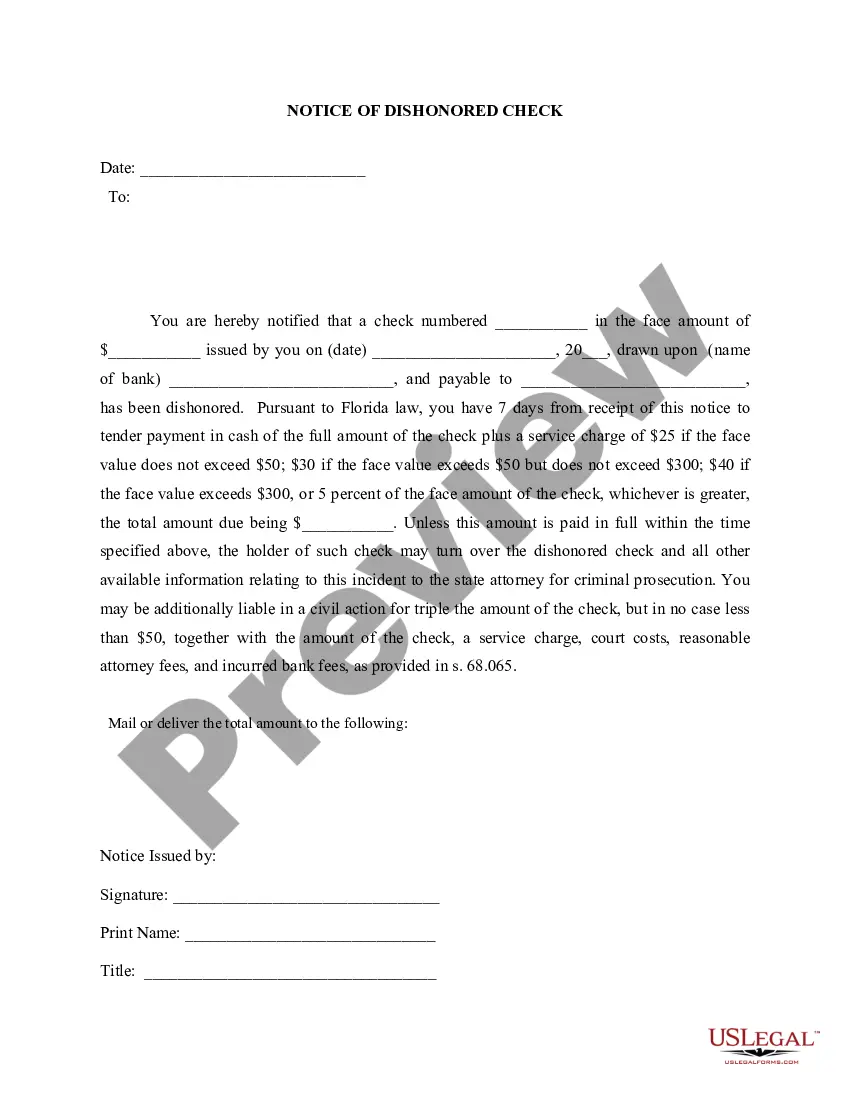

Title: Understanding the St. Petersburg Florida Notice of Dishonored Check — Civil Introduction: The St. Petersburg Florida Notice of Dishonored Check is a legal document that serves to inform an individual or business about a bounced or bad check that they received as payment. This notice is an essential step in the legal process of handling dishonored checks and seeks to resolve the matter civilly. This article will provide a detailed understanding of what this notice entails, the consequences of a dishonored check, and various types of notices that can be issued. 1. Definition of a Dishonored Check: A dishonored check, also known as a bad check or bounced check, refers to a check that is rejected by the bank upon presentation for payment. This occurs when the account holder has insufficient funds, a closed account, or has placed a stop payment on the check, making it invalid. 2. Purpose of the St. Petersburg Florida Notice of Dishonored Check — Civil: The St. Petersburg Florida Notice of Dishonored Check — Civil serves as a formal notice to the check issuer, informing them that their check has been dishonored and outlining their legal obligations and consequences. This notice initiates the civil process and gives the issuer an opportunity to rectify the situation before further legal action is taken. 3. Consequences of a Dishonored Check: Depending on the severity and intent behind writing a dishonored check, there can be several consequences, such as: — Civil Penalties: The recipient of the dishonored check has the right to send a St. Petersburg Florida Notice of Dishonored Check — Civil to the issuer, demanding them to repay the original check amount along with associated fees and penalties. — Criminal Charges: In some cases, repeated issuance of dishonored checks or fraudulent intent can lead to criminal charges, which can result in fines and even imprisonment. — Damage to Credit Rating: A dishonored check can have a negative impact on the issuer's credit score, affecting their ability to obtain future loans or financial services. — Legal Costs: The issuer may be responsible for covering the legal expenses incurred by the recipient if the matter escalates to a court proceeding. 4. Types of St. Petersburg Florida Notice of Dishonored Check — Civil: Within the context of St. Petersburg, Florida, a Notice of Dishonored Check — Civil can be categorized into the following types: a. Initial Notice: The first notice sent to the issuer, informing them about the dishonored check and providing a reasonable time frame to rectify the situation. b. Final Notice: If the initial notice does not elicit a response or if the issuer fails to rectify the dishonored check, a final notice is sent. This notice usually includes a stricter deadline for payment and warns of potential legal action. c. Court Summons: In cases where the issuer fails to respond or refuses to repay the dishonored check amount, the recipient may file a civil lawsuit and serve a court summons to the issuer, compelling their appearance in court. Conclusion: Dealing with a dishonored check can be a complex and challenging process. The St. Petersburg Florida Notice of Dishonored Check — Civil acts as an official way to address the issue while providing opportunities for resolution in a civil manner. Understanding the consequences and different types of notices involved can help both parties navigate the process more effectively and seek amicable solutions.

