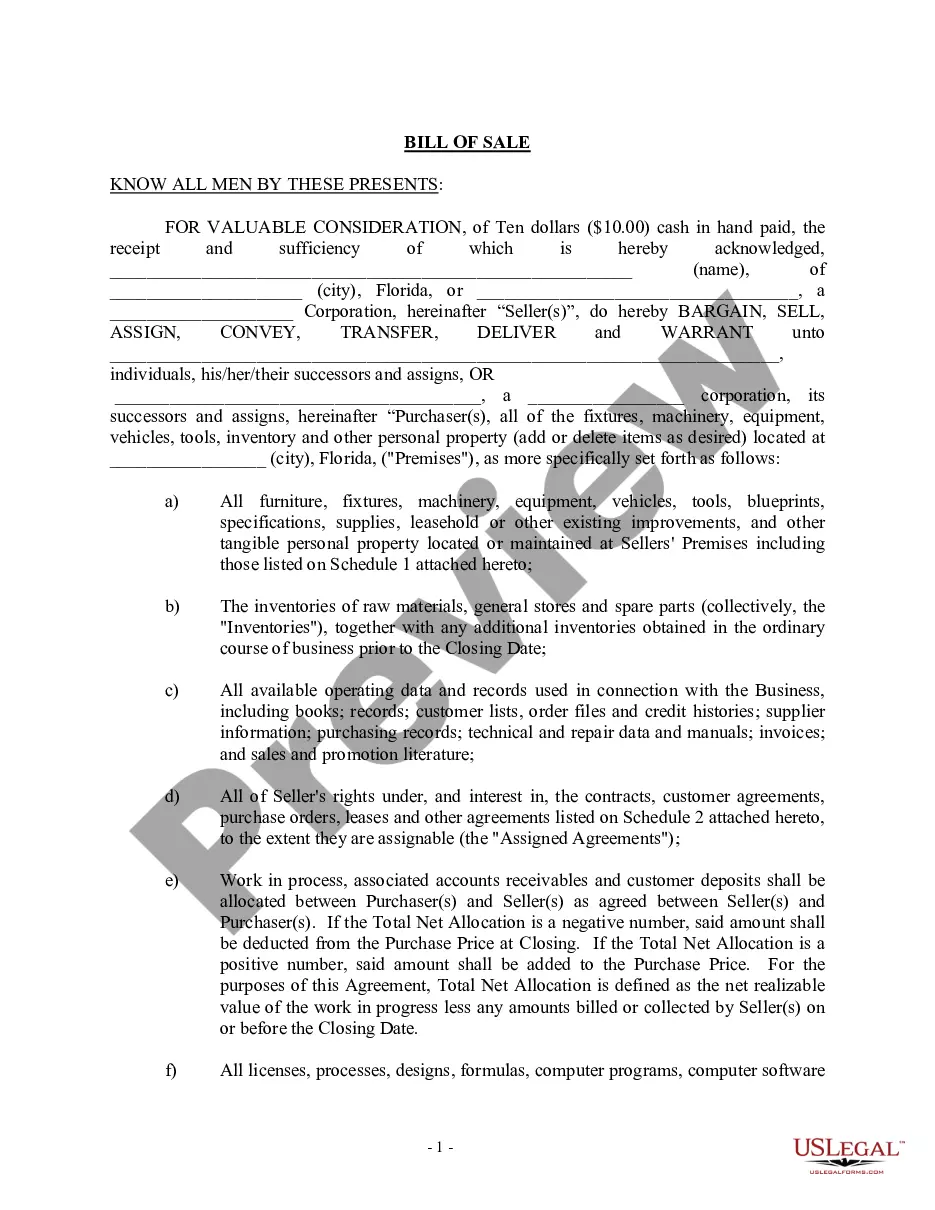

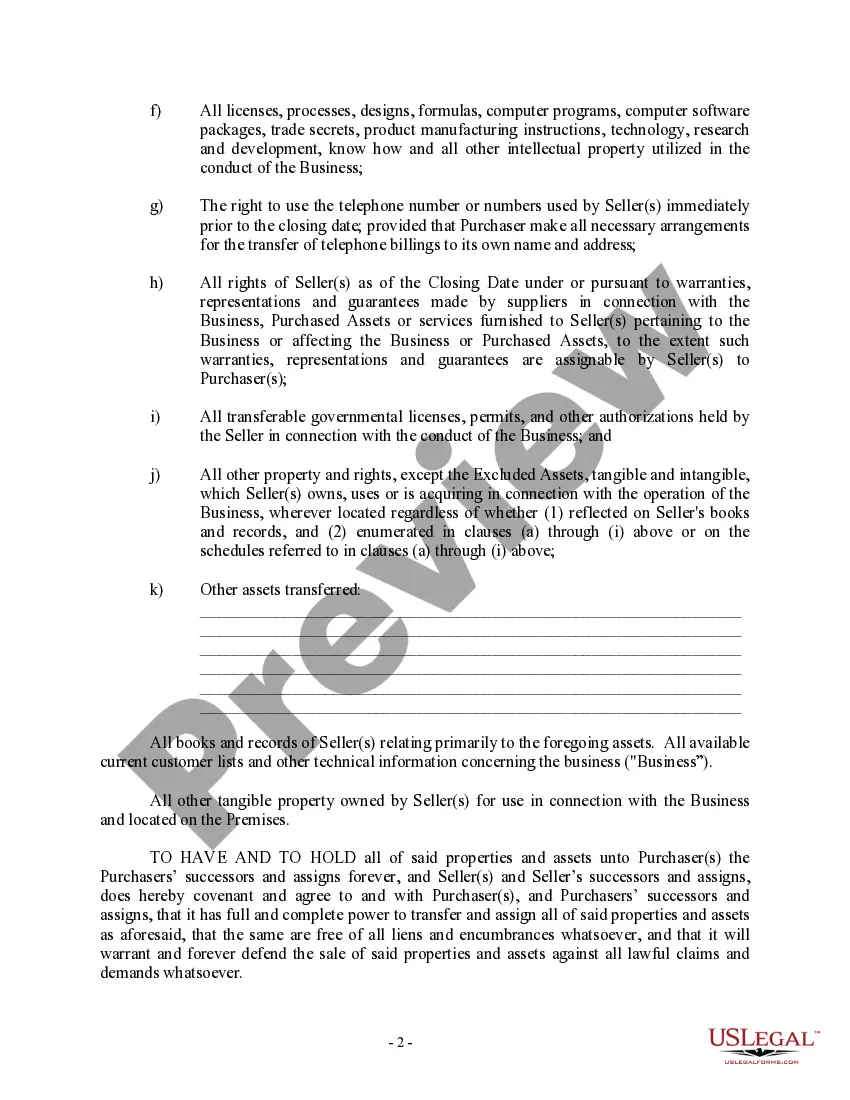

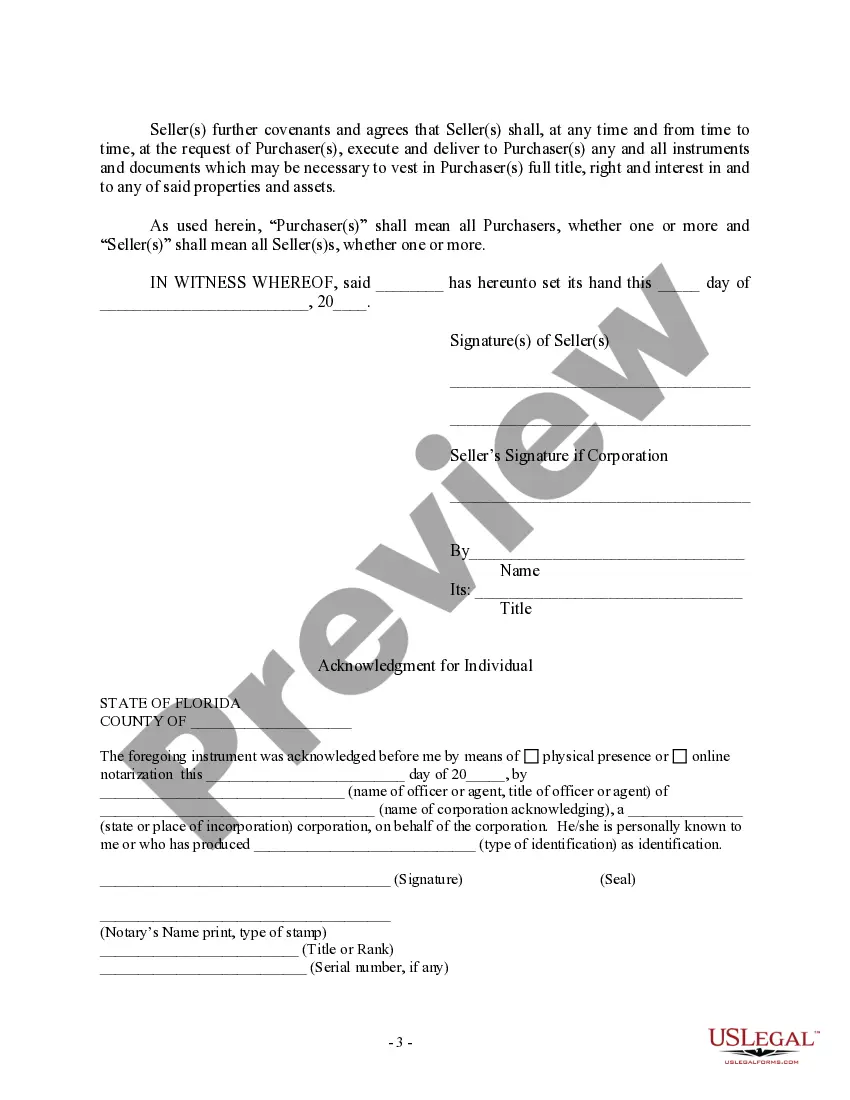

The Hillsborough Florida Bill of Sale in connection with the sale of a business by individual or corporate seller is a legal document that serves as proof of transfer of ownership of a business from one party to another. It outlines the terms and conditions agreed upon by the buyer and seller and provides a record of the transaction. In Hillsborough County, Florida, there are various types of bills of sale that may be used in connection with the sale of a business by an individual or corporate seller. These include: 1. Asset Purchase Agreement: This type of bill of sale is used when a buyer wishes to purchase specific assets of a business rather than acquiring the entire business entity. The agreement details the assets being sold, their value, and any liabilities or obligations the buyer may assume. 2. Stock Purchase Agreement: In cases where a buyer wants to acquire the entire business entity, including its stock, a stock purchase agreement is used. This document outlines the terms of the stock transfer, including the price per share, the number of shares being sold, and any warranties or representations made by the seller. 