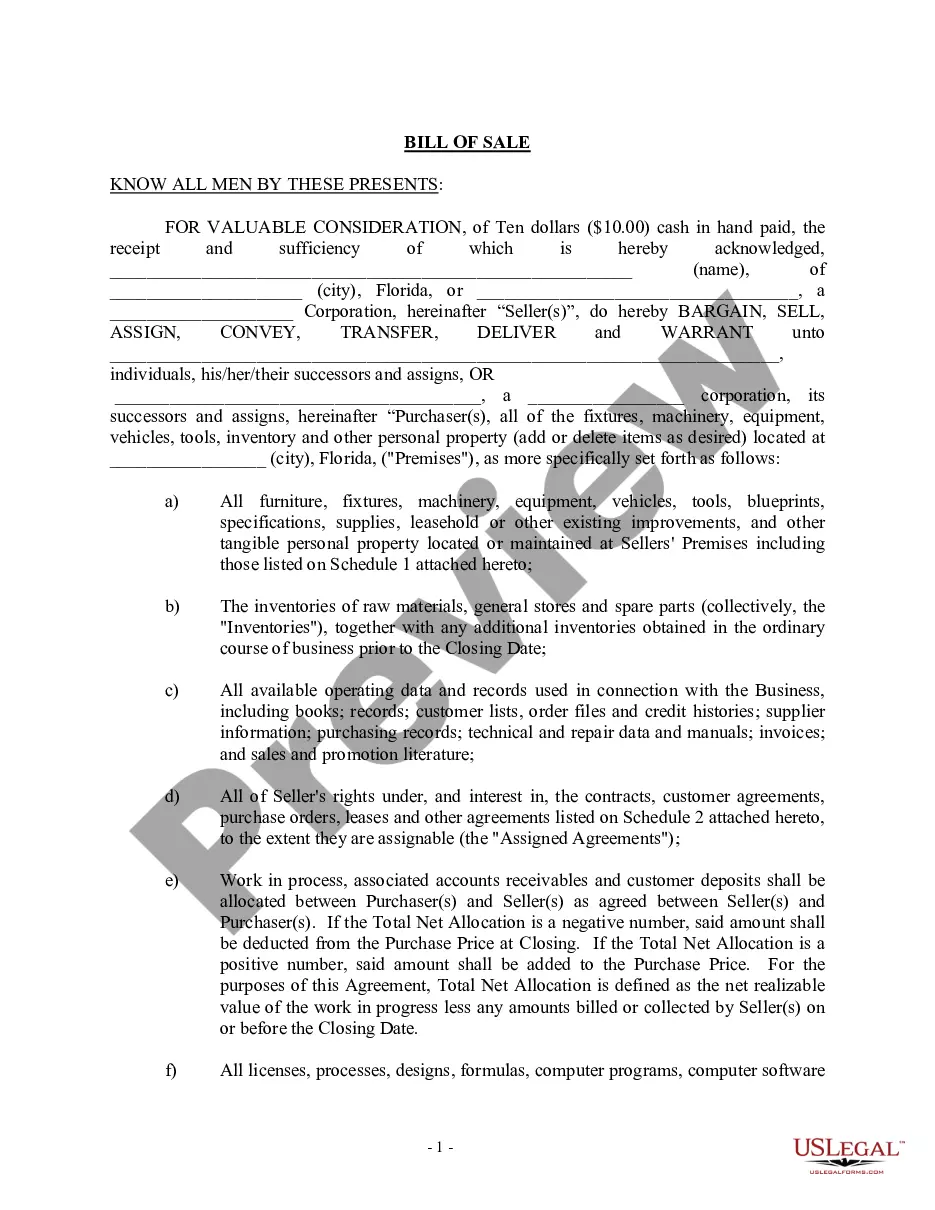

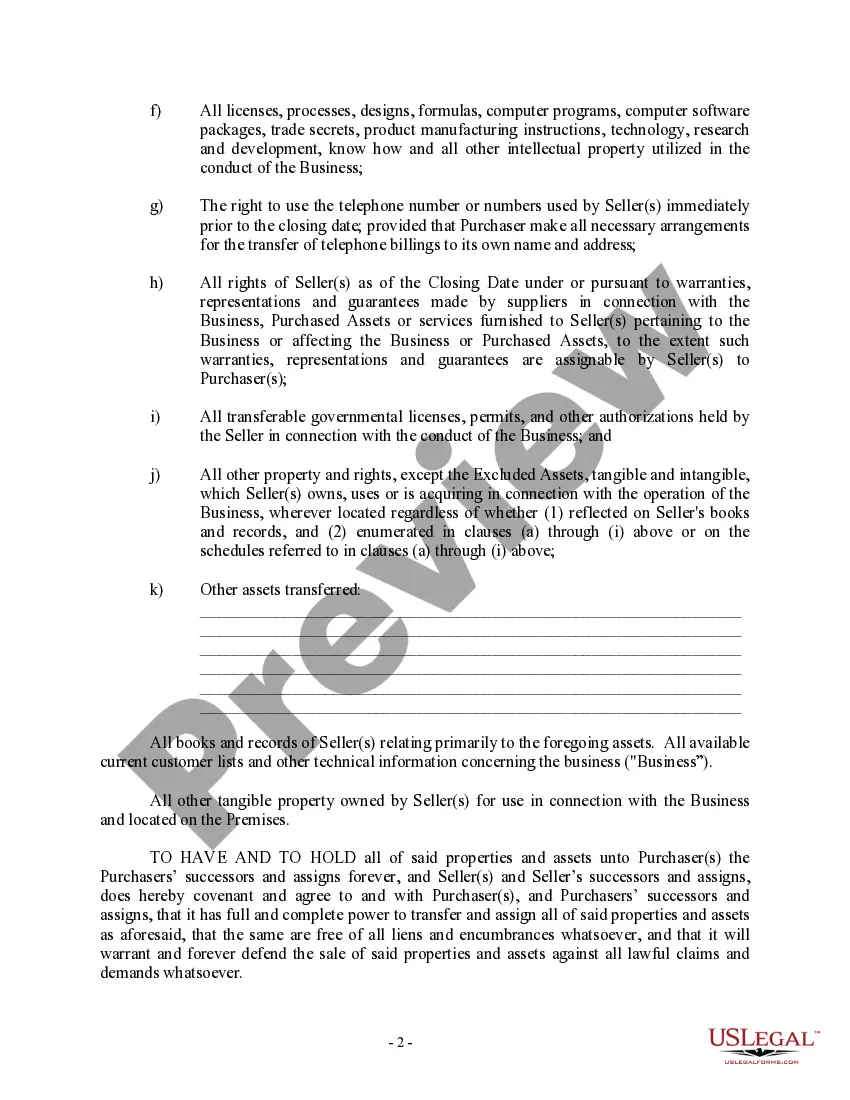

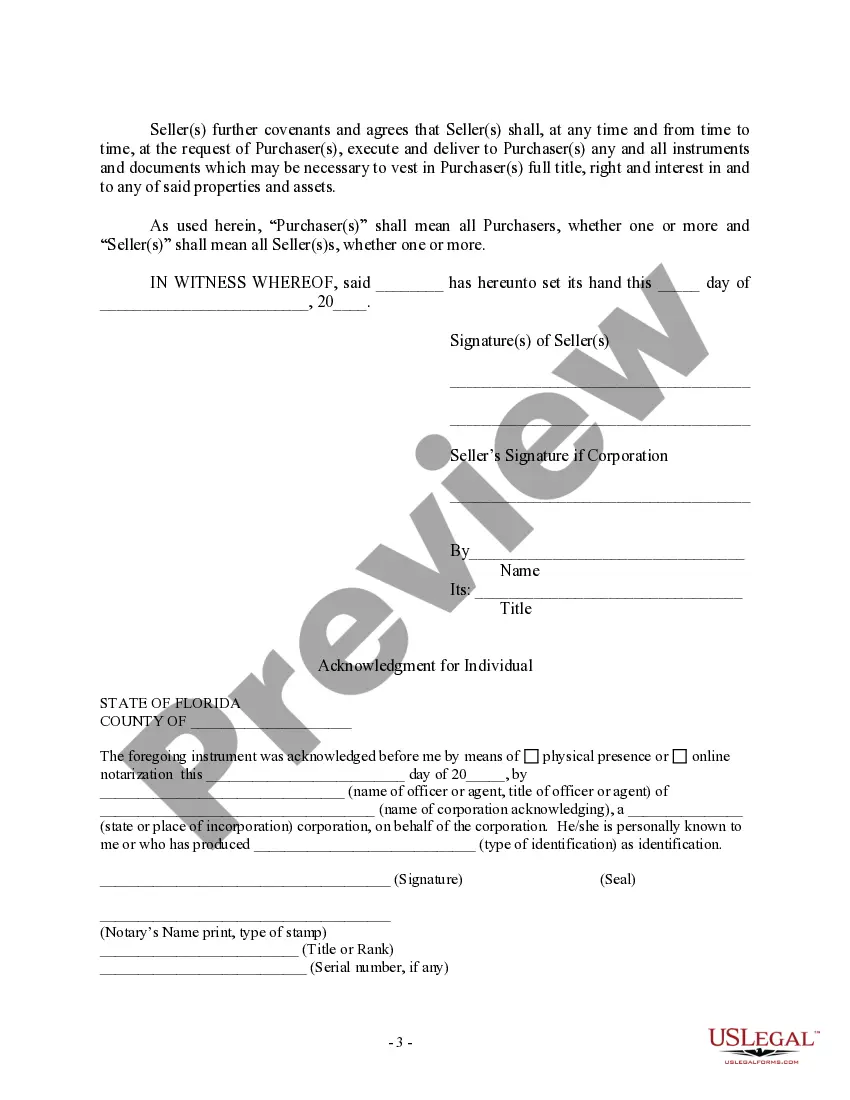

Pembroke Pines Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

How to fill out Florida Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller?

Are you seeking a reliable and budget-friendly legal forms provider to obtain the Pembroke Pines Florida Bill of Sale related to the Sale of Business by Individual or Corporate Seller? US Legal Forms is your ideal choice.

Whether you need a simple agreement to establish guidelines for living together with your partner or a collection of documents to facilitate your divorce through the legal system, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business purposes. All the templates we provide access to are not generic and are tailored to meet the standards of specific state and locality.

To obtain the document, you must Log In to your account, find the needed template, and click the Download button next to it. Please keep in mind that you can retrieve your previously purchased form templates at any moment from the My documents section.

Are you new to our service? Don’t worry. You can create an account within a few minutes, but first, make sure to do the following.

Now you can set up your account. Then select the subscription plan and continue to payment. Once the payment is completed, download the Pembroke Pines Florida Bill of Sale related to Sale of Business by Individual or Corporate Seller in any available file format. You can return to the website whenever you need and download the document again at no additional cost.

Acquiring updated legal documents has never been simpler. Try US Legal Forms today, and put an end to spending hours researching legal materials online.

- Confirm if the Pembroke Pines Florida Bill of Sale related to Sale of Business by Individual or Corporate Seller complies with the laws of your state and locality.

