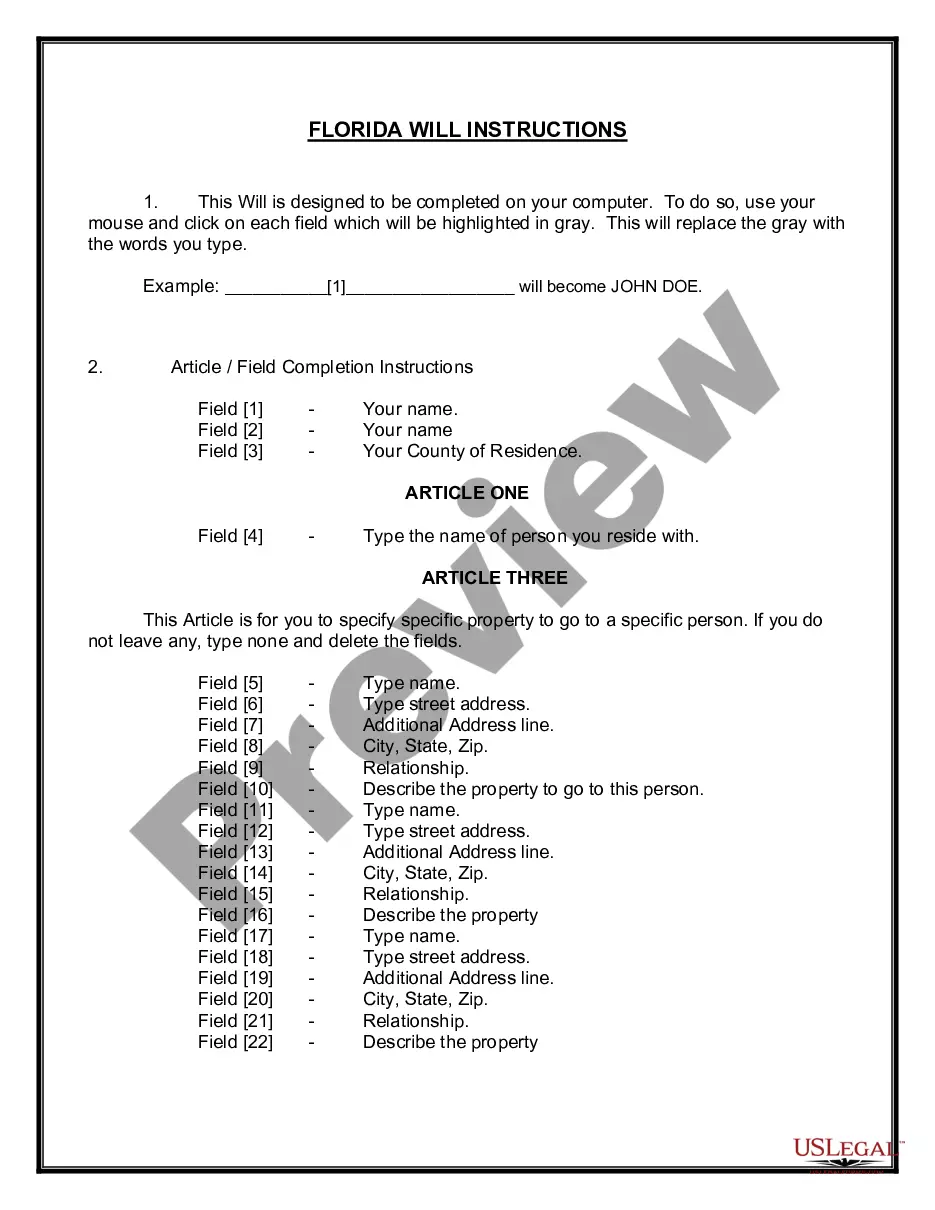

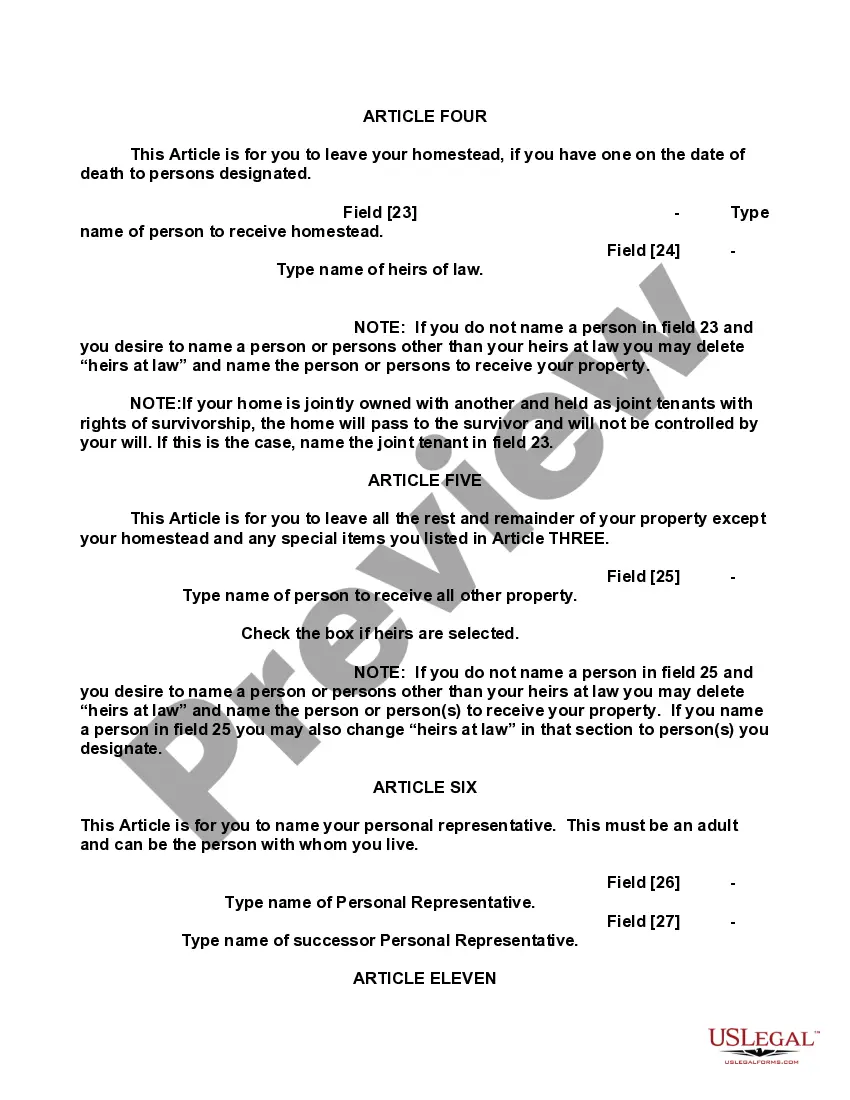

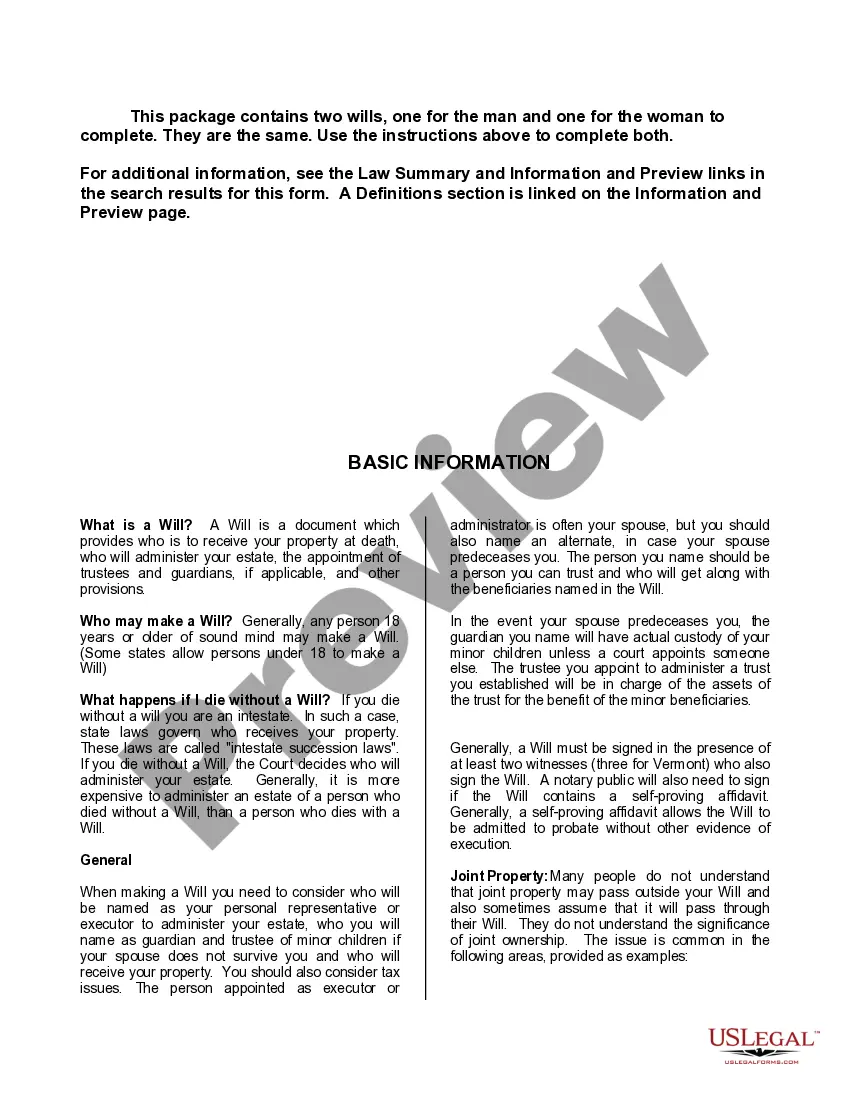

This will package contains two wills for a man and woman living together with no children. It is designed for persons that, although not married, desire to execute mutual wills leaving some of their property to the other. State specific instructions are also included.

