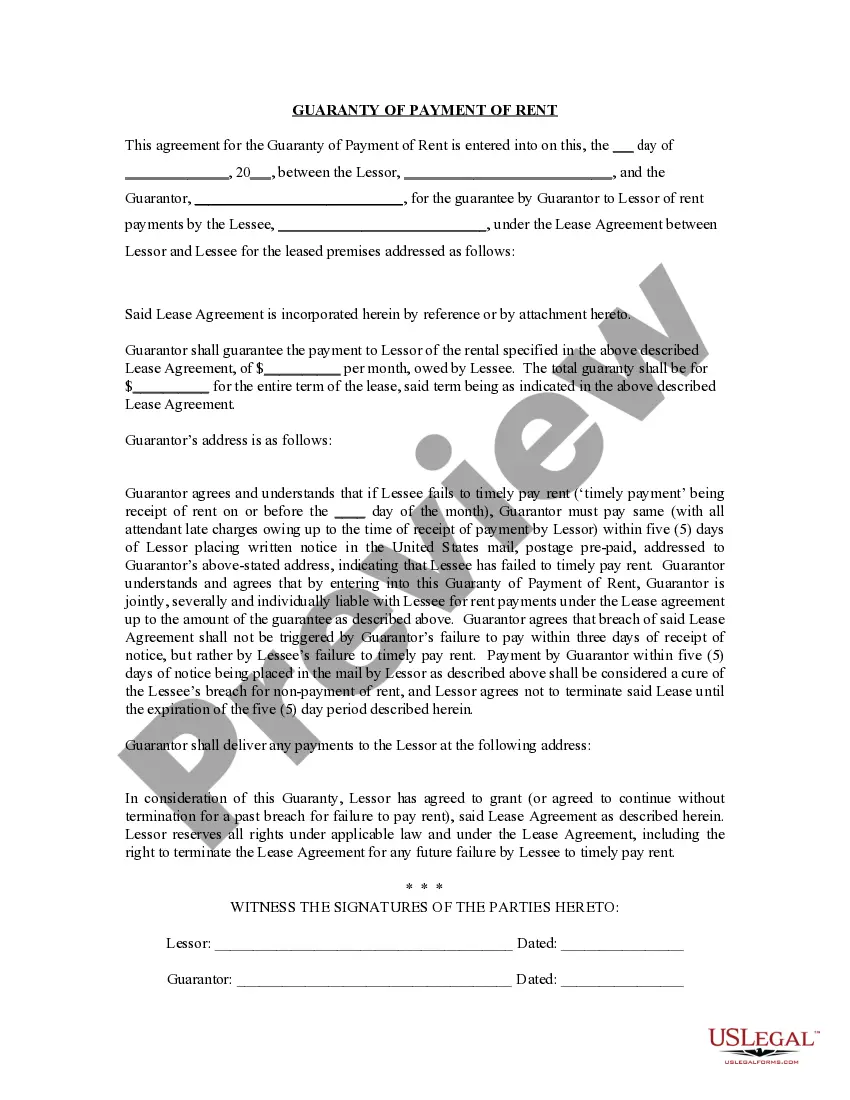

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor). Miramar Florida Guaranty or Guarantee of Payment of Rent is a legal agreement that ensures the landlord or property owner receives the agreed-upon rent from the tenant. This guarantee acts as a financial safety net for landlords in case the tenant defaults on paying rent. The Miramar Florida Guaranty or Guarantee of Payment of Rent can come in various forms, with each type offering different terms and conditions. One common type is the personal guaranty, where an individual, such as a family member or friend, guarantees to pay the rent if the tenant fails to do so. This provides an additional layer of assurance for the landlord. Another type is the corporate guaranty, where a corporation or business entity assumes the responsibility of paying the rent on behalf of the tenant. This is often used when a business leases a property, and the landlord requires assurance that the rent will be paid even if the business faces financial difficulties. There might also be a lease guaranty, which is typically signed when there are multiple tenants sharing a property. In such cases, each tenant may be required to guarantee the payment of their portion of the rent. This ensures that if one tenant fails to pay, the other tenants are still liable for their share, minimizing the risk for the landlord. The Miramar Florida Guaranty or Guarantee of Payment of Rent typically includes vital information such as the names of the parties involved, the property address, the amount of rent being guaranteed, and the duration of the guarantee. It may also outline the circumstances under which the guaranty is triggered, such as non-payment of rent or breach of lease terms. It is important to note that the terms and conditions of the Miramar Florida Guaranty or Guarantee of Payment of Rent may vary based on individual agreements between landlords and tenants. Consulting with a legal professional is advisable to ensure that the agreement complies with local laws and provides adequate protection for both parties involved. In summary, a Miramar Florida Guaranty or Guarantee of Payment of Rent is a legally binding agreement that serves as a safeguard for landlords, ensuring that rent is paid even if the tenant defaults. Different types of guaranties include personal guaranty, corporate guaranty, and lease guaranty, each offering distinct terms and conditions to protect the landlord's financial interests. Understanding these agreements is essential for both landlords and tenants to avoid any potential disputes or financial uncertainties.

Miramar Florida Guaranty or Guarantee of Payment of Rent is a legal agreement that ensures the landlord or property owner receives the agreed-upon rent from the tenant. This guarantee acts as a financial safety net for landlords in case the tenant defaults on paying rent. The Miramar Florida Guaranty or Guarantee of Payment of Rent can come in various forms, with each type offering different terms and conditions. One common type is the personal guaranty, where an individual, such as a family member or friend, guarantees to pay the rent if the tenant fails to do so. This provides an additional layer of assurance for the landlord. Another type is the corporate guaranty, where a corporation or business entity assumes the responsibility of paying the rent on behalf of the tenant. This is often used when a business leases a property, and the landlord requires assurance that the rent will be paid even if the business faces financial difficulties. There might also be a lease guaranty, which is typically signed when there are multiple tenants sharing a property. In such cases, each tenant may be required to guarantee the payment of their portion of the rent. This ensures that if one tenant fails to pay, the other tenants are still liable for their share, minimizing the risk for the landlord. The Miramar Florida Guaranty or Guarantee of Payment of Rent typically includes vital information such as the names of the parties involved, the property address, the amount of rent being guaranteed, and the duration of the guarantee. It may also outline the circumstances under which the guaranty is triggered, such as non-payment of rent or breach of lease terms. It is important to note that the terms and conditions of the Miramar Florida Guaranty or Guarantee of Payment of Rent may vary based on individual agreements between landlords and tenants. Consulting with a legal professional is advisable to ensure that the agreement complies with local laws and provides adequate protection for both parties involved. In summary, a Miramar Florida Guaranty or Guarantee of Payment of Rent is a legally binding agreement that serves as a safeguard for landlords, ensuring that rent is paid even if the tenant defaults. Different types of guaranties include personal guaranty, corporate guaranty, and lease guaranty, each offering distinct terms and conditions to protect the landlord's financial interests. Understanding these agreements is essential for both landlords and tenants to avoid any potential disputes or financial uncertainties.