- Review the details of the form (if available) to understand who the document is designed for and its purpose.

- If the template does not fit your particular situation, restart your search.

Form popularity

FAQ

Generally, the buyer retains the original copy of the Pembroke Pines Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller for their records. The seller may also keep a copy for their documentation. In certain situations, such as vehicle sales, filing with relevant state authorities may be necessary. Always verify the specific filing requirements based on the type of sale and jurisdiction.

The seller usually fills out the Pembroke Pines Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, providing all necessary details about the business being sold. However, both parties should review the document to ensure accuracy. This collaborative approach helps prevent misunderstandings. Utilizing platforms like uslegalforms can streamline this process.

In West Virginia, the DMV typically requires a bill of sale for vehicle transactions, but it can also apply to business sales. The Pembroke Pines Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller can help facilitate this process. It documents the sale and assists in the transfer of ownership. Be sure to check local laws for any additional requirements.

Yes, a bill of sale is generally required in California for certain transactions, including the sale of businesses. Specifically, the Pembroke Pines Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller can ensure compliance with various state regulations. It serves as a record of transfer, protecting both buyer and seller. Always consult with a legal expert to confirm your specific needs.

The individual or corporate seller submits the Pembroke Pines Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller. It serves as proof of the transfer of ownership between the seller and the buyer. Ensuring the proper submission is essential for recording the transaction legally. Both parties may require copies for their records.

