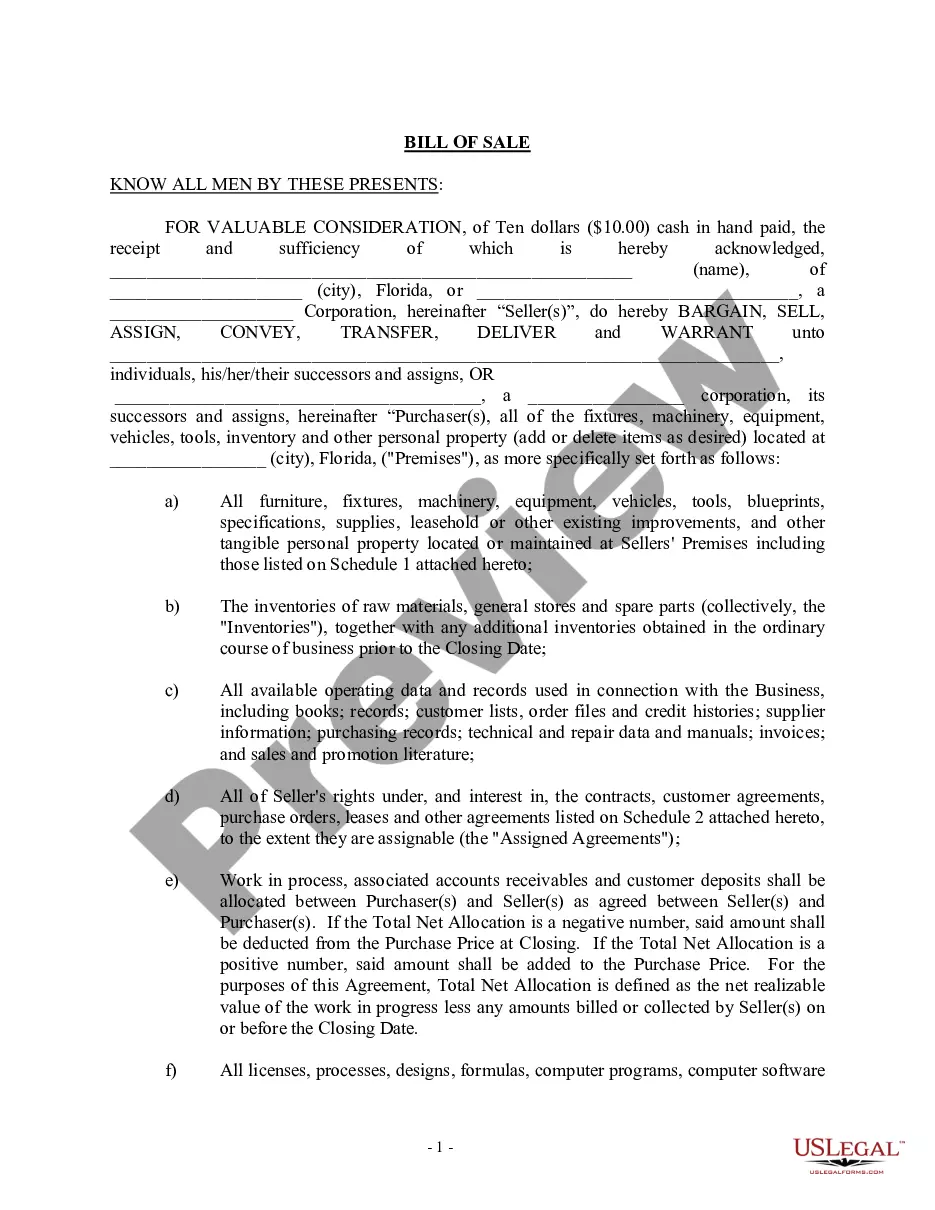

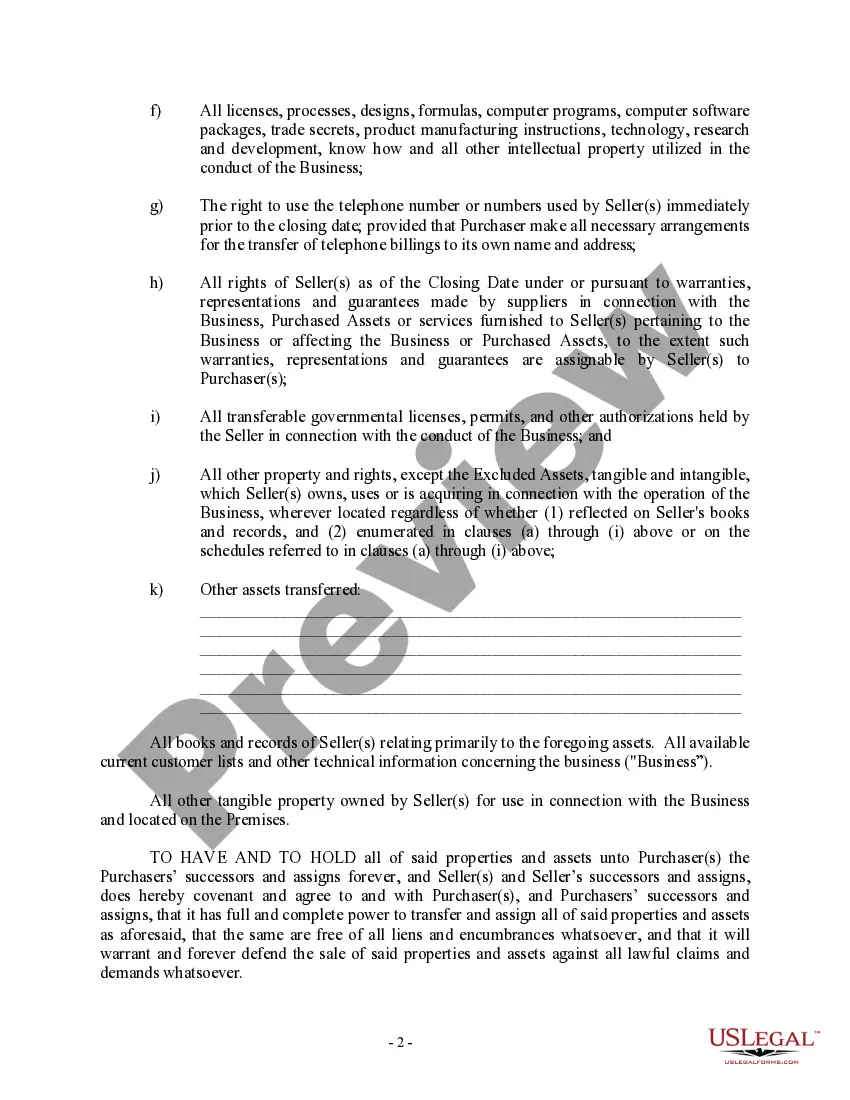

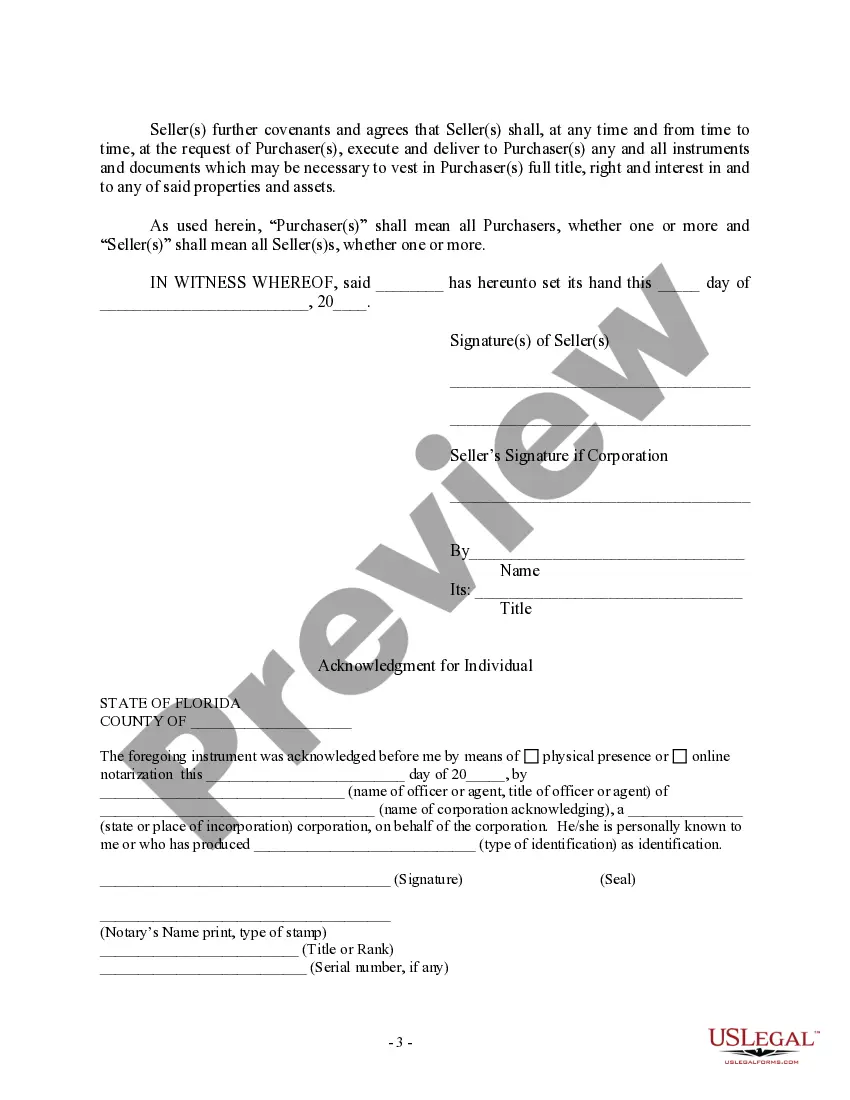

Title: Understanding the Gainesville Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller Introduction: The Gainesville Florida Bill of Sale in connection with the sale of a business by an individual or corporate seller serves as a legal document that outlines the details of the transaction. It provides protection and clarity for both parties involved, ensuring a smooth transfer of ownership. This article aims to provide a comprehensive understanding of the Gainesville Florida Bill of Sale in connection with the sale of a business, including its importance, key elements, and possible types. 1. Importance of the Gainesville Florida Bill of Sale: The Gainesville Florida Bill of Sale holds significant importance for both the buyer and seller in a business transaction. It serves as a legally binding agreement that records the terms and conditions of the sale, protecting the interests of all parties involved. This document ensures that the transaction is transparent and that there is no ambiguity regarding the transfer of ownership. 2. Key Elements of the Gainesville Florida Bill of Sale: a. Identification of the Buyer and Seller: The bill of sale must clearly identify both the individual or corporate seller and the buyer involved in the transaction. b. Description of the Business: It should provide a detailed description of the business being sold, including its physical assets, intellectual property, customer contracts, and any other relevant details. c. Purchase Price and Payment Terms: The bill of sale must include the agreed-upon purchase price of the business and any specific payment terms, such as lump sum, installment payments, or financing arrangements. d. Assets and Liabilities: The document should outline the assets and liabilities being transferred