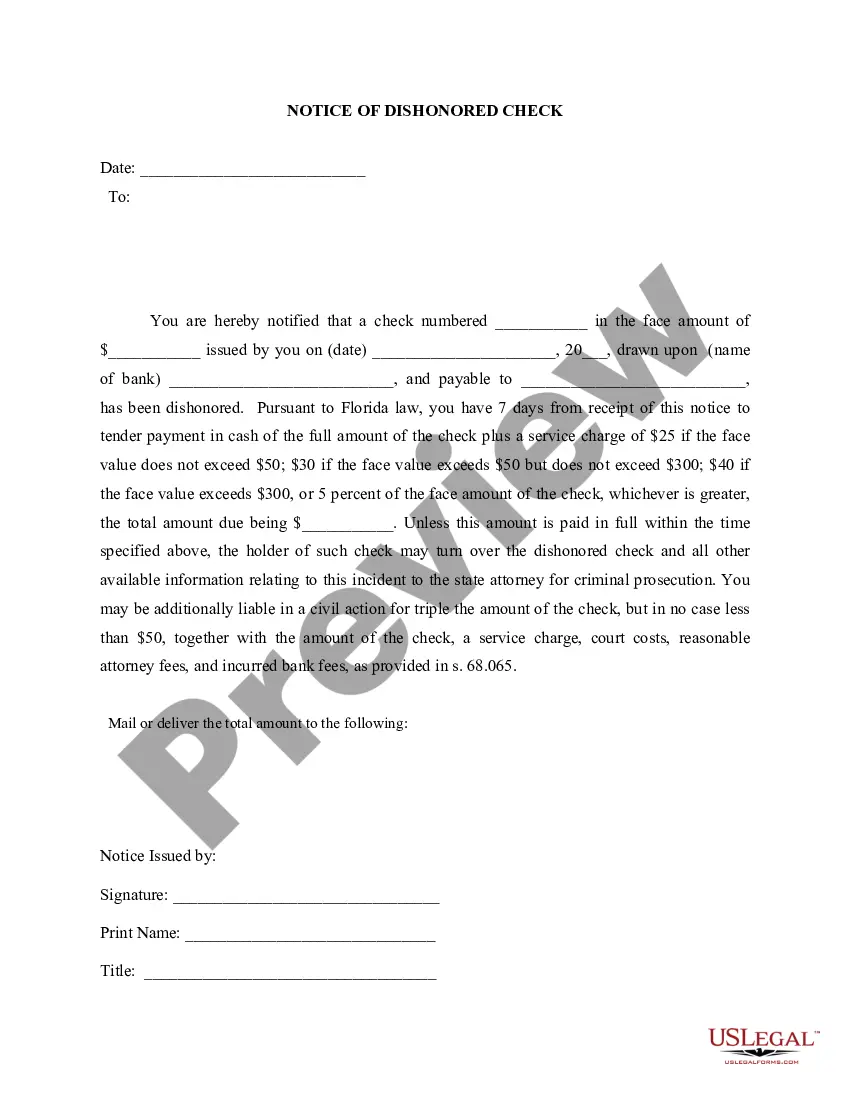

Title: Understanding the Orlando Florida Notice of Dishonored Check — Criminal Proceedings: Bad Check, Bounced Check, and More Introduction: If you've ever encountered a situation where a check you received was returned unpaid, you may have come across the Orlando Florida Notice of Dishonored Check. This legal document follows criminal proceedings against individuals involved in issuing bad checks or bounced checks. In this article, we will explore what these notices entail, their consequences, and shed light on different types of dishonored checks. 1. Orlando Florida Notice of Dishonored Check — Criminal: The Notice of Dishonored Check — Criminal is a formal notification sent by the State Attorney's Office or law enforcement agencies in Orlando, Florida, to inform the check issuer about a dishonored or returned check. It outlines the legal implications and penalties associated with passing a bad check or writing a check without sufficient funds. Keywords: Orlando Florida Notice of Dishonored Check, Criminal proceedings, penalties, bad check, bounced check. 2. Bad Checks: A bad check refers to a check used for payment by an account holder that does not have sufficient funds to cover the check's face value. It is considered a fraudulent act, often unintentional, but still requiring legal attention. Writing a bad check can result from an oversight, insufficient funds, or fraudulent intent. Keywords: Bad checks, insufficient funds, fraudulent payments, unintentional offense. 3. Bounced Checks: A bounced check is another term used to describe a dishonored check. It signifies that the check was presented for payment but was returned by the bank due to insufficient funds or account closure. Banks typically charge fees for each bounced check, and the check issuer must rectify the situation promptly to avoid further legal consequences. Keywords: Bounced checks, insufficient funds, account closure, bank fees. 4. Different Types of Dishonored Checks: While bad checks and bounced checks are general terms encompassing all dishonored checks, it's important to note the specific types recognized under Orlando Florida law. These include: a. Closed Account Checks: When a check is written from an account that has been closed. b. Insufficient Funds Checks: Checks written on accounts with inadequate funds to cover the check's amount. c. Forgery Checks: Checks that have been altered or signed without authorization. d. Account Not Open Checks: Using a non-existent or unopened account to issue a check. e. Post-Dated Checks: Issuing a check with a future date, but insufficient funds when presented. Keywords: Different types of dishonored checks, closed account checks, insufficient funds checks, forgery checks, account not open checks, post-dated checks. Conclusion: The Orlando Florida Notice of Dishonored Check — Criminal is an essential legal document concerning bad checks and bounced checks. By familiarizing yourself with these terms and understanding the consequences, you can ensure compliance with the law and avoid any unintended financial or legal entanglements. Always exercise caution while issuing checks and maintain sufficient funds in your accounts to honor your payment obligations and avoid any criminal implications.

Orlando Florida Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check

Description

How to fill out Orlando Florida Notice Of Dishonored Check - Criminal - Keywords: Bad Check, Bounced Check?

No matter the social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for a person without any legal education to create this sort of papers from scratch, mainly due to the convoluted jargon and legal subtleties they involve. This is where US Legal Forms can save the day. Our service provides a huge library with more than 85,000 ready-to-use state-specific forms that work for almost any legal scenario. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

No matter if you require the Orlando Florida Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Orlando Florida Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check in minutes employing our trusted service. If you are presently a subscriber, you can proceed to log in to your account to get the needed form.

However, if you are new to our platform, make sure to follow these steps prior to downloading the Orlando Florida Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check:

- Ensure the template you have found is specific to your location since the regulations of one state or county do not work for another state or county.

- Review the document and go through a brief outline (if available) of cases the paper can be used for.

- If the form you picked doesn’t meet your requirements, you can start over and search for the necessary document.

- Click Buy now and choose the subscription option that suits you the best.

- Log in to your account credentials or create one from scratch.

- Pick the payment gateway and proceed to download the Orlando Florida Notice of Dishonored Check - Criminal - Keywords: bad check, bounced check once the payment is completed.

You’re good to go! Now you can proceed to print the document or fill it out online. If you have any problems getting your purchased forms, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.