Title: Understanding the Fort Lauderdale Florida Notice of Dishonored Check — Criminal Proceedings Introduction: In Fort Lauderdale, Florida, failure to make timely payments or knowingly writing a check without sufficient funds can result in a dishonored check, commonly known as a bad or bounced check. This article aims to provide you with a detailed description of the Fort Lauderdale Florida Notice of Dishonored Check — Criminal proceedings. We will explore the legal implications, consequences, and various types of bad check scenarios that can lead to criminal charges. Types of Fort Lauderdale Florida Notice of Dishonored Check — Criminal: 1. Insufficient Funds: One type of dishonored check occurs when an individual knowingly writes a check despite lacking sufficient funds in their bank account. This type of check is frequently referred to as an "insufficient funds check" or an NSF (Non-Sufficient Funds) check. 2. Account Closed: Another situation involves writing a check from a bank account that has been closed, rendering the check invalid. This is known as an "account closed check." 3. Stop Payment: A stop payment occurs when a check recipient requests their bank to halt payment on a check they have received. If the check issuer attempts to cash or deposit the stopped payment check, it becomes a dishonored check. 4. Forgery or Alteration: If an individual alters the amount on a check or forges the signature, it becomes a dishonored check and may lead to criminal charges. Fort Lauderdale Florida Notice of Dishonored Check — Criminal Proceedings: When a party receives a dishonored check, they usually notify the check writer with a written notice known as the Fort Lauderdale Florida Notice of Dishonored Check — Criminal. Here are the key points to understand about the proceedings: 1. Notice Letter: The notice letter serves as a warning to the check writer about the dishonored check. It is typically sent via certified mail, return receipt requested, providing evidence that the notice was received. 2. Criminal Penalties: Under Florida law, knowingly issuing a dishonored check is a criminal offense. Depending on the circumstances, it may be categorized as a misdemeanor or a felony offense. The severity of the punishment depends on the check's value and any prior convictions. 3. Restitution and Penalties: In addition to criminal charges, the check writer may be required to pay restitution to the recipient to compensate for the bounced check. This amount generally includes the original amount, any associated bank fees, and potentially other damages. 4. Legal Defense: If facing criminal charges related to a dishonored check, it is essential for the check writer to seek legal counsel. An experienced attorney can guide them through the Fort Lauderdale Florida Notice of Dishonored Check — Criminal proceedings and assist in building a strong defense. Conclusion: Understanding the Fort Lauderdale Florida Notice of Dishonored Check — Criminal proceedings is crucial to individuals who may find themselves involved in such a situation. Avoiding intentional issuance of bad checks and promptly rectifying any accidental discrepancies can help individuals navigate these proceedings and prevent possible legal consequences.

Fort Lauderdale Florida Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check

Category:

State:

Florida

City:

Fort Lauderdale

Control #:

FL-402N

Format:

Word;

