Title: Miami-Dade Florida Notice of Dishonored Check Criminalna— - Understanding Bad Checks and Bounced Checks Introduction: In Miami-Dade, Florida, if a check bounces or is dishonored due to insufficient funds or any other reason, it can lead to serious legal consequences. This article aims to provide detailed information about the Miami-Dade Florida Notice of Dishonored Check — Criminal, commonly known as a bad check or bounced check, and its implications. We will explore the concept of bad checks, different types of dishonored checks, and the potential legal actions associated with them. 1. Definition of a Bad Check: A bad check, also referred to as a bounced check or dishonored check, is a check that has been returned unpaid by a bank due to insufficient funds, a closed account, or any other reason that renders the check invalid for payment. 2. Types of Dishonored Checks: a. Insufficient Funds Check: This occurs when the account holder writes a check without having enough funds in their account to cover the payment. b. Closed Account Check: If the bank account from which the check is drawn has been closed, any checks issued from that account will be dishonored. c. Stop Payment Check: When a bank receives a request from the account holder to stop payment on a specific check, any subsequent attempt to cash that check will result in dishonor. 3. The Miami-Dade Florida Notice of Dishonored Check — Criminal: In Miami-Dade, Florida, if someone writes a bad check, the recipient can pursue legal action against the check writer by initiating the Miami-Dade Florida Notice of Dishonored Check — Criminal. This formal notice advises the check writer of their responsibility to resolve the matter and warns of potential criminal charges if the issue is not resolved within a specified time. 4. Consequences of Writing a Bad Check: a. Criminal Charges: Writing a bad check is considered a crime in Florida, punishable under Florida Statutes Section 832.05. It can be charged as a misdemeanor or a felony, depending on the amount involved. b. Penalties: The penalties for writing a bad check can include fines, restitution, probation, community service, and even imprisonment. c. Civil Liability: Apart from criminal charges, the check writer may also be held liable for civil penalties, including the original check amount, bank fees, court costs, and legal expenses incurred by the payee. Conclusion: It is crucial for individuals in Miami-Dade, Florida, to be aware of the potential legal consequences of writing bad checks. To avoid criminal charges and other penalties associated with dishonored checks, one must ensure sufficient funds, maintain accurate account information, and promptly resolve any payment issues. Understanding the Miami-Dade Florida Notice of Dishonored Check — Criminal and its implications can help both payees and check writers navigate this complex legal situation.

