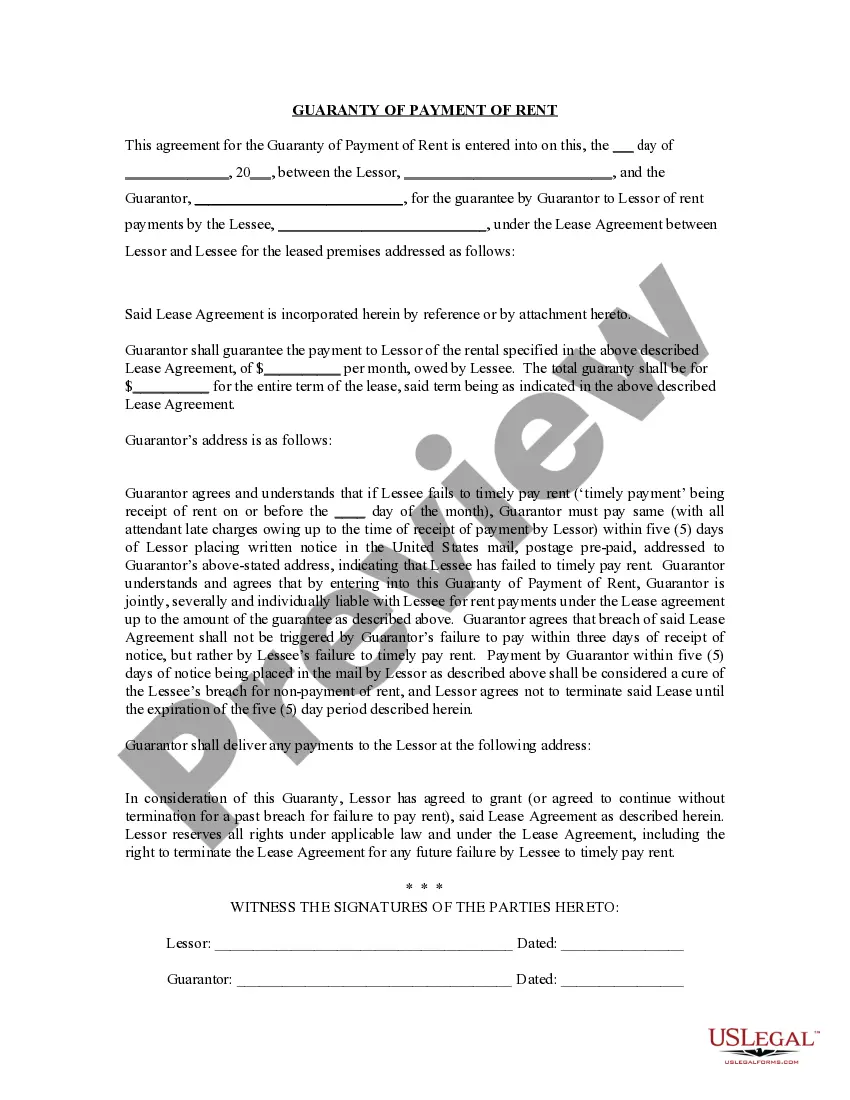

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor). Orlando, Florida Guaranty or Guarantee of Payment of Rent provides landlords with an added layer of security when entering lease agreements. This legally binding document ensures the payment of rent, protecting the landlord from potential loss or non-payment. Let's delve deeper into the details and explore different types of guarantees available in Orlando, Florida. 1. Personal Guaranty of Payment of Rent: A personal guaranty is a common type of Orlando, Florida Guaranty of Payment of Rent. It involves a third party, often a family member or business associate of the tenant, assuming the responsibility of rent payment if the tenant fails to meet their obligations. Landlords often require this guarantee when leasing to individuals with uncertain financial backgrounds or limited credit history. 2. Corporate Guaranty of Payment of Rent: In some instances, a corporate guaranty may be requested by landlords when leasing commercial properties to businesses. This guarantee involves a separate corporate entity or parent company assuming responsibility for rent payment on behalf of the tenant if they default. This type of guarantee provides landlords with added security when dealing with small or new businesses that may have insufficient credit or financial standing. 3. Letter of Credit as a Rent Guarantee: Another form of Orlando, Florida Guaranty of Payment of Rent is a letter of credit. This financial instrument is issued by a bank at the tenant's request, assuring the landlord that a specified amount is available in case of non-payment or default. The letter of credit acts as a guarantee of payment and can be drawn upon by the landlord in case the tenant falls behind on their rent. This type of guarantee enhances the landlord's confidence in the tenant's ability to meet financial commitments. 4. Security Deposit as a Rent Guarantee: Although not technically a guarantee, the security deposit is a common practice in rental agreements in Orlando, Florida. Tenants are required to provide a predetermined sum of money upfront, which serves as collateral against damages or unpaid rent. If the tenant fails to fulfill their rent obligations, the landlord can utilize the security deposit to cover the outstanding rent or damages, ensuring compensation for potential losses. It is important to note that the specific terms and conditions of Orlando, Florida Guaranty or Guarantee of Payment of Rent may vary depending on the lease agreement and individual circumstances. Landlords and tenants are advised to consult legal professionals to draft and review such guarantees, ensuring compliance with local laws and regulations. In summary, Orlando, Florida Guaranty or Guarantee of Payment of Rent comprises various types such as Personal Guaranty, Corporate Guaranty, Letter of Credit, and Security Deposit. These guarantees provide landlords with increased financial security by stipulating alternative sources for rent payment, particularly when dealing with tenants with limited financial history or businesses with uncertain stability.

