The Orange Florida Individual Credit Application is a comprehensive document required by financial institutions and creditors when individuals residing in Orange County, Florida, apply for credit facilities or loans. This application serves as a means for lenders to assess the creditworthiness of applicants and make informed decisions regarding the extension of credit. Keywords: Orange Florida, Individual Credit Application, financial institutions, creditors, credit facilities, loans, creditworthiness, extension of credit. In Orange County, Florida, there are various types of Individual Credit Applications available to meet the specific needs of different individuals. Some of these variations include: 1. Personal Loan Credit Application: This type of credit application is suitable for individuals seeking personal financing for various purposes such as debt consolidation, home improvements, education, or medical expenses. 2. Auto Loan Credit Application: Individuals who intend to purchase a vehicle and require financial assistance can submit the Auto Loan Credit Application. Lenders evaluate factors such as credit history, income level, and employment stability to determine loan eligibility and interest rates. 3. Mortgage Credit Application: People interested in homeownership or refinancing existing mortgages can utilize the Mortgage Credit Application. This application requires detailed information about employment, income, assets, and liabilities to assess the applicant's ability to repay the loan. 4. Credit Card Application: Issued by banks or credit card companies, Credit Card Applications enable individuals to apply for credit card facilities providing purchasing power and building credit history. These applications typically focus on income, employment, and credit score. 5. Student Loan Credit Application: Students pursuing higher education may require financial aid in the form of student loans. The Student Loan Credit Application helps assess the student's eligibility for loan programs offered by the government or private lenders. 6. Small Business Loan Credit Application: Entrepreneurs or individuals starting their own businesses can access financing opportunities by submitting a Small Business Loan Credit Application. Lenders evaluate the applicant's business plan, credit history, and collateral to determine loan approval and interest rates. By offering various types of Individual Credit Applications, Orange Florida ensures that residents have access to suitable credit options, enabling them to meet their financial goals and needs. The specific requirements for each application may vary, but the core objective remains the same: evaluating an individual's creditworthiness and ability to repay borrowed funds.

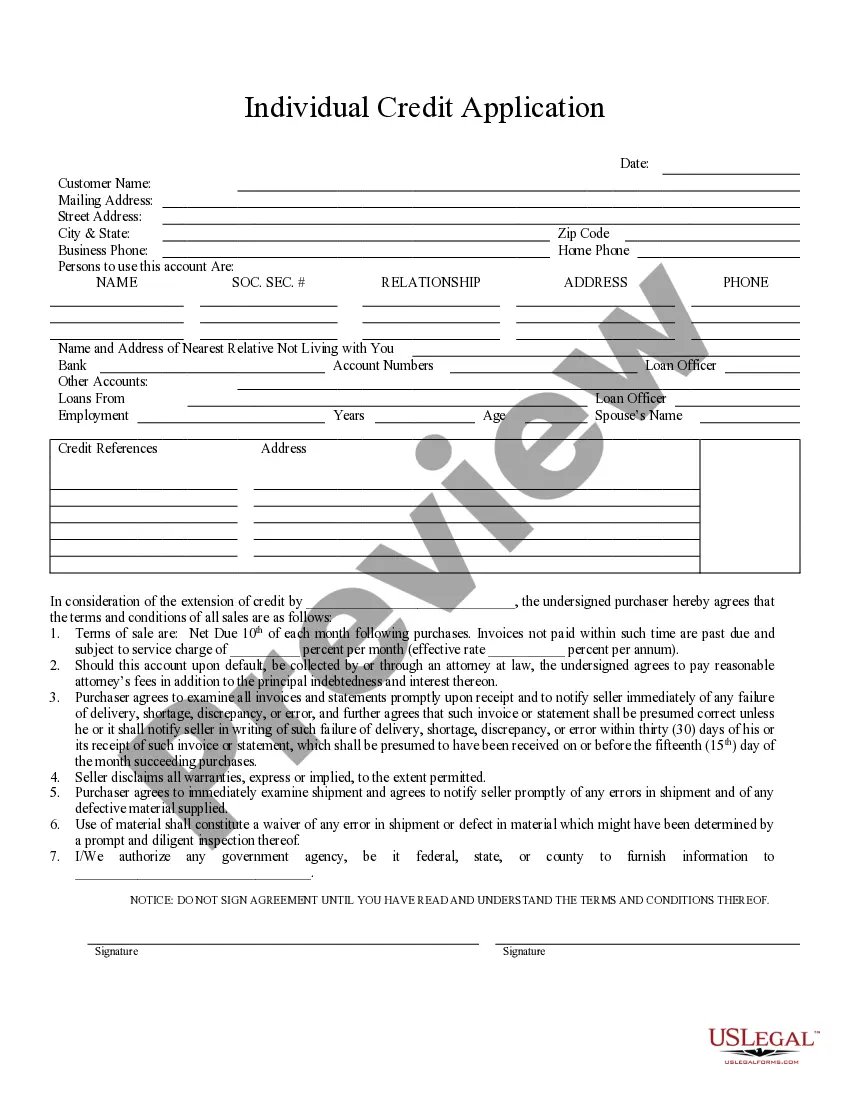

Orange Florida Individual Credit Application

Description

How to fill out Orange Florida Individual Credit Application?

Make use of the US Legal Forms and get instant access to any form template you want. Our helpful website with thousands of document templates makes it simple to find and get almost any document sample you will need. You can export, fill, and certify the Orange Florida Individual Credit Application in a few minutes instead of browsing the web for many hours attempting to find the right template.

Using our collection is an excellent strategy to improve the safety of your document submissions. Our experienced attorneys on a regular basis review all the records to make certain that the forms are relevant for a particular region and compliant with new laws and regulations.

How do you obtain the Orange Florida Individual Credit Application? If you already have a subscription, just log in to the account. The Download button will appear on all the documents you view. In addition, you can find all the previously saved files in the My Forms menu.

If you don’t have an account yet, follow the instructions below:

- Find the template you need. Make certain that it is the template you were hoping to find: verify its title and description, and use the Preview function if it is available. Otherwise, utilize the Search field to find the appropriate one.

- Launch the saving process. Click Buy Now and choose the pricing plan that suits you best. Then, create an account and process your order with a credit card or PayPal.

- Download the document. Pick the format to get the Orange Florida Individual Credit Application and revise and fill, or sign it according to your requirements.

US Legal Forms is among the most extensive and trustworthy template libraries on the web. Our company is always happy to assist you in virtually any legal procedure, even if it is just downloading the Orange Florida Individual Credit Application.

Feel free to make the most of our form catalog and make your document experience as convenient as possible!