Title: Understanding the West Palm Beach Florida Notice of Dishonored Check — Civil Introduction: Having knowledge about the West Palm Beach Florida Notice of Dishonored Check — Civil is essential, especially if you encounter issues related to bad checks or bounced checks. This notice serves as a legal document notifying individuals of the consequences and implications associated with writing or receiving a dishonored check. In this article, we will provide a detailed description of what constitutes a bad check, a bounced check, and discuss the different types of notices in West Palm Beach, Florida. Types of Bad Check Notices: 1. West Palm Beach Florida Notice of Dishonored Check — Civil: The West Palm Beach Florida Notice of Dishonored Check — Civil is issued by the state's civil court system to address the issue of bad checks. This notice is sent to the check writer informing them of the dishonored check and the penalties they may face. 2. Demand for Payment Notice: A Demand for Payment Notice is a type of bad check notice commonly used by businesses or individuals who have received a bounced check. It is sent to the check writer, demanding immediate payment for the bounced check amount along with any additional penalties or service fees incurred. 3. 10-Day Notice: The 10-Day Notice is typically sent after the initial Demand for Payment Notice if the check writer fails to respond or make the necessary payment. This notice provides the check writer with an additional 10 days to rectify the payment issue and avoid further legal actions. What Constitutes a Bad Check: A bad check refers to a check that is not honored by the bank due to various reasons, including insufficient funds, closed accounts, or the account holder's signature mismatch. When someone issues a bad check, it violates the legal agreement between the payer and the payee, leading to consequences for the check writer. Implications of a Bounced Check: When a check bounces, it can have several serious implications for both the payer and the payee. These may include: 1. Legal Consequences: Writing a bounced check can result in the payee pursuing legal action against the check writer, leading to potential civil penalties, fines, and even criminal charges in some cases. 2. Financial Penalties: Banks usually charge penalty fees for dishonored checks, which can range from a fixed amount to a percentage of the check's value. Additionally, the payee may also impose fees or charges to cover the cost of collection or legal actions. 3. Damaged Reputation: Consistently writing bad checks can tarnish an individual's reputation as it indicates financial irresponsibility. This can have long-lasting consequences, affecting future business opportunities, creditworthiness, and personal relationships. Conclusion: Understanding the West Palm Beach Florida Notice of Dishonored Check — Civil and the implications it carries is vital for both check writers and recipients. Avoiding the issuance of bad checks and promptly rectifying any unintentional dishonored checks can help individuals maintain their financial integrity while preventing legal complications and potential financial losses.

West Palm Beach Florida Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Category:

State:

Florida

City:

West Palm Beach

Control #:

FL-401N

Format:

Word;

