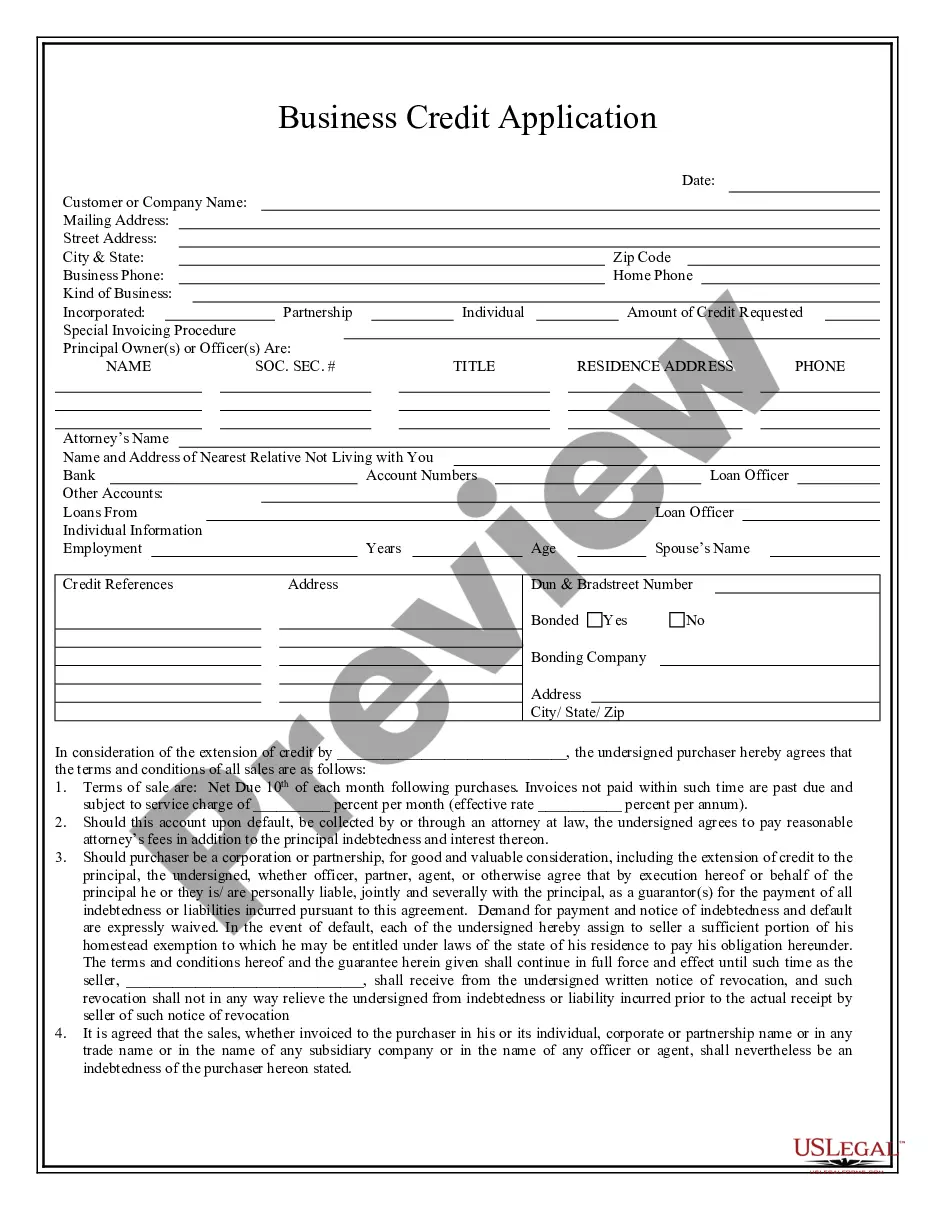

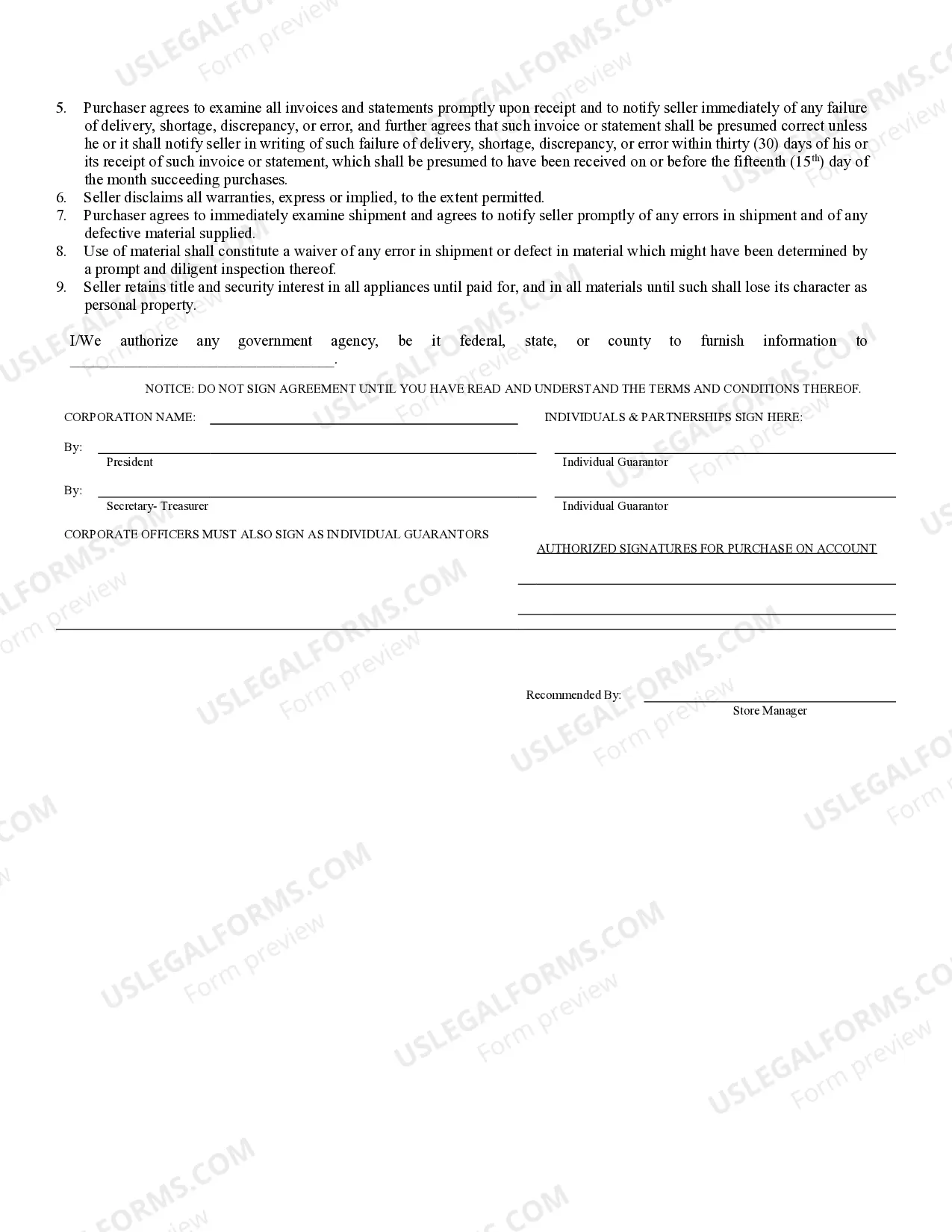

Keywords: Port St. Lucie, Florida, business, credit application, types Port St. Lucie Florida Business Credit Application is a document specifically designed for businesses operating in Port St. Lucie, Florida, that wish to apply for credit from financial institutions or suppliers. This application serves as a comprehensive tool for assessing the creditworthiness and financial stability of a business before granting credit. There are several types of Port St. Lucie Florida Business Credit Applications available, depending on the specific requirements and preferences of the entity providing the credit. These variations may include: 1. Traditional Business Credit Application: This type of application form typically includes standard sections, such as business information, owner information, financial statements, trade references, banking information, and a personal guarantee if required by the lender. 2. Small Business Credit Application: Tailored specifically for small businesses, this application is designed to accommodate the limited resources and financial information often associated with small-scale enterprises. It may include simplified financial statements and require less extensive documentation compared to larger businesses. 3. Commercial Credit Application: Aimed at larger corporations or commercial enterprises, this application is more comprehensive and may request additional documentation, such as audited financial statements, tax returns, and a detailed description of the company's operations. 4. Supplier Credit Application: Often used by businesses seeking credit from suppliers or vendors, this application focuses on the company's purchasing history, projected sales volumes, trade references, and payment terms. This type of application may not require as much financial information as traditional credit applications. Regardless of the type, a Port St. Lucie Florida Business