In Palm Bay, Florida, if you have encountered a bad check or a bounced check, you may receive a Palm Bay Notice of Dishonored Check — Civil. This legal document serves as a notification that the check you received was not honored by the bank due to insufficient funds or other reasons. To ensure comprehensiveness, let's explore different types relevant to this topic: 1. Palm Bay Florida Notice of Dishonored Check — Civil: This is a general term encompassing all instances where a check does not clear and leads to legal action. It emphasizes civil consequences resulting from the dishonored check. 2. Notice of Dishonored Check — Insufficient Funds: If a check bounces due to insufficient funds in the account, you may receive a Notice of Dishonored Check — Insufficient Funds. This notifies you that the payment was declined because the account holder did not have enough money to cover the check's amount. 3. Notice of Dishonored Check — Account Closed: In cases where the issuer's account has been closed before the check could be cleared, you may be issued a Notice of Dishonored Check — Account Closed. It alerts you that the account holder no longer maintains an active account, causing the check to be invalid. 4. Notice of Dishonored Check — Irregular Signature: Sometimes, a check may be dishonored due to a mismatched or irregular signature. In such instances, you might receive a Notice of Dishonored Check — Irregular Signature, indicating that the signature on the check differs significantly from the authorized signatory's usual pattern. 5. Notice of Dishonored Check — Stolen Check: If it is discovered that the check used was stolen, resulting in its dishonoring, you can expect to receive a Notice of Dishonored Check — Stolen Check. This alerts you that the check was illegitimately obtained or used by the issuer. Understanding these different types of Palm Bay Florida Notices of Dishonored Check — Civil helps you identify the specific reason behind the check's non-payment. It is important to take appropriate legal action, such as contacting the issuer or consulting a legal professional specializing in financial disputes.

Palm Bay Florida Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Category:

State:

Florida

City:

Palm Bay

Control #:

FL-401N

Format:

Word;