Rich Text

Instant download

Description

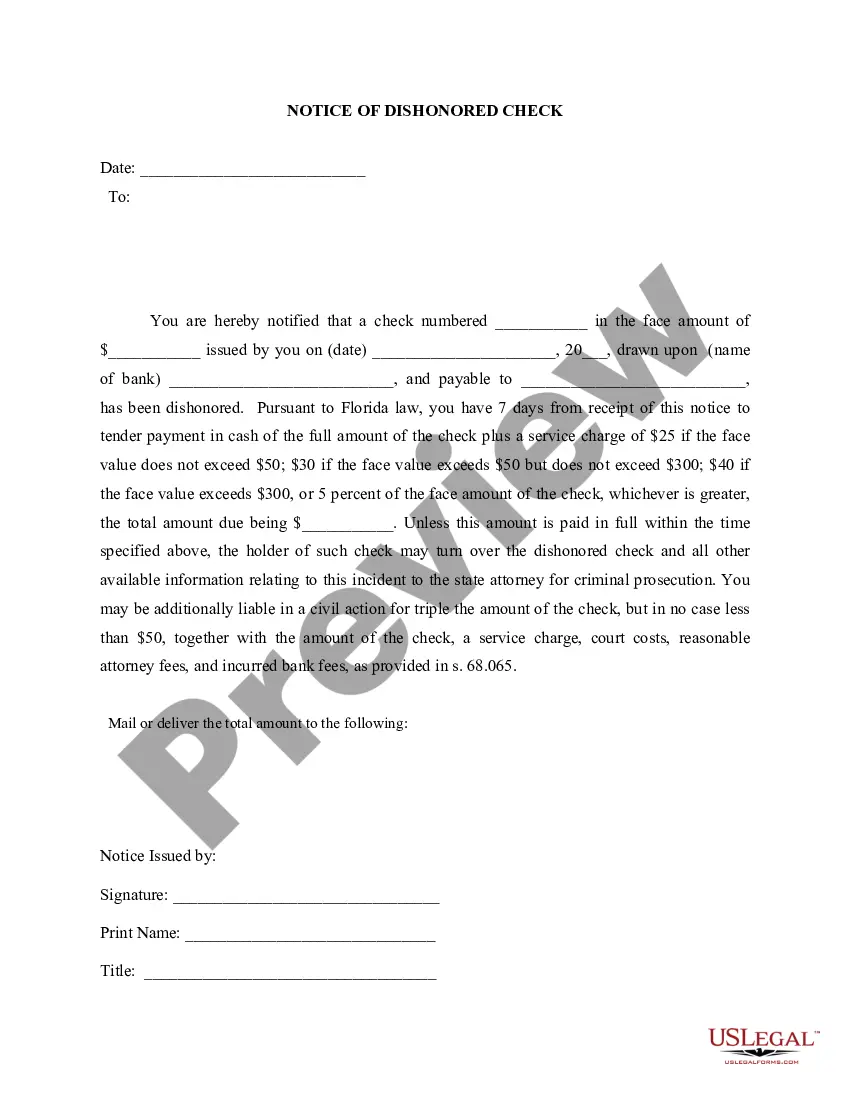

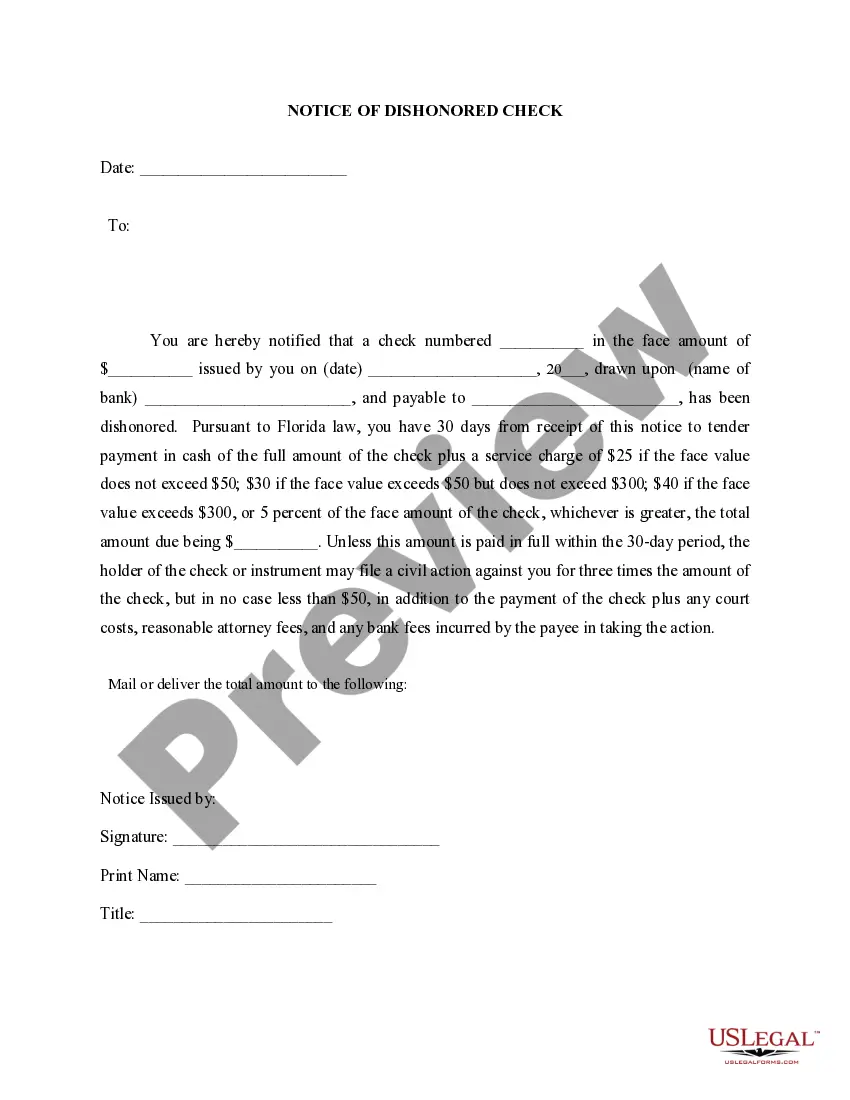

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Title: Understanding the West Palm Beach Florida Notice of Dishonored Check — Civil Introduction: Having knowledge about the West Palm Beach Florida Notice of Dishonored Check — Civil is essential, especially if you encounter issues related to bad checks or bounced checks. This notice serves as a legal document notifying individuals of the consequences and implications associated with writing or receiving a dishonored check. In this article, we will provide a detailed description of what constitutes a bad check, a bounced check, and discuss the different types of notices in West Palm Beach, Florida. Types of Bad Check Notices: 1. West Palm Beach Florida Notice of Dishonored Check — Civil: The West Palm Beach Florida Notice of Dishonored Check — Civil is issued by the state's civil court system to address the issue of bad checks. This notice is sent to the check writer informing them of the dishonored check and the penalties they may face. 2. Demand for Payment Notice: A Demand for Payment Notice is a type of bad check notice commonly used by businesses or individuals who have received a bounced check. It is sent to the check writer, demanding immediate payment for the bounced check amount along with any additional penalties or service fees incurred. 3. 10-Day Notice: The 10-Day Notice is typically sent after the initial Demand for Payment Notice if the check writer fails to respond or make the necessary payment. This notice provides the check writer with an additional 10 days to rectify the payment issue and avoid further legal actions. What Constitutes a Bad Check: A bad check refers to a check that is not honored by the bank due to various reasons, including insufficient funds, closed accounts, or the account holder's signature mismatch. When someone issues