Miami-Dade Florida Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check

Description

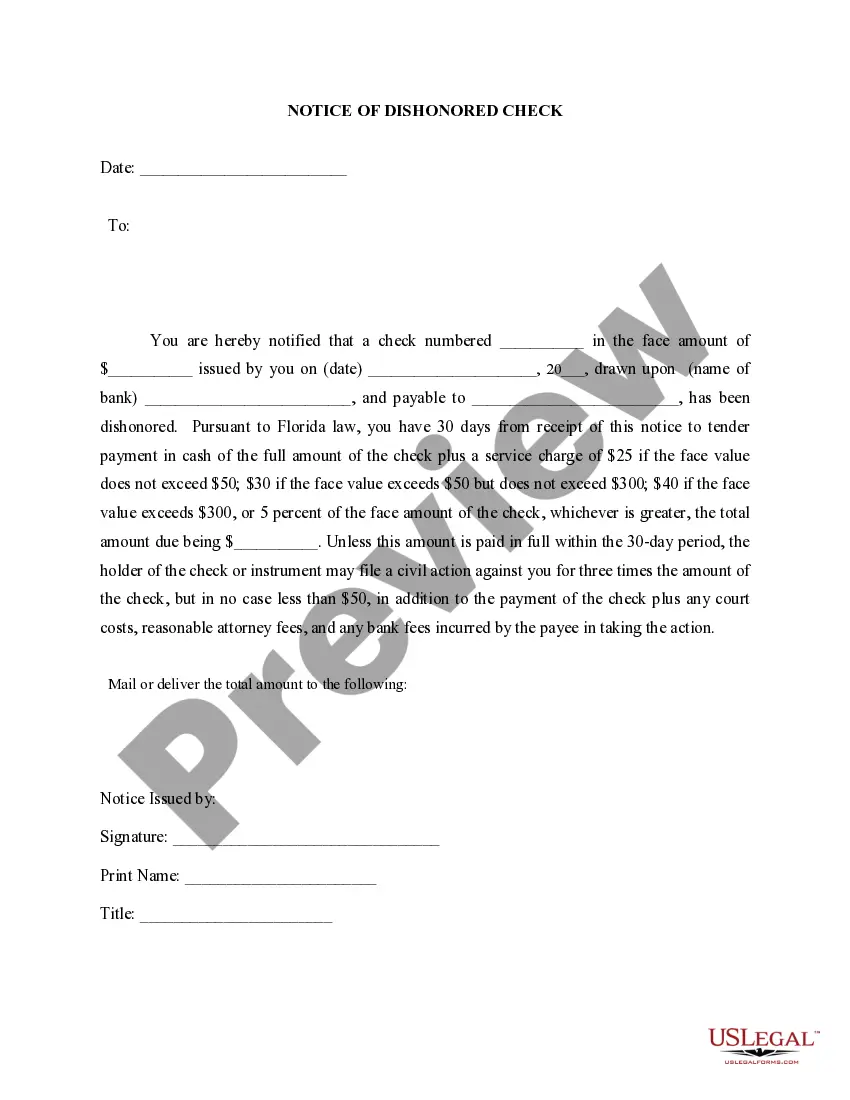

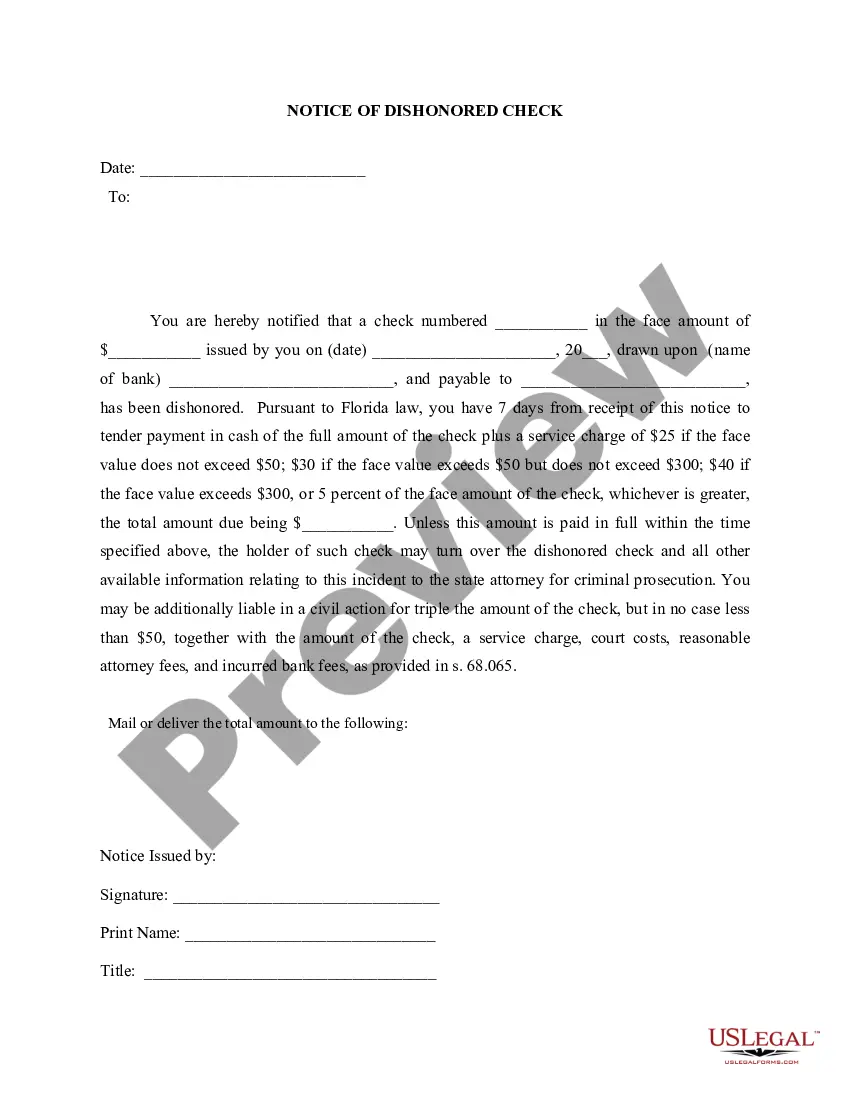

How to fill out Miami-Dade Florida Notice Of Dishonored Check - Criminal - Keywords: Bad Check, Bounced Check?

No matter the social or professional status, completing legal documents is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for a person with no law education to create such paperwork from scratch, mainly because of the convoluted jargon and legal nuances they involve. This is where US Legal Forms can save the day. Our platform provides a huge catalog with over 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to save time using our DYI forms.

Whether you require the Miami-Dade Florida Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Miami-Dade Florida Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check in minutes employing our trustworthy platform. In case you are presently an existing customer, you can proceed to log in to your account to get the needed form.

However, if you are new to our library, make sure to follow these steps before downloading the Miami-Dade Florida Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check:

- Ensure the form you have found is good for your area considering that the regulations of one state or county do not work for another state or county.

- Preview the document and read a short description (if provided) of cases the document can be used for.

- In case the one you picked doesn’t suit your needs, you can start over and look for the suitable form.

- Click Buy now and choose the subscription plan that suits you the best.

- with your credentials or create one from scratch.

- Pick the payment method and proceed to download the Miami-Dade Florida Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check once the payment is completed.

You’re all set! Now you can proceed to print the document or fill it out online. In case you have any problems locating your purchased documents, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.