St. Petersburg Florida Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

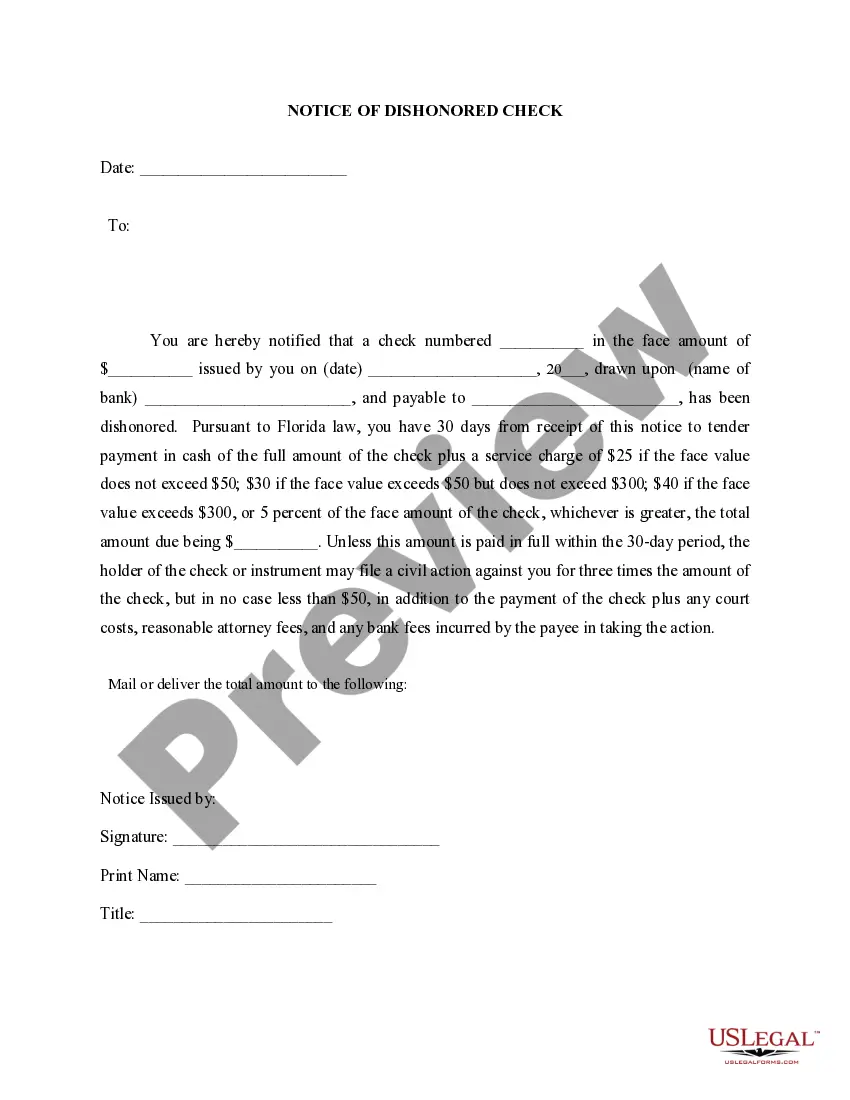

Description

How to fill out St. Petersburg Florida Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

Regardless of one's social or occupational position, completing legal forms is an unfortunate requirement in contemporary society.

Frequently, it is almost unfeasible for someone lacking any legal experience to create this type of documentation from the beginning, primarily due to the intricate language and legal subtleties involved.

This is where US Legal Forms can be a lifesaver.

Confirm that the template you have located is appropriate for your area, as the laws of one state or region do not apply to another.

Examine the document and review a brief description (if available) of the situations for which the document can be utilized.

- Our platform offers a vast repository of over 85,000 state-specific forms that are applicable for nearly any legal matter.

- US Legal Forms also acts as an excellent resource for associates or legal advisors seeking to enhance their efficiency by using our DIY papers.

- Whether you need the St. Petersburg Florida Notice of Dishonored Check - Civil - Keywords: bad check, bounced check or any other documentation that is appropriate for your state or region, with US Legal Forms, everything is readily available.

- Here’s how you can obtain the St. Petersburg Florida Notice of Dishonored Check - Civil - Keywords: bad check, bounced check within minutes using our dependable platform.

- If you are currently a subscriber, feel free to Log In to your account to access the required form.

- However, if you are new to our library, make sure to follow these steps before downloading the St. Petersburg Florida Notice of Dishonored Check - Civil - Keywords: bad check, bounced check.

