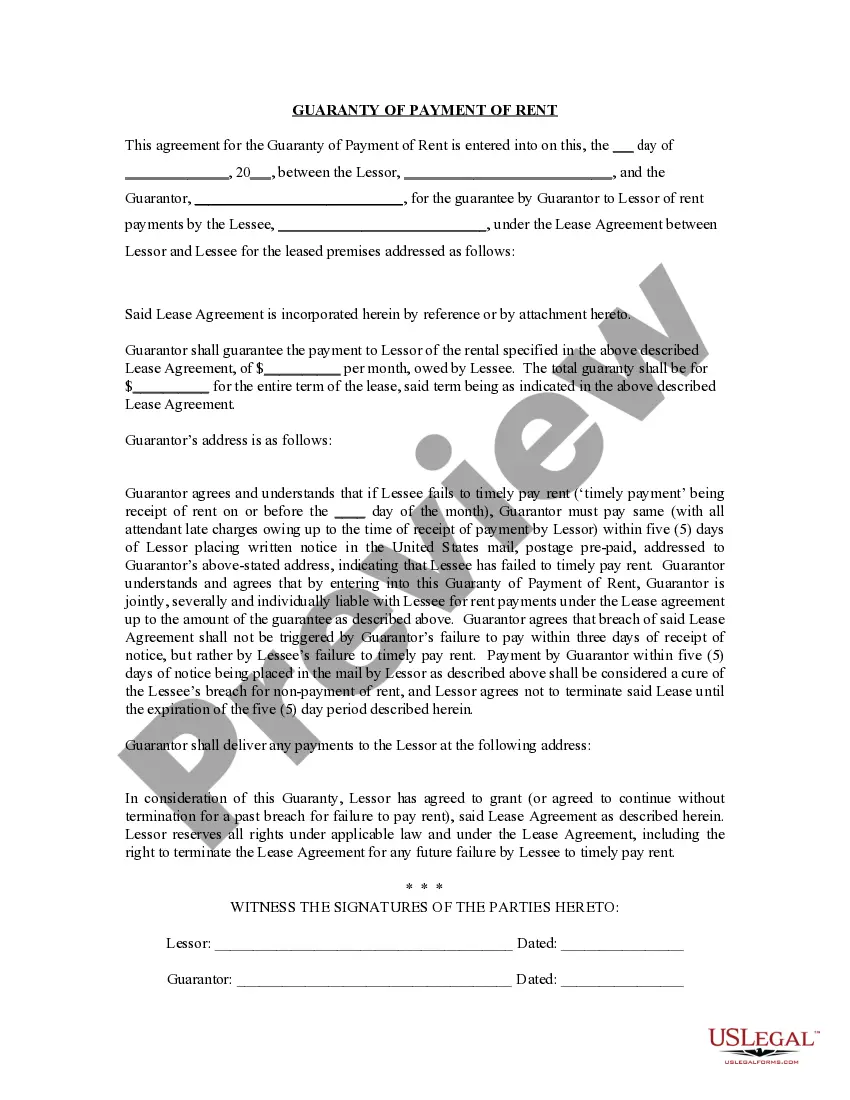

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

The Broward Florida Guaranty or Guarantee of Payment of Rent is a legal document that provides assurance to the landlord, often referred to as the beneficiary, that the rental payments will be made in a timely manner by the tenant. This guarantee acts as a safety net for landlords, ensuring that they will receive the agreed-upon rent amount even if the tenant defaults. There are various types of Broward Florida Guaranty or Guarantee of Payment of Rent that can be utilized depending on the specific circumstances and requirements. Some key types include: 1. Individual Guarantor: This type of guarantee involves an individual, often a third party, who guarantees the rent payment on behalf of the tenant. The guarantor assumes responsibility for making the rent payments in case the tenant fails to do so. 2. Corporate Guarantor: In some cases, a corporation or company may act as a guarantor for the tenant's rental payment obligations. This type of guarantee demonstrates financial stability and ensures that the rental payments will be fulfilled. 3. Parental Guarantor: Particularly common for students or young adults, a parental guarantor involves the parents or legal guardians of the tenant assuming responsibility for the rent payments. This type of guarantee offers additional security for landlords by leveraging the financial stability of the parents. 4. Joint Guarantors: In situations where multiple tenants co-sign a lease agreement, joint guarantors may be required. This type of guarantee ensures that each co-tenant assumes joint responsibility for the full rent amount, protecting the landlord from potential defaults by any individual tenant. The Broward Florida Guaranty or Guarantee of Payment of Rent acts as a binding legal contract, outlining the obligations and liabilities of the guarantor. The agreement typically includes essential details such as the names of parties involved, the rental property address, the amount of rent, and the duration of the guarantee. Landlords often require such guarantees to mitigate the risk of rental income loss and safeguard their investment. This legal provision assures landlords that even in the event of tenant default, the rent will still be paid, reducing potential financial burdens and maintaining a steady income stream. It is crucial for both tenants and guarantors to carefully review and understand the terms and conditions of the Broward Florida Guaranty or Guarantee of Payment of Rent before signing. Seeking legal advice is advisable to ensure compliance with local laws and regulations, protecting the rights and interests of all parties involved.