Credit Application typically aims to gather essential information about the applying business, including its legal structure, industry, current financial position, payment history, and any outstanding debts. Additionally, the application may inquire about the intended purpose of the credit, how it will be used, and the anticipated payback period. It is essential for businesses in Port St. Lucie, Florida, to accurately complete the credit application, providing all requested information and supporting documents. A thorough and well-prepared application increases the chances of obtaining favorable credit terms and facilitates the smooth processing of credit requests.

Port St. Lucie Florida Business Credit Application

Description

How to fill out Port St. Lucie Florida Business Credit Application?

Are you looking for a reliable and inexpensive legal forms supplier to buy the Port St. Lucie Florida Business Credit Application? US Legal Forms is your go-to option.

No matter if you require a simple arrangement to set rules for cohabitating with your partner or a set of documents to move your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed based on the requirements of specific state and county.

To download the document, you need to log in account, locate the needed template, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Port St. Lucie Florida Business Credit Application conforms to the regulations of your state and local area.

- Read the form’s description (if available) to find out who and what the document is good for.

- Restart the search in case the template isn’t suitable for your specific scenario.

Now you can create your account. Then pick the subscription plan and proceed to payment. Once the payment is completed, download the Port St. Lucie Florida Business Credit Application in any available format. You can return to the website at any time and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time learning about legal paperwork online for good.