A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

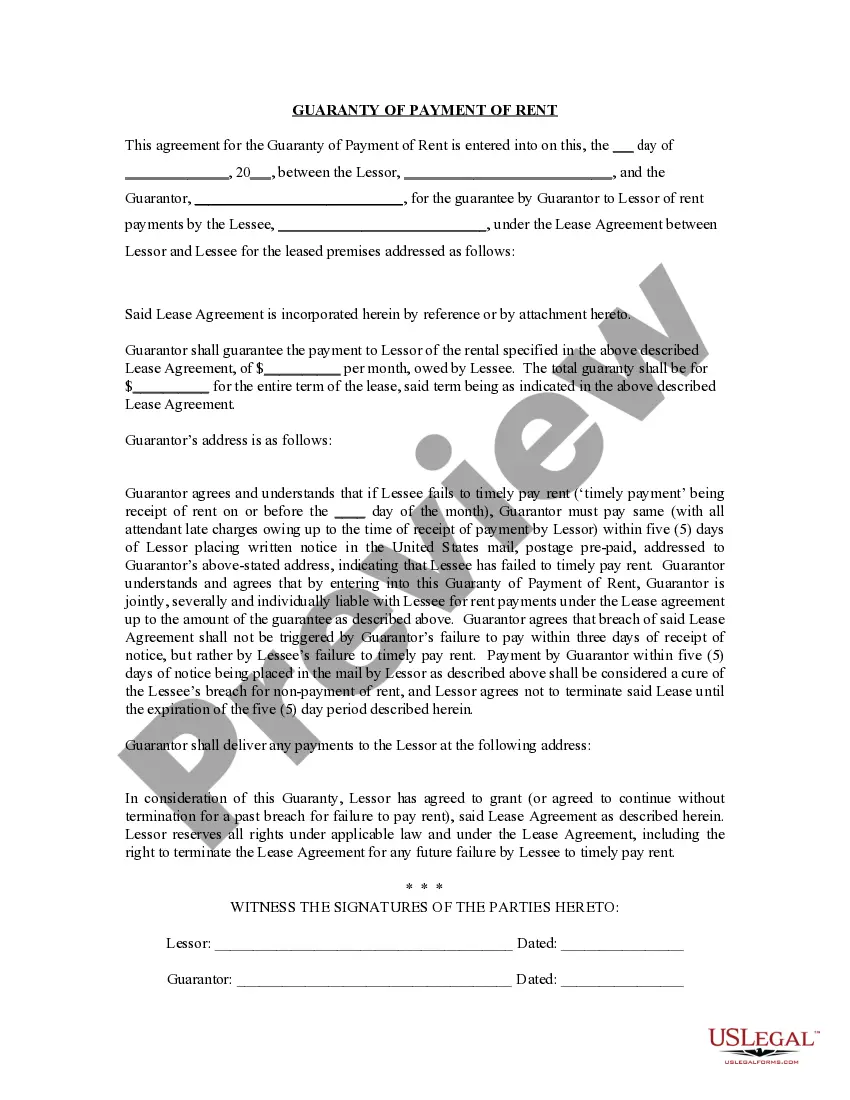

The Palm Beach Florida Guaranty or Guarantee of Payment of Rent is a legally binding document that serves as an assurance or security for rental payments in the upscale Palm Beach area. Landlords often require tenants to provide this guarantee, ensuring that rent will be paid in a timely manner as agreed upon in the lease agreement. This agreement minimizes the risk for property owners and provides a financial safety net in case of tenant default or inability to pay rent. There are several types of Guaranty or Guarantee of Payment of Rent options available in Palm Beach, Florida, depending on the specific requirements of the landlord and tenant. Some common types include: 1. Personal Guaranty: In this type of guarantee, an individual (other than the tenant) agrees to take on the responsibility of paying rent in case the tenant defaults. The guarantor's financial stability and creditworthiness play a crucial role in assuring the landlord that the rent will be paid. 2. Corporate Guaranty: When a business entity leases a property, its owners or executives may be required to sign a corporate guaranty. This legal document holds the corporation liable for the rent payment if the business fails to fulfill its obligations. 3. Parental Guaranty: When a tenant is a student or young adult with limited income or credit history, landlords often ask for a parental guaranty. In this case, the tenant's parent or legal guardian takes responsibility for paying the rent if the tenant defaults. 4. Letter of Credit: Instead of relying on an individual's financial standing, some landlords may accept a letter of credit from a financial institution. This document ensures payment from the issuer should the tenant fail to pay rent. By implementing one of these Guaranty or Guarantee of Payment of Rent options, landlords in Palm Beach, Florida, protect their investment and help maintain a consistent stream of rental income. Tenants, on the other hand, must carefully review the terms and conditions associated with these guarantees to understand their obligations and potential financial consequences in case of default.