as part of the sale, including inventory, equipment, licenses, leases, and outstanding debts. e. Representations and Warranties: It is common for the seller to provide certain representations and warranties regarding the business being sold, ensuring that the provided information is accurate and complete. f. Closing and Possession: The bill of sale should specify the date of closing, when ownership will transfer to the buyer, and when the seller will no longer have access or control over the business. 3. Types of Gainesville Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller: a. Basic Bill of Sale: A simple bill of sale that outlines the essential details of the transaction, including buyer and seller information, description of the business, and purchase price. b. General Bill of Sale with Asset Schedule: This type of bill of sale provides a more comprehensive breakdown of the assets being transferred, including equipment, real estate, intellectual property, and any other major assets involved in the sale. c. Specialized Bill of Sale for Specific Business Types: Certain industries or businesses may require specialized bill of sale forms to address their unique needs. For example, a restaurant bill of sale may include specific clauses related to liquor licenses, health permits, or lease assignments. Conclusion: The Gainesville Florida Bill of Sale in connection with the sale of a business is a vital document that protects the interests of both the buyer and seller. By clearly outlining the terms and conditions of the transaction, it ensures a smooth transfer of ownership and minimizes potential disputes. Understanding the key elements and different types of Gainesville Florida Bill of Sale is crucial for individuals or corporate sellers embarking on a business sale in this region.

Gainesville Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

How to fill out Gainesville Florida Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller?

Regardless of social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for someone with no legal background to create such papers cfrom the ground up, mainly because of the convoluted jargon and legal subtleties they involve. This is where US Legal Forms can save the day. Our platform provides a massive collection with over 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also is a great resource for associates or legal counsels who want to save time using our DYI forms.

Whether you need the Gainesville Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Gainesville Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller quickly employing our trustworthy platform. In case you are presently a subscriber, you can go ahead and log in to your account to get the needed form.

Nevertheless, in case you are new to our platform, make sure to follow these steps prior to downloading the Gainesville Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller:

- Ensure the template you have chosen is specific to your location because the regulations of one state or county do not work for another state or county.

- Preview the form and go through a short outline (if provided) of scenarios the paper can be used for.

- If the one you chosen doesn’t meet your requirements, you can start over and search for the suitable document.

- Click Buy now and pick the subscription option you prefer the best.

- utilizing your credentials or register for one from scratch.

- Select the payment gateway and proceed to download the Gainesville Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller as soon as the payment is through.

You’re good to go! Now you can go ahead and print the form or fill it out online. If you have any problems getting your purchased documents, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.