Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Note: This summary is not intended to be an all-inclusive summary of the law of bad checks, but does contain basic and

other provisions.

CIVIL PROVISIONS

Florida Statutes

TITLE VI - CIVIL PRACTICE AND PROCEDURE

CHAPTER 68 - MISCELLANEOUS PROCEEDINGS

Fla. Stat. Ch. 68.065 Actions to collect worthless payment instruments; attorney fees and collection costs. (Florida Statutes (2016 Edition)

68.065 Actions to collect worthless payment instruments; attorney fees and collection costs.

(1) As used in this section, the term payment instrument or instrument means a check, draft, order of payment, debit card order, or electronic funds transfer.

(2) In lieu of a service charge authorized under subsection (3), s. 832.062(4)(a), or s. 832.07, the payee of a payment instrument, the payment of which is refused by the drawee because of lack of funds, lack of credit, or lack of an account, or where the maker or drawer stops payment on the instrument with intent to defraud, may lawfully collect bank fees actually incurred by the payee in the course of tendering the payment, plus a service charge of $25 if the face value does not exceed $50; $30 if the face value exceeds $50 but does not exceed $300; $40 if the face value exceeds $300; or 5 percent of the face value of the payment instrument, whichever is greater. The right to damages under this subsection may be claimed without the filing of a civil action.

(3)(a) In any civil action brought for the purpose of collecting a payment instrument, the payment of which is refused by the drawee because of lack of funds, lack of credit, or lack of an account, or where the maker or drawer stops payment on the instrument with intent to defraud, and where the maker or drawer fails to pay the amount owing, in cash, to the payee within 30 days after a written demand therefor, as provided in subsection (4), the maker or drawer is liable to the payee, in addition to the amount owing upon such payment instrument, for damages of triple the amount so owing. However, in no case shall the liability for damages be less than $50. The maker or drawer is also liable for any court costs and reasonable attorney fees incurred by the payee in taking the action. Criminal sanctions, as provided in s. 832.07, may be applicable.

(b) The payee may also charge the maker or drawer of the payment instrument a service charge not to exceed the service fees authorized under s. 832.08(5) or 5 percent of the face amount of the instrument, whichever is greater, when making written demand for payment. In the event that a judgment or decree is rendered, interest at the rate and in the manner described in s. 55.03 may be added toward the total amount due. Any bank fees incurred by the payee may be charged to the maker or drawer of the payment instrument.