Rich Text

Instant download

Description

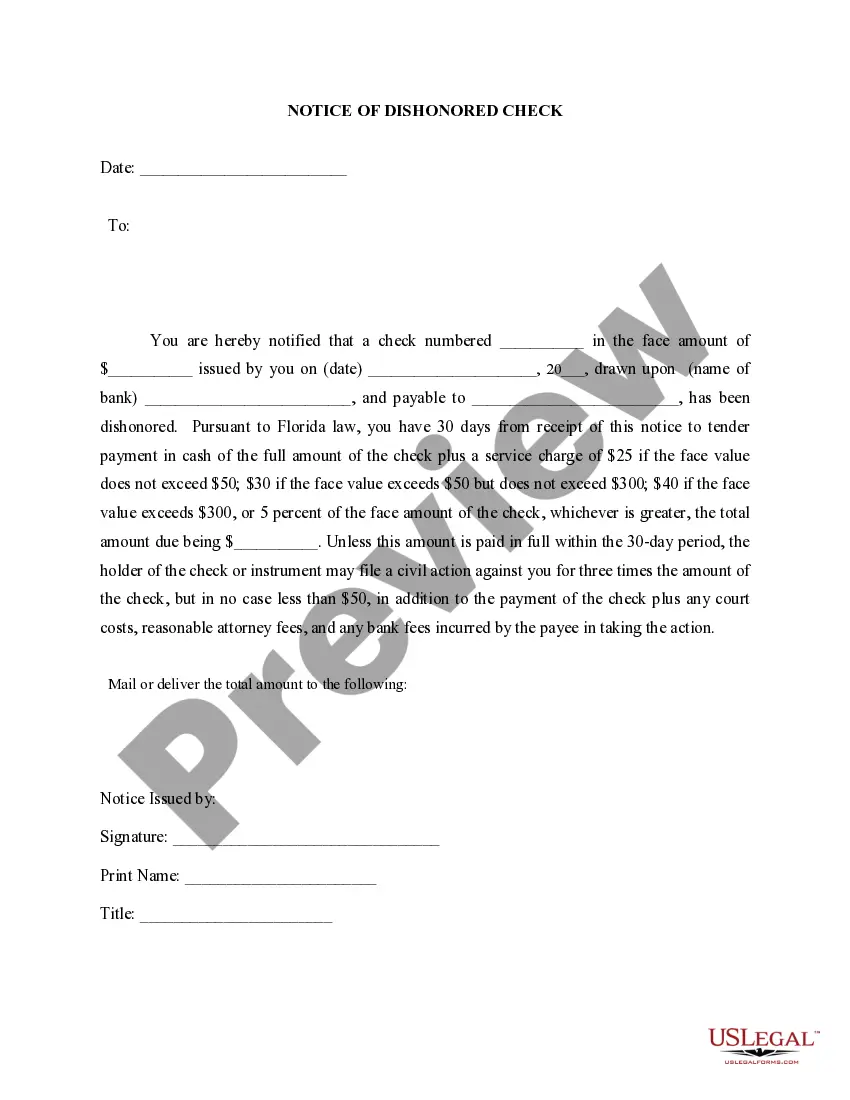

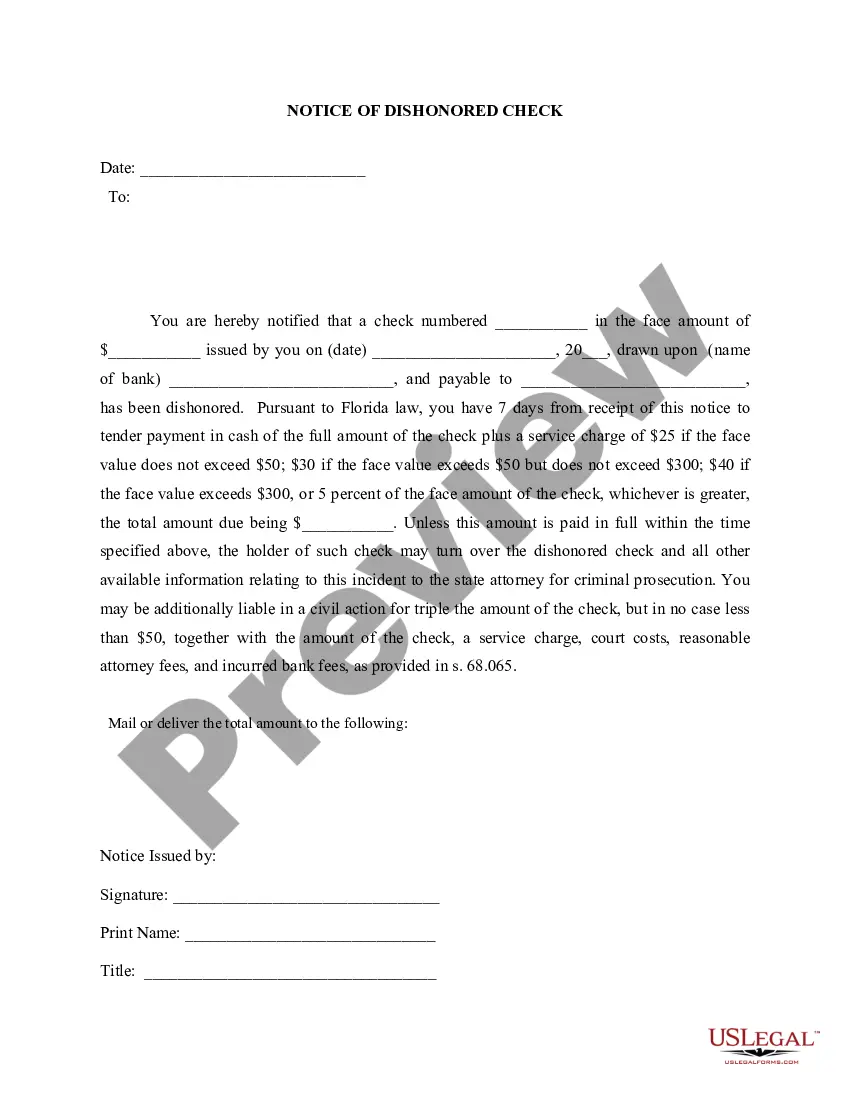

This is a Complaint - Warrant for Dishonored Check - Criminal. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner or any other person given a dishonored check may be required by state law to notify the debtor that the check was dishonored.

Title: Understanding the Fort Lauderdale Florida Notice of Dishonored Check — Criminal Proceedings Introduction: In Fort Lauderdale, Florida, failure to make timely payments or knowingly writing a check without sufficient funds can result in a dishonored check, commonly known as a bad or bounced check. This article aims to provide you with a detailed description of the Fort Lauderdale Florida Notice of Dishonored Check — Criminal proceedings. We will explore the legal implications, consequences, and various types of bad check scenarios that can lead to criminal charges. Types of Fort Lauderdale Florida Notice of Dishonored Check — Criminal: 1. Insufficient Funds: One type of dishonored check occurs when an individual knowingly writes a check despite lacking sufficient funds in their bank account. This type of check is frequently referred to as an "insufficient funds check" or an NSF (Non-Sufficient Funds) check. 2. Account Closed: Another situation involves writing a check from a bank account that has been closed, rendering the check invalid. This is known as an "account closed check." 3. Stop Payment: A stop payment occurs when a check recipient requests their bank to halt payment on a check they have received. If the check issuer attempts to cash or deposit the stopped payment check, it becomes a dishonored check. 4. Forgery or Alteration: If an individual alters the amount on a check or forges the signature, it becomes a dishonored check and may lead to criminal charges. Fort Lauderdale Florida Notice of Dishonored Check — Criminal Proceedings: When a party receives a dishonored check, they usually notify the check writer with