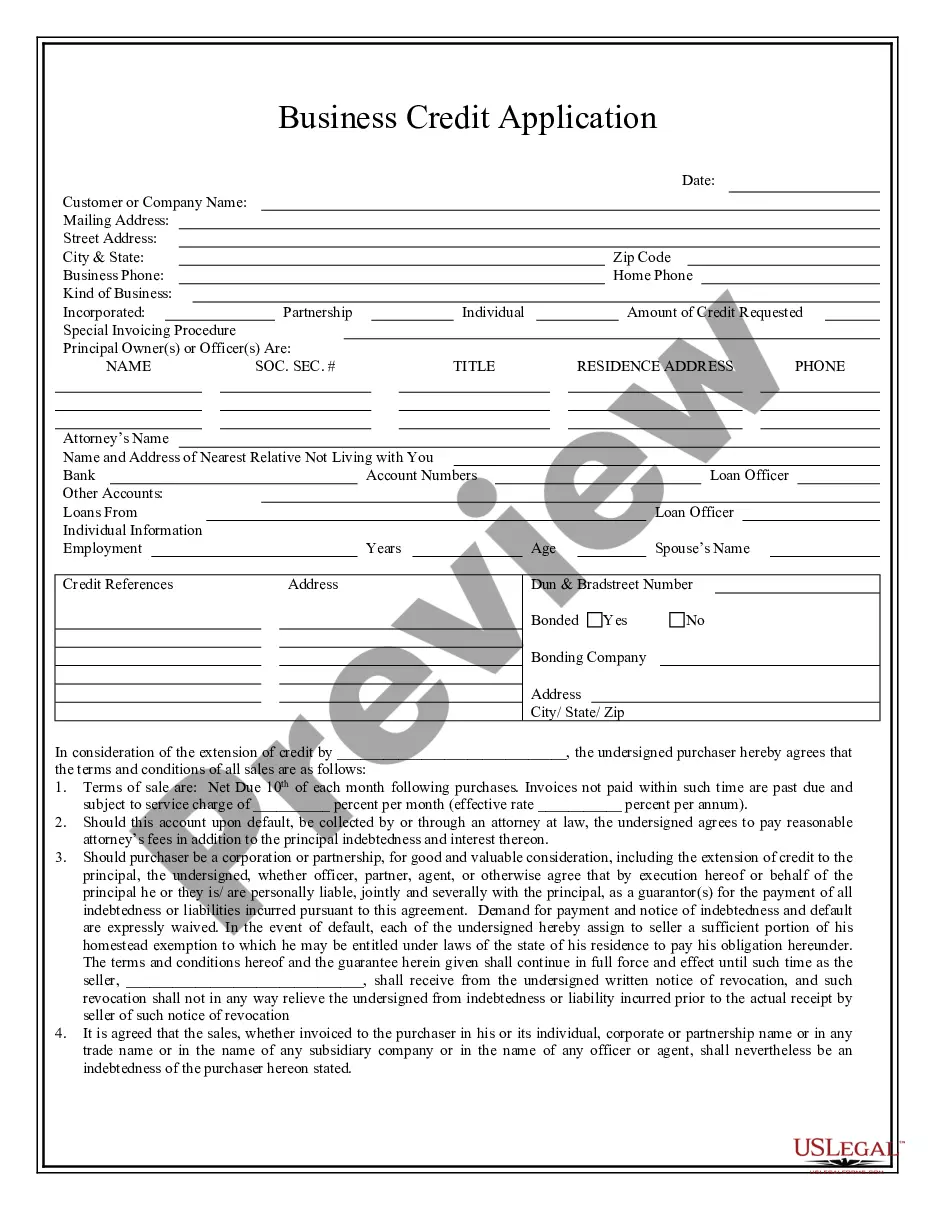

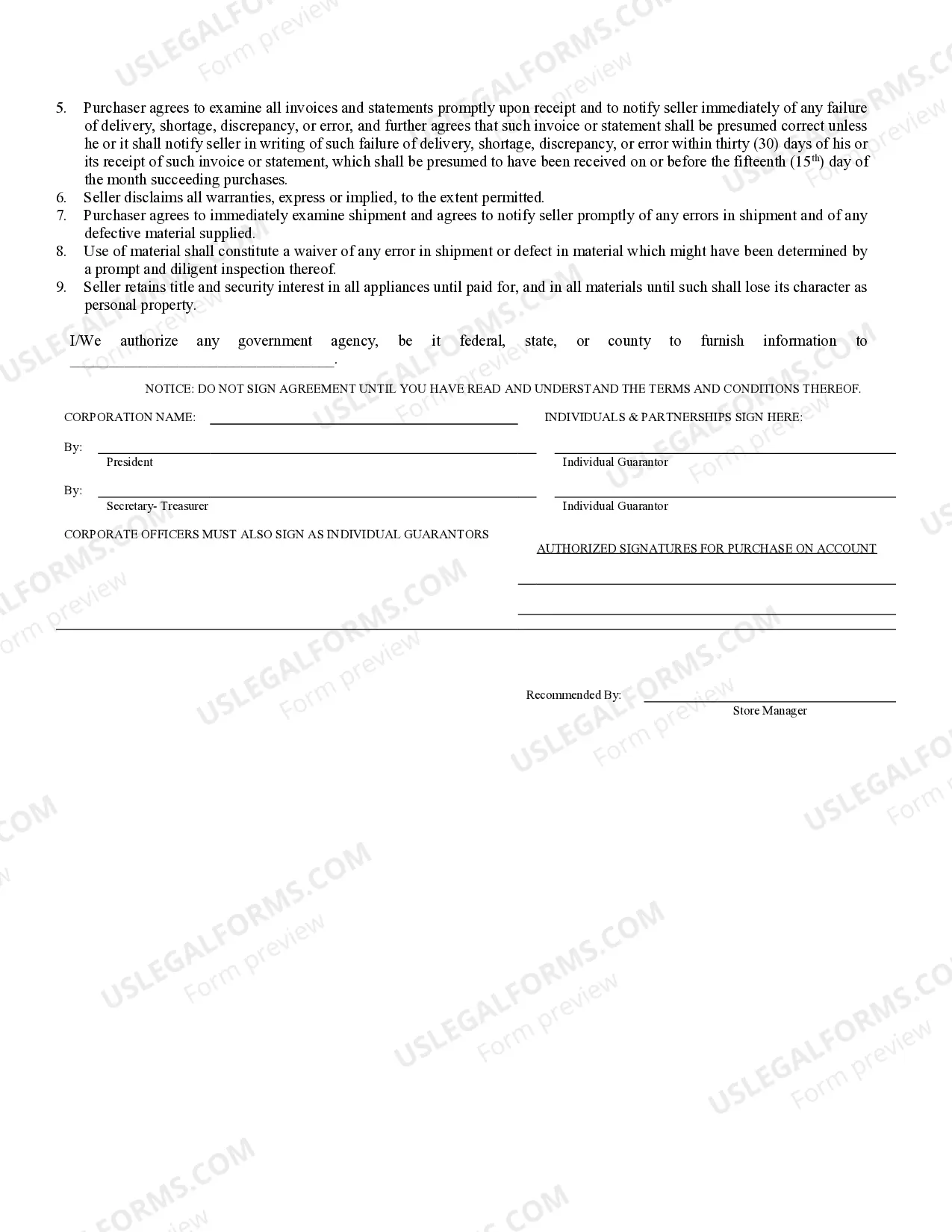

West Palm Beach Florida Business Credit Application is a crucial tool for businesses in the city to secure credit from financial institutions and establish a line of credit to meet their financial needs. This application is specifically designed for businesses operating in West Palm Beach, Florida, and aims to streamline the credit approval process. The West Palm Beach Florida Business Credit Application captures vital information about the business, such as the legal name, address, contact details, and the nature of the business. Moreover, it includes financial information like the business's income statements, balance sheets, and cash flow statements to assess its financial stability. Past credit history, as well as details of any existing loans or liabilities, are also required to evaluate the creditworthiness of the business. In addition to these essential details, the application may involve providing information about the business's principals, including personal financial statements and credit histories. This information allows the financial institution to assess the overall creditworthiness of both the business and its owners or partners. The West Palm Beach Florida Business Credit Application may offer different types of credit options to cater to varying business needs. Some common categories include: 1. Business Line of Credit Application: This type of application allows businesses to access a pre-approved credit limit, enabling them to withdraw funds when required. It provides the flexibility to manage cash flow and cover unexpected expenses. 2. Business Term Loan Application: This application is for obtaining a fixed amount of funds for a specified duration, usually for a specific purpose like purchasing equipment, expanding operations, or funding a project. 3. Business Credit Card Application: This category involves applying for a credit card specifically designed for business expenses, providing easy access to credit for day-to-day business operations and expense management. 