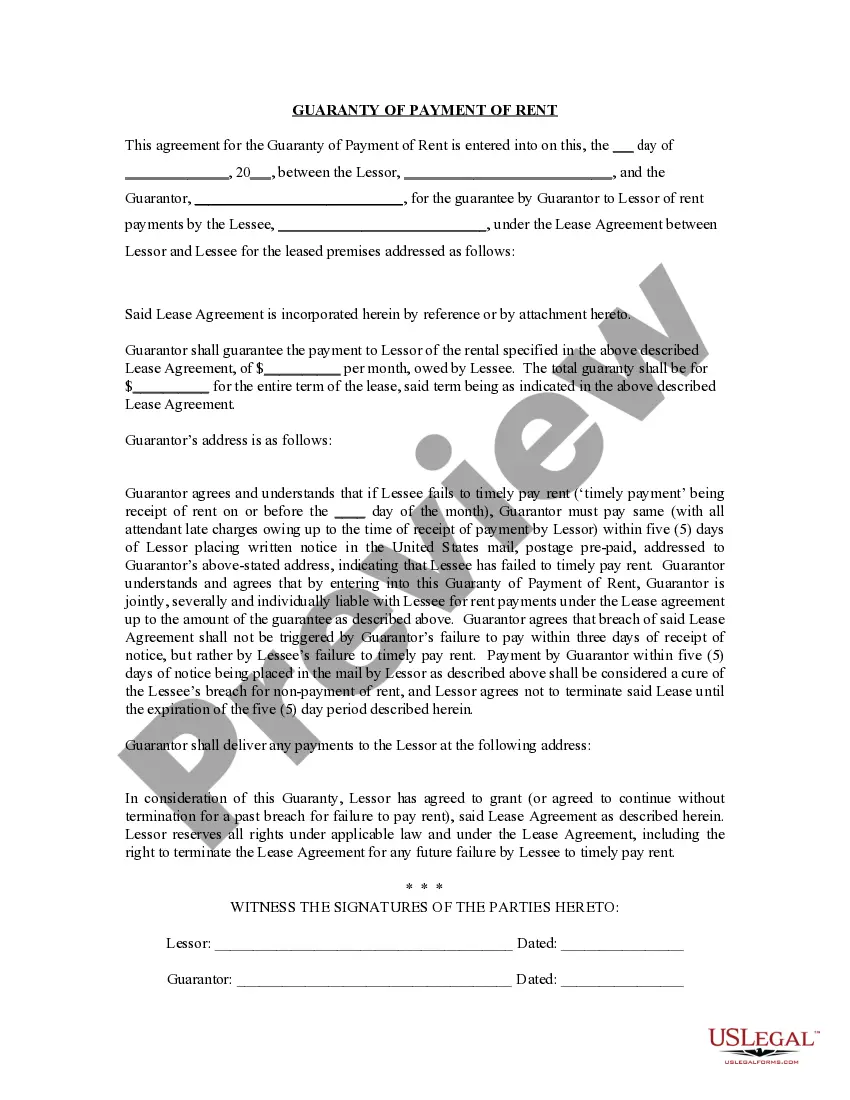

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor). The Orange Florida Guaranty or Guarantee of Payment of Rent refers to a legal arrangement in which a third party assumes the responsibility of rent payment if the tenant defaults on their financial obligations. This guarantee acts as a form of assurance for the landlord that they will receive the agreed-upon rental income even if the tenant is unable to make timely payments. In Orange, Florida, there are primarily two types of Guaranty or Guarantee of Payment of Rent: 1. Personal Guaranty: A personal guaranty involves an individual, usually a family member or close associate of the tenant, assuming liability for the payment of rent. This type of guarantee provides the landlord with the security of receiving the rent directly from the guarantor if the tenant fails to make payments. The guarantor's creditworthiness and financial standing are usually assessed to ensure their ability to fulfill the obligation. 2. Corporate Guaranty: A corporate guaranty, on the other hand, involves a business entity assuming the payment responsibilities on behalf of the tenant. This type of guarantee is commonly used in commercial real estate leasing, where a company guarantees the rent payments for its subsidiary, branch, or franchisee. In such cases, the parent company's financials and creditworthiness are evaluated to ascertain its capability to cover the rental obligations if required. Both types of Guaranty or Guarantee of Payment of Rent aim to protect the landlord's financial interests and minimize the risk associated with potential payment defaults. These agreements provide a layered approach to ensuring rent payments, allowing the landlord to have recourse to two separate entities — the tenant and the guarantor/business entity — in case of financial difficulties or breaches of contract. It's crucial for both landlords and tenants to understand the terms and conditions of Guaranty or Guarantee of Payment of Rent agreements before entering into any leasing contracts. Seeking legal advice, thoroughly reviewing the terms, and negotiating mutually acceptable conditions can help ensure a fair and transparent commitment for all parties involved.

The Orange Florida Guaranty or Guarantee of Payment of Rent refers to a legal arrangement in which a third party assumes the responsibility of rent payment if the tenant defaults on their financial obligations. This guarantee acts as a form of assurance for the landlord that they will receive the agreed-upon rental income even if the tenant is unable to make timely payments. In Orange, Florida, there are primarily two types of Guaranty or Guarantee of Payment of Rent: 1. Personal Guaranty: A personal guaranty involves an individual, usually a family member or close associate of the tenant, assuming liability for the payment of rent. This type of guarantee provides the landlord with the security of receiving the rent directly from the guarantor if the tenant fails to make payments. The guarantor's creditworthiness and financial standing are usually assessed to ensure their ability to fulfill the obligation. 2. Corporate Guaranty: A corporate guaranty, on the other hand, involves a business entity assuming the payment responsibilities on behalf of the tenant. This type of guarantee is commonly used in commercial real estate leasing, where a company guarantees the rent payments for its subsidiary, branch, or franchisee. In such cases, the parent company's financials and creditworthiness are evaluated to ascertain its capability to cover the rental obligations if required. Both types of Guaranty or Guarantee of Payment of Rent aim to protect the landlord's financial interests and minimize the risk associated with potential payment defaults. These agreements provide a layered approach to ensuring rent payments, allowing the landlord to have recourse to two separate entities — the tenant and the guarantor/business entity — in case of financial difficulties or breaches of contract. It's crucial for both landlords and tenants to understand the terms and conditions of Guaranty or Guarantee of Payment of Rent agreements before entering into any leasing contracts. Seeking legal advice, thoroughly reviewing the terms, and negotiating mutually acceptable conditions can help ensure a fair and transparent commitment for all parties involved.