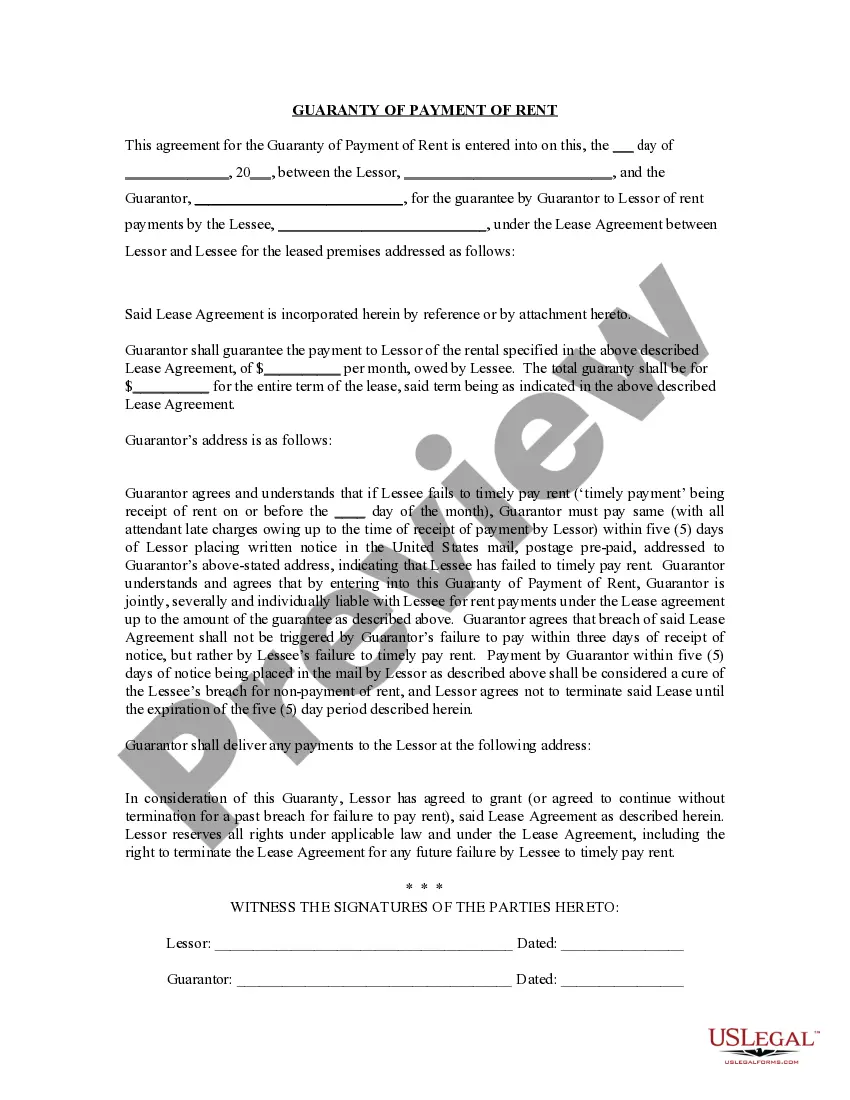

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor). The Jacksonville Florida Guaranty or Guarantee of Payment of Rent refers to a legally binding agreement between a tenant and a guarantor, ensuring that the tenant will fulfill their rental payment obligations to the landlord. This guarantee is often required by landlords to protect their financial interests in cases where the tenant fails to make rental payments on time or breaches the lease agreement. It serves as a way to provide assurance to landlords that they will receive the full amount of rent they are owed, even if the tenant is unable to pay. There are typically two types of Jacksonville Florida Guaranty or Guarantee of Payment of Rent: 1. Individual Guaranty: This type of guarantee involves an individual acting as the guarantor. The individual guarantor takes on the responsibility of paying the rent themselves if the tenant defaults. The individual guarantor's financial stability and creditworthiness are evaluated by the landlord before finalizing the agreement. This type of guaranty is commonly used when the tenant has limited or no credit history, insufficient income, or poor credit score. 2. Corporate Guaranty: In some cases, particularly for commercial properties or when dealing with a business entity as a tenant, a corporate guaranty may be required. This type of guarantee involves a corporation or another business entity taking on the responsibility of paying rent if the tenant defaults. The landlord evaluates the financial standing, assets, and credibility of the corporation before entering into the agreement. A corporate guaranty offers an added layer of security as it often involves a financially stable organization with a proven track record. It is important to note that the Guaranty or Guarantee of Payment of Rent is a legally binding document and must adhere to applicable laws and regulations in Jacksonville, Florida. Both the tenant and the guarantor should thoroughly review the agreement and understand their obligations and liabilities before signing. Often, the guarantor is required to sign the guarantee alongside the tenant, accepting liability for any unpaid rent or damages resulting from the tenant's breach of lease. To execute a valid Jacksonville Florida Guaranty or Guarantee of Payment of Rent, key elements such as the names and addresses of the tenant, guarantor, and landlord, the property address, lease duration, and specific payment terms are usually included. Additionally, terms regarding the guarantor's release from the obligation and any conditions for terminating the guarantee may also be outlined in the document. Overall, the Jacksonville Florida Guaranty or Guarantee of Payment of Rent serves as a protective measure for landlords to ensure the consistent collection of rental income, especially when dealing with tenants who may pose a higher risk in terms of payment default.

The Jacksonville Florida Guaranty or Guarantee of Payment of Rent refers to a legally binding agreement between a tenant and a guarantor, ensuring that the tenant will fulfill their rental payment obligations to the landlord. This guarantee is often required by landlords to protect their financial interests in cases where the tenant fails to make rental payments on time or breaches the lease agreement. It serves as a way to provide assurance to landlords that they will receive the full amount of rent they are owed, even if the tenant is unable to pay. There are typically two types of Jacksonville Florida Guaranty or Guarantee of Payment of Rent: 1. Individual Guaranty: This type of guarantee involves an individual acting as the guarantor. The individual guarantor takes on the responsibility of paying the rent themselves if the tenant defaults. The individual guarantor's financial stability and creditworthiness are evaluated by the landlord before finalizing the agreement. This type of guaranty is commonly used when the tenant has limited or no credit history, insufficient income, or poor credit score. 2. Corporate Guaranty: In some cases, particularly for commercial properties or when dealing with a business entity as a tenant, a corporate guaranty may be required. This type of guarantee involves a corporation or another business entity taking on the responsibility of paying rent if the tenant defaults. The landlord evaluates the financial standing, assets, and credibility of the corporation before entering into the agreement. A corporate guaranty offers an added layer of security as it often involves a financially stable organization with a proven track record. It is important to note that the Guaranty or Guarantee of Payment of Rent is a legally binding document and must adhere to applicable laws and regulations in Jacksonville, Florida. Both the tenant and the guarantor should thoroughly review the agreement and understand their obligations and liabilities before signing. Often, the guarantor is required to sign the guarantee alongside the tenant, accepting liability for any unpaid rent or damages resulting from the tenant's breach of lease. To execute a valid Jacksonville Florida Guaranty or Guarantee of Payment of Rent, key elements such as the names and addresses of the tenant, guarantor, and landlord, the property address, lease duration, and specific payment terms are usually included. Additionally, terms regarding the guarantor's release from the obligation and any conditions for terminating the guarantee may also be outlined in the document. Overall, the Jacksonville Florida Guaranty or Guarantee of Payment of Rent serves as a protective measure for landlords to ensure the consistent collection of rental income, especially when dealing with tenants who may pose a higher risk in terms of payment default.