke Pines Business Credit Applications: 1. Revolving Line of Credit Application: This type of application is designed for businesses seeking access to a flexible credit line. A revolving line of credit allows borrowers to withdraw funds up to a predetermined credit limit. As the borrower repays the borrowed amount, the credit limit is replenished, providing ongoing access to funds. 2. Equipment Financing Application: If your business requires funding for purchasing or leasing equipment, an equipment financing application will be specific to this purpose. Lenders typically evaluate equipment value, anticipated usage, and projected cash flow from its use when considering such applications. 3. Business Credit Card Application: Some financial institutions offer business credit cards tailored to the needs of small business owners. These applications focus on credit card usage, limits, and associated benefits, such as rewards programs or introductory offers. Remember, each Pembroke Pines Business Credit Application may vary slightly depending on the lender or financial institution. It is advisable to research specific application requirements and tailor your submission accordingly. Additionally, ensuring that your business has maintained good financial records and a positive credit history can significantly improve your chances of a successful credit application in Pembroke Pines, Florida.

Free preview

How to fill out Pembroke Pines Florida Business Credit Application?

If you’ve already utilized our service before, log in to your account and download the Pembroke Pines Florida Business Credit Application on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Pembroke Pines Florida Business Credit Application. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!