Form popularity

FAQ

PENALTY UPON CONVICTION: Generally the issuing of a worthless check for $150 or more for services or merchandise is a Third Degree Felony and if convicted the maker of the check could receive up to 5 years in prison and/or $5,000 fine.

PENALTY UPON CONVICTION: Generally the issuing of a worthless check for $150 or more for services or merchandise is a Third Degree Felony and if convicted the maker of the check could receive up to 5 years in prison and/or $5,000 fine.

Felony Issuing Worthless Checks The crime of Issuing Worthless Checks in an amount of $150 or more is a Third Degree Felony in Florida and is punishable by up to five (5) years in prison, five (5) years of probation, and a $5,000 fine.

Worthless checks (usually referred to by the acronym PWBC - Passing Worthless Bank Checks) are either 1st degree Misdemeanors or 3rd degree Felonies under Florida law.

A violation of the provisions of this subsection, if the check, draft, other written order, or debit card order is in the amount of $150, or its equivalent, or more, constitutes a felony of the third degree, punishable as provided in s. 775.082, s. 775.083, or s. 775.084.

Florida's worthless / bounced check law does not criminalize the mere writing a check when there are inadequate funds in your bank account. The law requires the prosecution to show that the accused knew (at the time the check was made or issued) that there were insufficient funds in his or her account.

Stat. §832.05) makes it not only a civil offense to write a bad check, or issue a check that the remitter knows has no funds and will not clear, but also makes it a misdemeanor or felony in the State of Florida, depending on the face amount of the worthless check.