a bad check, it violates the legal agreement between the payer and the payee, leading to consequences for the check writer. Implications of a Bounced Check: When a check bounces, it can have several serious implications for both the payer and the payee. These may include: 1. Legal Consequences: Writing a bounced check can result in the payee pursuing legal action against the check writer, leading to potential civil penalties, fines, and even criminal charges in some cases. 2. Financial Penalties: Banks usually charge penalty fees for dishonored checks, which can range from a fixed amount to a percentage of the check's value. Additionally, the payee may also impose fees or charges to cover the cost of collection or legal actions. 3. Damaged Reputation: Consistently writing bad checks can tarnish an individual's reputation as it indicates financial irresponsibility. This can have long-lasting consequences, affecting future business opportunities, creditworthiness, and personal relationships. Conclusion: Understanding the West Palm Beach Florida Notice of Dishonored Check — Civil and the implications it carries is vital for both check writers and recipients. Avoiding the issuance of bad checks and promptly rectifying any unintentional dishonored checks can help individuals maintain their financial integrity while preventing legal complications and potential financial losses.

How to fill out West Palm Beach Florida Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

If you’ve already utilized our service before, log in to your account and download the West Palm Beach Florida Notice of Dishonored Check - Civil - Keywords: bad check, bounced check on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Make sure you’ve located an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your West Palm Beach Florida Notice of Dishonored Check - Civil - Keywords: bad check, bounced check. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!