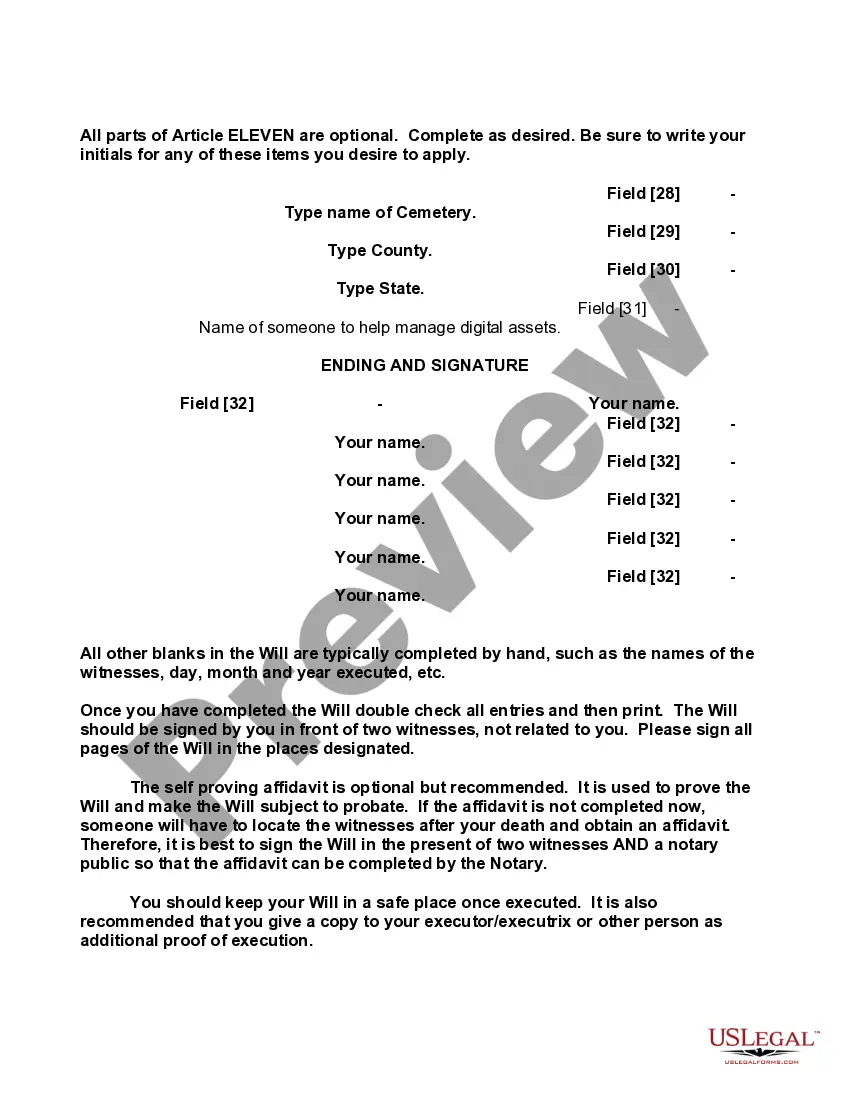

The wills must be signed in the presence of two witnesses, not related to you or named in the wills. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the wills. Miramar Florida Mutual Wills: Last Will and Testaments for Unmarried Persons living together with No Children If you and your partner are in an unmarried relationship, living together in Miramar, Florida, it is essential to protect yourselves and your assets by having a comprehensive estate plan in place. One crucial legal document that unmarried couples often choose is a Miramar Mutual Will, also known as a Joint Will or a Reciprocal Will. A Miramar Mutual Will is specifically designed for unmarried couples who want to ensure that their assets are distributed according to their wishes if one or both partners pass away. It allows you and your partner to create a shared estate plan while maintaining individual flexibility and control over your assets. Benefits of Miramar Florida Mutual Wills for Unmarried Persons: 1. Asset Distribution: A Miramar Mutual Will enables unmarried couples to outline how they want their assets, properties, investments, and personal belongings to be distributed upon their deaths. This ensures that your partner is provided for and receives the assets you intended them to have. 2. Decision-Making Powers: In a Miramar Mutual Will, you can name your partner as an executor or personal representative, giving them the authority to handle your estate and make important decisions on your behalf. This allows your partner to be involved in all matters concerning your estate, ensuring their rights and interests are protected. 3. Avoiding Intestacy Laws: Without a Miramar Mutual Will, Florida's intestacy laws will automatically determine how your assets are distributed. If you are unmarried and have no children, your assets may pass to other family members, which may not align with your wishes. Mutual Wills allow you to override these default rules and ensure your partner receives the assets that you desire them to have. Different Types of Miramar Florida Mutual Wills for Unmarried Persons: 1. Simple Mutual Will: A basic Miramar Mutual Will outlines the distribution of assets and designates your partner as the main beneficiary. It may also include instructions for funeral arrangements, guardianship for any dependents, and alternate beneficiaries. 2. Traditional Mutual Will: A Miramar Traditional Mutual Will often includes more complex provisions, such as creating trusts to manage and distribute assets over time. This type of will, can be beneficial if you have substantial assets or if you want to provide for other beneficiaries, such as close friends or charities. 3. Contingent Mutual Will: A Contingent Mutual Will is used when unmarried couples want to leave assets to each other but also have a plan in place if their partner predeceases them. This will outline secondary beneficiaries or alternate distribution plans to ensure your wishes are carried out. It is important to consult with a qualified estate planning attorney in Miramar, Florida, to ensure that your Mutual Will precisely reflects your intentions and meets the legal requirements of the state.

