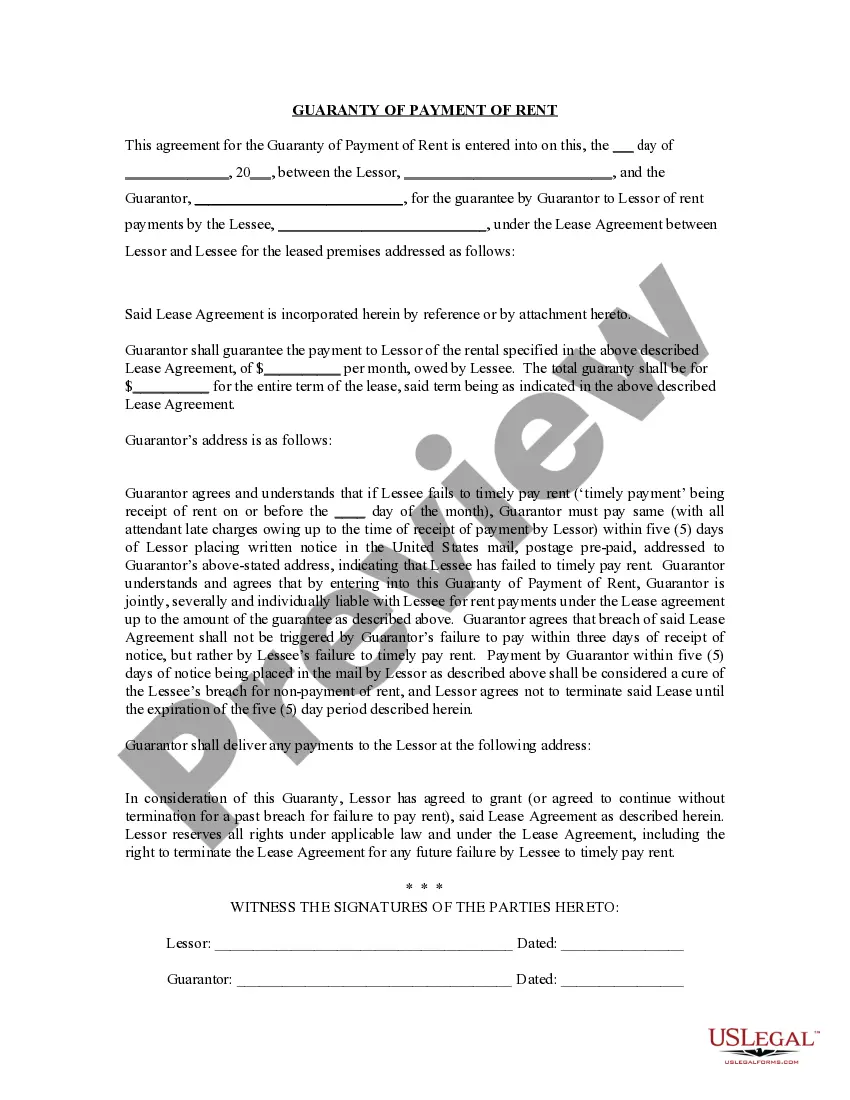

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor). A Lakeland Florida Guaranty or Guarantee of Payment of Rent is a legally binding contract between a landlord and a guarantor that helps ensure the payment of rent in case the tenant defaults or is unable to meet their financial obligations. This provides a significant layer of financial security for landlords, especially when dealing with tenants who may pose a higher risk. 1. Personal Guaranty: A personal guaranty is the most common type of guarantee used in Lakeland, Florida. It involves an individual, often a close associate of the tenant, who pledges their personal assets and creditworthiness to cover any outstanding rent payments if the tenant fails to fulfill their obligations. 2. Corporate Guaranty: In some cases, landlords may require a corporate guaranty, which involves a company taking on the responsibility of rent payment instead of an individual. This is often required when the tenant is a business entity or a franchise. 3. Limited Guaranty: A limited guaranty sets a specific dollar amount or time period within which the guarantor is liable for covering unpaid rent. This type of guarantee offers some level of protection to the guarantor by limiting their liability. 4. Continuing Guaranty: A continuing guaranty is an agreement that extends beyond the initial lease term, covering any potential rental defaults that may occur during lease renewals or extensions. This type of guarantee ensures the landlord has ongoing protection throughout the tenancy period. Lakeland Florida Guaranty or Guarantee of Payment of Rent serves as a safeguard for landlords, minimizing financial risks associated with renting properties. It is essential for landlords to carefully consider the terms and conditions of the guarantees in order to protect their interests and secure consistent rental income. Furthermore, it is important to consult legal professionals to ensure compliance with local regulations and maximize the effectiveness of such guarantees in the event of non-payment or default by tenants.

A Lakeland Florida Guaranty or Guarantee of Payment of Rent is a legally binding contract between a landlord and a guarantor that helps ensure the payment of rent in case the tenant defaults or is unable to meet their financial obligations. This provides a significant layer of financial security for landlords, especially when dealing with tenants who may pose a higher risk. 1. Personal Guaranty: A personal guaranty is the most common type of guarantee used in Lakeland, Florida. It involves an individual, often a close associate of the tenant, who pledges their personal assets and creditworthiness to cover any outstanding rent payments if the tenant fails to fulfill their obligations. 2. Corporate Guaranty: In some cases, landlords may require a corporate guaranty, which involves a company taking on the responsibility of rent payment instead of an individual. This is often required when the tenant is a business entity or a franchise. 3. Limited Guaranty: A limited guaranty sets a specific dollar amount or time period within which the guarantor is liable for covering unpaid rent. This type of guarantee offers some level of protection to the guarantor by limiting their liability. 4. Continuing Guaranty: A continuing guaranty is an agreement that extends beyond the initial lease term, covering any potential rental defaults that may occur during lease renewals or extensions. This type of guarantee ensures the landlord has ongoing protection throughout the tenancy period. Lakeland Florida Guaranty or Guarantee of Payment of Rent serves as a safeguard for landlords, minimizing financial risks associated with renting properties. It is essential for landlords to carefully consider the terms and conditions of the guarantees in order to protect their interests and secure consistent rental income. Furthermore, it is important to consult legal professionals to ensure compliance with local regulations and maximize the effectiveness of such guarantees in the event of non-payment or default by tenants.