3. Membership Interest Purchase Agreement: This bill of sale is used when a buyer wants to purchase membership interests in a limited liability company (LLC), which grants them ownership rights in the company. The agreement outlines the terms of the sale, including the purchase price, the percentage of membership interests being sold, and any restrictions or conditions. Regardless of the specific type of bill of sale used, important details that should be included in the document are: a. Identification of the parties: The names and contact information of the buyer(s) and seller(s) involved in the transaction. b. Description of the business: A detailed description of the business being sold, including its name, address, industry, and any unique features or assets. c. Purchase price: The agreed-upon purchase price for the business or assets being sold. d. Payment terms: The payment terms, including how and when the payment will be made, any installments or down payments, and if there are any financing options involved. e. Representations and warranties: A list of representations and warranties made by the seller regarding the business's condition, ownership, financial status, and legal compliance. This protects the buyer from any unknown liabilities or issues. f. Closing details: Information about the closing date, location, and any other conditions necessary to complete the sale. g. Governing law: Specification of the governing law and jurisdiction under which any disputes arising from the agreement will be resolved. It is important to note that a Hillsborough Florida Bill of Sale for the sale of a business by an individual or corporate seller should always be drafted or reviewed by an attorney familiar with business and contract law to ensure compliance with local regulations and to protect the rights and interests of both parties involved.

Hillsborough Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

How to fill out Hillsborough Florida Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Hillsborough Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Hillsborough Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a few more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve selected the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Hillsborough Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!