a written notice known as the Fort Lauderdale Florida Notice of Dishonored Check — Criminal. Here are the key points to understand about the proceedings: 1. Notice Letter: The notice letter serves as a warning to the check writer about the dishonored check. It is typically sent via certified mail, return receipt requested, providing evidence that the notice was received. 2. Criminal Penalties: Under Florida law, knowingly issuing a dishonored check is a criminal offense. Depending on the circumstances, it may be categorized as a misdemeanor or a felony offense. The severity of the punishment depends on the check's value and any prior convictions. 3. Restitution and Penalties: In addition to criminal charges, the check writer may be required to pay restitution to the recipient to compensate for the bounced check. This amount generally includes the original amount, any associated bank fees, and potentially other damages. 4. Legal Defense: If facing criminal charges related to a dishonored check, it is essential for the check writer to seek legal counsel. An experienced attorney can guide them through the Fort Lauderdale Florida Notice of Dishonored Check — Criminal proceedings and assist in building a strong defense. Conclusion: Understanding the Fort Lauderdale Florida Notice of Dishonored Check — Criminal proceedings is crucial to individuals who may find themselves involved in such a situation. Avoiding intentional issuance of bad checks and promptly rectifying any accidental discrepancies can help individuals navigate these proceedings and prevent possible legal consequences.

How to fill out Fort Lauderdale Florida Notice Of Dishonored Check - Criminal - Keywords: Bad Check, Bounced Check?

If you’ve already used our service before, log in to your account and download the Fort Lauderdale Florida Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Make certain you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Fort Lauderdale Florida Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!