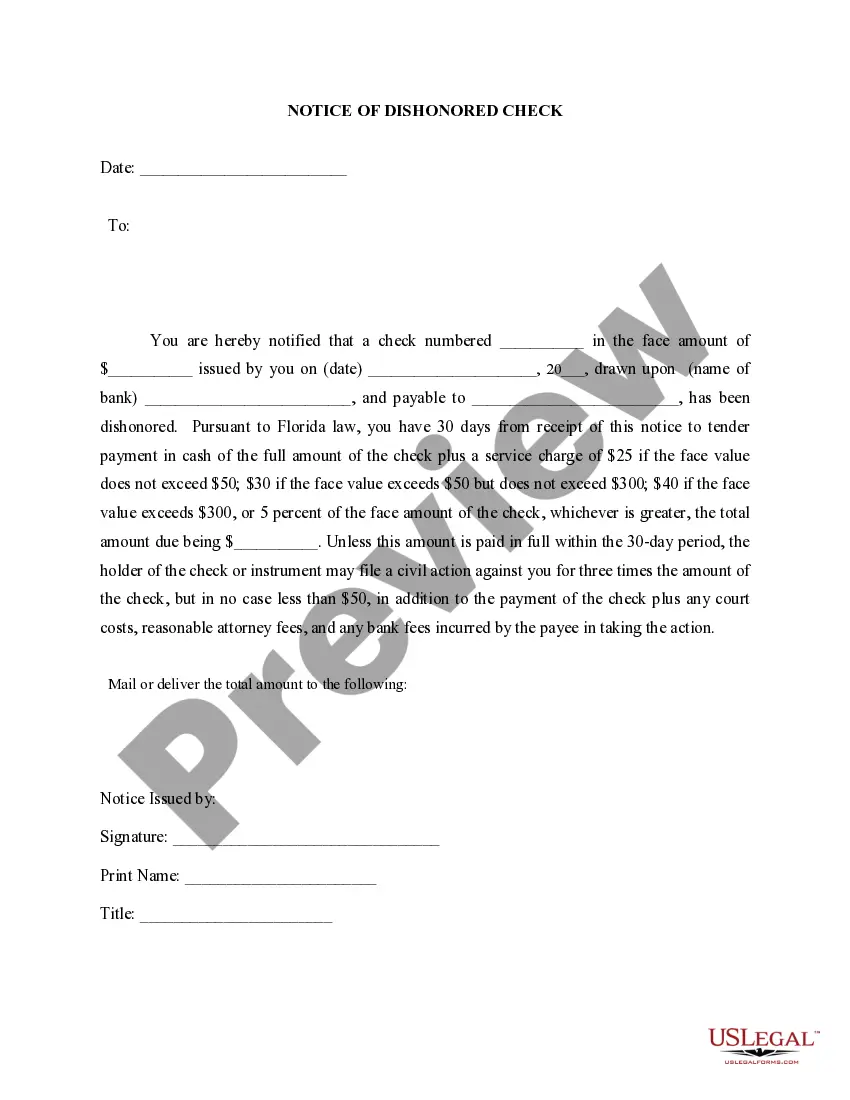

(4) Before recovery under subsection (3) may be claimed, a written demand must be delivered by certified or registered mail, evidenced by return receipt, or by first-class mail, evidenced by an affidavit of service of mail, to the maker or drawer of the payment instrument to the address on the instrument, to the address given by the drawer at the time the instrument was issued, or to the drawer's last known address. The form of such notice shall be substantially as follows:

You are hereby notified that a check, draft, order of payment, debit card order, or electronic funds transfer numbered in the face amount of $ issued by you on (date) , drawn upon (name of bank) , and payable to , has been dishonored. Pursuant to Florida law, you have 30 days from receipt of this notice to tender payment in cash of the full amount of the dishonored payment instrument, plus a service charge of $25 if the face value does not exceed $50, $30 if the face value exceeds $50 but does not exceed $300, $40 if the face value exceeds $300, or 5 percent of the face amount of the dishonored instrument, whichever is greater, the total amount due being $ and cents. Unless this amount is paid in full within the 30-day period, the holder of the dishonored payment instrument may file a civil action against you for three times the amount of the dishonored instrument, but in no case less than $50, in addition to the payment of the dishonored instrument plus any court costs, reasonable attorney fees, and any bank fees incurred by the payee in taking the action.

(5) A subsequent person receiving a payment instrument from the original payee or a successor endorsee has the same rights that the original payee has against the maker of the instrument, if such subsequent person gives notice in a substantially similar form to that provided in subsection (4). A subsequent person providing such notice is immune from civil liability for the giving of such notice and for proceeding under the forms of such notice, so long as the maker of the instrument has the same defenses against the subsequent person as against the original payee. However, the remedies available under this section may be exercised only by one party in interest.

(6) After commencement of the action but before the hearing, the maker or drawer may tender to the payee, as satisfaction of the claim, an amount of money equal to the sum of the payment instrument, the service charge, court costs, and incurred bank fees. Other provisions notwithstanding, the maker or drawer is liable to the payee for all attorney fees and collection costs incurred by payee as a result of the payee's claim.

(7) If the court or jury determines that the failure of the maker or drawer to satisfy the dishonored payment instrument was due to economic hardship, the court or jury has the discretion to waive all or part of the statutory damages.

History.s. 2, ch. 79-345; s. 1, ch. 86-89; s. 41, ch. 88-381; s. 1, ch. 89-303; s. 1, ch. 91-211; s. 1, ch. 96-239; s. 1, ch. 98-297; s. 1, ch. 2001-243; s. 1, ch. 2003-69; s. 1, ch. 2013-113.

Fla. Stat. Ch. 832.07 Prima facie evidence of intent; identity. (Florida Statutes (2016 Edition)

832.07 Prima facie evidence of intent; identity.(1) INTENT.(a) In any prosecution or action under this chapter, the making, drawing, uttering, or delivery of a check, draft, or order, payment of which is refused by the drawee because of lack of funds or credit, shall be prima facie evidence of intent to defraud or knowledge of insufficient funds in, or credit with, such bank, banking institution, trust company, or other depository, unless such maker or drawer, or someone for him or her, shall have paid the holder thereof the amount due thereon, together with a service charge not to exceed the service fees authorized under s. 832.08(5) or an amount of up to 5 percent of the face amount of the check, whichever is greater, within 15 days after written notice has been sent to the address printed on the check or given at the time of issuance that such check, draft, or order has not been paid to the holder thereof, and bank fees incurred by the holder. In the event of legal action for recovery, the maker or drawer may be additionally liable for court costs and reasonable attorney's fees. Notice mailed by certified or registered mail, evidenced by return receipt, or by first-class mail, evidenced by an affidavit of service of mail, to the address printed on the check or given at the time of issuance shall be deemed sufficient and equivalent to notice having been received by the maker or drawer, whether such notice shall be returned undelivered or not. The form of such notice shall be substantially as follows:

You are hereby notified that a check, numbered , in the face amount of $ , issued by you on (date) , drawn upon (name of bank) , and payable to , has been dishonored. Pursuant to Florida law, you have 15 days from the date of this notice to tender payment of the full amount of such check plus a service charge of $25, if the face value does not exceed $50, $30, if the face value exceeds $50 but does not exceed $300, $40, if the face value exceeds $300, or an amount of up to 5 percent of the face amount of the check, whichever is greater, the total amount due being $ and cents. Unless this amount is paid in full within the time specified above, the holder of such check may turn over the dishonored check and all other available information relating to this incident to the state attorney for criminal prosecution. You may be additionally liable in a civil action for triple the amount of the check, but in no case less than $50, together with the amount of the check, a service charge, court costs, reasonable attorney fees, and incurred bank fees, as provided in s. 68.065.

Subsequent persons receiving a check, draft, or order from the original payee or a successor endorsee have the same rights that the original payee has against the maker of the instrument, provided such subsequent persons give notice in a substantially similar form to that provided above. Subsequent persons providing such notice shall be immune from civil liability for the giving of such notice and for proceeding under the forms of such notice, so long as the maker of the instrument has the same defenses against these subsequent persons as against the original payee. However, the remedies available under this section may be exercised only by one party in interest.

(b) When a check is drawn on a bank in which the maker or drawer has no account or a closed account, it shall be presumed that such check was issued with intent to defraud, and the notice requirement set forth in this section shall be waived.

(2) IDENTITY.

(a) In any prosecution or action under the provisions of this chapter, a check, draft, or order for which the information required in paragraph (b), paragraph (d), paragraph (e), or paragraph (f) is available at the time of issuance constitutes prima facie evidence of the identity of the person issuing the check, draft, or order and that such person is authorized to draw upon the named account.

(b) To establish this prima facie evidence:

1. The driver license number or state identification number, specifying the state of issuance of the person presenting the check must be written on the check; or

2. The following information regarding the identity of the person presenting the check must be obtained by the person accepting such check: The presenter's full name, residence address, home phone number, business phone number, place of employment, sex, date of birth, and height.

(c) The information required in subparagraph (b)2. may be provided by either of two methods:

1. The information may be recorded on the check; or

2. The number of a check-cashing identification card issued by the accepter of the check may be recorded on the check. In order to be used to establish identity, such check-cashing identification card may not be issued until the information required in subparagraph (b)2. has been placed on file with the accepter of the check.

(d) If a check is received by a payee through the mail or by delivery to a representative of the payee, the prima facie evidence referred to in paragraph (a) may be established by presenting the original contract, order, or request for services that the check purports to pay for, bearing the signature of the person who signed the check, or by presenting a copy of the information required in subparagraph (b)2. which is on file with the accepter of the check together with the signature of the person presenting the check.

(e) If a check is received by a payee and the drawer or maker has a check-cashing identification card on file with the payee, the prima facie evidence referred to in paragraph (a) may be established by presenting the signature found on the check-cashing identification card bearing the signature of the person who signed the check.

(f) If a check is received by the Department of Revenue through the mail or by delivery to a representative of the Department of Revenue, the prima facie evidence referred to in paragraph (a) may be established by presenting the original tax return, certificate, license, application for certificate or license, or other document relating to amounts owed by that person or taxpayer which the check purports to pay for, bearing the signature of the person who signed the check, or by presenting a copy of the information required in subparagraph (b)2. which is on file with the accepter of the check together with the signature of the person presenting the check. The use of taxpayer information for purposes of establishing the identity of a person pursuant to this paragraph shall be considered a use of such information for official purposes.

History. 1, ch. 75-189; s. 1, ch. 77-174; s. 1, ch. 79-345; s. 1, ch. 80-301; s. 2, ch. 86-89; s. 10, ch. 86-161; s. 1, ch. 86-198; s. 12, ch. 87-102; s. 2, ch. 89-303; s. 2, ch. 91-211; s. 1, ch. 94-207; s. 3, ch. 96-239; s. 1821, ch. 97-102; s. 3, ch. 98-297; s. 7, ch. 2004-273.