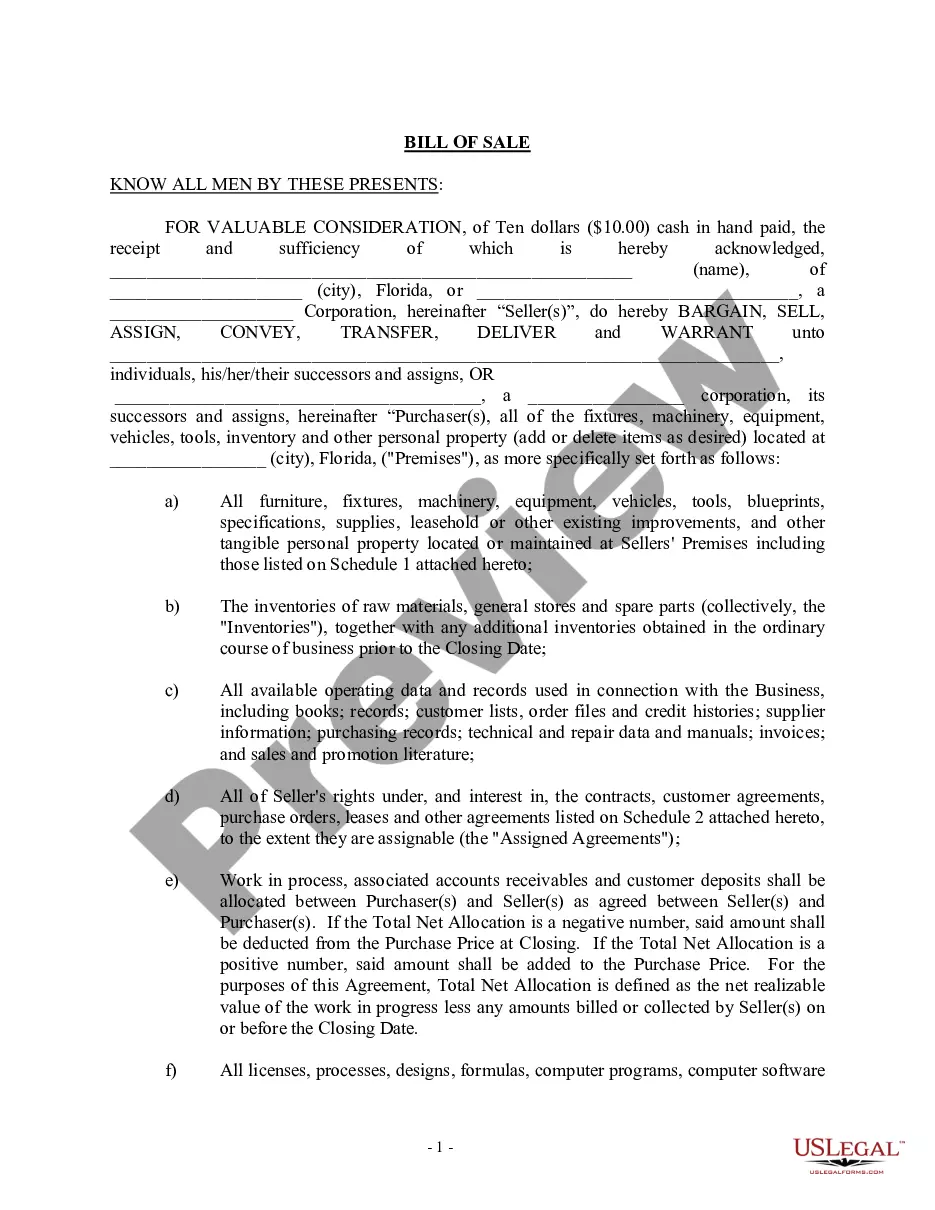

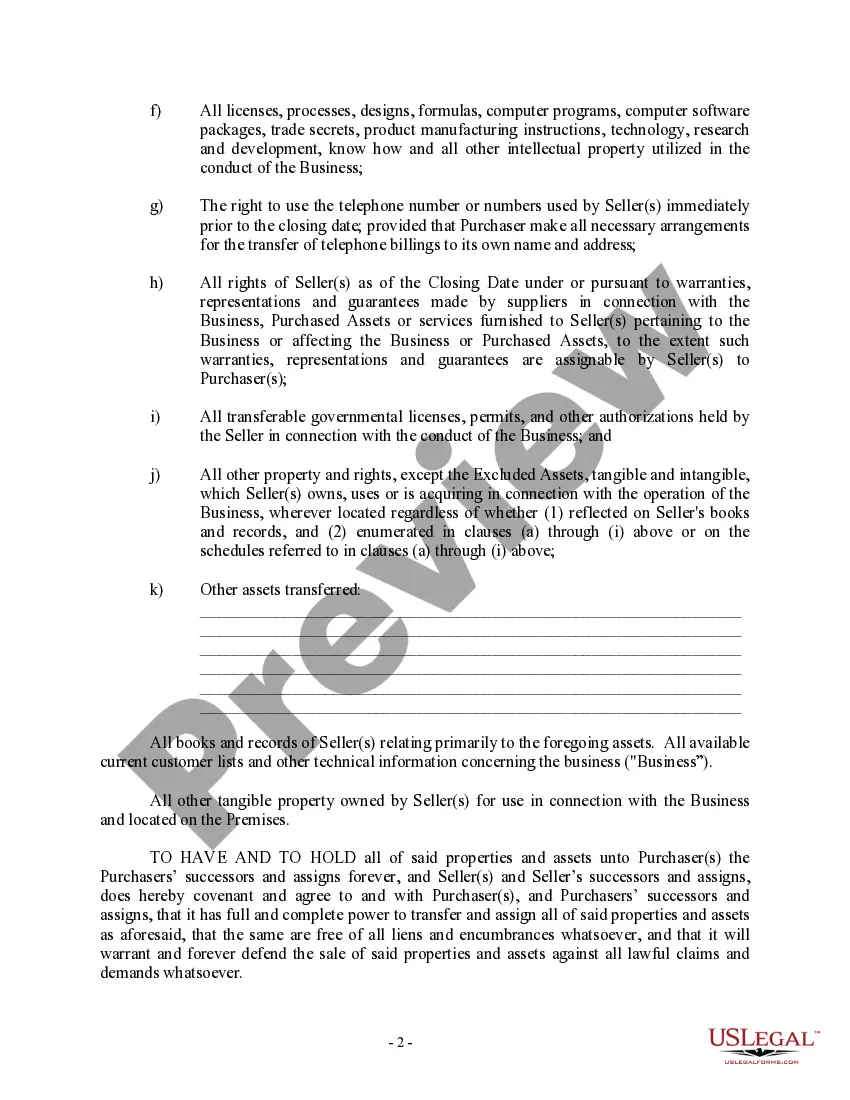

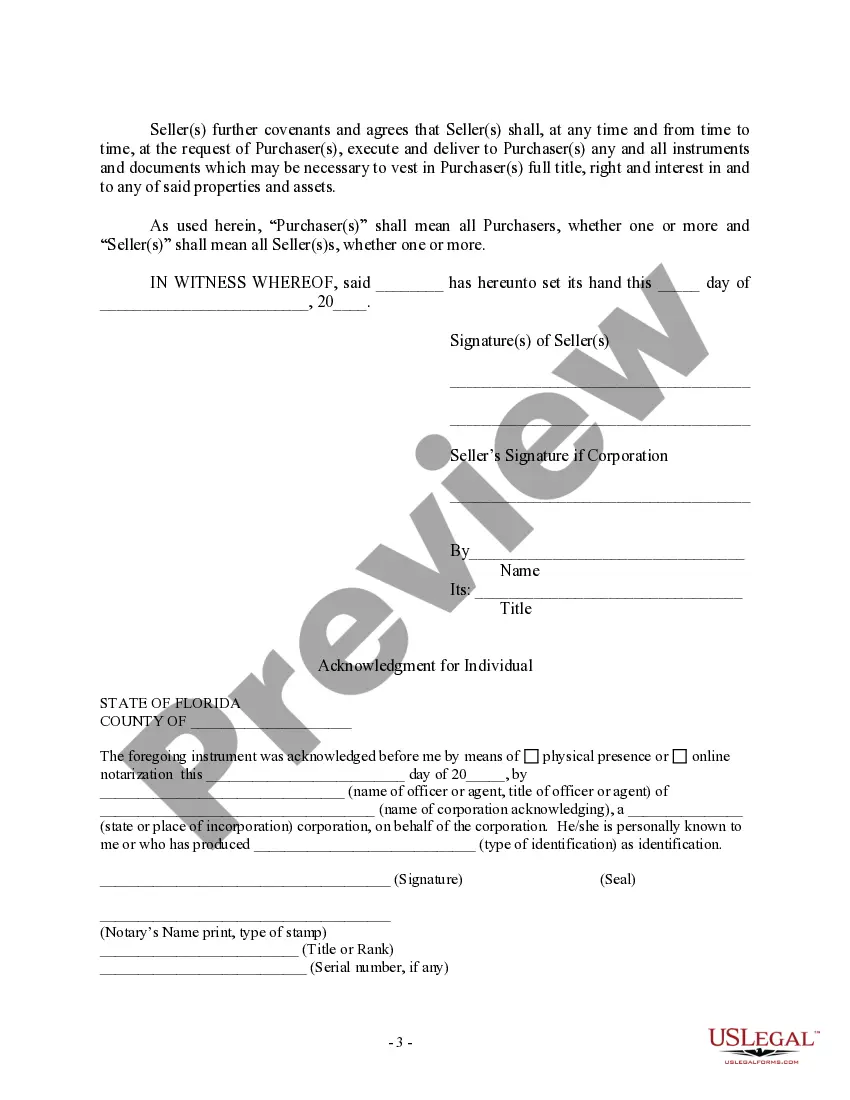

A bill of sale is a legal document that serves as proof of a transaction between a buyer and a seller. In the context of a sale of business in Tampa, Florida, the bill of sale acts as a crucial document to legally transfer ownership rights from an individual or a corporate seller to a buyer. This document outlines the terms and conditions of the sale, ensuring both parties are protected in the transaction. The Tampa Florida Bill of Sale in Connection with the Sale of Business by an Individual or Corporate Seller contains various essential elements to ensure a smooth transfer of ownership: 1. Parties Involved: The bill of sale identifies the buyer and seller, including their legal names, addresses, and contact information, to clearly establish the individuals or entities involved in the business sale. 2. Business Description: Detailed information about the business being sold is included in the bill of sale. This may comprise the business name, type, address, assets, and inventory to provide a comprehensive understanding of what the buyer is acquiring. 3. Purchase Price and Payment Terms: The bill of sale outlines the agreed-upon sale price for the business. It is important to clearly specify details such as whether the price includes tangible assets, inventory, or intangible assets. Payment terms, such as the method of payment and any installment plans, should also be included. 4. Representations and Warranties: The document may include representations and warranties provided by the seller to the buyer. This section aims to disclose the condition of the business, any ongoing legal issues, pending lawsuits, or outstanding debts, ensuring transparency during the transaction. 