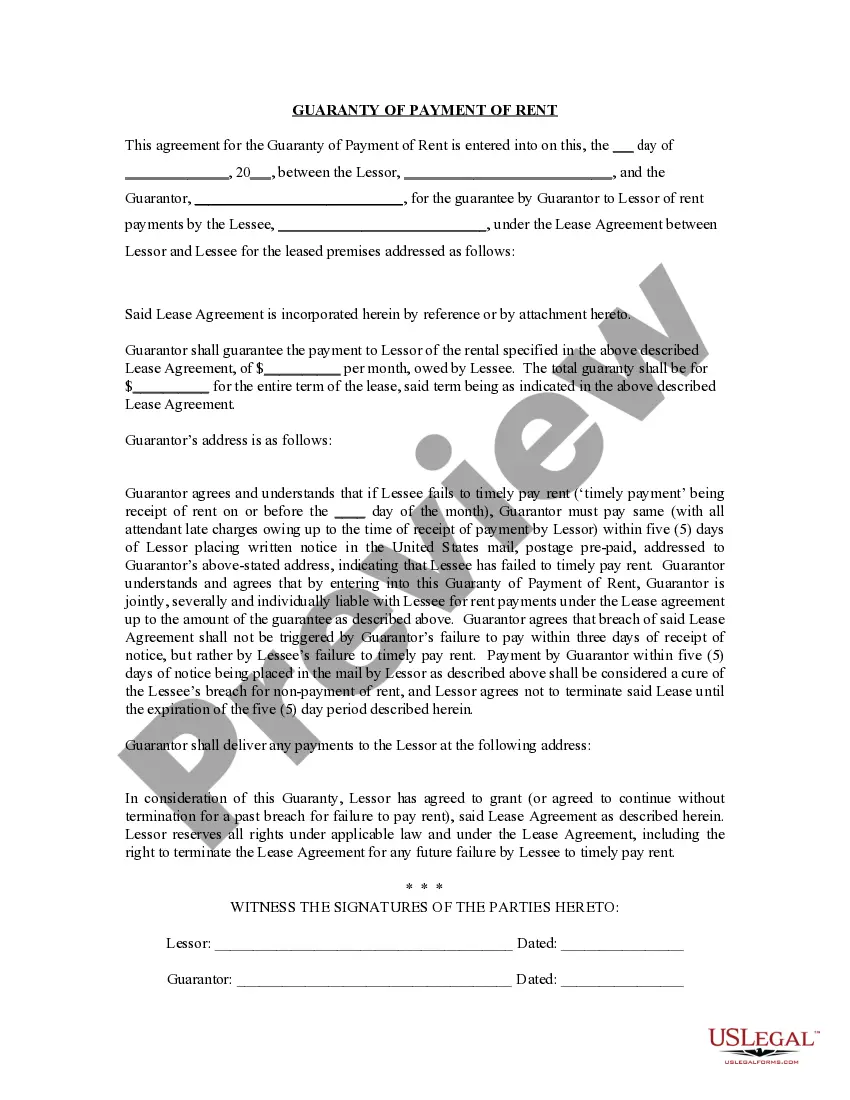

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor). Miami-Dade Florida Guaranty or Guarantee of Payment of Rent is a legally binding agreement designed to protect landlords and property owners against potential financial losses resulting from tenant defaulting on rent payments. This guarantee ensures that the property's rental income remains consistent and provides landlords with added financial security. There are different types of Miami-Dade Florida Guaranty or Guarantee of Payment of Rent that landlords may implement based on their specific needs. Some common types include: 1. Personal Guaranty: This type of guarantee involves an individual taking responsibility for ensuring rent payments are made on time. Typically, the guarantor is financially stable and has a proven track record of meeting financial obligations, such as a parent co-signing the lease on behalf of a student tenant. 2. Corporate Guaranty: In situations where the tenant is a business entity, such as a corporation or limited liability company (LLC), a corporate guaranty may be required. This form of guarantee ensures that the business itself is responsible for rent payments and offers additional protection for the landlord. 3. Letter of Credit: A letter of credit serves as a guarantee of payment issued by a financial institution. This document assures the landlord that the issuing bank will make rent payments on behalf of the tenant, up to a specific amount, if the tenant defaults. It provides landlords with an added layer of financial security. 4. Security Deposit: Although not strictly considered a guarantee of payment of rent, the security deposit held by landlords can act as a form of collateral in case of non-payment. In Miami-Dade Florida, landlords typically hold a security deposit of up to two months' rent, which can be used to cover outstanding rent or damages caused by the tenant. Implementing a Miami-Dade Florida Guaranty or Guarantee of Payment of Rent is vital for landlords to safeguard their investment and ensure consistent rental income. These guarantees provide peace of mind by holding either the tenant, their parent, a business entity, or a financial institution responsible for rent obligations. By considering these various types of guarantees, landlords in Miami-Dade Florida can choose the most suitable option that aligns with their specific circumstances and requirements.

Miami-Dade Florida Guaranty or Guarantee of Payment of Rent is a legally binding agreement designed to protect landlords and property owners against potential financial losses resulting from tenant defaulting on rent payments. This guarantee ensures that the property's rental income remains consistent and provides landlords with added financial security. There are different types of Miami-Dade Florida Guaranty or Guarantee of Payment of Rent that landlords may implement based on their specific needs. Some common types include: 1. Personal Guaranty: This type of guarantee involves an individual taking responsibility for ensuring rent payments are made on time. Typically, the guarantor is financially stable and has a proven track record of meeting financial obligations, such as a parent co-signing the lease on behalf of a student tenant. 2. Corporate Guaranty: In situations where the tenant is a business entity, such as a corporation or limited liability company (LLC), a corporate guaranty may be required. This form of guarantee ensures that the business itself is responsible for rent payments and offers additional protection for the landlord. 3. Letter of Credit: A letter of credit serves as a guarantee of payment issued by a financial institution. This document assures the landlord that the issuing bank will make rent payments on behalf of the tenant, up to a specific amount, if the tenant defaults. It provides landlords with an added layer of financial security. 4. Security Deposit: Although not strictly considered a guarantee of payment of rent, the security deposit held by landlords can act as a form of collateral in case of non-payment. In Miami-Dade Florida, landlords typically hold a security deposit of up to two months' rent, which can be used to cover outstanding rent or damages caused by the tenant. Implementing a Miami-Dade Florida Guaranty or Guarantee of Payment of Rent is vital for landlords to safeguard their investment and ensure consistent rental income. These guarantees provide peace of mind by holding either the tenant, their parent, a business entity, or a financial institution responsible for rent obligations. By considering these various types of guarantees, landlords in Miami-Dade Florida can choose the most suitable option that aligns with their specific circumstances and requirements.