Rich Text

Instant download

Description

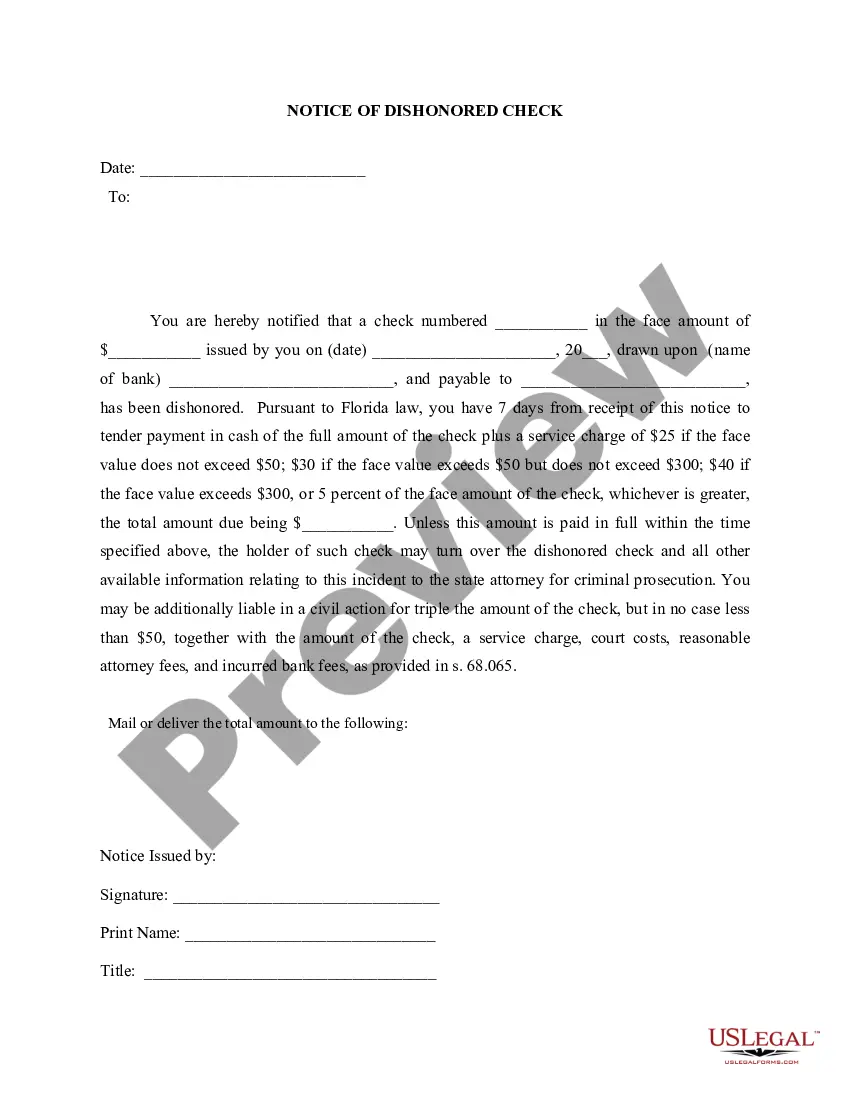

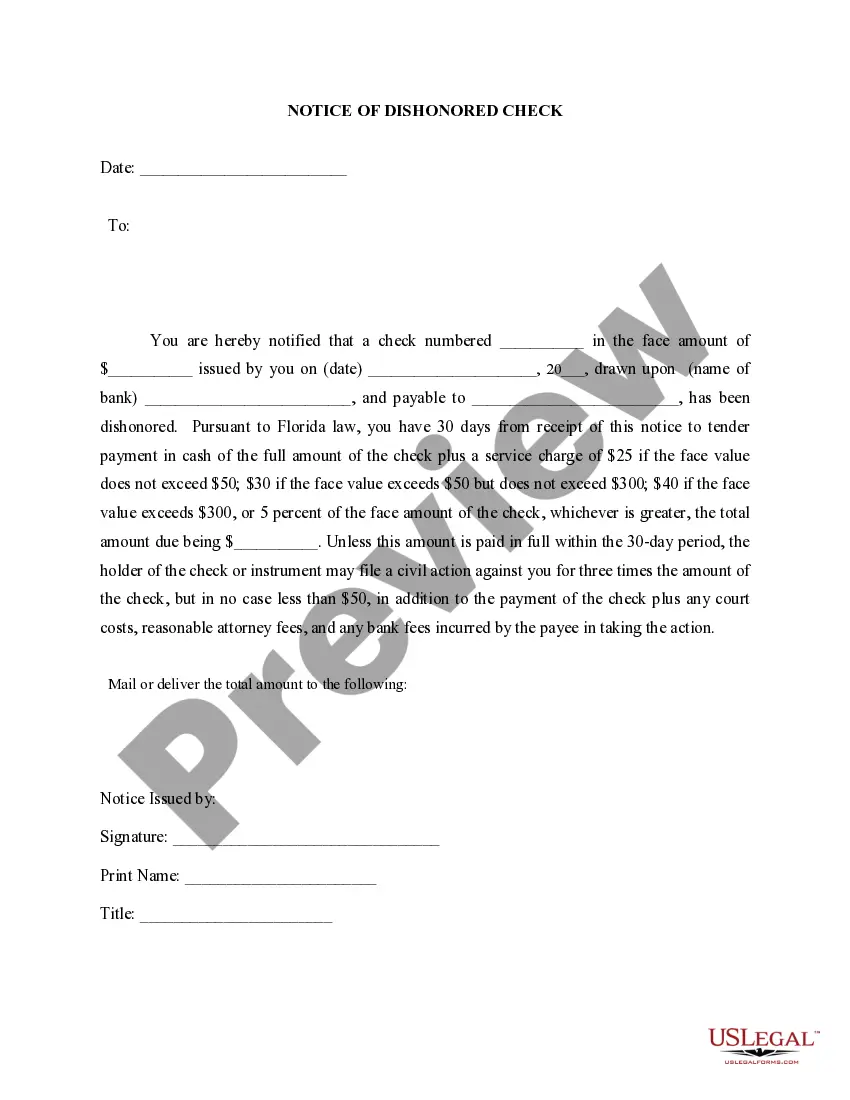

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

In Palm Bay, Florida, if you have encountered a bad check or a bounced check, you may receive a Palm Bay Notice of Dishonored Check — Civil. This legal document serves as a notification that the check you received was not honored by the bank due to insufficient funds or other reasons. To ensure comprehensiveness, let's explore different types relevant to this topic: 1. Palm Bay Florida Notice of Dishonored Check — Civil: This is a general term encompassing all instances where a check does not clear and leads to legal action. It emphasizes civil consequences resulting from the dishonored check. 2. Notice of Dishonored Check — Insufficient Funds: If a check bounces due to insufficient funds in the account, you may receive a Notice of Dishonored Check — Insufficient Funds. This notifies you that the payment was declined because the account holder did not have enough money to cover the check's amount. 3. Notice of Dishonored Check — Account Closed: In cases where the issuer's account has been closed before the check could be cleared, you may be issued a Notice of Dishonored Check — Account Closed. It alerts you that the account holder no longer maintains an active account, causing the check to be invalid. 4. Notice of Dishonored Check — Irregular Signature: Sometimes, a check may be dishonored due to a mismatched or irregular signature. In such instances, you might receive a Notice of Dishonored Check — Irregular Signature, indicating that the signature on the check differs significantly from the authorized signatory's usual pattern. 5. Notice of Dishonored Check — Stolen Check: If it is discovered that the check used was stolen, resulting in its dishonoring, you can expect to receive a Notice of Dishonored Check — Stolen Check. This alerts you that the check was illegitimately obtained or used by the issuer. Understanding these different types of Palm Bay Florida Notices of Dishonored Check — Civil helps you identify the specific reason behind the check's non-payment. It is important to take appropriate legal action, such as contacting the issuer or consulting a legal professional specializing in financial disputes.

How to fill out Palm Bay Florida Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

If you’ve already used our service before, log in to your account and save the Palm Bay Florida Notice of Dishonored Check - Civil - Keywords: bad check, bounced check on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Make certain you’ve found an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Palm Bay Florida Notice of Dishonored Check - Civil - Keywords: bad check, bounced check. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!