5. Transfer of Assets: The bill of sale should specifically identify the assets being transferred to the buyer. This includes tangible assets like equipment, furniture, and inventory, as well as intangible assets such as licenses, permits, trademarks, and intellectual property rights. 6. Closing and Possession: The bill of sale indicates the date when the ownership transfer will occur officially. It also outlines the process for handing over possession of the business, including any inspection period or training provided to the buyer. 7. Indemnification: This section provides protection to both the buyer and seller, stating that each party will indemnify and hold the other harmless from any liabilities arising from the transaction before or after the closing. Types of Tampa Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller: 1. Asset Purchase Agreement: This bill of sale type focuses on the specific assets being transferred from the seller to the buyer, ensuring the buyer gains ownership of designated assets while excluding any unwanted liabilities. 2. Stock Purchase Agreement: In cases where the business is a corporation, this bill of sale type is used to transfer ownership of stocks, allowing the buyer to acquire the corporation's shares rather than individual assets. 3. Company Purchase Agreement: This type of bill of sale is utilized when the buyer is interested in acquiring an entire entity, including all its assets and liabilities, as well as contracts, employees, and goodwill. In conclusion, the Tampa Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller serves as a vital legal document that outlines the terms, conditions, and specifics of a business sale. It provides protection to both the buyer and seller by documenting the agreed-upon terms and ensuring a smooth transfer of ownership. Various types of bill of sale documents cater to different scenarios, from asset-based transactions to complete entity acquisitions.

Tampa Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

How to fill out Tampa Florida Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller?

Do you need a reliable and affordable legal forms supplier to buy the Tampa Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller? US Legal Forms is your go-to option.

No matter if you require a simple agreement to set regulations for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked based on the requirements of specific state and area.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Tampa Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller conforms to the regulations of your state and local area.

- Read the form’s details (if available) to learn who and what the form is intended for.

- Restart the search in case the template isn’t good for your specific scenario.

Now you can register your account. Then pick the subscription option and proceed to payment. Once the payment is completed, download the Tampa Florida Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller in any available file format. You can get back to the website at any time and redownload the form without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting your valuable time learning about legal paperwork online once and for all.