Yes, a bill of sale is considered proof of ownership in Florida when correctly executed. It indicates that a transaction has occurred between the seller and buyer. In the case of a Pembroke Pines Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, this document provides substantial legal backing for ownership claims, making it essential to maintain accurate records for future reference.

If you have lost the title to your car in Florida, you can apply for a replacement title through the Florida Department of Highway Safety and Motor Vehicles (DHSMV). You will need to provide documentation like a bill of sale or a court order to establish ownership. When using a Pembroke Pines Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, this document aids in verifying your claim to the vehicle and can expedite the process.

In Florida, proof of ownership can come from various documents, including a bill of sale, a vehicle title, or a deed. For a Pembroke Pines Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, this document acts as tangible evidence that ownership has been transferred. It is vital, especially when engaging in any professional or legal processes related to ownership confirmation.

A bill of sale becomes legally binding when it includes certain essential elements, such as the names of the buyer and seller, a description of the item being sold, and both parties' signatures. In the context of a Pembroke Pines Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, clarity and mutual consent regarding the business terms are critical. Ensuring all these components are present protects both parties in the transaction.

Yes, a bill of sale is a recognized legal document in Florida. It serves as proof of the transfer of ownership of goods between parties. Specifically, when dealing with a Pembroke Pines Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller, this document ensures both parties adhere to the sales agreement.