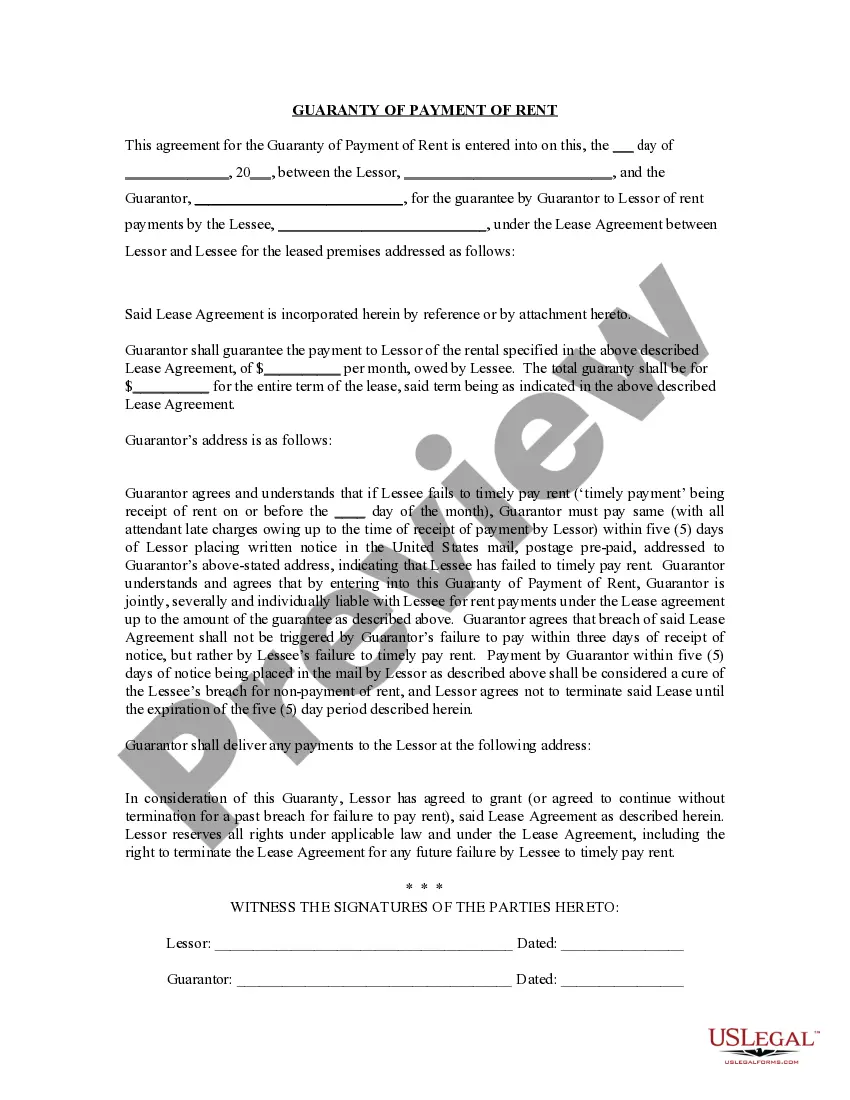

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor). The Tallahassee Florida Guaranty or Guarantee of Payment of Rent is a legally binding agreement that provides security and ensures that rent is paid by a third party in the event that the tenant is unable to fulfill their obligations. This document offers peace of mind to property owners and landlords, ensuring that they receive rental payments consistently. One of the types of Tallahassee Florida Guaranty or Guarantee of Payment of Rent is the Personal Guaranty. In this type, an individual, often a friend or family member of the tenant, takes on the responsibility of covering the rent payments if the tenant defaults. Personal Guaranty offers an added layer of security by establishing financial accountability beyond the tenant. Another type is the Corporate Guaranty, whereby a company or corporation guarantees the payment of rent on behalf of the tenant. This is commonly used in commercial leases where a business entity leases a property. By having a Corporate Guaranty, the landlord can be assured that even if the business fails, the rent will still be paid by the company. One key benefit of the Tallahassee Florida Guaranty or Guarantee of Payment of Rent is that it helps protect landlords from potential financial losses due to rent defaults or tenant bankruptcies. It ensures a steady rental income stream, especially during unforeseen circumstances. Landlords typically conduct a thorough screening process before entering into such agreements. They evaluate the creditworthiness and financial stability of the individual or organization providing the guarantee, ensuring that they have the means to honor the commitment. It is essential for both the tenant and the guarantor to fully understand the terms and obligations outlined in the Tallahassee Florida Guaranty or Guarantee of Payment of Rent. The agreement should clearly state the duration of the guarantee, any limits to the amount covered, and the circumstances under which the guarantor may be released from the agreement, such as when the tenant successfully completes the lease term. In conclusion, the Tallahassee Florida Guaranty or Guarantee of Payment of Rent is a vital legal document that safeguards the interests of landlords and property owners. Whether through Personal or Corporate Guaranties, it ensures a consistent rental income, mitigates financial risks, and adds an extra layer of security to lease agreements in Tallahassee.

The Tallahassee Florida Guaranty or Guarantee of Payment of Rent is a legally binding agreement that provides security and ensures that rent is paid by a third party in the event that the tenant is unable to fulfill their obligations. This document offers peace of mind to property owners and landlords, ensuring that they receive rental payments consistently. One of the types of Tallahassee Florida Guaranty or Guarantee of Payment of Rent is the Personal Guaranty. In this type, an individual, often a friend or family member of the tenant, takes on the responsibility of covering the rent payments if the tenant defaults. Personal Guaranty offers an added layer of security by establishing financial accountability beyond the tenant. Another type is the Corporate Guaranty, whereby a company or corporation guarantees the payment of rent on behalf of the tenant. This is commonly used in commercial leases where a business entity leases a property. By having a Corporate Guaranty, the landlord can be assured that even if the business fails, the rent will still be paid by the company. One key benefit of the Tallahassee Florida Guaranty or Guarantee of Payment of Rent is that it helps protect landlords from potential financial losses due to rent defaults or tenant bankruptcies. It ensures a steady rental income stream, especially during unforeseen circumstances. Landlords typically conduct a thorough screening process before entering into such agreements. They evaluate the creditworthiness and financial stability of the individual or organization providing the guarantee, ensuring that they have the means to honor the commitment. It is essential for both the tenant and the guarantor to fully understand the terms and obligations outlined in the Tallahassee Florida Guaranty or Guarantee of Payment of Rent. The agreement should clearly state the duration of the guarantee, any limits to the amount covered, and the circumstances under which the guarantor may be released from the agreement, such as when the tenant successfully completes the lease term. In conclusion, the Tallahassee Florida Guaranty or Guarantee of Payment of Rent is a vital legal document that safeguards the interests of landlords and property owners. Whether through Personal or Corporate Guaranties, it ensures a consistent rental income, mitigates financial risks, and adds an extra layer of security to lease agreements in Tallahassee.