Miramar Florida Mutual Wills: Last Will and Testaments for Unmarried Persons living together with No Children If you and your partner are in an unmarried relationship, living together in Miramar, Florida, it is essential to protect yourselves and your assets by having a comprehensive estate plan in place. One crucial legal document that unmarried couples often choose is a Miramar Mutual Will, also known as a Joint Will or a Reciprocal Will. A Miramar Mutual Will is specifically designed for unmarried couples who want to ensure that their assets are distributed according to their wishes if one or both partners pass away. It allows you and your partner to create a shared estate plan while maintaining individual flexibility and control over your assets. Benefits of Miramar Florida Mutual Wills for Unmarried Persons: 1. Asset Distribution: A Miramar Mutual Will enables unmarried couples to outline how they want their assets, properties, investments, and personal belongings to be distributed upon their deaths. This ensures that your partner is provided for and receives the assets you intended them to have. 2. Decision-Making Powers: In a Miramar Mutual Will, you can name your partner as an executor or personal representative, giving them the authority to handle your estate and make important decisions on your behalf. This allows your partner to be involved in all matters concerning your estate, ensuring their rights and interests are protected. 3. Avoiding Intestacy Laws: Without a Miramar Mutual Will, Florida's intestacy laws will automatically determine how your assets are distributed. If you are unmarried and have no children, your assets may pass to other family members, which may not align with your wishes. Mutual Wills allow you to override these default rules and ensure your partner receives the assets that you desire them to have. Different Types of Miramar Florida Mutual Wills for Unmarried Persons: 1. Simple Mutual Will: A basic Miramar Mutual Will outlines the distribution of assets and designates your partner as the main beneficiary. It may also include instructions for funeral arrangements, guardianship for any dependents, and alternate beneficiaries. 2. Traditional Mutual Will: A Miramar Traditional Mutual Will often includes more complex provisions, such as creating trusts to manage and distribute assets over time. This type of will, can be beneficial if you have substantial assets or if you want to provide for other beneficiaries, such as close friends or charities. 3. Contingent Mutual Will: A Contingent Mutual Will is used when unmarried couples want to leave assets to each other but also have a plan in place if their partner predeceases them. This will outline secondary beneficiaries or alternate distribution plans to ensure your wishes are carried out. It is important to consult with a qualified estate planning attorney in Miramar, Florida, to ensure that your Mutual Will precisely reflects your intentions and meets the legal requirements of the state.