4. Small Business Administration (SBA) Loan Application: SBA loans are government-backed loans provided by financial institutions. This application type requires additional documentation to comply with the SBA's loan program guidelines. In conclusion, the West Palm Beach Florida Business Credit Application is an essential tool for local businesses to access credit and establish financial stability. By carefully providing relevant financial and personal information, businesses can increase their chances of obtaining credit. Different types of applications cater to various credit needs, such as lines of credit, term loans, credit cards, and SBA loans.

West Palm Beach Florida Business Credit Application

Description

How to fill out West Palm Beach Florida Business Credit Application?

Do you need a trustworthy and inexpensive legal forms provider to get the West Palm Beach Florida Business Credit Application? US Legal Forms is your go-to solution.

No matter if you need a basic arrangement to set regulations for cohabitating with your partner or a package of forms to advance your separation or divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed based on the requirements of particular state and county.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the West Palm Beach Florida Business Credit Application conforms to the regulations of your state and local area.

- Read the form’s description (if available) to learn who and what the form is intended for.

- Start the search over in case the template isn’t suitable for your legal scenario.

Now you can create your account. Then choose the subscription option and proceed to payment. As soon as the payment is completed, download the West Palm Beach Florida Business Credit Application in any available file format. You can get back to the website at any time and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting hours learning about legal papers online once and for all.