Orlando, Florida Guaranty or Guarantee of Payment of Rent provides landlords with an added layer of security when entering lease agreements. This legally binding document ensures the payment of rent, protecting the landlord from potential loss or non-payment. Let's delve deeper into the details and explore different types of guarantees available in Orlando, Florida. 1. Personal Guaranty of Payment of Rent: A personal guaranty is a common type of Orlando, Florida Guaranty of Payment of Rent. It involves a third party, often a family member or business associate of the tenant, assuming the responsibility of rent payment if the tenant fails to meet their obligations. Landlords often require this guarantee when leasing to individuals with uncertain financial backgrounds or limited credit history. 2. Corporate Guaranty of Payment of Rent: In some instances, a corporate guaranty may be requested by landlords when leasing commercial properties to businesses. This guarantee involves a separate corporate entity or parent company assuming responsibility for rent payment on behalf of the tenant if they default. This type of guarantee provides landlords with added security when dealing with small or new businesses that may have insufficient credit or financial standing. 3. Letter of Credit as a Rent Guarantee: Another form of Orlando, Florida Guaranty of Payment of Rent is a letter of credit. This financial instrument is issued by a bank at the tenant's request, assuring the landlord that a specified amount is available in case of non-payment or default. The letter of credit acts as a guarantee of payment and can be drawn upon by the landlord in case the tenant falls behind on their rent. This type of guarantee enhances the landlord's confidence in the tenant's ability to meet financial commitments. 4. Security Deposit as a Rent Guarantee: Although not technically a guarantee, the security deposit is a common practice in rental agreements in Orlando, Florida. Tenants are required to provide a predetermined sum of money upfront, which serves as collateral against damages or unpaid rent. If the tenant fails to fulfill their rent obligations, the landlord can utilize the security deposit to cover the outstanding rent or damages, ensuring compensation for potential losses. It is important to note that the specific terms and conditions of Orlando, Florida Guaranty or Guarantee of Payment of Rent may vary depending on the lease agreement and individual circumstances. Landlords and tenants are advised to consult legal professionals to draft and review such guarantees, ensuring compliance with local laws and regulations. In summary, Orlando, Florida Guaranty or Guarantee of Payment of Rent comprises various types such as Personal Guaranty, Corporate Guaranty, Letter of Credit, and Security Deposit. These guarantees provide landlords with increased financial security by stipulating alternative sources for rent payment, particularly when dealing with tenants with limited financial history or businesses with uncertain stability.